Every one of us expects to retire after decades of working. But many people don’t understand pensions and the importance of retirement planning. Our 2022 Workplace Pension Survey found that 28% of staff don’t understand their workplace pension. If they don’t understand pensions, how do they know they’re saving enough?

Although the State Pension is available, the stark reality is that this won’t be enough. Employees need to be educated on the importance of pensions and saving for retirement, and employers play a big part in this.

Employee benefits are key to providing extra value to staff alongside their salary. This includes your workplace pension. It’s not only workers who don’t understand pensions, employers can struggle too. There are many aspects to consider and strict legal obligations to abide by. Find out more in our employer’s guide to workplace pensions.

What Is A Workplace Pension Scheme?

The majority of your employees will get a state pension from the government when they reach the State Pension Age (SPA). While this is a key component for retirement, it’s often not enough.

Workplace pension schemes allow employees to save money during employment for retirement. These are also called company pensions, group pensions, and occupational pensions. Set up by the employer, the employee makes contributions every month to add to their pension fund. These contributions are usually deducted from the employee’s monthly pay.

What Is Auto-Enrolment?

Auto-enrolment was introduced by the government in 2012. It made providing a workplace pension a legal obligation for all UK employers, regardless of size. This was to try and get more people saving into a pension to help avoid an uncomfortable retirement.

Since its introduction it’s made a positive impact, especially in certain industries. For example, participations rates within the Public Admin, Education and Health Industry rose from 14% in 2012 to 86% in 2022.

Employers must set up auto-enrolment from the date they first hire someone. Staff are auto-enrolled, so they don’t need to do anything to contribute to their pension. It’s down to the employer to set up the scheme for them. Once enrolled contributions are then made to the workplace pension by the employee and the employer.

Who Is Eligible For Auto-Enrolment?

Employers must automatically enrol any employees who meet the following criteria:

- Aged above 22 (through to SPA)

- Earn over £10,000 a year

- Usually works in the UK.

Employees can be part of more than one workplace pension scheme providing they meet the qualifying criteria.

How Does A Workplace Pension Scheme Work In The UK?

Whether you have one staff member or 1,000, you must offer all eligible employees a workplace pension. It’s your legal obligation to ensure a scheme is set up and that all staff get auto-enrolled as soon as they join your company.

Types Of Workplace Pension

The most common type of workplace pension you’ll come across today is a defined contribution scheme. With this type of scheme, you and your employee pay a percentage of their salary each month into a pension pot.

Contributions get invested into a pension fund that can go up or down in value. How the investment performs determines the final pension amount. The final pension amount depends on:

- The amount of money paid in by employer and employee

- Investment performance

- How long an employees contributed

- Charges deducted.

Trust Or Contract-Based Group Pension?

Defined contribution workplace pensions can be either trust-based or contract-based.

A trust-based pension is managed by a group of trustees on behalf of the employees.

By separating the funds from the company, it ensures employees get their pension pot, even if their employer doesn’t stay in business.

There’s also master trusts, such as Nest, Aviva, and Scottish Widows. These can be used by multiple unrelated employers and their employees. The employer still has key responsibilities, even if the scheme is set up in a trust.

A contract-based pension is an individual contract between a member and a pension provider. These are commonly used for personal pensions instead of group workplace pensions. The provider is often an insurance company or investment platform.

Is It Mandatory To Provide A Corporate Pension In The UK?

Providing a workplace pension to your employees is mandatory in the UK for all employers. As it’s a mandatory employee benefit, there are a number of legal obligations you have to adhere to.

What Are Your Legal Duties As An Employer?

Employers have a legal duty to offer an auto-enrolment pension to eligible workers. To ensure the auto-enrolment duties are carried out, responsibilities include:

Assessing And Enrolling Your Workforce

When it’s time to set up your workplace pension scheme, you’ll need to assess your team to see who is eligible.

