How Much Do Employee Benefits Cost In The UK 2026?

All businesses, of all shapes and sizes, offer at least some form of Employee Benefits to their staff. How much these will cost depends on which benefits you want to offer and how comprehensive your Employee Benefits package is.

There is not a one-size-fits-all approach to the benefits you offer, and there are so many to consider. Here are some examples of the benefits that sit underneath this umbrella:

- Insurance policies (e.g. Group Life Insurance or Group Income Protection)

- Health and wellbeing benefits (e.g. Group Health Insurance or Corporate Health Cash Plans)

- Workplace Pension Schemes

- Training / development budgets

- Childcare resources & support

- Cycle to work / Electric Car Schemes

- Employee Discount Platforms.

All of these have different features, so it’s hard to put an exact price down on paper. It then becomes even harder when you discover that the cost of Employee Benefits in the UK can depend on your specific business and workforce.

While there’s no simple formula to calculate how much employee benefits cost, we’ve used our knowledge and experience to give you a rough idea.

Cost Of Mandatory Employee Benefits

Before delving into the costs of ancillary benefits, it’s important to first understand which employee benefits are legally required in the UK and the potential costs associated with them. These mandatory benefits include:

- A workplace pension scheme

- Statutory Sick Pay

- Maternity and paternity pay

- Annual leave entitlement / paid holiday.

Workplace Pension Contributions

There are minimum contributions for workplace retirement plans in the UK. As an employer, you must contribute at least 3% of an employee’s qualifying earnings. The total cost of which will depend on the number of staff, their salaries and your contributions. We’ll explore this in more detail later on!

Statutory Sick Pay

As a minimum, companies must provide Statutory Sick Pay (SSP) to eligible employees. This is £118.75 for up to 28 weeks. You do not need to provide SSP for the first three days of qualifying sickness absence.

You can offer employees more company paid sick leave if you wish. But this is down to your discretion and how much your business can afford.

Maternity And Paternity Pay

Pregnant employees are entitled to up to 52 weeks of maternity leave, which can be paid for up to 39 weeks. Statutory Maternity Pay provides:

- 90% of their average weekly earnings for the first 6 weeks before tax

- £184.03 or 90% of their average weekly earnings (whichever is lowest) for the remaining 33 weeks.

Statutory Paternity Pay works out the same, but this is usually for only 1 or 2 consecutive weeks’ leave.

Annual Leave Entitlement

Eligible employees are entitled to 5.6 weeks of paid annual leave. This can include public and bank holidays.

When an employee leaves your company, any untaken leave in that financial year must be paid to the employee as holiday pay. This is something to consider in your employee benefits budget.

How Much Do Insurance Benefits Cost Per Employee?

Once you’ve covered mandatory benefits you can look into ancillary ones to enhance your reward package, such as insurance policies, which are increasingly popular among employees.

Our 2025 Employee Benefits Survey found that workers want their employers to offer insurance policies to help protect themselves and their families. This growing demand highlights the importance of insurance benefits in attracting and retaining top talent.

There are many different policies you can set up, including:

- Death In Service (Group Life)

- Group Income Protection

- Group Critical Illness Cover.

Each policy offers valuable financial protection to employees; however, the cost of offering these benefits can vary based on key factors such as the size of your company and how much cover you want.

The Cost of Group Life Insurance

Group Life Insurance – also known as Death in Service – pays out a lump sum if an employee dies while working for you. They don’t have to die during work hours or in the workplace to be eligible for a payout.

This lump sum is a multiple of an employee’s earnings and often goes to their family. Although it can also be paid to a charity of their choice.

For employers, HMRC views premiums as a tax-deductible business expense. The premiums you pay can be offset against your corporate tax bill.

What Impacts The Cost Of Group Life Insurance?

The cost of Group Life Insurance depends on your staff demographics and the level of cover chosen.

