Looking for Private Health Insurance as a doctor or other medical professional? You’ve come to the right place.

As a doctor, you know first-hand the strain the NHS is facing due to higher demand and lack of funding. That’s why so many of our Private Medical Insurance (PMI) clients are doctors, surgeons, and nurses. Those working in healthcare want to ensure they can get treatment when they need it rather than waiting on the NHS.

But what exactly is Doctors Health Insurance? What does it cover? How much is it? We’re going to tell you everything you need to know!

What Is Doctors Private Health Insurance?

Let’s start with explaining what Doctors Health Insurance is. It’s the same as a standard Private Medical Insurance policy, except it’s designed for doctors and healthcare professionals.

Private Health Insurance offers you:

- Private healthcare when you need it most, bypassing NHS waiting lists

- Peace of mind—you know that there are shorter waiting lists and you’ll get the highest standards of care

- Quick access to diagnosis, treatment and medication

- A choice over where and when your treatment will take place, and the specialist who treats you.

Why Is It Important?

The NHS is fantastic. But as a doctor you’ll be all-too-aware of the struggles the service is currently experiencing due to lack of funding and long waiting times.

Working as a healthcare professional comes with a busy schedule, and often long hours. This can make it harder for you to get your own medical care when you need it.

Doctors Health Insurance provides a sense of security that you can get treatment and medication for any acute health condition when you need it most. It frees up the NHS time you know is scarce anyway. And if you can afford the monthly premiums, it’s something to consider.

How Does Health Insurance For Doctors Work?

Doctors Health Insurance works exactly the same way as a standard Private Health Insurance policy.

You’ll pay for the policy from your own bank account. Once your policy is ready to go, you’ll be able to make a claim whenever you need to and get treatment privately. This is as long as the care you need is covered by your policy.

Does It Replace The NHS?

No, Doctors Private Health Insurance will never replace the NHS. Instead, it’s designed to supplement it.

You’re likely aware of what kinds of situations the NHS will always cover, even if someone has private insurance. For example, accidents and emergencies.

For you personally, the conditions for which you’ll still use the NHS will depend on the level of cover you select for your policy. We’ll explain this next.

Your GP is still very much at the forefront of your routine healthcare, but the process of receiving treatment depends on whether you add outpatient cover to your policy.

