How Employers Can Help Employees During The Cost Of Living Crisis

Soaring energy bills, high fuel costs, and skyrocketing groceries are some of the reasons for the UK cost of living crisis. The BBC reported a price hike of 9.9% in August 2022, which is a higher inflation rate than twelve months ago.

Rising costs of everyday essentials and winter energy bills are a great source of stress. So, it’s no surprise that people are seeking extra financial support for the winter.

Now, as an employer, you have no legal obligation to help staff beyond paying the real living wage. But 49% of employees believe it’s an employer’s duty to improve financial wellbeing (YuLife Employee Financial Wellbeing Survey).

Increasing all salaries might not be possible for every business. But there are plenty of ways you can help your employees. It’s also in your best interest to support employees, as money worries and poor mental health go hand in hand. You play an important role in their financial and mental wellbeing.

Financial problems can cause staff to:

- Be unproductive

- Have more sick days

- Become stressed

- Suffer from poor mental health.

In fact, financial stress affects attendance for 35% of staff (PWC 2022 Employee Financial Wellness Survey). So, what can you do to help your employees during the UK cost of living crisis? We’ve got a few suggestions for you.

Communicate The Employee Benefits & Support You Provide That Can Help With The Cost Of Living

It is important to put a stake in the ground and recognise the ongoing crisis and that you are on hand to try and support your staff.

Start by making sure employees are aware of what you already provide.

- Are employees aware of the support you currently provide?

- Are they aware of the employee benefits and additional services on offer that could help during these difficult times?

Evaluate what you already offer and ensure they’re being communicated effectively to your employees. If engagement is low, you might want to consider creating a communications plan.

Communicating What You Already Provide

If you provide a Corporate Cash Plan make sure staff understand what everyday medical expenses they can claim back and how to do this. Provide anecdotal evidence of how other employees in the business have been saving on medical expenses to support your communication.

We provide a cash plan to our staff and when you add up the savings for dental appointments, optician’s costs and diagnostics tests there are hundreds of pounds of savings to be made each year.

If you offer an employee discount scheme make sure you communicate the discounts regularly. If an employee needs a new laptop or is doing DIY, savings of 6-7% at Currys or B&Q can really help soften the blow and it is making sure your staff are taking advantage of these discounts.

Channels Of Communication

It doesn’t matter how valuable your employee benefits are if no one knows about them. It’s crucial that you tell staff about your benefits and continue to tell them. You can do this by:

- Providing up-to-date information

- Showing employees how to access benefits

- Sending a company-wide email

- Offering 1-2-1’s

- Arranging staff meetings.

During the UK cost of living crisis, promoting your employee benefits package is vital. You want to be able to support your employees in any way you can throughout these hard times.

If you know your current benefits communication is strong and engagement is high the next step is to talk to your staff about what other benefits or support they may really value right now.

Review Your Financial Wellbeing Policy

Firstly what is a financial wellbeing policy? It might sound complex but it really isn’t. It simply is a document which outlines all the benefits and support you as an employer offer to help improve the financial wellbeing of your staff. For example:

- Do you offer benefits which specifically help with cost of living such as discounts?

- Do you provide financial education on topics such as debt management, savings and pensions?

- Do you pay higher pension contributions and utilise salary sacrifice?

- Do you offer interest free loans or low interest short term loans?

Documenting the support you provide in one place can make it very clear where there are gaps that can be addressed. If you have an existing financial wellbeing policy, it’s important to review this and bring it up to date before implementing new benefits.

Despite this recent research by CIPD found 49% of employers don’t have a financial wellbeing policy in place. If this applies to you it’s a good time to consider implementing one.

Your employees’ financial wellbeing policy needs to go further than a liveable wage. You can implement benefits like an EAP (Employee Assistance Programme), a confidential service for staff to discuss problems, such as money worries, mental health, and bereavement.

