What Benefits Should You Include In Your Total Reward Statements?

There’s no one-size-fits-all approach to Total Reward – it needs to be tailored to the needs of your business and your staff. However, the benefits you can include tend to fall into a few different categories.

Core Benefits

Your core benefits make up the heart of your rewards offering, and usually have the most monetary value.

Pay, Bonus, and Car Allowance

The most universal reward is a base pay – whether it’s their hourly rate or annual salary. This will be the first and most significant building block of your statement.

On top of pay, you might offer your staff bonuses or overtime. These are also shown as a financial reward, as the employee receives the extra sum directly.

Instead of using a company car scheme, you might offer a car allowance to help employees with maintenance on their own vehicles (unlike an expenses scheme where fuel costs are reimbursed). Car allowances are also shown as financial rewards on the Total Reward Statement, as they’re paid alongside salary.

Company Share Schemes

If you offer your employees shares in your company, this also needs to be included in the Total Reward Statement. Any dividends they’ve received in the past year or quarter can be classified as a financial reward.

Pension Schemes and ISAs

There’s a large range of different schemes for company pensions. Many employers use net pay methods, but Salary Sacrifice Workplace Pensions are a popular option (and yes, they’re still worth doing even after the 2025 Autumn Budget announcement). This is because it allows for tax savings for the employer and the employee.

This isn’t a financial reward, as that only refers to benefits that give them a direct sum of money. But, their pension will eventually yield a monetary return, so it’s known as a monetary benefit. The same also applied to Workplace ISAs.

Some firms choose to match contributions into their employee’s ISAs which can then be added to their Total Reward Statement as a monetary benefit like their Workplace Pension contributions.

Group Risk Benefits

There are three different policies under the umbrella of ‘Group Risk’ that you might offer:

- Group Life Insurance

Also known as a “Death in Service” benefit. Group Life Insurance policies pay out a lump sum in the event an employee passes away while employed by you. The amount can be a multiple of their earnings, such as 4 x their basic annual salary. Or, it might be a fixed sum, for example, £100,000 for all employees

- Group Critical Illness

If an employee receives a critical diagnosis, this policy will pay out a lump sum. Each insurer has their own list of critical conditions which they cover. The most common claims are for cancer, heart disease and strokes

- Group Income Protection

Group Income Protection policies protect your employees’ earnings should they become too sick to work. The claim may last a certain length of time and most insurers offer return-to-work support.

These benefits will be a monetary reward on your Total Reward Statement. This is because group risk benefits come with a potential payout for each employee. It’s also important to remember that group risk providers offer a lot of free additional benefits.

SPECIALIST TIP 🤓

Virtual GP services, counselling, and wellbeing apps often come included with group insurance policies. These are important features that enhance the value of group risk policies, but employees are often

unaware they exist – another reason to include them in your Total Reward Statements.

Health and Wellbeing Benefits

There are many health and wellbeing benefits you might offer your team. Depending on budget, many firms choose to offer Group Health Insurance, a Corporate Health Cash Plan, or both. These work in distinct and different ways and can complement each other.

Group Health Insurance

Employees are insured to receive treatment at a private hospital. The insurance provider settles the bill directly with the hospital. Staff can receive GP referrals and ongoing treatment for a range of health issues.

Company Health Cash Plan

With a cash plan, staff pay for their medical care up front. This can be either via the NHS or privately. They can then receive a cashback reimbursement for the costs paid, up to the agreed cover limit. Private Medical Insurance policies and Company Health Cash Plans are also monetary rewards. This is because your employees receive the benefit of free healthcare costs.

Other Health and Wellbeing Benefits

While it may be difficult to quantify the value to your workers, if you offer an on-site gym, massages, yoga, or meditation in the workplace, these should be included in your Total Reward Statement.

Holiday Entitlement

Offering annual leave is a mandatory benefit in the UK, and it can’t be considered a financial reward. Paid holiday days are non-financial benefits that need to be included on your team’s Total Rewards Statements.

Remember, allowances will vary if you offer a flexible holiday trading scheme. You’ll need to take into account which staff members are buying or selling annual leave. Once you know the value of any extra days’ holiday, make sure it’s included.

Financial Education

It can be difficult to determine a tangible value for certain benefits. And the term “financial education” can refer to many different things. For example, sharing free webinars and online resources is hard to quantify.