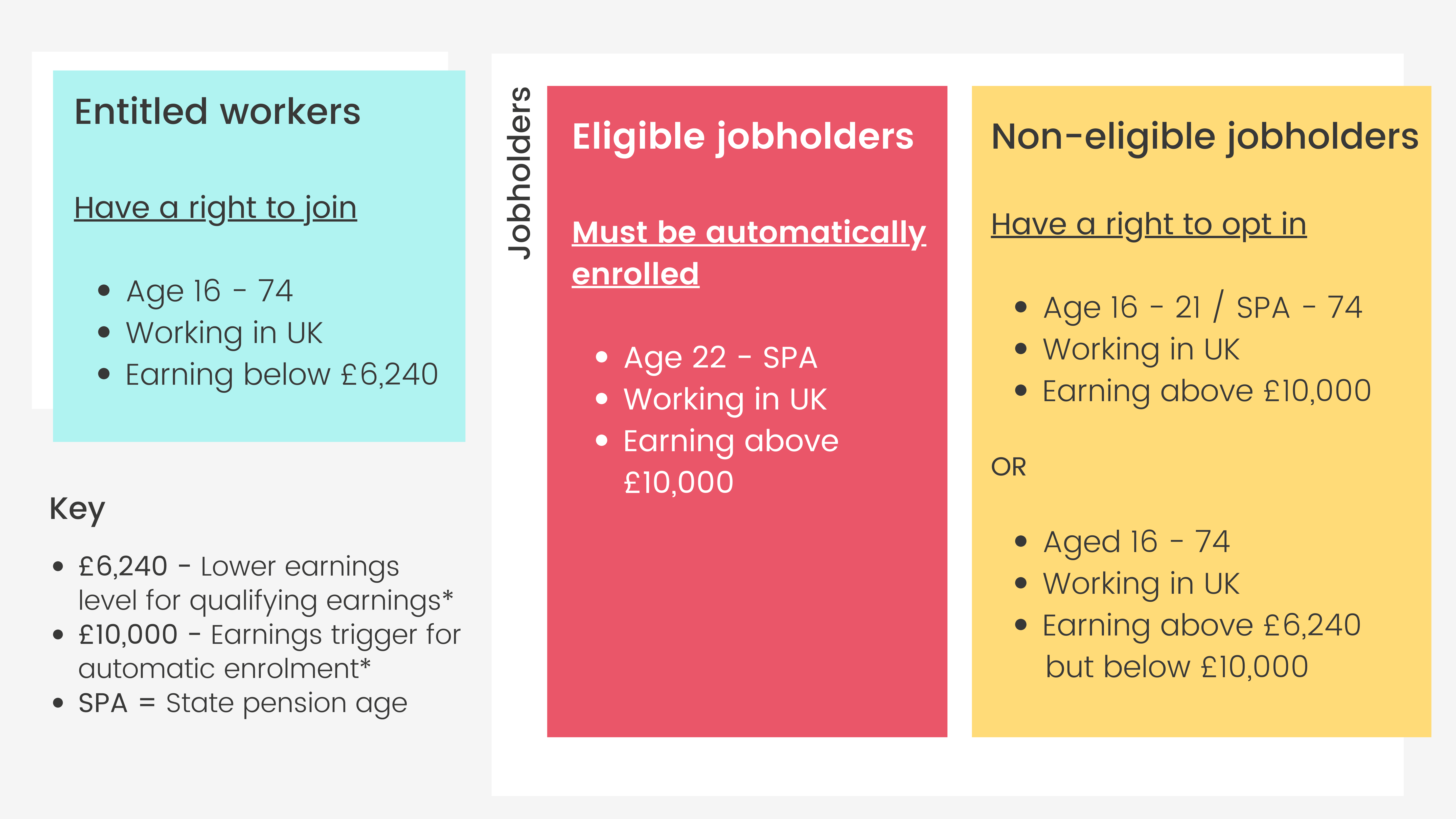

This is assessed by the employee’s age, earnings, and frequency of payments. You’ll need to identify which category your employees fall into from this infographic:![]()

For those not eligible when you start the scheme, you must add them if circumstances change—if they reach the necessary age or their earnings change, for example. As soon as they meet criteria, you must write to them about the scheme within six weeks. You also have to give the pension provider all relevant eligible employee information.

