The Best Employee Benefits UK Businesses Can Offer (2026 Guide)

A strong employee benefits package can make a huge difference to the success of any UK business. Yet, with only 12% of UK employees truly satisfied with their current benefits, there’s clearly room for improvement.

Choosing the right mix of benefits can be daunting. From Workplace Pensions and healthcare to flexible working and wellbeing perks, how do you know which ones really make an impact?

This guide breaks down the best employee benefits in the UK, what workers value most, and how you can build a cost-effective package that boosts retention, engagement, and productivity.

Why Employee Benefits Matter More Than Ever

A competitive benefits package not only helps your people, but supports your business. The right benefits package can help to:

- Improve morale and motivation

- Reduce stress and absenteeism

- Enhance productivity and engagement

- Strengthen your company culture and values

- Improve retention and attract top talent.

Our 2025 Employee Benefits Survey found that a whopping 90% of UK employees are stressed, and 80% admit it affects their productivity. Ignoring this could have long-term costs for your organisation.

How Stress Impacts Work Performance

Chronic stress affects both physical and mental health, leading to potential burnout. These can seriously damage motivation, attendance, and output – not to mention increase the cost of sick leave.

A well-designed benefits package can help employees manage stress and feel supported. From Private Healthcare to financial protection, the right benefits show your people that you genuinely care.

The Best Company-Paid Employee Benefits in the UK

Paid employee benefits – mainly group insurance and Workplace Pension schemes – are among the most valued. Here are the top options for UK employers to consider.

Group Pension Scheme

An auto-enrolment Workplace Pension is mandatory in the UK, but the minimum contributions often don’t go far enough to build lasting financial security.

Our 2025 Workplace Pensions Survey found that:

- The majority of employees are relying on Workplace Pensions to fund retirement, but 68% don’t believe it’ll be enough to keep them comfortable

- 58% would prefer bigger pensions over other benefits, and nearly half would pay more if their employer matched it

- 84% say a good pension scheme is an important factor when choosing an employer.

Employers that go beyond the legal minimum can turn a legal obligation into a powerful retention tool – especially as enhanced pension contributions made the top three most-wanted benefits in 2025. See why you should consider more than the minimum in our article: Rethinking Rewards: 58% Of Employees Would Prefer Bigger Pensions Over Other Benefits.

Key Considerations

- What contribution level will you offer – minimum or competitive?

- Which provider offers the right fees, funds, and tools?

- How will you communicate pension value to staff?

Only 15% of employees feel they truly understand how pensions work, and 57% don’t know how much they need to save for a comfortable retirement. Offering financial education (such as webinars or one-to-one sessions) can dramatically improve engagement.

We not only help businesses find the best group pension providers for their needs, but also support with tools to educate and engage employees.

Corporate Health Insurance

With more than 6 million people waiting for NHS treatment as of August 2025, private healthcare is among the most valued benefits in the UK today.

Group Health Insurance gives employees faster access to specialists and treatment for acute conditions, meaning less time off sick and higher productivity. Almost a third of employees want it, but only 15% actually receive it.

Key Considerations

- Will you offer core hospital cover or include extras like dental and optical?

- Excess and Cost Control: Balancing affordability with comprehensive care is key when deciding an excess

- Provider network should be suitable for your team

- How will you promote the benefit actively so staff know how and when to use it?

A Health Cash Plan can be an excellent alternative to Private Health Insurance if you’re on a budget. See how Drewberry employee Colette used her Cash Plan to sort her eye issues with ease.

Death In Service Cover

12% of UK adults say they have no idea how their family would cope financially if they passed away, yet only 38% of UK adults have personal Life Insurance in place. Because of this, a Death in Service benefit is one of the most appreciated employee benefits for those unable to afford a personal policy.

With a Group Life Insurance scheme, if an employee dies while in your employment, the policy pays a tax-free lump sum (usually 2-4 times their yearly salary) to their loved ones. It’s one of the most affordable benefits you can provide (premiums are considered an allowable business expense, and therefore eligible for tax relief), and it’s invaluable for staff.

Key Considerations

- Align the payout with industry benchmarks, or offer a different cover level?

- Decide if cover begins immediately for team members, or after a probation period

- Ensure your scheme uses a discretionary trust for tax efficiency

- Explain to employees that it costs them nothing, yet provides vital family protection.

