Group Private Medical Insurance

In today’s competitive job market, offering the right employee benefits can make all the difference when it comes to attracting and retaining top talent. Group Health Insurance is one of the most valued benefits, providing employees with access to private healthcare while demonstrating your commitment to their wellbeing. In fact, it’s the third most sought-after benefit, according to our 2024 Employee Benefits Survey.

Whether you’re looking to reduce absenteeism, enhance productivity, or support your team in staying healthy, Group PMI is an essential way to invest in your workforce. In this guide, we’ll explore all you need to know about this particular benefit.

What Is Group Health Insurance?

Group Health Insurance, is an employee benefit that provides private healthcare for your team, offering them quicker access to medical treatment than the NHS can often provide. It’s designed to support your employees’ health and wellbeing, helping them get the care they need, when they need it.

Typically, Group Health Insurance covers essentials like consultations, diagnostic tests, and hospital treatment. Many policies can be customised to include extras such as mental health support, dental and optical care, or wellbeing apps, making it a truly valuable benefit for your workforce.

Why Is It Important?

For businesses, offering Group Health Insurance isn’t just about healthcare—it’s about showing your employees you value them. It’s a benefit that’s proven to boost morale, attract top talent, and help retain your best people. Plus, healthier employees often mean fewer absences and a more productive, motivated team.

GOOD TO KNOW 🤓

According to the World Health Organisation (WHO) companies that implement effective health and wellbeing programmes can see a productivity increase of up to 20%.

What Are The Benefits Of Group Private Medical Insurance?

While Group Medical Insurance might seem like a big expense, there are a number of tangible benefits to both your employees and your business.

Benefits For Employers

By offering access to private healthcare, you can create a healthier, more productive workforce while standing out as an employer that truly values its people. Here are some of the key advantages for your business:

- Minimise sickness absence by ensuring employees receive prompt treatment and return to work sooner.

- Improve retention and recruitment by offering a highly sought-after benefit

- Premiums are usually an allowable business expense against corporation tax (although there are other tax rules – see below)

- Some plans allow employees to cover family members through Salary Sacrifice, thereby reducing your employer National Insurance contributions.

Benefits For Employees

Company Health Insurance has a number of benefits for your staff too:

- Fast access to quality private medical care, negating the need for individual Health Insurance

- Can cut time spent off sick on reduced sick pay

- Potentially offers cover for therapies, e.g. physiotherapy which can help with common ailments for office workers such as back pain

- Potential to include cover for family members

- Potential cover for pre-existing conditions if the Group Health Insurance plan is large enough.

What Does Group Private Medical Insurance Cover?

It’s important to recognise that Group Health Insurance, is designed to supplement and complement the NHS rather than replacing it fully. It therefore doesn’t cover every medical need that may arise.

Medical treatment is broadly split into:

- Inpatient care

Where a patient needs a hospital bed overnight, for example post-surgery. Also includes day-patient treatment, where a patient needs a bed just for the day. All Group Health Insurance policies cover inpatient and day-patient cover as standard - Outpatient care

An optional extra for policies, outpatient care includes all healthcare where a patient doesn’t need a hospital bed, for example diagnostic tests and scans.

In addition, most Group Health Insurance policies cover cancer care in full as part of the inpatient treatment. It provides access to cutting-edge cancer treatment, including drugs and procedures that don’t tend to be available on the NHS (because the cost is prohibitive).

While outpatient cover is optional when setting up a policy (as adding it increases costs), relying on NHS outpatient care runs the risk of delaying private inpatient treatment.

Inpatient Vs Outpatient Health Insurance Coverage

Here’s how the different options look in practice:

Group Health Insurance With No Outpatient Cover

Group Health Insurance Including Outpatient Cover

To avoid potential delays in an employee’s private medical treatment, you can:

- Add full outpatient cover

Covers all eligible outpatient procedures under the Health Insurance policy - Choose limited outpatient cover

Covers outpatient procedures up to a set limit (usually £1,000) per patient per policy year.

📣 CLIENT STORY: Trailmix 📣

Read why mobile gaming startup Trailmix chose to set up Group Health Insurance for their workforce.