If, for whatever reason, a worker wants to opt out of the auto-enrolment scheme, you have to act on this request.

Can You Postpone Auto-Enrolment Workplace Pension Duties?

It’s an employer’s legal duty to begin auto-enrolment duties as soon as they recruit their first employee. That said, postponement is available. This allows companies to postpone their duties start date for some, or all, staff for three months.

You may postpone auto-enrolment if you:

- Have seasonal or temporary staff

- Employ workers on a probationary period

- Need more time to set up the pension scheme.

Ongoing Responsibilities

Your duties as an employer don’t end after auto-enrolment. It’s also your responsibility to ensure your scheme is being managed correctly.

Even if you use a financial adviser or have a trust-based pension the buck stops at you. You need to:

- Check if and when employees should be enrolled

- Manage requests to opt out or join

- Keep records

- Check if existing staff should be added to your pension scheme.

If you need help with these tasks or anything else pension related, our team at Drewberry are on hand to help.

Our corporate pension specialists have a wealth of experience and can help ensure you meet all your regulatory needs, as well as provide a valuable benefit to your staff. Pop us a call on 02074425880 or email help@drewberry.co.uk.

Enrolling Eligible Employees Into Your Workplace Pension

Once an employee is enrolled, each month they will make pension contributions. This is based on a percentage of their earnings. You, as an employer, will also make contributions into their pension (don’t worry we cover this in more detail later).

What Are The Minimum Required Pension Contributions?

Auto-enrolment sets out that 8% of an employees qualifying earnings must be contributed into a workplace pension. Employers have to pay at least 3% of this. The remaining 5% would then come from your employee.

If you were to increase your contribution to more than 3%, employees could reduce theirs if they wanted to. For example, if you opted to pay 6%, employees could contribute just 2%, as long as the total contribution is 8%.

What Are Qualifying Earnings?

All schemes class ‘qualified earnings’ as the total pay between £6,240 and £50,270 a year, before tax (for 2022/23 tax year). Those within this earnings bracket will be auto-enrolled into a scheme.

Employees earning below £6,240 have a right to join, but as the employer, you don’t have to pay contributions. You can if you want to.

There are several pay definitions for you to choose from. These are:

- Qualifying earnings

- Basic pay or pensionable pay

- Total pay.

Where Do Group Pension Contributions Go?

The money contributed to your staff’s pensions is invested into a pension fund, which is a unique type of investment fund. The money paid in is invested in different types of financial assets.

The aim of these funds is to help your employees pension pot grow over time, so they get the best return possible at retirement.

How Are Corporate Pension Contributions Invested?

Different scheme providers will have different investment options. Contributions can be invested in many ways; from property, company shares, and bonds, or a mix.

Most providers, however, will use a ‘default fund’. This is a lifestyle fund which offers more balanced risk, rather than it being too high or too low. These funds tend to invest employees savings in two stages, growth and consolidation.

- Growth Stage

Younger employees who aren’t near retirement fall into the growth stage. Their savings are invested into risker assets to try and generate as much return as possible

- Consolidation Stage

Older employees, typically 10-15 years away from retiring, would fall into the consolidation stage. At this point, their investments would be moved to less riskier investments. This is done to protect what they would have accumulated within the growth stage.

Each provider has its own default fund, so it’s important to review these against each other when setting up a scheme. The level of risk may differ from provider to provider.

For example, Aviva’s default fund is higher risk compared with the likes of Royal London. This means Aviva might provide greater returns, however, it’s a riskier option. Riskier investments tend to fluctuate, while steadier ones change slowly over time.