Here are the factors considered when calculating premiums:

- Employees’ earnings / level of cover

As the benefit is a multiple of each employee’s earnings, this, plus the multiple you choose to offer, has a major impact on the cost - Cease age

The age when the policy stops covering an employee. This is typically 65 / each employee’s state pension age, but can be up to 75. The higher the cease age, the greater the risk of employees dying during the scheme, which means higher premiums - Your industry / job titles

Some industries, and jobs (e.g. manual work / work at heights), are riskier than others. If your employees partake in high-risk activities at work, you pay more for cover - Employees’ ages

Older employees are more likely to pass away, so the older your workforce, the higher the cost of cover - Group size

You might think large groups will cost more, but insurers often offer discounts for large group schemes due to economies of scale - Employees’ place of work

Location matters because life expectancy differs across the UK. Employees living and working in some areas are less likely to die prematurely than those in other areas.

Example Premiums

In the table below, we’ve provided example Group Life Insurance premiums on a per employee basis for different companies. Each company also offers a different level of cover.

Compare Group Life Insurance quotes from the top UK insurers ⟶

Employees | Benefit | Cost per Employee | Software company in London |

|---|---|---|

10 | 4 x salary to age 65 / State Pension Age | £15.75 per month | Health service company in Barnsley |

100 | 1 x salary to age 65 / State Pension Age | £4.02 per month |

As you can see, the cost of Group Life Insurance varies depending on the level of cover provided, as well as how many employees you want cover for. Larger groups typically cost less to insure as insurance companies offer discounts for large schemes.

It’s relatively low cost, which is why it’s usually the first employee benefit our clients introduce.

The Cost Of Group Income Protection

Group Income Protection – sometimes called Group Sick Pay Insurance or Disability Insurance – pays a monthly benefit if an employee is off sick for a long duration. The benefit is a percentage of their annual gross income.

This can act as an extension of your company’s sick pay policy. It covers any accident or sickness that stops an employee working for longer than the policy’s deferred period.

HMRC deems Group Income Protection premiums as a business expense. However, the insurer pays claims to the company and you distribute it to the employee (as you do their salary). At that point, the employee will pay tax on the benefit.

What Impacts The Cost Of Group Income Protection?

As with Group Life, the cost of Group Income Protection is dependent on your team demographics and the level of cover.

The following factors affect the price:

- Level of cover

You can cover between 50% and 80% of gross earnings. The bigger this percentage, the higher the costs of the policy - Deferred period

This is the time between an employee becoming unwell and the insurer paying out. The longer the deferred period, the lower your premiums - Length of payout

You can limit the payout to 2 years, for example, or have it pay out until retirement. The longer the payment period, the higher the premiums - Employees’ ages

The older your workforce, the higher the cost of cover, as older workers are more likely to suffer illnesses and injuries - Industry and occupation

Some industries are more risky than others. For instance, builders face a higher risk of on-the-job injuries than desk workers do. Industries with a higher claims risk attract higher premiums - Include National Insurance and pension contributions

You can cover employer National Insurance contributions and employer / employee pension contributions, too. Doing so will increase premiums, but it does provide an extra level of protection.

Example Premiums

The table below details example Group Income Protection premiums for companies of various sizes in different industries. Each company also has different policy options that affect the cost of cover.

Compare Group Income Protection quotes from the UK’s top insurers ⟶

Construction Firm (10 Employees) | |

|---|---|

Benefit | 50% of salary |

Cease Age | 65 / State Pension Age |

Deferred Period | 26 weeks |

Payment Period | 2 years | Cost Per Employee | £5.36 per month | Bakery Business (100 Employees) |

Benefit | 75% of salary |

Cease Age | 65 / State Pension Age |

Deferred Period | 13 weeks |

Payment Period | 2 years | Cost Per Employee | £12.60 per month |

As you can see, the level of cover and the deferred period both have a significant impact on the cost. If you’d like to compare quotes specific to your business, get in touch with us today!

The Cost Of Group Critical Illness Cover

Group Critical Illness Insurance pays a lump sum if a worker suffers a critical illness listed on the policy. This lump sum is a multiple of an employees earnings or a fixed amount of your choice.

