What Does Moratorium Underwriting Mean on My Health Insurance?

I have just been given company Private Medical Insurance through work and received my policy documents today. It said my Health Insurance policy has moratorium underwriting, but I’m a little confused as to what this means?

What is Medical Insurance Underwriting?

Thank you for your question, Anna. This is one of the most popular questions that our clients ask us about their Individual Health Insurance.

It’s important to understand the answer as it can make a significant impact on the amount of coverage you receive from your Private Medical Insurance (PMI) policy.

Moratorium underwriting can be quite difficult to understand, which is why we’re here to help.

To start with the basics, the term ‘Underwriting‘ is used to describe how insurers assess the extent of coverage you are eligible for – either before you take out Health Insurance or when you make a claim.

Typically, insurers would use your medical history to decide the level of coverage that you will get with your policy.

There are three main types of Underwriting when it comes to Group Private Medical Insurance:

- Full medical underwriting (FMU)

- Moratorium underwriting

- Medical history disregarded or MHD (note that PMI with medical history disregarded underwriting is only available on larger group schemes and is the most expensive).

What is Moratorium Underwriting?

The type of underwriting on your Company Heath Insurance scheme, moratorium underwriting, does not require you to submit any details about your past health.

Instead, the insurer will exclude treatment for any conditions you have suffered from in the recent past. This is often set as the past 5 years, and any conditions suffered during this period are defined as pre-existing.

However, there is a complication to be found with moratorium Health Insurance underwriting, known as a 2 year rolling moratorium, which is used by some insurers.

What is rolling moratorium medical underwriting?

If you have a 2 year rolling moratorium it means that although pre-existing conditions would be excluded from the plan at the point of application, your insurer may allow you to include them in your plan at a later date.

In order for pre-existing conditions to be included in your Private Health Insurance plan, you would be required to go a certain length of time without exhibiting any symptoms of your preexisting condition in addition to not receiving any treatment, medication, or professional medical advice.

Typically, this period extends to 2 years and if you manage to fulfil this requirement, the condition will be added to your plan. Should it reoccur from that point, you would receive coverage from your insurer for it.

It is important to note that the definition of Moratorium Underwriting can vary between insurers. To ensure that you are getting the right amount of coverage, you will need confirm the definition in your policy terms with your insurer before you make the final decision.

What is Full Medical Underwriting?

Full medical underwriting involves disclosing your full medical history prior to your Health Insurance policy being finalised on a health declaration form. Your insurer will use this information to decide the conditions and treatment you’ll be eligible for under the plan.

PMI with full medical underwriting requires a medical application to join the scheme.

This application will include declaring any past health conditions or treatments you may have had as well as any conditions you are currently suffering from or being treated for.

With all of this information, the insurer would then decide what you would or would not be covered for under your PMI policy.

What is the Best PMI Underwriting?

The question of which type of Underwriting is the better one is a question that we are often asked by our clients. Because so many people have wanted to know the answer, we have put together a full length guide – Moratorium Underwriting vs Full Medical Underwriting.

Frequently Asked Questions

How Is Private Health Insurance Taxed?

How Can I Reduce My Private Health Insurance Premiums?

My health insurance premiums have increased, can I change my insurance provider?

Why Should I Get Health Insurance Advice Rather Than Going Direct?

If I Take Out Private Health Insurance, Will I Still Be Able to Use the NHS?

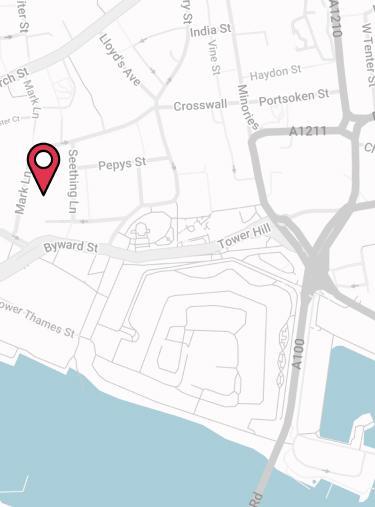

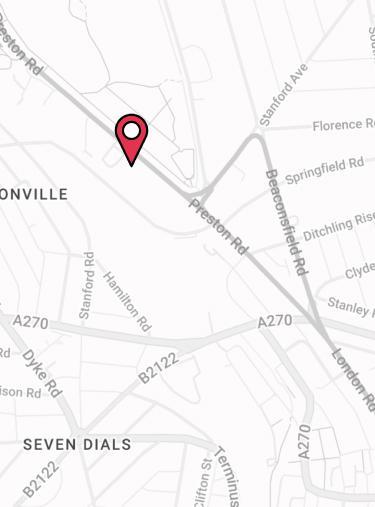

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.