SPECIALIST TIP 🤓

A default fund may not suit all employees. Some will have a higher tolerance to risk than others. If this is the case, they can opt out of the default fund and choose another if they wish too.

Can employees add previous pension pots into their workplace scheme?

There are no limits to how much an employee can save across multiple pension schemes. They can join a new workplace pension scheme even if they have a previous pot from another employer.

Most schemes allow members to transfer old pension pots into a new one. The rules of which depend on the scheme provider.

Can employees make additional contributions?

Yes, they can. Employees can pay AVCs (Additional Voluntary Contributions) to boost their pension pot. They can either:

- Increase the percentage of contributions they pay through payroll every month

- Pay a lump sum amount.

What happens to their pension if an employee leaves your company?

When an employee leaves your company, they are ‘opting out’ and will no longer pay contributions. If they have been a member of a defined contribution scheme for at least a month, the fund stays invested. It belongs to the employee whether they leave the company or not.

They may be able to move this pension to another scheme, such as the one at their new place of employment.

How Much Does A Group Pension Cost?

There are costs associated with setting up a workplace pension. It also costs to continue running the scheme. No matter what size your company is, there are fees involved. All pension providers have different charges, so the price you pay varies.

Providers take into account your employees, their salaries, and your business turnover. Some providers may charge a monthly fee. While others charge one singular set-up fee to cover the running of the scheme.

Before setting up a workplace pension, it’s essential you understand the potential costs.

Setup Costs

When it comes to setting up a workplace pension, there are a number of things you need to consider that might affect the cost. Before you get the ball rolling, it’s important to consider the following:

- What payroll needs do you have?

- Do you require external support?

- How much do pension providers charge?

Provider Charges

Some pension providers charge a one-off fee that covers the setup of the group pension. For example, one has a fee of £500 plus VAT, which reduces to £300 plus VAT if you use a financial or business adviser.

Some charge an annual fee and an Annual Management Charge (AMC). This is typically for smaller businesses and those with low pension contributions. You may find that your chosen pension provider has an annual fee and AMC, instead of a set-up cost.

Payroll Setup

Most payroll software is compatible with auto-enrolment. It needs extra upkeep though, so this is something to think about.

As an employer, you can manage the payroll yourself or outsource the task. Outsourcing it to a payroll agency or accountant will come at a cost. Some will offer auto-enrolment obligations in their price, while others have an extra fee.

For example, a small-sized company may pay up to £300 for this setup, so it’s something to consider in your budget.

Adviser Charges

If you opt for the support of a corporate financial adviser to help you set up and manage your workplace pension there will be separate costs. The price you’ll pay will depend on what kind of help you need and whether it’s a one-off or ongoing service.

For instance, we have a fixed fee for setting up a new corporate pension or providing ongoing workplace pension support. Other firms may charge an hourly rate.

Limitations of doing it yourself

If you don’t utilise the services of a specialist corporate adviser, you’ll have to set up auto-enrolment yourself. This is doable, but there are a lot of duties you are required fulfil with penalties if they are not met. Keeping records, for example, is essential to ensure you’re meeting your obligations.

If doing it yourself, you have to keep records of the following:

- Workers assessed and enrolled, including name, address, employment start date, and when they joined the scheme

- Contribution data – amounts paid to pension provider

- Details of employees that opt in

- Pension scheme reference number and registry number

- Information sent to provider – must be kept for 6 years

- Opt-out members’ information saved for 4 years.

The above, as well as communicating the scheme, can be time-consuming. If you’re prepared to pay for extra support, using a corporate adviser can free up your time. They can help you find the right pension scheme and set up your payroll for auto-enrolment.

If you need any help please do not hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

Ongoing Costs

Once you’ve set up your corporate pension, there are a few ongoing payments to make.

