When it comes to Private Health Insurance, many people overestimate the cost of putting a policy in place.

Like with most things in life – you get what you pay for. It’s the same with Private Health Insurance. If you were to get a basic level of cover, a policy will be cheaper than if you opted for one that was all singing, all dancing.

Calculating the cost of health insurance will heavily depend on your budget and the policy options you choose.

It’s not just Health Insurance either, our 2025 Individual Protection Survey found many think that other types of personal protection such as Income Protection, Critical Illness and Life Insurance are also more expensive than they really are.

What is Private Medical Insurance?

Health Insurance provides you with access to private medical treatment so you can receive prompt care should you need it.

In the UK we are lucky to have access to free medical treatment through the NHS. However, due to resource and funding cuts it can’t always offer the same services and treatment that private hospitals can.

The advantages of having private medical insurance include:

- Avoiding potentially lengthy NHS waiting lists

- Access to a wider range of amenities than would be available in the typical NHS hospital

- Private, ensuite rooms and round-the-clock visiting hours

- Access to the latest drugs and treatments, even those not yet routinely available on the NHS.

How Much Does Basic Private Health Insurance Cost?

Health Insurance doesn’t have to cost the earth. A basic private Medical Insurance policy will cover the cost of inpatient medical treatment.

What we mean by inpatient treatment is any treatment which requires you to stay in hospital overnight or use a bed as a result of day surgery.

Most insurers now also provide full cancer cover with their basic policies. Should you be diagnosed with cancer your policy would cover all treatment and care relating to it. However this is where basic cover stops.

To provide you with some useful examples we have calculated the cost of Private Health Insurance for a 43 year old who:

- has no pre-existing health conditions

- is a non-smoker

- is willing to pay an excess of £250

- lives in the Brighton area

We use the same individual below to highlight the difference in cost of a mid range and comprehensive Health Insurance policy.

We have compared health insurance quotes from all the top UK insurers including Bupa, Aviva, Axa and Vitality and used the cheapest option for each example.

The Cost Of Adding £1,000 Outpatient Cover

From a basic plan the next step is to decide whether you want to include any outpatient cover.

If you wanted to cover tests, consultations or treatment where a hospital bed is not required you would need to a level of outpatient cover.

By opting for a mid range policy and adding £1,000 of outpatient cover the cost of the above basic policy increases by just under £15.

The Cost Of Opting For Full Outpatient Cover

Choosing Comprehensive Health Insurance providing full outpatient cover increases the cost by around £16 per month.

This cost enables you to get diagnosed quickly, regardless of how many scans, consultations or tests are required.

Personal Factors Affecting The Cost Of Health Insurance

There are a number of factors that can affect the amount you pay for Private Health Insurance. Some we have control over and others we don’t, and some are more obvious than others.

The Cost Increases With Age

Although it can’t be helped, the older you are the more your premiums will be, this is because the health risks we face as we age are greater. Using the same basic policy from above, the cost of the 43 year old, non-smoker goes from £49.06 a month to £69.77 a month for a 53 year old.

Smokers Can Pay More For Health Insurance

Some insurers will charge smokers more for Private Health Insurance while others don’t discriminate. The additional cost is due to the fact that there are a number of associated health risks that come with being a smoker.

If I Give Up Smoking Could I Get Reduced Premiums?

Absolutely. If you can prove you haven’t consumed nicotine in the last 12 months, most insurers will class you as a ‘non-smoker’ and lower your premiums.

Does Vaping Increase The Cost Of Private Health Insurance?

It is important to note that insurers don’t just class those using cigarettes as smokers. A ‘smoker’ refers to anyone using any nicotine based products including things such as vapes and patches. If you consume nicotine in any way your premiums will increase, even if it is through vaping.

Pre-Existing Medical Conditions Don’t Impact Your Premiums

If you have a pre-existing health condition, it is more likely to be excluded than increase your premium.

Choosing moratorium underwriting you may have the opportunity to cover your pre-existing condition. If you’ve experienced no symptoms or had any treatment for a set amount of time e.g 5 years it may be included.

It is important to note that moratorium underwriting can be more expensive than full medical underwriting.