The insurer defines what illnesses they will and will not cover, and to what extent, on an individual insurer basis. The most common claims on a policy are for cancer, heart attacks, and strokes.

Group Critical Illness premiums are a tax-deductible business expense for employers. The employee pays P11D tax on the premiums. The benefit is then paid out tax free when a claim is successful.

What Impacts The Cost Of Group Critical Illness Insurance?

As with all insurance benefits, the cost of group CIC depends on staff factors and the level of cover. The following will impact the cost:

- Benefit amount

Employers typically offer workers a payout of between 1 and 5 times their yearly earnings. The higher the payout, the higher your premiums - Employees’ ages

The older your workforce, the more likely they are to suffer a critical illness, meaning a greater monthly cost - Coverage

‘Core’ cover protects against around 12 critical conditions. You can extend your policy with ‘additional’ cover for a further 20-25 conditions. The more conditions the policy covers, the higher your premiums.

Example Group Critical Illness Insurance Costs

The table below shows example Group Critical Illness premiums for companies of various sizes with different policy options.

Compare Group Critical Illness Cover quotes tailored to your company ⟶

Education Provider (100 Employees) | |

|---|---|

Benefit | 2 x earnings in last 12 months |

Coverage | Extended: Core + Additional Illnesses |

Cease Age | 65 / state pension age | Cost per Employee | £10.63 per month | Storage Company (40 Employees) |

Benefit | 1 x annual salary |

Coverage | Standard: Core conditions only |

Cease Age | 65 / state pension age | Cost per Employee | £7.44 per month | Business Services Firm (10 Employees) |

Benefit | 2 x annual salary |

Coverage | Extended: Core + Additional Illnesses |

Cease Age | 65 / state pension age | Cost per Employee | £42.23 per month |

Since cancer is a common illness, many employers offer Critical Illness to provide financial support to their staff. If you’d like to compare quotes from all the leading UK Group Critical Illness providers, enquire below!

How Much Do Employee Health and Wellbeing Benefits Cost?

Employers can set up Business Health Insurance or a Corporate Health Cash Plan, or both. While these do cost, many insurers offer a range of free extras on top of the core cover, including Virtual GPs and mental health services.

The Cost Of Business Health Insurance

Business Health Insurance gives your employees access to private healthcare. They can bypass NHS waiting lists and get the care they need exactly when they need it.

This employee benefit not only improves health and wellbeing but also has a positive business impact. It provides faster access to treatment, helps reduce absenteeism, and increases productivity and employee engagement.

What Impacts The Cost Of Business Health Insurance?

Premiums will vary from business to business, as there are so many factors to consider. But like other insurance benefits, your employee demographics and the level of cover play a part in the price.

To price up a Business Health Insurance plan, insurers consider your:

- Group size

While covering more employees means higher premiums, the more staff you have, the lower the cost tends to be per worker. This is due to economies of scale in covering larger groups - Employees’ ages

It costs more to insure older employees because they’re more likely to claim. So you’ll pay more to cover older staff - Location

The cost of healthcare around the UK varies. As staff are likely to want treatment near their home, it costs more for cover in areas where care is more expensive, such as in and around London - Industry

Health insurers adjust premiums according to the industry you’re in. Some industries, such as construction, are riskier than others, and so, the premiums reflect this additional risk - Policy options / coverage

Every policy option added on affects the premium cost. All Business Health policies cover inpatient care as standard, but there are optional add-ons. These increase coverage for a higher premium. There are also options that cut premiums, such as an excess or guided care.

Example Premiums

We’ve generated example Business Health Insurance quotes for two different businesses. This is for illustrative purposes only, so the cost of employee benefits completely depends on your specific circumstances.

Compare Group Health Insurance quotes for your business here ⟶

Example 1: Small Architect Firm, London

Let’s use the example of an architecture firm with five team members. They want Business Health Insurance to cover all of their employees. This is what their costs might look like:

Small Architect Firm (5 Employees) | |

|---|---|

Benefits |

|

Excess | £100 |

Underwriting | Cost Per Employee | £60.25 per month with AXA |

Example 2: Large Tech Company, Manchester

Let’s take another example of a 76-person technology company based in Manchester. This is what their costs might look like:

Large Tech Company (76 Employees) | |

|---|---|

Benefits |

|

Excess | £100 |

Underwriting | Cost Per Employee | £47.80 per month with Vitality |

While they have more employees than the architects firm, they benefit from a group discount, leading to a lower cost per employee.