Employer Contributions

By law, you have to pay the minimum employer contributions to your employees’ pension. These are monthly payments you’ll have to make for every employee enrolled in the scheme.

How much you pay depends on the scheme’s rules, but you still need to factor this cost into your budget. You can work out total contributions by using The Pensions Regulator calculator.

You can choose to contribute more than the minimum 3%. Some pay all of their employees’ pensions as part of their employee benefits package.

Monthly Administration Fees

Most pension providers have charges in place for companies using their schemes. This will vary from provider to provider, but it’s important to have a clear understanding of the fees to expect.

As an employer, you may pay a monthly fee to cover the running and management costs of the scheme. For example, one provider charges £36 a month. But if you use a payroll bureau to manage your payroll and send data to your provider, the monthly cost is lower. You’ll get a discount if you’re not using all the provider’s services.

Annual Management Charge (AMC)

Workplace pensions often have an Annual Management Charge. Employees have to pay this to cover the cost of running the scheme and investing money in their pot. They will be charged an amount a year, which is either a set fee or a percentage of the value of their pension.

Each investment often has a different AMC to reflect the type of investment. More specialist, or actively managed funds, will come with a higher charge.

SPECIALIST TIP 🤓

If an employee remains in the ‘default fund’, the maximum annual management fee is capped at 0.75% per year.

This is a single percentage charge of the pension value. Charges may differ when transferring out of a default fund.

Ongoing Advice Support

Some companies get advice from a financial or business adviser when setting up a pension. Depending on the level of support you need, this might be a one-off service for you.

That said, it’s important to regularly review your pension scheme. You may be able to make effective changes, such as switching to a provider with better rates or reducing the AMC for your employees.

If you want to outsource the management and admin of the group pension, you can hire ongoing support. Again, this comes at a cost and will depend on your requirements. Fees are regularly reviewed in line with the services your company needs. This is worthwhile paying for if your business doesn’t have the resources to keep up with the admin.

We provide these services to businesses of all sizes. Many simply want the peace of mind knowing they have a specialist in their corner who can ensure they meet all their workplace pension obligations.

If you need help, pop us a call on 02074425880 or email help@drewberry.co.uk.

When can employees withdraw their corporate pension fund?

Most workplace pensions set an age for when an employee’s pension is available. Often, this is between 60 and 65. In some circumstances, staff can access it at 55.

All defined contribution workplace pensions let employees take up to 25% as a tax-free lump sum. The remaining 75% is subject to income tax. This is dependent on the type of pension though, as is age. Old pension plans, for example, may have different rules. In such cases, speaking to a financial specialist can help pinpoint the finer details.

Generally, employees can either:

- Take it all as cash and some of it tax free

- Buy a product that guarantees income for life (known as an annuity)

- Invest the fund to get a regular, adjustable income (known as flexi-access drawdown)

- Leave it all invested and take an element as income as and when they need it.

When do corporate pension contributions have to be paid?

Your employer duties include paying contributions by the 22nd of each month. These must be passed to your provider before the 22nd (19th if they pay by cheque).

The Pensions Regulator can issue warnings and fines. If you are more than 90 days late paying your contributions, it’s classed as a breach to The Pensions Regulator. If you don’t keep up to date with pension payments, you’ll pay back any missed contributions.

Are there workplace pension schemes that invest ethically?

There are ethical investments in most schemes, since focus on sustainability is high. These are true ethical or ESG options. Both of which support environmental issues, such as carbon emissions, waste, and energy.

We go into more detail about ethical investment funds below.

How Are Workplace Pension Contributions Taxed?

There are two initial ways that tax relief is provided when your employees pay into a pension. It’s best to pick a plan with a tax relief arrangement that suits your circumstances.

The method used will determine how the contributions are taxed and paid. Keep reading to find out how each of these methods work.

Relief At Source (RAS)

Relief at source takes an employee’s contributions from their salary after it’s been taxed. This is the setup most workplace pension schemes use.