Nick Nelms

Senior Consultant, Employee Benefits

Provide Financial Support Resources

It may become clear, after reviewing your benefits and financial wellbeing policy, that more help and guidance is needed for staff. This is where financial education becomes key.

In our Employee Benefits & Workplace Satisfaction Survey we found money worries to be the second highest factor causing employee stress.

Helping employees understand more about finances can empower them to make informed decisions. This knowledge can make a significant difference when it comes to dealing with the likes of the UK cost of living crisis.

A simple, yet effective thing you can do, is to compile a list of helpful external resources. This might include:

- Free budgeting tools and apps, like live webinars

- Information about government benefits and grants, such as universal credit

- How and where to apply for monetary support (Citizens Advice, for example)

- Debt management and money helplines

- General financial education

- Investment advice.

Provide Specialist Financial Education In The Workplace

Money worries affect other areas of our lives and are a significant cause of stress. Employees may be less productive, struggle with sleep, and take more sick days.

Supporting your employees with seminars and 1-2-1’s on important financial topics so they can make better financial decisions can help alleviate stress and improve your team’s health and work performance.

Workplace financial education can go a long way, helping staff learn about money management which they may find difficult teaching themselves and understanding on their own.

Providing Financial Education

As the employer, you can offer financial services yourself or through an external app. For example, our My.Drewberry platform allows your employees to access all their benefits in one place including all the additional supporting services that can prove invaluable in times of need.

Our team of financial advisers can also conduct presentations and 1-2-1’s on a wide variety of topics to help your staff make informed decisions when it comes to their finances. We can work with your staff to create a personalised financial roadmap to help them build a strong financial future and alleviate money worries where possible.

To discuss further get in touch by giving us a call on 02074425880 or emailing help@drewberry.co.uk.

Help Employees Save By Offering An Employee Discount Scheme

Helping your employees’ pay go further each month can be a big help during the cost of living crisis. An employee discount scheme is a great benefit to offer. It can help reduce some of the financial pressure your staff may be experiencing.

Staff can get access to discounts at a wide range of retailers and save hundreds of pounds a year. For example, a household spending £400 a month on groceries could save up to £336 a year through a discount platform.

As the cost of living increases, our everyday essentials are more expensive to buy. Fresh food cost rose by 10.5% in August 2022—the highest rate since the last financial crisis in 2008.