If you have a pre-existing condition it’s best to speak with a specialist. If you need help don’t hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

Your Postcode & Where You Live Could Increase The Cost

It’s true. Your postcode is one factor that will affect the cost of your Private Medical Insurance premiums. But why?

London, for example, is more expensive than other areas around the UK. If you are based in the London area, the likelihood is you will pay more for cover than if you were in a more rural location.

The change in cost can vary by insurer so its always good to do your homework or get advice from a specialist adviser.

Factors That Reduce The Cost Of Health Insurance

Increasing Your Excess

The Excess is the amount you choose to pay should you need to make a claim. The higher amount of excess you opt for the lower your premiums will be.

It is important to note that when you need treatment you would need to pay the excess upfront before being able to claim for the rest of the cost. If your treatment costs less than the excess you selected, you will be responsible for paying the full cost.

Using our 43 year old, we’ve highlighted the difference in cost of a basic Health Insurance policy with a range of excess amounts below.

Reducing Your Hospital List

Many insurers have ‘tiers’ of hospitals in which you can have treatment. If you want access to the best facilities, such as those in Central London, you’ll pay more for your policy.

However if you decide to have a restricted list you could reduce the amount you pay each month. For example when using the details of our 43 year old, by restricting the hospital list where you can have treatment premiums reduced by up to 7%.

If you consider this option it is important to check the hospitals in your area to make sure you are comfortable with the limited options.

Opting For 6 Week Wait Option

If the treatment you need is available on the NHS with a wait of less than 6 weeks, you would use the NHS for your treatment rather than private medical care.

It’s only if the treatment you need either isn’t available on the NHS or the wait is longer than 6 weeks you would then use your Private Health Insurance cover.

This can have a significant impact on the cost, reducing premiums by up to 30%.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Factors Which Increase The Cost Of Health Insurance

Increasing Your Outpatient Cover

The most basic health insurance will only cover inpatient treatment. More comprehensive policies cover outpatient treatment in full or up to a monetary limit often set at £500, £1,000 or £1,500. The more outpatient cover you add to your policy, the more expensive it will become.

Without any outpatient cover you run the risk of NHS outpatient waiting lists potentially delaying your care.

Extending Your Hospital List

By adding an extended hospital list to our basic policy the premiums increased from £49.06 to £64.01.

The policy will now include treatment in some of the very best London hospitals where the cost tends to be more expensive.

Hospitals in the higher cost extended list often include The Portland, Bupa Cromwell and other top facilities.

Add Dental and Optical Cover For An Additional Cost

Some Health Insurance providers include a dental and optical benefit for an additional cost. These bolt on features tend not to affect your core health insurance plan as it often works as a separate Health Cash Plan.

This provides a set level of cover for routine dental treatment, say £200 per annum. For example, should you require a dental check-up you would have your required treatment and then claim the cost back from your insurer.

Although adding this optional extra won’t affect your core Health Insurance plan it will increase the amount you pay.

The level of dental cover can vary considerably from one provider to the next. Some basic cash back dental options such as Aviva Healthier Solutions can add as little as £5 per month to the premium. Other more comprehensive options such as Vitality Personal Healthcare could increase the cost by over £30 per month.

Mental Health & Psychiatric Add-on

As standard many private medical insurance policies don’t include mental health cover.

For an addition cost you can often add full or partial cover for private mental health treatment.

The types of mental health treatment covered are typically categorised as inpatient psychiatric treatment or outpatient mental healthcare and therapies. Adding this to your policy will see premiums increase by about 10% .

Alternative Therapies

Alternative therapies can be added to a typical Health Insurance policy for an additional cost.

This additional cover would give you access to treatment such as:

- Physiotherapy

- Acupuncture

- Osteopathy

- Homeopathy.

If you were to add these to your policy you could expect your premiums to increase any where between 2% and 10%.

Need International Cover? It Costs More…

International health cover is far more comprehensive than policies covering private healthcare solely in the UK.