Via this method, contributions are made to your chosen scheme provider. For basic rate tax payers, the provider then automatically tops up your employees pension by 20% when their money gets invested. The provider then claims that 20% tax relief from the government.

Take this example. One of your employees earns a monthly salary of £2,000 and pays a 5% contribution of £100. An £80 deduction comes from their take home pay, then the provider tops it up by £20 and claims it back from HMRC.

It’s important to note that those on higher tax rates have to claim their full tax relief through a tax return or HMRC.

Net Pay

Through net pay, employee’s contributions come from their salary before tax. They will only pay tax on the remaining income, meaning they get full tax relief straight away.

For example, if an employee earns £2,000 a month and contributes 5% (£100) they will only pay tax on £1,900. As they don’t pay tax on the £100 pension contribution, they effectively save £20. This means their £100 contribution really only costs £80.

Unfortunately as tax relief is provided straightway, those earning below the personal allowance of £12,570, won’t get any tax relief via the net pay method. Basic tax payers receive full tax relief immediately and higher / additional tax payers have to claim back tax on their annual tax return to get tax relief.

SPECIALIST TIP 🤓

Employers needs to pick which tax relief method to use. It’s important to align this with your employee demographic. For example, relief at source maybe more suited to lower earners who don’t meet the tax threshold compared to a net pay method.

Salary Sacrifice

Some workplace pension schemes operate through salary sacrifice. Employees contribute to their pension without lowering their take home pay. It’s a tax-efficient way to contribute. As deductions occur before taxing an employee’s salary, there are great tax savings.

Salary sacrifice (also known as salary exchange) can be arranged in two ways:

- Simple

An employee’s net pay increases as their National Insurance (NI) savings are added

- SMART

Staff get higher contributions without reducing take home pay as NI savings are included.

Employee Savings Through Salary Sacrifice

Employees save on National Insurance Contributions (NIC) as they sacrifice pay before tax. This means that their remaining taxable income is lower. Income tax payments follow the same process.

They can enjoy higher pension contributions made by you, the employer, too. If you’re willing to contribute all or part of your company’s NI savings, their pension fund can grow.

It may seem like your employees don’t receive tax relief as you contribute on their behalf. But the employee’s contributions are exempt from Income Tax and NI.

Employer Savings Through Salary Sacrifice

As your employees’ taxable income is lower, employers also save on NI. This is because you only have to pay NI on the remaining income after deductions. There are several things you can do with these savings. You can give all, or some of, the amount to your staff to boost their pension, or you can invest it back into your business.

How Is The Cash Taxed When Drawing From A Workplace Pension?

When your employees reach their retirement age, they can drawdown their pension. This essentially means they can begin taking money from their pot. At the same time, they can continue to invest their money while accessing their pension. This allows the pension to grow further during their retirement.

All workplace pension schemes are taxed. The first 25% an employee withdraws is tax free, though. The remaining 75% is subject to tax. This applies if the member opts for pension drawdown.

When paying out a pension fund via income drawdown, the amount is taxed under PAYE. This could be 20%, 40% or 45% depending on their income. What this means is the amount an employee accesses (minus the tax-free amount) is taxed as income.

Some pension providers allow members to withdraw more than 25% tax free if there are sufficient uncrystallised funds. Spreading the tax-free income throughout retirement can lead to lower tax.

Workplace Pension Investment Options

All pension schemes invest contributions into an investment fund to help it grow. There are many options, including the following types:

Default Funds

When you set up a workplace pension scheme, the money is placed automatically into a fund. This is a ‘default fund’. It’s picked by the provider with the aim of meeting the needs of all members. These funds are balanced on a low to medium risk basis.

You’ll find that most default funds are lifestyle strategies. This means contributions are first invested in high-risk funds, like equities or property. As the employee nears retirement, these are switched to lower risk funds, such as bonds and cash, to protect the value of the pension.