Coverage For Chronic Vs Acute Health Conditions

When it comes to how Group Health Insurance providers view medical conditions, they can be sorted into two broad camps:

- Acute conditions – covered under Group Health

Health conditions that pass with time and treatment, such as joint pain or flu - Chronic conditions – not covered under Group Health

Lifelong health conditions that don’t go away with treatment, such as diabetes and asthma.

Group Health Insurance doesn’t cover chronic conditions, so the NHS will therefore continue to take care of conditions such as asthma and diabetes.

Other Group Private Medical Insurance Exclusions

Most Group Insurance Health Plans contain a number of standard exclusions (conditions that aren’t covered), these are usually:

- Emergency care

- Ongoing management and treatment of chronic conditions

- Kidney dialysis

- Fertility treatment / IVF

- Pregnancy and childbirth (unless there are complications)

- Treatment for alcoholism / substance abuse

- HIV / AIDS

- Pre-existing conditions (dependent on underwriting).

For these conditions, employees will need to receive NHS care through the usual routes.

Extra Perks Included With Group Health Insurance Plans

When deciding whether to buy Company Medical Insurance, it’s worth noting the extra perks that come with such a policy. These extra benefits are often free services that offer employees something valuable to use when they’re not claiming. The most common ones include:

Digital GP Services

Most Group Health Insurance coverage includes access to a Virtual GP service, offering online or telephone appointments with a doctor (usually 24/7) from the comfort of an employee’s own home.

Employee Assistance Programmes

Employee Assistance Programmes are a range of services provided by a Group Health insurer, designed to support employees’ physical, financial, and mental health. They usually consist of: legal, medical and financial advice, counselling, and online/phone information and guides.

Wellness Apps

Wellness apps provide access to technology to aid wellbeing, health and fitness. Employees can get recommendations for different aspects of physical and mental health, such as meals, workouts, and meditations.

Read more about the top free services that come with employee benefits.

How Much Does Group Private Health Insurance Cost?

There’s no one-size-fits–all answer to this question: your Group Health Insurance cost will depend on the unique needs of your business. There are a number of different factors that can affect what you’ll pay, including:

- How many employees you want to insure

- The average age of your workforce

- Where your business is based

- How you want your Group Health plan to be underwritten

- The level of health cover you choose

- The type of hospitals you want your staff to be treated in (i.e. if you’re based in London, a London hospital list makes sense, but costs more).

Example Monthly Costs

To give you an idea, here are some examples of Health Insurance premiums for businesses of different sizes. These examples include:

- A £1,000 cap on outpatient treatment (per employee)

- A £100 excess on treatment

- A mid-tier hospital list.

Average Cost Per Employee | Employees | Cost |

|---|---|

10 | £42.87 |

50 | £35.52 |

100 | £37.23 |

These premiums are for illustration only – the true cost for your business will vary depending on your needs. Give us a call on 02074425880, or email help@drewberry.co.uk to get quotes from the top Group Health Insurance companies.

How Is Group Private Medical Insurance Taxed?

Employers usually pay for employees’ Private Medical Insurance from pre-tax earnings. HMRC typically treats premiums as a business expense.

For staff, employer Medical Insurance is a P11D taxable benefit in kind, so they pay additional tax on this cover.

As an employer, tax rules require you to fill out a P11D form declaring that you’ve provided employees with a benefit in kind. You’ll also usually need to pay employer’s National Insurance on the premiums as well.

Policy Options That Impact The Cost Of Group PMI

There are a number of things that affect the the cost of your Group Private Health Insurance, some you can control and others you can’t.

Things You Can’t Control

As with many insurance products, there are some factors that increase the cost of Group Health Insurance that you won’t be able to change. These include:

Your Industry

Some industries and jobs (such as manual work or working at heights), are riskier than others. If you’re in a riskier industry and have a high number of employees doing higher-risk activities each working day, you’ll likely pay more for your Group Health Insurance policy.

Employee Ages

The older your workforce, the more your Group Health Insurance policy will cost. This is because the chance of making a claim gets higher as we get older. If you have a fairly young workforce, you’ll usually benefit from lower premiums.