UK plans are designed to supplement the free healthcare provided by the NHS. International plans tend to cover all healthcare. As a result they are often a lot more expensive. They typically cover:

- All expenses paid for in-patient, day-patient and out-patient treatment

- Specialists’ fees

- Drugs and dressings

- Home nursing

- GP costs

- Dentistry

- Front line medical services, such as Accident & Emergency or Intensive Care Unit

- Normal pregnancy and childbirth.

Most providers also offer a 24 / 7 emergency health telephone helpline to arrange urgent medical care while you’re overseas.

There are a range of International Health Insurance providers that sit outside of the typical UK market. The price can vary significantly depending on where in the world you need to be covered.

Given how specialist the international market can be if you need help please don’t hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

If I Need To Make A Claim Will It Impact The Cost?

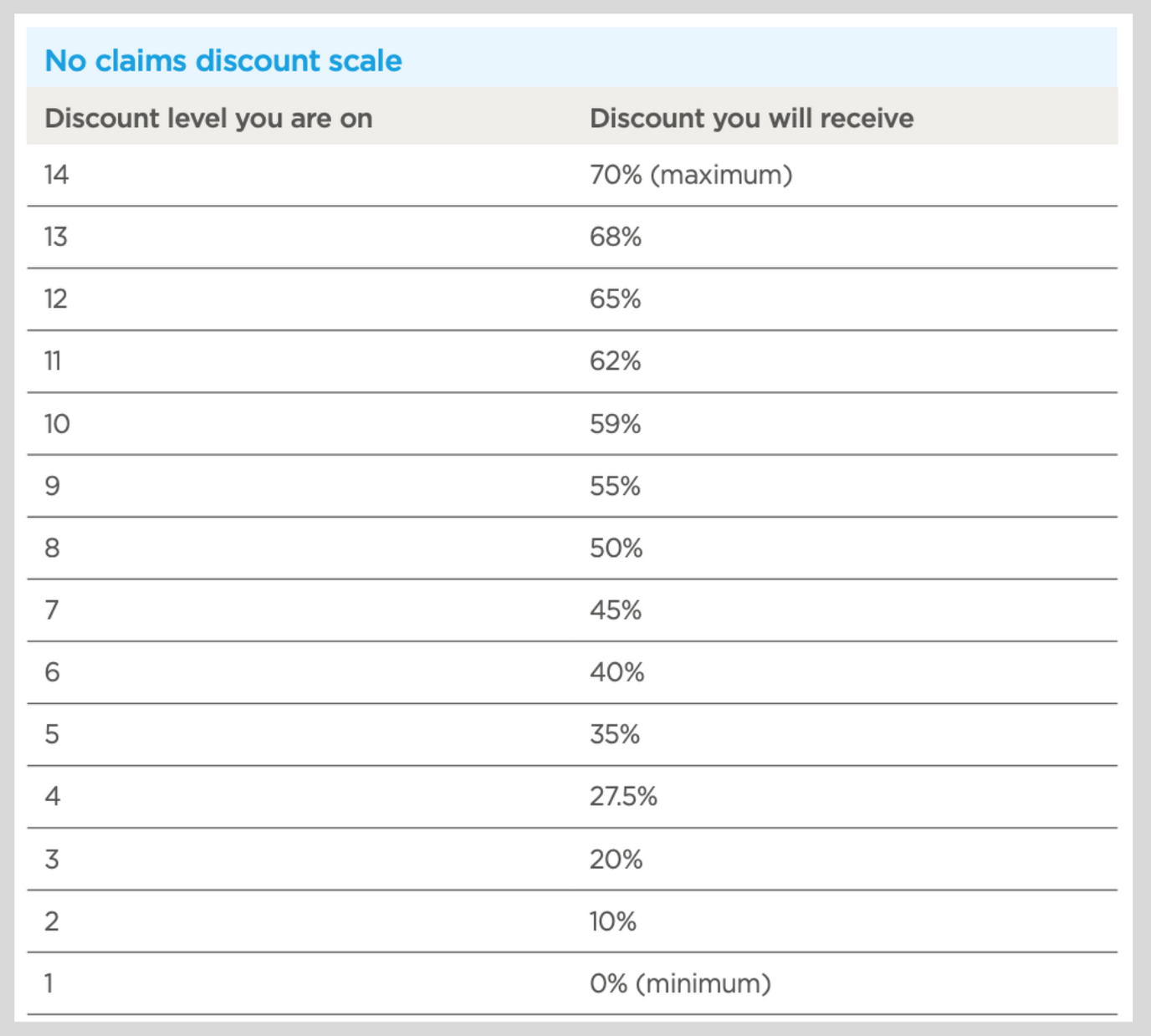

Like with car insurers, most Health Insurance Providers offer a no claims discount. If you make a claim the likelihood is that the cost of your premiums will increase and your no claims discount will be reduced.