If you’re happy with this fund for your staff, you don’t need to do anything else.

Wide Range Of Choice

Most workplace pensions allow your employees to choose where their money is invested. This gives them more choice over where their fund goes and can suit personal preferences.

There are a wide range of investment fund options. One provider has over 4,000 options, for example. Staff can make their own decision over whether to invest in high- or low-risk investments.

The range of funds means they can invest in:

- Equities (shares in companies)

- Bonds and gilts (loans to companies or governments)

- Cash

- Specific locations, e.g. UK or USA based

- Funds designed to protect their assets.

- Ethical options.

If staff want extra guidance on investments, a financial adviser, like one on our team, can be valuable. Not only can we help set up a corporate pension for your company, we can help on an individual basis, too.

Nowadays, more providers offer ethical options to support changes in consumer choices. For employees wanting to invest their fund in a sustainable way, they can! It’s also beneficial for B Corp certification for your company.

There are true ethical options or ESG (Environmental, Social, and Governance) funds. You’ll find more ESG-based funds than true ethical ones in pension schemes. These steer clear of taboo industries, like tobacco or gambling.

Employees can pick companies that support the environment. This might be renewable energy, water waste, or reducing carbon emissions.

Sharia Funds

Some pension providers offer Sharia-compliant funds which invest according to Islamic law. Islamic banking has long-standing rules over which practices are permissible or halal. Companies partaking in activities that go against Sharia law are not permitted. This includes:

- Manufacturing, selling or offering alcohol

- Manufacturing, selling or offering haram meat

- Gambling, night club activities, and pornography.

The available Sharia-compliant funds should be communicated by you, the employer, when setting up a workplace pension scheme. If you know you have employees in this demographic, it’s important to seek out the right setup for them.

Setting Up And Communicating Your Workplace Pension To Staff

Part of setting up a workplace pension scheme involves communicating it to your team. Aside from the legal duties, you have a responsibility to let your staff know what the scheme is and how it works.

Communication Obligations

Your communications should cover:

- How automatic enrolment affects your eligible employees

- The assessment of workers

- Costs and charges

- Retirement options

- Investment options

- Contributions payable by the employee and employer

- Postponement.

You’ll have to notify staff of their opt-out rights and how this works. If they leave the scheme within one month of auto-enrolment, you have a duty to refund any contributions. This one-month period starts the day after sending the opt-out communication.

You can postpone the start date of your auto-enrolment duties for new employees by up to three months. Should you do this, you must issue a postponement letter within 6 weeks of the employment start date.

The easiest way to communicate the above is through email. You can send all relevant pension information to your employees, such as introductions from the pension provider, how it works, and an agreement to sign. You’ll have to provide them with information regarding contractual changes to salaries, how their payslip will change, and what it means for the payroll system.

The Pensions Regulator (TPR) provides templates online. But these might not cover everything about your workplace pension scheme, so it’s best to use templates as a starting point.

Our team of workplace pension specialists can support you and provide advice on how to effectively communicate the pension scheme. This can include a tailored approach to your specific business and 1-2-1’s to ensure staff are aware of their employee benefits and what a workplace pension offers.

Who Are The Top 6 UK Workplace Pension Providers 2026?

There are many pension providers operating within the UK market. Not all schemes are equal. You’ll see many options with different charges and investment funds. To help, we’ve got a summary of the top UK workplace pension providers for you.

Information is accurate to the best of our knowledge as of December 2022.

Our specialist in-depth review of each of the UK's leading corporate pension providers

Compare Workplace Pension Providers & Get Specialist Advice

Choosing the right auto-enrolment pension scheme for your workplace can be difficult. We know that pensions are a complex topic, but the schemes are essential for your team’s retirement planning.

Try to pick a provider that offers a good range of investments for your employees. It should have flexible retirement options, effective communications and ease of use. It’s also essential that the provider shows commitment to the pension market in the UK.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.