If you want to understand the specific costs of Group Health Insurance, get in touch. Our team of specialists are here to help you find the best cover for your employees.

Corporate Medical Insurance Product Reviews

The Cost Of A Corporate Health Cash Plan

A Corporate Health Cash Plan is an affordable alternative to comprehensive Health Insurance. It enables employers to offer at least some level of health cover if health insurance is too costly for a business.

Rather than paying for private medical treatment, Health Cash Plans provide cashback for part of the costs of everyday care, such as routine dental and optical services. It might also pay towards other treatments / procedures, such as:

- Therapies (e.g. physiotherapy, acupuncture, osteopathy, podiatry)

- Health checks

- Dental accidents / injuries

- NHS prescriptions

- Diagnostic tests / scans.

What Affects The Cost Of Corporate Health Cash Plans?

Corporate Health Cash Plans aren’t as complicated as Group Health Insurance policies, so there are fewer options to consider.

The key factors behind the cost of premiums are the number of workers you have and the level of cover. The level of cover affects how much an employee can claim back for a certain treatment. Higher cover means greater reimbursements and, therefore, higher premiums.

Again, like healthcare coverage, HMRC views Corporate Health Cash Plan premiums as a business expense.

Example Corporate Health Cash Plan Premiums

The premiums in the table below are for a company with 156 employees and show the cost of different levels of cover. This only offers a rough idea of the price—it could be different for your company.

Compare Corporate Health Cash Plan quotes from the top UK insurers ⟶

| Level Of Cover | Cost Per Employee |

|---|---|

| Level 1 Cash Plan | £5.23 a month |

| Level 2 Cash Plan | £14.09 a month |

| Level 3 Cash Plan | £32.20 a month |

These premiums are for illustration purposes only. The level of cash plan you opt for, as shown above, will affect the cost per employee a month.

How Much Will Employee Pensions Cost My Business?

You must offer a Workplace Pension Scheme to your eligible employees, as it’s one of the legally required benefits in the UK.

Since the introduction of auto-enrolment in 2012, every business must offer a suitable pension. Employers have to enrol employees who are:

- Aged between 22 and their State Pension Age

- Earning at least £10,000

- Normally working in the UK under a contract of employment.

The cost of your Workplace Pension Scheme will depend on the pension provider, its charges and general set up and management costs.

How Much Do I Have To Pay Into My Employees’ Pensions?

You’re obliged to contribute a minimum of 3% of an employee’s qualifying earnings into the scheme.

You can pay this 3% and leave it there. Or you can contribute more, which will increase your monthly payments into the pension.

It’s hard to provide an exact price for your company pension as it depends on:

- How many eligible employees you have

- Their earnings

- Your contributions as an employer.

What Are Qualifying Earnings?

To figure out how much a workplace pension will cost, you first need to understand what the contribution percentage is based on.

An employee’s qualifying earnings are earnings between £6,240 and £50,270 for the 2024/25 tax year, and include:

- Salary / wages

- Bonuses / commission

- Overtime

- Statutory Sick Pay

- Statutory maternity, paternity or adoption pay.

£50,270 is the cutoff for qualifying earnings. You don’t have to pay 3% on anything above this.

For example, if an employee earns £50,270, your contribution as an employer is £1,320.90 per year / £110.08 per month. You calculate this using this formula:

Qualifying Earnings |

|---|

£50,270 – £6,240 = £44,030 | Employer Contributions |

£44,030 x 3% = £1,320.90 per year / £110.80 per month |

But if an employee earns more, say £55,000, the 3% employer contribution is still only on earnings between £6,240 and £50,270. Your total contribution under auto-enrolment is £1,320.90 per year per employee.