Company Size

While large workforces will cost more to insure, insurers usually offer a discount if you insure a greater number of employees.

Controllable Group Health Options

Unlike the above, there are a number of options you can toggle in order to bring down the price of your Company Health Insurance. These include:

Policy Excess

The excess on your Company Health Insurance plan is the set amount that an employee must pay (per year or per claim) towards their private healthcare. Setting a higher excess will bring the cost of your Health Insurance down, but if it’s too high it risks being unaffordable for employees.

Underwriting Options

The underwriting choice you make plays a key role in shaping both the cost and coverage of your Group Health Insurance. We go into more detail about these options later on.

Psychiatric Cover

Psychiatric care is one of the most sought-after options for Group Health plans but also among the most expensive. This reflects how difficult many mental health problems are to treat. However, given that each year the UK loses £300 billion annually due to mental ill health, it’s a valuable additional benefit to Business Health Insurance.

Dental And Optical Cover

While a typical Group Health Insurance plan covers surgical procedures such as cataract removal or wisdom tooth extraction, this isn’t the case for routine dental and optical care such as eye tests or checkups at the dentist. Adding a dental and optical option covers the routine stuff, but will inevitably cost more.

Cover for family members

Many employers allow employees to add immediate family to their Group Health Insurance plans. You can also choose who pays for it: your business or your employees.

Additional hospitals

Any Health Insurance company will have multiple ‘tiers’ of hospital facilities in their network. The higher the tier, the higher the cost – so if you’re happy to not pay the extra premium for access to the top facilities in the country (usually those in Central London), it can reduce the cost of your Business Health Insurance.

Six-week NHS wait option

Another way to bring your Group Private Medical Insurance costs down is to select the six week NHS wait option. This means your Health Insurance Company will only pay for private inpatient treatment if the NHS waiting list for that particular procedure exceeds six weeks.

IMPORTANT❗️

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Need Help?

Want a better idea of how much your Group Health Plan might cost? We’ve got a whole guide dedicated to Group Health Insurance cost per employee, along with example quotes and the biggest cost factors affecting Group Health Insurance plans. Or if you’re ready for some bespoke quotes, give us a call on 02084327333 or email help@drewberry.co.uk to get started.

How Is Group Private Medical Insurance Underwritten?

Medical underwriting is a technical term for the way health and medical information is used when assessing a Health Insurance plan. You have a few different options when it comes to how your Group Health Insurance policy is underwritten:

Full Medical Underwriting (FMU)

Full medical underwriting sees employees disclose their medical history. The insurer will likely exclude pre-existing conditions, but employees will know exactly which exclusions apply from the start.

FMU is usually the cheapest because it excludes pre-existing conditions upfront. However, as employees must declare all history of treatment, there’s usually lots of paperwork.

Moratorium Underwriting

Moratorium underwriting requires much less initial information. It sees a condition excluded if, at the start of the policy, the employee has suffered from it in the past five years.

Employees don’t need to make any medical disclosures upfront. Instead, the insurer checks their health history at the time of a claim to make sure that condition hasn’t occurred during a period where it would be disqualified.

Moratorium underwriting is one of the most commonly chosen options for Business Health Insurance.

It allows for pre-existing conditions to be covered after employees have spent two consecutive years on the policy without receiving any advice, medication or treatment for that condition.

Nadeem Farid

Head of Health & Wellbeing Benefits

Medical History Disregarded (MHD)

MHD underwriting is the best underwriting available. It ignores any pre-existing/chronic conditions, no matter when your employees have suffered from them. As the name suggests, your employees’ previous medical history is totally disregarded and they’re able to claim for any eligible condition under the policy’s terms.

It’s the most expensive type of medical underwriting because it’s so all-encompassing, and it’s usually only available if you’re a larger organisation, with at least 20 employees.

Corporate Client Stories

Who Are The Best UK Group Health Insurance Providers?

There are four main Group Health Insurance providers on the market. Each offers very different policies and pricing structures:

- Aviva

- AXA

- Bupa

- Vitality.