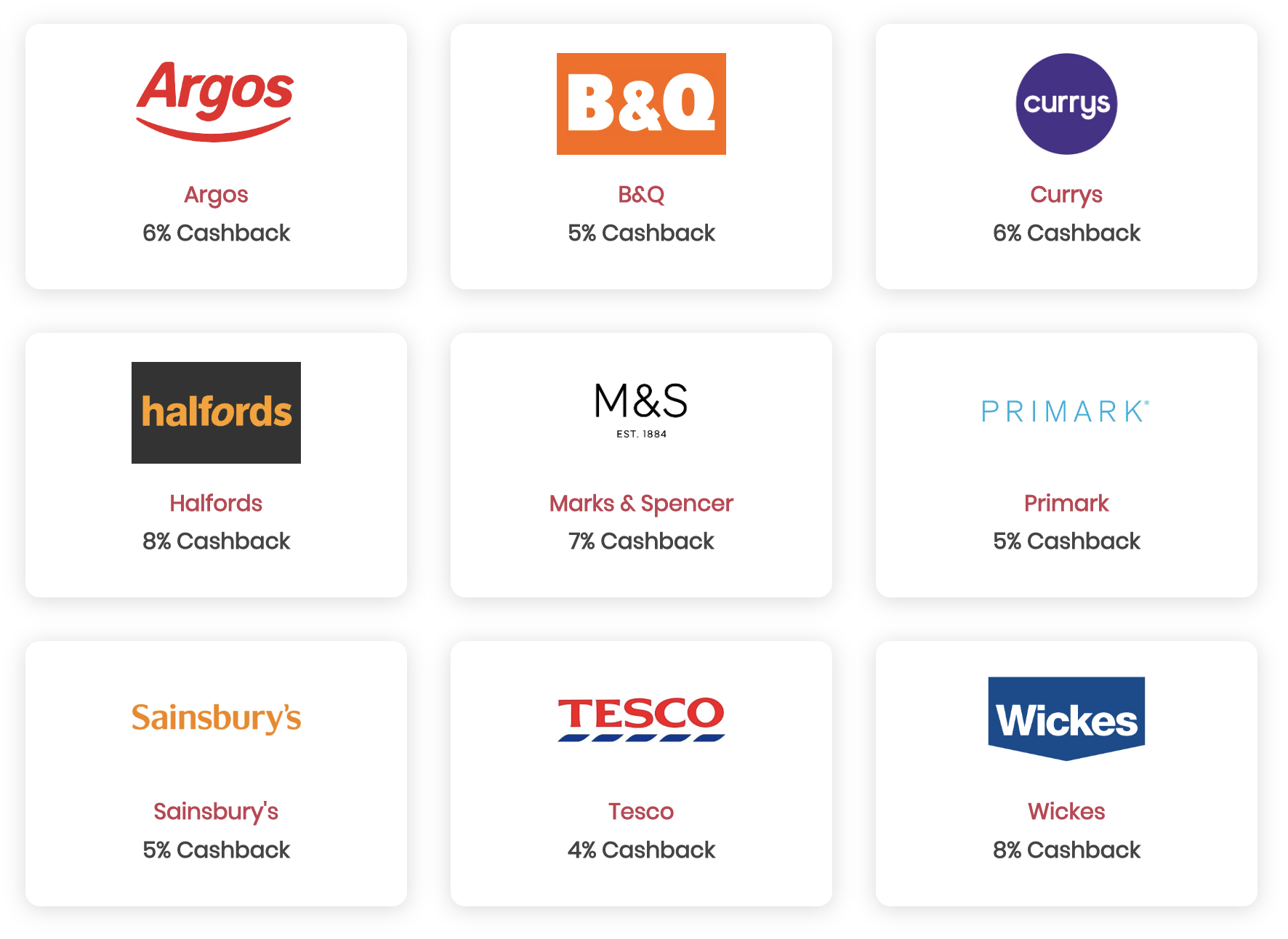

Depending on the platform you choose, your employees may get discounts from the likes of:

These are a few examples, but there are many more. Staff can get cashback, digital vouchers, and reloadable gift cards. When used regularly, the savings soon start to add up.

An employee discount scheme can cost as little as a couple of pounds per employee per month while each employee can make hundreds of pounds per year in savings.

For most businesses it is a no brainer to provide a scheme for their staff to help with the cost of living.

Joseph Toft

Employee Benefit Consultant

Provide A One-Off Payment To Help With Living Costs

Some employers are giving a single payment to combat inflation and help employees through the UK cost of living crisis. It’s not possible for every employer to give every worker a pay rise to counteract the price hikes. But a one-off payment is a short-term benefit you can offer to help your team during this time.

Some businesses are offering it to everyone, while others exclude top earners. One financial firm is providing payments between £300 and £1,000 for employees earning up to £35,000. It’s up to the employer to decide which workers are eligible.

In new research by ONS, 77% of adults reported feeling worried about the cost of living crisis. A typical household’s energy bill is expected to rise to £2,500 a year from October 2022. So, a one-off payment will help soften the blow of this increase.

One thing to consider if you do offer a one off payment, is that it will be subject to Income Tax and National Insurance (NI).

Nadeem Farid

Head of Health & Wellbeing

Introduce New Salary Sacrifice Schemes

If you don’t already offer benefits through salary sacrifice, this is worthwhile setting up. Salary sacrifice schemes give employees a non-cash benefit through the company payroll. This enables staff to save on tax.

Since salary sacrifice payments are from the employee’s gross salary, there’s no Income Tax or NI payable. This is a great way for them to get a new item or service and save at the same time.