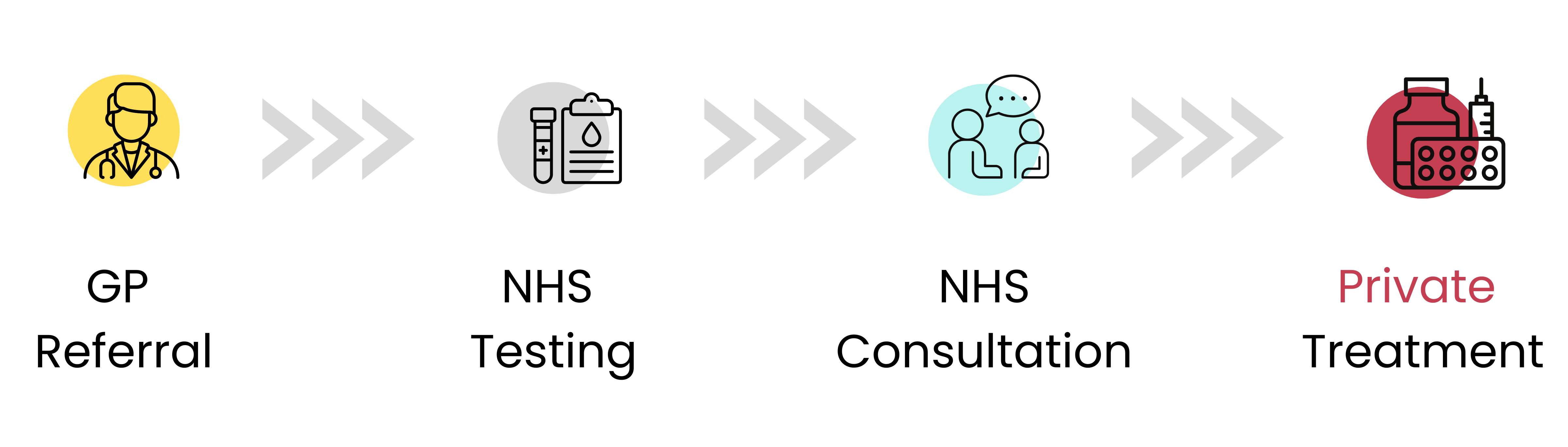

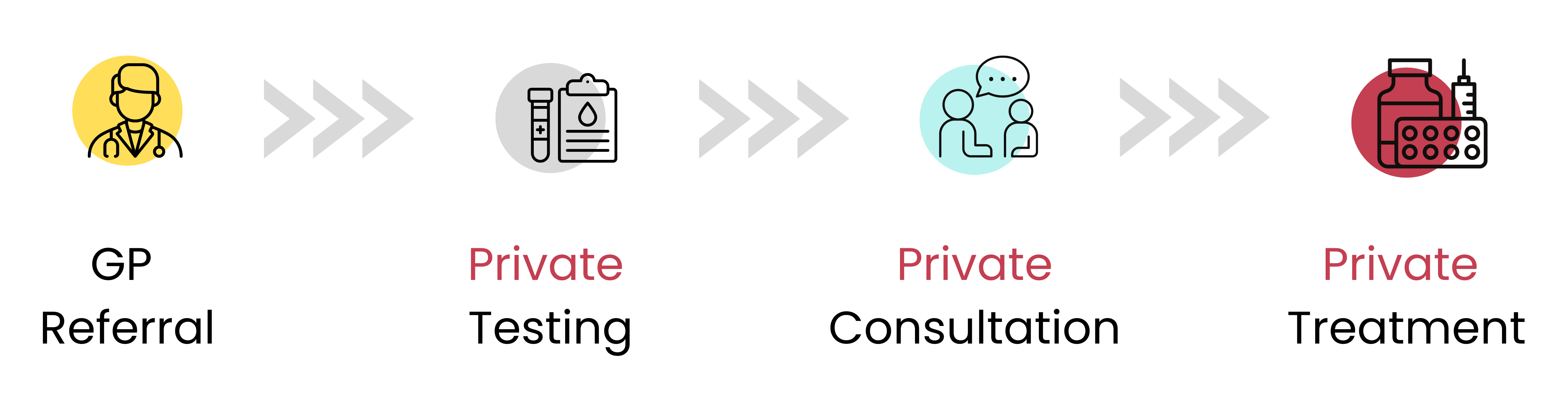

Doctors Health Insurance With No Outpatient Cover

If you buy a basic health policy that doesn’t include outpatient care, your GP will refer to the NHS for any tests, consultations, and diagnostics you need. After this, you’ll be referred to a private hospital for treatment.

Doctors Health Insurance With Outpatient Cover

If you pay extra for the outpatient cover add-on, your journey to private healthcare is a little different. Rather than your GP referring you to the NHS for tests, you’ll get a referral straight to a private facility for care. This process is typically faster than the NHS.

Chronic Vs Acute Conditions

Being a Doctor you will no better than anyone how medical conditions are categorised. You have acute and chronic.

- Acute conditions

Conditions which can be treated and cured - Chronic conditions

Conditions which can’t be cured and require ongoing management.

Before taking out Doctors Health Insurance, it’s important to flag that only acute conditions are covered. So, should you suffer from a chronic health issue, the NHS will carry out the ongoing management of it.

Health Insurance Client Stories

What Does Doctors Health Insurance Cover?

Doctors Health Insurance is designed to cover acute conditions. But what’s actually included in your cover depends on the policy options you choose.

All Private Health Insurance policies cover certain conditions and treatments as standard. Others may only be covered if you pay extra.

Inpatient Or Outpatient Treatment

All medical treatment, whether it’s private or NHS, is split into two categories: Inpatient/Day-Patient and Outpatient. All private health insurers cover inpatient procedures as standard. But when choosing your Doctors Health Insurance policy, you’ll have the option to add Outpatient cover.

Here’s the difference between the two:

- Inpatient / Day-Patient Care

Any treatment which requires a hospital bed, either overnight (inpatient) or for the day (day-patient). This includes surgeries - Outpatient Care

Any treatment you have without needing a hospital bed. Diagnostic tests and scans, as well as physiotherapy, for example, are normally carried out as an outpatient.