In addition to the core cover, all of the leading providers now provide a Virtual GP service. Other benefits also include counselling helplines, wellbeing services, and high street discounts.

Being an independent Health Insurance broker, we work with all the leading providers in the UK. Given our scale and knowledge, we’re in a great position to negotiate the best deal for your company.

Corporate Medical Insurance Product Reviews

Where Does Health Insurance Fit In An Employee Benefits Package?

Health Insurance is one of the most popular and sought-after employee benefits, and therefore goes a long way towards increasing workplace satisfaction. Not only this, but it forms a valuable cornerstone to any employee benefits package. Other core benefits you might want to consider include:

- Group Life Insurance

Pays a cash lump sum to an employee’s family if they pass away while working for your company. Read more about Group Life Insurance. - Group Income Protection

Works with your company’s sick pay policy to offer cover in the form of a continuation of a worker’s monthly income if they are ill or injured. Some insurers provide a discount if you provide your team with both income protection and medical insurance. Read more about Group Income Protection. - Group Critical Illness Cover

Offers your employees a lump sum if they’re diagnosed with a critical illness such as cancer, heart attack or stroke. Read more about Group Critical Illness Cover.

Common Group PMI Questions

Can Small Businesses Get A Group Health Insurance Plan?

Any small business with two or more employees can offer Private Medical Insurance to its employees. We advise and arrange cover for businesses of all sizes – from single director companies to large international organisations. However, if you’re the sole director of a limited company, you might want to check out the specific products for Director Health Insurance.

How Do You Make A Claim?