While this is the maximum employers pay by law, many companies pay higher contributions or offer to match staff contributions up to a set percentage.

In a competitive labour market, it helps you stand out among the crowd, especially when a quarter of UK employees would switch employers for higher pension contributions.

Nick Nelms

Senior Consultant, Employee Benefits

How Much Do Salary Sacrifice Benefits Cost?

Salary sacrifice schemes allow employees to access benefits by agreeing to reduce their salary in exchange for non-cash benefits. These arrangements are often tax-efficient, helping employees save on income tax and National Insurance contributions. However, the cost to employers can differ based on the type of benefit offered and the structure of the scheme.

Workplace Nursery Scheme

It’s a well-known fact that many working parents in the UK struggle to balance work and childcare. It’s estimated that over a fifth of parents spend 30% to 70% of their income on childcare (charity Theirworld). This statistic highlights the need for financial support where possible. This is where Workplace Nursery Schemes come into play.

They allow staff to cover the costs of childcare through salary sacrifice. This helps to make childcare more affordable for parents and provides tax savings.

How Much Would It Cost To Offer A Workplace Nursery?

Schemes are designed to be cost neutral for employers, while potentially offering savings through reduced National Insurance Contributions (NICs).

However, if you set up a workplace nursery scheme you may need to make additional contributions to help cover the operational costs of the nursery you work with. Some require a fixed fee e.g. £1,200, while others suggest passing all the NIC savings back to them.

Holiday Trading

Holiday Trading allows your employees to buy extra days of annual leave, or sell unwanted holiday back to you, their employer. It is a great benefit that allows your workforce to choose the holiday leave that better suits their personal needs.

How Much Does A Holiday Trading Scheme Cost?

There is no cost to implement a simple holiday trading scheme. However, whether employees are buying or selling holiday, it will impact the salary you pay them. For employees buying holiday, you’ll pay them a slightly lower salary, and you’ll pay more in salary costs to employees who sell days. You will need to make sure if the majority of staff decide to sell days you have budgeted for the increase in salary you will need to pay.

Salary sacrifice benefits can help to set you apart as an employer. It can open up benefits to your staff which might otherwise have been unaffordable, such as electric cars, tech and even enhanced pension contributions.

Nadeem Farid

Head of Health & Wellbeing Benefits

Tech Schemes

Techscheme is a UK salary sacrifice program that allows employees to purchase the latest technology and homeware items through their employer while spreading the cost over time. Employees can choose from a range of products such as laptops, smartphones, tablets, and more.

How Much Would It Cost To Offer A Techscheme?

As a benefit, Techscheme is designed to be cost neutral. As an employer, you either lease the equipment or purchase it upfront, passing the cost onto the employee. They then make monthly repayments from their gross salary. This arrangement is tax-efficient, reducing both the employees taxable income and your National Insurance Contributions, making it a cost-effective benefit to offer.

Cycle To Work Schemes

The government introduced Cycle to Work schemes in 2011 to reduce traffic congestion and boost physical activity.

Any sized employer can run a Cycle To Work Scheme. Staff can buy a bike and relevant safety equipment as part of a consumer hire agreement. To be eligible, the bike must be mainly for commuting and business travel.

How Much Does A Cycle To Work Scheme Cost?

This is a free employee benefit to offer, but it will cost the staff who sign up to the scheme. They will pay for their new bicycle and accessories from their gross salary via salary sacrifice.

By sacrificing some of their pre-tax salary, they pay less Income Tax and National Insurance (NI). As their employer, you also make savings as you’ll pay less NI on the employees’ salaries. You can look at a cycle to work scheme as an employee benefit that actually helps your business to save money.

GOOD TO KNOW! 🤓

There was once a £1,000 cap in place – the maximum an employee could spend on a bike. This has been lifted by the government, so there is now no upper limit for spending.

Electric Car Schemes

The costs and savings that apply to cycle to work and tech schemes also apply to Electric Car schemes. Employers pay nothing to set up a scheme. In fact, it offers cost savings to both the employer and the employee.