These benefits can be salary sacrificed:

- Electric vehicles (EV)

- Bicycles

- Technology, such as mobile phones, laptops and gaming consoles

- Childcare vouchers

- Bus passes

- Pension schemes.

The savings add up over time. An employee earning £30,000 a year getting a bike worth £1,000 through the Cycle to Work Scheme will save £27.71 a month. In a year, this adds up to £332.50 off the cost of retail price.

Salary sacrifice schemes for bicycles, EVs and bus passes can help people reduce commuting costs and avoid high fuel prices.

Paying Workplace Pension Contributions Via Salary Sacrifice

If you do not pay corporate pension contributions via salary sacrifice then you maybe able to put more money back in your employees pocket with this simple switch.

Simple Salary Sacrifice Pension Contribution Savings

By making these pension contributions as a pre-tax salary deduction it reduces income tax and NI payments. As a result, net income is higher without affecting the employee’s pension contribution.

Another way an employee’s net income can increase is via their employer’s NI savings. Passing these onto the employee also boosts take home income without changing contributions.

For example an employee earning £27,000 a year who pays 5% (£1,350) into their pension through the scheme and the employer contributes 3% (£810) can get an extra £178 in their monthly paycheck with this simple switch.

If you want to discuss switching to a salary sacrifice workplace pension please don’t hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

Offer Flexible Working Options

Covid-19 has normalised a hybrid-working model for many companies. This was successful during the pandemic, but it isn’t the end.

There are many benefits to this way of working, including:

- A healthy work-life balance

- More time with friends and family

- More time for hobbies

- Less time spent commuting

- Cost savings.

Flexible working can be valuable through the cost of living crisis. Your workers can save money on commuting. They can also save on food prices in the current economy, swapping shop-bought lunches for homemade meals.

With the winter energy bill increase, some staff may prefer working in the office to cut down on costs. Others may opt for remote work to reduce travel fares. Giving employees flexibility is key.

Remember that everyone has a different financial situation, though. Flexible working options need to accommodate all employees. If there’s ever a reason you do need staff to attend the office, you could cover travel costs and provide lunch.

By factoring in the cost of living into work setups, you show staff you value them and their personal finances.

Normalise Talking About Money At Work

Last but not least, it’s important to get your team talking about money. Doing so will help fight the stigma attached to finances. Most of the time, people feel uncomfortable discussing their money. Debt, for example, can cause embarrassment.

Our money problems can have a knock on effect on our mental health, making issues worse. In turn, low mood can make it harder to manage money. Our 2018/19 Employee Benefit Survey found that more than one in three SME workers had taken sick leave due to stress or a mental health condition.

Some will even avoid the topic altogether. They may feel anxious about opening bills, making payments on time, or talking to their bank. But opening up the money discussion can help employees get the support they need.

Encouraging your team to talk about money will normalise the subject. It will also boost their financial confidence.

You can start by sharing your own experiences or even addressing the company’s finances.

Nick Nelms

Employee Benefits, Senior Consultant

Another way to normalise money conversations is during employee performance reviews. In the same way you’d talk about their mental health, you can do a financial check-in too. Talk about the benefits available that could help, bonuses and potential pay rises. Present yourself as approachable so staff can reach out if they need support.

Get Specialist Advice On Your Employee Benefits Package

Pulling together a valuable employee benefits package isn’t an easy task. When you factor in the cost of living crisis, it’s important to get this right. It’s also important to communicate your company benefits so staff know what’s available.

At Drewberry, we can help you do this for your team. We help companies set up their employee benefits to ensure workers are receiving the most useful perks. In a time when support is necessary for staff, we can tailor your benefits to your specific business needs. It also means we take a time-consuming task off your hands!

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

If you’d like some extra guidance, don’t hesitate to get in touch with us. You can call us on 02074425880 or email our team at help@drewberry.co.uk.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.