If you choose a basic Doctors Health Insurance Policy that only covers inpatient cover, you can expect the following to be covered:

- Cancer care and treatment (we explain this more next)

- Private hospitals and nursing care

- Surgery as inpatient or day-patient.

However if you opt for a more comprehensive policy it is likely to include:

- Outpatient treatment (Diagnostic testing, such as CT / MRI scans and blood tests)

- Mental health cover

- Complementary therapies

- Physiotherapy.

While adding outpatient care increases premiums, we tend to recommend some level of outpatient cover with your Doctors Private Medical Insurance. It can considerably speed up your diagnosis and treatment compared to waiting for the NHS.

If you want to discuss the type of cover you can get for your budget, give us a call on 02074425880 or email help@drewberry.co.uk.

Cancer Cover

Unfortunately, cancer is a common health problem. But you’ll now find that all health insurers include Cancer Care in their Health Insurance policies as standard. What this actually covers differs from provider to provider. Generally, it includes:

- Chemotherapy / radiotherapy

- Bone strengthening drugs

- Surgical procedures

- Money towards prosthesis / wigs you require as a result of cancer treatment.

This is one of the most valuable parts of your Health Insurance policy as it offers access to drugs and treatments not yet available on the NHS. Some insurers will even supply new experimental medicine.

On top of the core cover on offer, some providers also allow you to add Dental and Optical care to your policy for an additional premium.

Rauri Taylor

Independent Protection Specialist

What Doesn’t Health Insurance Cover?

Like all insurance policies, there are certain things which are excluded from your policy. Here it doesn’t matter whether you’re a doctor or an office worker, these exclusions apply to everyone:

- Pre-existing conditions

- Emergency care

- Issues related to alcohol / substance abuse

- Pregnancy / fertility treatment

- Cosmetic treatment which isn’t medically necessary

- HIV / AIDS

- Kidney dialysis

- Self-inflicted injuries, such as those sustained through dangerous sports / hobbies.

Additional Health Insurance Options for Doctors

There are a number of cover options which can be particularly beneficial for doctors and other types of healthcare professionals. These include:

Physiotherapy And Alternative Therapies

Not all insurers offer therapies such as physiotherapy, chiropody and osteopathy as standard. Some will require you to add these on as an optional extra if you want to benefit from such treatments.

Some health insurers, however, may cover certain therapies under outpatient cover. This is often a set number of sessions per year if you add outpatient treatment to your policy.

Certain insurers even have ‘fast-track’ options for musculoskeletal issues needing physiotherapy. Here, you can self-refer for private care.

As a doctor (or any medical professional), the impact of performing certain procedures may result in musculoskeletal issues. Most prevalent is lower back pain. A Private Health Insurance policy that includes therapies can benefit your physical health and posture.

Overseas Cover

In your profession, you may be thinking of taking a sabbatical and working overseas.

For this, you’d need International Medical Insurance. This cover extends your policy beyond the UK to provide coverage overseas.

Some UK policies have the option of overseas cover for a higher monthly premium. But if you’re living or working abroad for any length of time, you’ll likely need a specialist International Health Insurance policy. This could even be a condition of your working visa, so it pays to check before you travel.

Psychiatric Cover

Psychiatric cover is another optional add-on to your Doctors Health Insurance. One of the biggest areas of NHS underfunding is its mental health services. Doctors often complain that mental health care has taken a ‘back seat’ when it comes to time and funding. Waiting lists for talking therapies, for example, are often months or even years long.

Adding psychiatric cover to your policy can provide private care if you develop a mental health condition. You’ll have access to psychiatrists, psychologists and even private inpatient treatment.

GOOD TO KNOW 🤓

Leading UK health insurer Aviva covers inpatient / day-patient mental health cover in full up to 28 days per policy year.

Do You Really Need Private Health Insurance As A Medical Professional?

We’re all extremely grateful for the NHS. It’s a fantastic institution, offering free healthcare to all.