This is a hugely valuable employee benefit for your workers as they get access to a new vehicle that may not have been affordable outside of the scheme.

The Costs Of Other Flexible Employee Benefits

As well as the mandatory benefits, insurance policies and salary sacrifice perks, there is more to offer. Again, how much these voluntary benefits cost is dependent on your employee demographics and how much you can put into your benefits package.

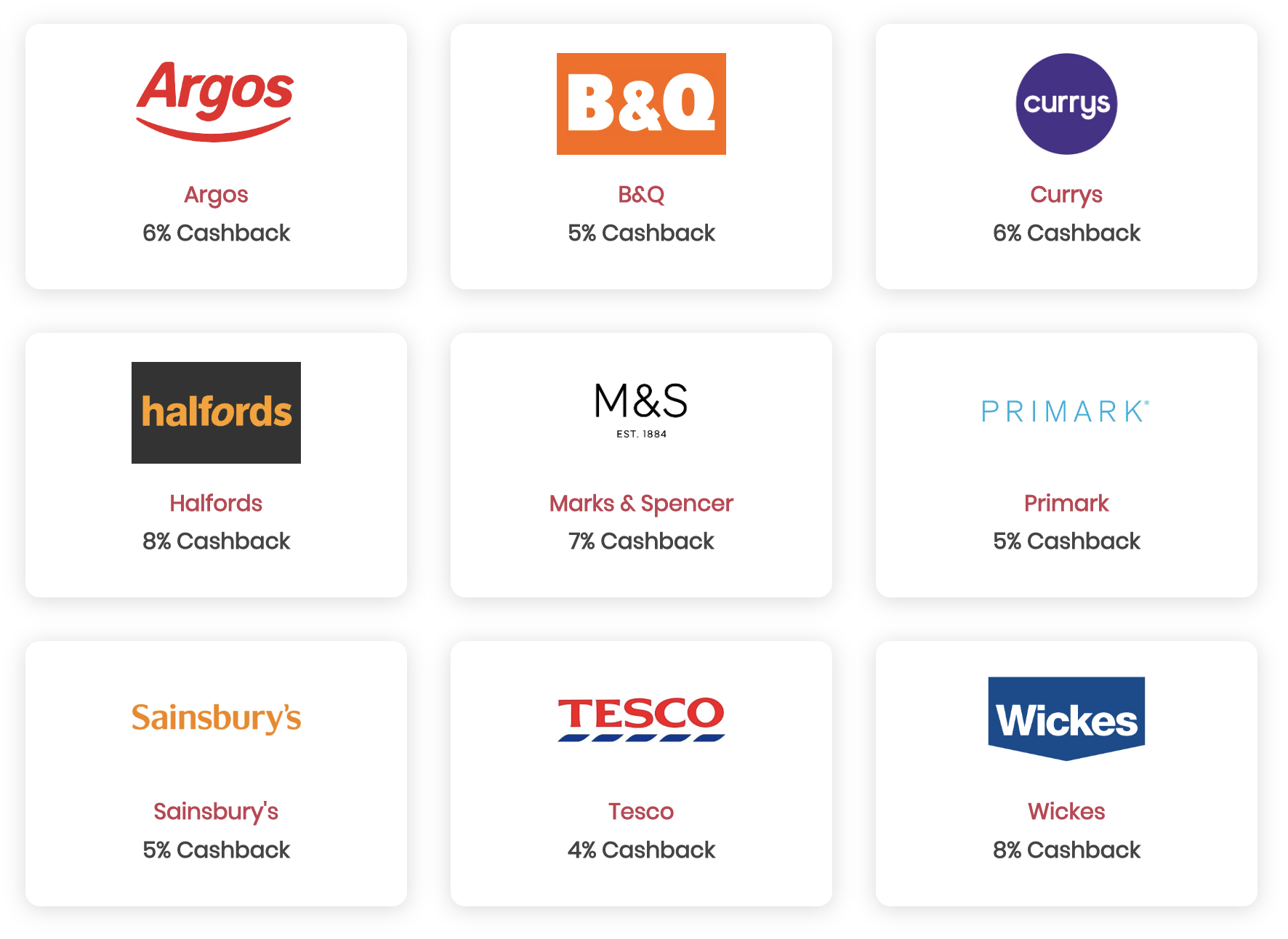

Employee Discount Schemes

With the cost of living still a concern for many people, employers are doing all they can to support their staff. An employee discount scheme is a great way of providing extra help during difficult financial times.