We’ve included Bupa’s no claims discount scale below to give you an idea of how making a claim could affect the cost of a policy.

![bupa no claims discount scale]()

Save On Your Premiums By Reviewing Your Health Insurance Annually

One of the biggest mistakes to make is becoming complacent with your existing policy. Even if you buy a Health Insurance policy at a competitive price today, there is no guarantee that your premiums will competitive next year.

How We Helped Hayden Half His Health Insurance Costs…

We were able to help 69 year old, retiree Hayden, halve the cost of his Health Insurance by simply reviewing his existing policy. You can read more about Haydens story here.

Has Covid Affected The Cost of Health Insurance?

In our latest Health and Protection survey we found that 76% of respondents thought the cost of private Health Insurance had increased as a result of the pandemic.

However, we’ve been keeping a close eye on the market and have seen no major changes in pricing as a result of the pandemic. Insurers such as Bupa have even offered its customers a rebate on their premiums due to some of their services being disrupted.

Does The Type Of Underwriting Impact The Cost?

When setting up up health insurance you can opt for Full Medical Underwriting or Moratorium Underwriting.

Full medical underwriting looks at your full medical history which can make the process of putting a policy in place a lot longer. However with Moratorium underwriting you only need to disclose medical conditions you’ve experienced in the last 5 years and no examinations are required.

Some insurers offer a 5% premium discount if you opt for Full Medical Underwriting. Even with this discount given moratorium is quicker to set-up and can allow existing conditions to be covered in the future many still opt for Moratorium underwriting.

How Much Does Bupa Cost?

Bupa are synonymous with private medical insurance as such we often get clients ask what bupa costs.

Given the name, Bupa can be more expensive than the cheapest options but like with anything in life you often get what you pay for.

To give you an idea we’ve calculated Bupa premiums based on our 43 year old, with no existing health conditions who is willing to pay £250 excess.

For a basic plan it was slightly more expensive at £52.88 per month.

This increased to £73.54 per month for a mid-range plan and £89.53 per month for fully comprehensive cover.

Who Are The Top UK Private Health Insurance Companies?

When it comes to Health Insurance there are a range of providers and policies to choose from which of course will bring varying costs. Rather than focusing on getting the cheapest deal, it’s important to look for cover that meets your particular circumstances.

For a comprehensive review of the best health insurance you can read our specialist guide comparing all the leading insurers side by side.

To help you compare different insurers we’ve picked our top 4 and have written individual product reviews of each for you.

There are also a number of smaller boutique providers who specialise in niches including covering the self employed and providing international cover.

It is important to obtain quotes from all of the top UK providers when doing your research as premiums can vary considerably based on your age and your current circumstances. To compare the top UK providers in seconds use our handy health insurance quote tool →

Top Free Additional Benefits

The majority of Health Insurance providers now offer a number of FREE additional benefits which sit outside of your core cover.

Its important when looking at the cost of your premiums what other benefits are included as these could add real value to your policy. For example some additional services include:

- 24/7 Video GP Service

- Online Prescription Service

- Nurse Staffed Medical Advice Helpline

- High Street and Fitness Discounts

Compare Health Insurance Quotes & Get Specialist Advice

As you can see from the above, there are a number of factors which can affect the price you pay for Health Insurance.

Because of this, it is best to discuss your options with a specialist so you ensure you get cover thats tailored to your specific needs.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

If you need help comparing UK health insurance quotes or want to review existing cover give us a call on 02074425880 or email help@drewberry.co.uk.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=2059)