However, the health service has come under unprecedented pressure recently. An increasing population, understaffed facilities and a lack of funding are factors in this. You’re likely well aware of this working in the midst of it all.

On top of this, NHS budgets have barely grown above inflation under a program of austerity.

You Can Skip Long NHS Waiting Lists

As demand has grown, and budgets have been squeezed, NHS waiting lists have lengthened. As of March 2023, 7.3 million people were waiting for treatment by the NHS. And many of these patients have been waiting longer than the target time of 18 weeks.

So, this is where Health Insurance steps in. It can take some of the burden off the NHS by providing treatment for conditions much faster than the NHS can currently provide. As someone working in the midst of the chaos, you’ll know that this is an excellent way of relieving the pressure.

You should consider Private Medical Insurance if you:

- Want access to private healthcare services

- Prefer flexibility over where and how you receive treatment

- Want peace of mind that you can get the care you need as quick as possible

- Want to skip long NHS waiting lists

- Can afford monthly Health Insurance premiums.

Whether you need Doctors Private Health Insurance depends on your personal circumstances.

If you’d like to discuss your options, please don’t hesitate to get in touch with our team today. Drop us a line on 02074425880 or email at help@drewberry.co.uk.

Alex Weir

Independent Health & Protection Specialist

Health Insurance Product Reviews

How Much Does Doctors Health Insurance Cost?

How much your Doctors Private Healthcare will cost will depend on several factors. Some of which are within your control, however others, such as your age, aren’t.

To give you a better idea of how these factors can impact the cost of a policy, here are some example quotes.

The Provider

Each Health Insurance provider will charge a different monthly premium. This is because each insurer has its own appetite for risk and can offer different services and benefits. So it’s always good to shop around when looking for the right Health Insurance for you.

To show how costs can differ from provider to provider, we’ve pulled some quotes below. These are based on:

- A 35-year-old doctor

- Comprehensive cover

- £250 excess

- Non-smoker.

Different Providers | |

|---|---|

|

|

£64.18 a month | £112.15 a month |

The Level Of Outpatient Cover

By adding outpatient cover to your Doctors Health Insurance policy, you’ll pay more.

A mid-range policy may provide up to £1,000 worth of outpatient cover. While comprehensive Doctors Health Insurance policies provide full cover.

Using the same factors as above, here are some quotes so you can see how much different levels of outpatient cover cost.

Level Of Outpatient Cover | Type Of Policy | Outpatient Cover | Monthly Cost |

|---|---|---|

Basic | £0 | £45.52 |

Mid-Range | £1,000 | £56.86 |

Comprehensive | Full Cover | £64.18 |

Excess

An excess is the amount you’re willing to pay upfront towards your care before your insurance kicks in to cover the rest. The higher your excess, the lower your premiums. You’ll either pay this excess per claim or per policy year. Your policy documents will detail this.

Excesses start at £0 and go all the way up to £5,000. As an example of how excesses can impact premiums, we’ve got some example quotes. These are based on the same 35-year-old doctor from above.

Level Of Excess | Excess Amount | Monthly Premium |

|---|---|

£250 | £64.18 |

£500 | £58.52 |

£1,000 | £49.08 |

Your Age

Age plays a big role in how much your Doctors Private Health Insurance costs. As we get older, the more likely we are to suffer an illness or accident, and therefore, more likely to claim. To cover this increased risk, premiums are higher.

Using the same factors as above, we’ve calculated the monthly cost of Health Insurance for doctors of different ages.

30 Year Old | 40 Year Old | 50 Year Old |

|---|---|---|

£58.42 | £73.58 | £102.96 |

Smoker Status

As a doctor, it’s likely you know the detrimental impacts of a regular smoking habit. Some health insurers will charge smokers more for their insurance than non-smokers.

So, to give you an idea of the cost, we’ve provided examples from AXA PPP. This is based on a 35-year-old doctor, wanting comprehensive cover and a £250 excess.

Smoker Vs Non-Smoker | |

|---|---|

🚬 | 🚭 |

£92.20 | £82.75 |

Treatment Facilities

Just because you own a Doctors Private Health Insurance policy doesn’t mean you’re eligible for treatment in all UK private facilities. When you buy a policy, you’ll pick a hospital list. This determines the private facilities you can get treatment in.