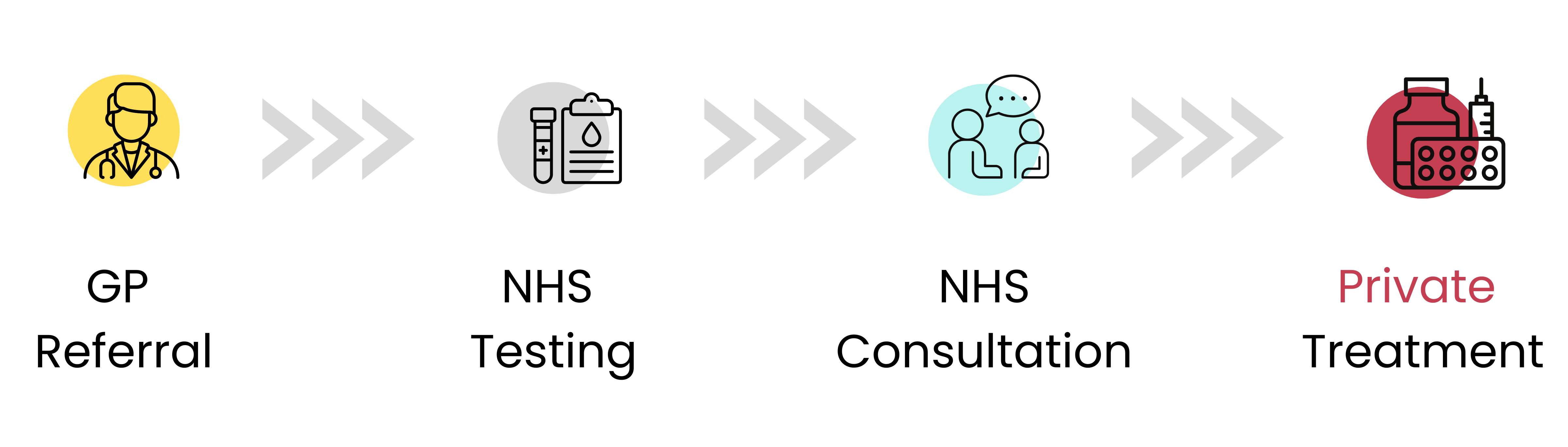

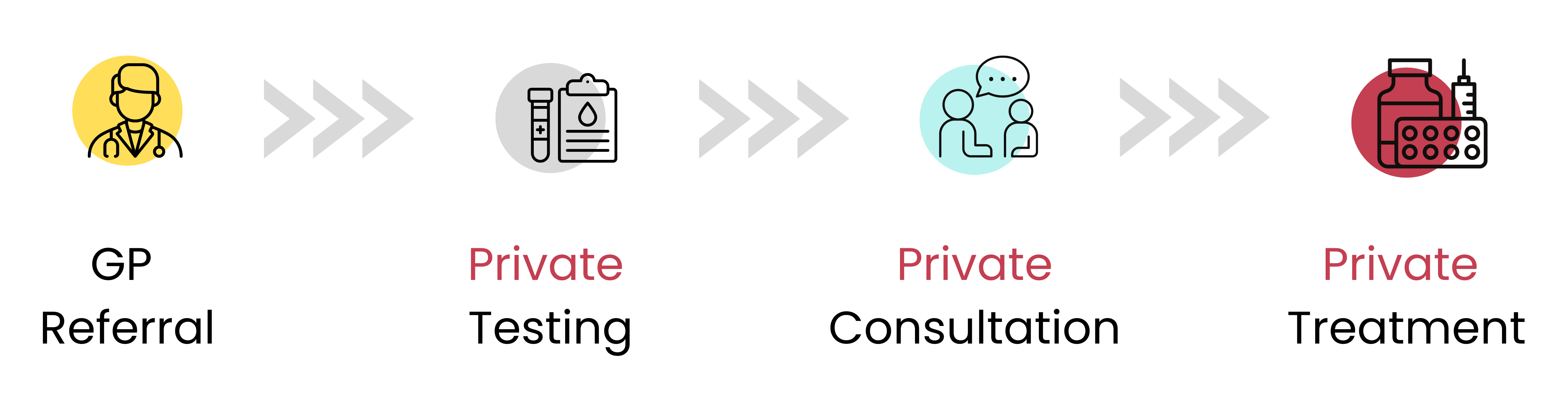

When your employees need to make a claim on their Private Medical Insurance, they’ll need to get in touch with the insurer, who’ll then assess the medical need for the claim (e.g. a GP referral). Once the employee receives an authorisation from the insurer, they can take it to an appropriate private facility for treatment.

This treatment will usually be faster than would be available on the NHS. However, even with the best Group Health Insurance, the process will start with a referral from an NHS GP. This is because Corporate Health Insurance usually excludes GP visits (also known as primary care).

Once your employees have a GP referral, their treatment will depend on the level of cover on the policy.

Are Pre-existing Health Conditions Excluded From Group Medical Insurance?

This will depend on the underwriting of the policy.

The vast majority of group health insurance is underwritten on a Moratorium or Full Medical Underwriting basis, and in both cases, pre-existing conditions will be excluded from cover.

There is a more expensive option called Medical History Disregarded (MHD) which often requires at least 20 employees to be covered.

With MHD cover, all policy members are covered for all treatment – regardless of any pre-existing conditions.

Will Employees Need A Medical Exam Before Getting Insurance?

Employees are not required to have a medical when setting up cover.

If you opt for full medical underwriting, they’ll be required to complete a detailed medical application.

However, if you opt for moratorium underwriting no application will be required. The policy would simply exclude all pre-existing conditions from the previous five years for the first two years of the policy.

Will It Cover Medical Treatment Abroad?

This will depend on the level of cover you choose to provide.

Some insurers provide cover for employees over a set number of days while travelling abroad, while others offer additional travel options that need to be bolted on to the plan.

If you’re looking at health insurance to cover staff abroad there are other international providers including Cigna, Aetna and Allianz which we would consider when comparing quotes and providing recommendations.

Compare Group Health Insurance Quotes And Get Specialist Advice

Setting up and maintaining your employee benefits requires a decent bit of admin, so it quickly becomes time consuming. We do the heavy lifting for you, giving you more time to focus on what matters.

We live and breathe employee benefits, doing this day in-day out for businesses just like yours. Looking at the big picture, we get to know your unique workforce and benchmarking your offering against competitors.

We have access to competitive rates for Group Health Insurance, so give us a call on 02074425880 or email help@drewberry.co.uk to get started.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

If you need help setting up group private medical insurance give us a call on 02074425880 or email help@drewberry.co.uk.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.