Although, you might offer sessions with a financial adviser through presentations or 121s. You could also pay for access to financial support through apps or other services. If so, these benefits will have a tangible value that you can itemise on your Total Reward Statement.

Additional Perks and Rewards

Some benefits are hard to assign a measurable value, and others are employee-led. However, this doesn’t mean you shouldn’t be highlighting them to your staff. Other benefits / rewards you can include on your Total Reward Statement include:

Employee Discounts

Offering an Employee Discount Scheme helps staff save money on discounts. They can also earn cashback or rewards. Many retailers sign up to discount platforms. This makes it useful for everyday shopping and luxury purchases alike. The real value of a reward like this comes from how many employees engage with this benefit.

Your employee benefits platform should provide data on the engagement levels. If people aren’t using it, it may be that you need to communicate the benefit more effectively. Or, it could be a sign that you need to review your Total Reward Strategy.

Salary Sacrifice Benefits

Benefits available through Salary Sacrifice are also employee-led. It’s up to each person if they opt into a salary sacrifice scheme. They might use it for holiday trading, new technology, or an electric vehicle. Each employee needs to know what these benefits are and how it will impact their pay.

It’s vital that your staff understand salary sacrifice. Members can only engage with their benefits when they fully understand them. Their use of these schemes will be unique to them, based on their earnings and expenses, and can help them save a significant amount of tax.

Learning and Development Budget

Continuing professional development is a requirement for many roles. Often, the value of learning & development comes in the form of new knowledge. Employees might be keeping their skill set relevant, or preparing for career progression. In these cases, it can be difficult to represent the true value of this benefit.

What you can do is display any courses and qualifications your company is footing the bill for. This evidences how much you’re investing in your team. Doing so will go a long way towards showing staff how invested you are in their future.

Praise and Recognition Tools

Giving your employees appreciation through recognition is a fantastic way of showing staff they’re valued. However, it’s an element of your company culture that can’t really be measured. Nevertheless, your Total Reward Statement should have a section for Intangible Rewards.

Flexible Working Arrangements

Much like recognition tools, flexible arrangements can be hard to quantify. The value of a casual dress code or hybrid working can be often overlooked. It’s important to remind staff that these enhance the value of their employment.

How To Create A Total Reward Statement

A Total Reward Statement can be drawn up in two different ways. The first option is for employers to do this on their own, manually. The second is to use an employee benefits platform, such as My.Drewberry.

My.Drewberry gives your employees an easy way to view and manage all their benefits in one place. Often, people try to hold on to emails, attachments, and notes from different sources. These can often get misplaced, and it’s easy to forget what benefits you have access to.

My.Drewberry brings everything together. Using the platform allows your team to do all of the following things on one centralised web page:

- View and manage their Workplace Pension

- Access all their employee benefits, policy documents, and contact details for claims

- Opt into any Salary Sacrifice schemes

- Use shopping discounts, and earn cashback or rewards

- Give and receive recognition from colleagues for going above and beyond

- Access their Total Reward Statement.

SPECIALIST TIP 🤓

With My.Drewberry, all employee data is completely confidential. This eliminates a lot of the pains that can come with drawing up a Total Reward Statement on your own.

Request a demo to see how easy benefits management can be.

Manual Vs Digital Total Reward Statements

A manual Total Reward Statement requires a lot of admin and can be very time consuming. You’ll need to pull a lot of data from your HR systems and make sure it’s correct for every individual. This can be costly if you don’t already have the appropriate software in place. In fact, companies who produce Total Reward Statements in-house often have a full-time person or a small team dedicated to it.

You’ll also need to think about how you’re issuing your Total Reward Statements. Online statements are best for meeting sustainability initiatives and achieving environmental goals. Most importantly, you’ll also need a clear process in place to make sure all the data you are handling is secure and accurate.