Health policies tend to have several ‘tiers’ of private facilities. The best private hospitals in the country, such as those in Central London, are the priciest to receive medical care in.

The more comprehensive your network and the pricier the facilities, the more you’ll pay. If you’re not too bothered about which level of private facility you’re treated in, you can limit your hospital network and reduce the cost of your premiums. These are limited to care in local private facilities and private wings of NHS hospitals.

Your Location

Where you’re based is another factor taken into account when you buy Health Insurance. Let’s say you live in Central London, which has a variety of high-profile private hospitals, premiums will rise to accommodate this. Essentially, it’s a postcode lottery.

SPECIALIST TIP 🤓

Some providers, such as Freedom, don’t base premiums on location. Providers like this could be more suitable if you live in London, unlike others, as they won’t rate premiums on your postcode.

6 Week Wait Option

A 6 week NHS wait option is offered by most UK health insurers. Choosing it will mean your policy only pays out if the NHS waiting list for the inpatient treatment you need is more than 6 weeks. Or if the NHS doesn’t offer the procedure you need. If the wait is less than 6 weeks, you’ll receive care via the NHS.

This option only applies to inpatient treatment. Outpatient care is unaffected as this is an optional add-on. You’ll always receive care privately with this add-on.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Common Doctors Medical Insurance Questions

Which underwriting should I choose?

There are two underwriting options for Private Health Insurance: Moratorium or Full Medical Underwriting. Which one is best for you depends on your medical history—not just on the conditions you’ve had, but also how severe those conditions were.

Moratorium Underwriting (MORI)

Moratorium is the most common form of underwriting. Your insurer will assess your medical history and exclude any medical condition you’ve had advice, medication or treatment for in the past 5 years.

That said, most providers do this under a 2-year rolling basis, in which they might reconsider covering you for a previous condition as long as you haven’t sought any treatment or advice for it in 2 years.

Full Medical Underwriting (FMU)

With full medical underwriting, you fill in a form declaring any pre-existing conditions. The insurer will then typically exclude those conditions. While you’ll know what you’re covered for from the start, there’s often very little opportunity to remove exclusions.

FMU provides a faster payout due to the fact you don’t need to provide medical proof as you would on a moratorium basis. Your insurer already knows your health history.

It’s critical you get the underwriting of your policy right, so if you have a pre-existing condition, please don’t hesitate to pop us a call on 02074425880 for advice. You can also email us at help@drewberry.co.uk if you’d prefer.

Can I still use the NHS if I have Doctors Health Insurance?

Absolutely. Private Health Insurance isn’t designed to replace the NHS. You’ll still use the NHS for emergency care, routine pregnancy, and chronic conditions.

Your Health Insurance supplements the NHS, stepping in to provide care for treatable acute conditions.

You’ll keep your NHS GP, as they’ll be the ones making onward referrals for private treatment. Although, these days, many insurers have an app where you can see a remote GP via your smartphone if you wish. And you don’t always need a direct referral from your GP to access private care.

Is going private quicker than NHS?

The purpose of private healthcare via your Health Insurance plan is to provide you with access to fast treatment when you need it most. As it allows you to bypass NHS waiting lists, access to private treatment is often quicker.

- The most recent figures from March 2023 (BMA) reveal that 7.3 million people were waiting for NHS treatment

- 360,00 of these have been waiting more than a year.

The last thing anyone wants is to have to wait more than a year to get the medical attention they need. The private healthcare sector aims to be a much faster service.

With a Health Insurance policy, you’ll usually be seen within a week of your GP making a referral. Although you don’t always need a GP referral to access private care. Most UK health insurers have virtual GP appointment services and 24/7 hotlines, which can speed up the process of diagnosis and treatment.

Compare UK Doctors Health Insurance Quotes and Get Specialist Advice

Health policies offer peace of mind that you can access private healthcare quickly, whilst having the NHS on standby for emergencies and chronic illnesses.

There are a lot of different policy options to choose from, so we understand it can be confusing. If you’d like to talk through your options, please don’t hesitate to get in touch. We can help you find the most suitable cover. Pop us a call on 02074425880 or email help@drewberry.co.uk.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=2113)