An employee discounts platform gives your workers access to a variety of useful employee discounts. They can get cashback on everything from their weekly groceries to clothing, technology, and travel.

How Much Does A Retail Discount Scheme Cost?

It can cost as little as a few pounds a month per employee for you to provide a discount platform. You can help staff save hundreds of pounds a month on everyday living expenses for just a small price.

It’s an affordable benefit that shows staff you care about their financial wellbeing. It also helps to bolster your reputation as a supportive employer. Below are some discounts your employees may have access to through a discount platform.

Want to go the extra mile and offer valuable discounts to your team? Call us on 02074425880 or email help@drewberry.co.uk. We can help you choose the right discount platform for your business and support with its setup.

Training and Development

Your training and development opportunities may not seem like an employee benefit. But they do benefit your staff, as they can develop in their role and expand their knowledge.

How Much Will It Cost To Train and Educate My Existing Employees?

There are a lot of free training resources, but paying for training demonstrates your active role in helping staff progress. It’s an investment in your team which can prove fruitful for business growth in the long-term.

The best bit? The cost of training, when it aims to improve your employee’s skills, is an allowable business expense. You can get tax relief on the costs, as long as said training benefits your business.

By upskilling and investing in your staff, HMRC lets you deduct the cost when calculating your taxable business profits. You may reclaim the costs associated with training and development too. This can include:

- Travel costs (e.g. public transport, parking, congestion charges / tolls)

- Hotel accommodation if an employee needs to stay overnight

- Food and drink

- Books / course materials.

IMPORTANT❗️

If the training takes place at an employee’s usual workplace, travel expenses to that location are not allowed.

Your training requirements are unique to your company. Staff may require more support in one area of business than another. When it comes to pricing, you can check and compare average costs with the professional training bodies within your industry.

While it’s highly likely that training will cost, when it’s incorporated into your business plan, it has the potential to pay off in the long run.

Season Ticket Loan Schemes

A Season Ticket Loan Scheme offers an interest-free loan which helps to cover the costs of commuting. It allows employees to avoid those ever-increasing peak travel costs. The employee’s travel is covered for a year, and it tends to be cheaper than buying a ticket every day.

How Much Do Season Ticket Loans Cost To Implement?

There aren’t any costs for an employer when setting up a season ticket loan scheme. However, as your company pays for the season ticket upfront (and the employee pays it back in monthly instalments), it’s important to ensure loans sit within your business finances. While you get the loan amount back, the initial loan is a cost to consider.

The cost of a season ticket loan will depend on:

- The two stations your employee travels between

- How often they travel

- Whether it’s standard or first class

- The duration of the season ticket

- If the employee has an active railcard.

So, if you’re looking to add some more perks to your comprehensive benefits package, the free ones make a dent. You can create an employee benefit package that includes a mix of perks and provides value to your staff beyond their salary.

Get Employee Benefits Quotes and Specialist Advice

With the majority of employee benefits, the cost depends on a variety of factors, making it hard to know where to start! At Drewberry, employee benefits are our speciality. We provide regulated advice to businesses from start-ups to large corporations across the UK.

Our team of specialists has many years of experience helping businesses to set up their employee benefits package. Even if you have a small budget, we can work with it and find the right perks for your business.

Additionally, we can benchmark your benefits against industry standards, ensuring what you offer is competitive without overspending. This way, you’ll strike the perfect balance—attractive enough to retain talent while avoiding the cost of overproviding benefits compared to your competitors.

If any of the benefits above seem like a great fit for your company, get in touch. You can drop us a line on 02074425880 or email help@drewberry.co.uk. We’ll be happy to help.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.