Example Total Reward Statement

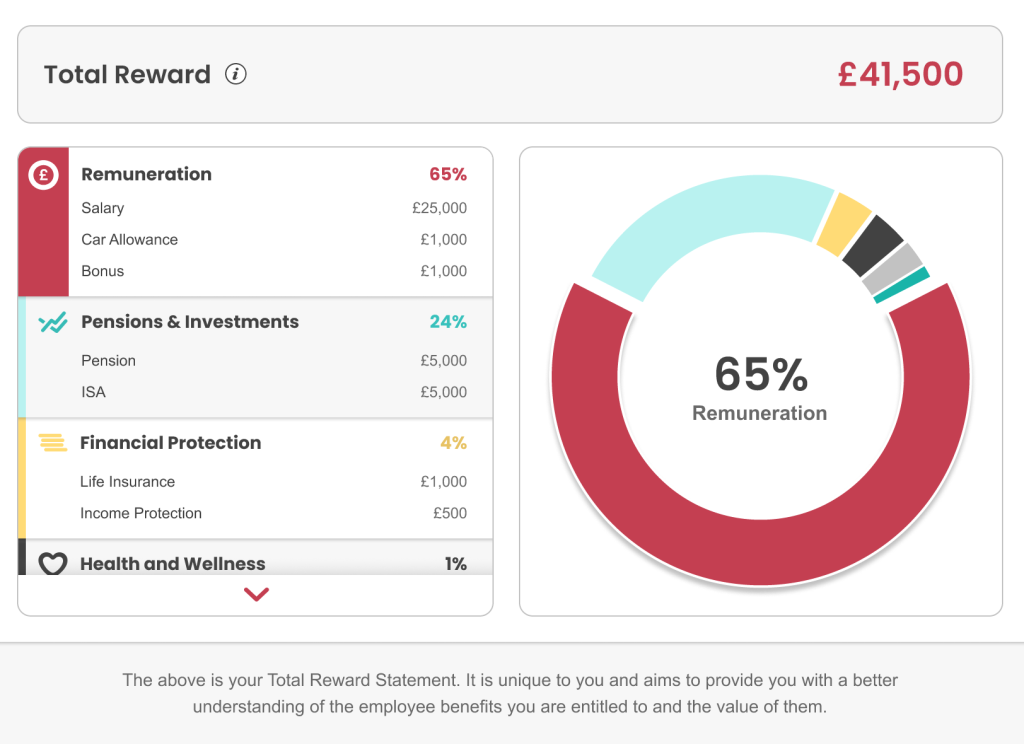

A Total Reward Statement on our My.Drewberry portal will look something like this:

![Total Reward Statement Example]()

See how powerful a Total Reward Statement is? Although the employee’s annual salary is £25,000, when you include all the additional rewards and benefits, this quickly goes up to £41,500. That’s an additional £16,500 being invested on top of their annual salary.

Without this clear overview, it would be easy to overlook the value of what’s on offer.

How To Communicate Your Total Reward Statement

It’s important to clearly communicate all the rewards you provide to your team. You also need to make it easy for them to access the benefits they want to use, which is where a robust communication strategy is essential.

Think about the comms channels you have at your disposal. You could start by emailing employees one month before making their Total Reward Statements available. Then, you might send a follow-up email the week before they’re released. You might even highlight the Total Reward Statement availability in staff meetings or 1-2-1s.

You’ll also want to reinforce the Total Reward value at regular intervals. This could be at certain milestones when people think about reviewing their circumstances, such as:

- At the end of each quarter

- At the start of a new financial year

- During your employees’ performance reviews.

In a cost of living crisis, people are more likely to review their financial circumstances. So, when employees have conversations around their pay and benefits, this can be a great opportunity to reinforce your Total Rewards offering.

Measuring The Success of Your Total Reward

The likelihood is, if you have implemented Total Reward Statements, you will have put together a Total Reward Strategy.

You will have crafted your employment package from the ground up, listening to employee input and clarifying your business objectives. In doing so, you’ve implemented a holistic compensation package.

This means that the levels of employee engagement in your benefits should be high. Higher uptake shows that your workers are taking advantage of their benefits. And that’s exactly what they’re there for.

If engagement remains low for certain benefits, even with Total Reward Statements, it suggests you need to review them. It might be that employees don’t find them valuable. If this is the case, you can review and implement an alternative.

Get Specialist Help Setting Up Your Total Reward Statements

Using a Total Reward strategy can be a complex undertaking with a lot to consider. And putting together a holistic benefits package will depend on many factors. Your industry, business objectives and budget will all come into play.

Whether you’re beginning your Total Reward approach, or you’ve had one in place for some time, our team can help. They can talk you through all the elements involved and recommend the best options for your team. Call 02074425880, email help@drewberry.co.uk, or make an enquiry to arrange a free consultation.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.