Group Income Protection

Worrying about money is one of the leading causes of stress among UK employees, having a significant impact on their productivity and wellbeing. 1 in 4 also admitted they wouldn’t last a month on their current savings if their income was to suddenly stop.

Group Income Protection ensures that if an employee becomes too ill to work, they continue to receive a percentage of their salary – their bills are covered so they can focus on getting better. Policies can pay out for a few years, or even up to retirement, providing real financial reassurance when it’s needed most.

Key Considerations

- Benefit levels range from 50–75% of salary – what’s sustainable for your business?

- Is a short term payout more suitable for your business (1–5 years)? Or to retirement?

- Set the right deferral period (e.g. 13 or 26 weeks) to balance cost and support

- Look for insurers that provide return-to-work support and occupational health services

Group Critical Illness Cover

Critical Illness Insurance pays a tax-free lump sum if an employee is diagnosed with a serious condition like cancer, heart attack or stroke. Beyond financial relief, it offers peace of mind and supports recovery, showing your business cares about long-term wellbeing.

Most policies cover around 12 critical illnesses as standard, and some have the option to add additional conditions for an extra premium.

Key Considerations

- Which conditions are included as standard, and what’s not covered?

- Benefit size is usually 1-5 their annual salary – how much financial security do you want to offer?

- Many policies include or add optional child cover – it’s worth reviewing demand within your workforce

- Look for insurers with valuable additional benefits such as counselling and recovery programmes.

Added-Value Health and Wellbeing Services

When weighing up the value of group insurance policies, remember that most providers now offer a suite of additional services alongside their core insurance propositions.

They’re there to provide added support and help individuals before they get to the point of needing to make a claim. The most common extras include

- Employee Assistance Programmes (EAPs)

- 24/7 Digital GP access

- Mental-health and physiotherapy support

- Second medical-opinion services.

These can be accessed any time, not only during claims — helping staff resolve health issues early and stay fit for work.

Key Considerations

- Will your employees know these services exist and how to access them? (67% of employees are unaware they have access to these extra perks)

- Think about how to align wellbeing resources with your wider engagement and absence-management strategy.

Get Specialist Help With Your Benefits

These extra perks offer convenient, efficient, and often free solutions that can significantly enhance your employee benefits package. Promoting them can lead to healthier, happier, and more productive employees.

But setting up and maintaining your perks requires a decent bit of admin, so it quickly becomes time consuming. We do the heavy lifting for you, giving you more time to focus on what matters.

We live and breathe employee benefits, doing this day in-day out for businesses just like yours. Looking at the bigger picture, we get to know your unique workforce and benchmark your offering against competitors.

If you’re looking to set-up an employee benefits package or want to review any existing schemes, give us a call on 02074425880 or email help@drewberry.co.uk. Alternatively, submit an enquiry online and one of our friendly consultants will get in touch.

The Best Free and Low-Cost Employee Perks

Not every valuable employee benefit comes with a high price tag. Some of the best employee benefits UK businesses can offer are low-cost or even free to implement – yet they can make a huge difference to staff engagement, wellbeing, and loyalty.

Flexible Working (Flexi-Time and Hybrid Models)

Flexible working is now one of the most in-demand perks in the UK workplace. 68% of employees say work-life balance is what makes them happiest, and is one of the biggest draws for jobseekers, according to our 2025 Employee Benefits Survey. Not only this, but almost a third suggested that by adopting flexible hours and working patterns, their employers could help reduce their stress levels.

With little to no cost to you as an employer, flexible working can dramatically improve morale, reduce stress, and boost productivity.

Key Considerations

- Will flexibility be available to all roles, or just specific functions?

- Choose between hybrid models, flexi-hours, or compressed weeks

- Invest in collaboration tools to ensure remote teams stay connected.

Flexibility supports inclusivity, work–life balance, and employee retention – all at virtually zero cost.

Increased Holiday Allowance

Going beyond statutory holiday entitlement is an easy way to stand out as an employer of choice. Reduced working hours and enhanced leave consistently tops the list of most-wanted benefits in our nationwide employee surveys. And it’s not hard to see why: more time off encourages rest, prevents burnout, and improves performance.

Some organisations even experiment with unlimited holiday or holiday trading schemes, where staff can buy or sell days.

Key Considerations

- Would extra leave be universal or linked to service length?

- Plan ahead to manage workloads during peak absence periods

- Communicate regularly and encourage employees to take regular breaks throughout the year.

Learning and Development Opportunities

Career growth is one of the top drivers of engagement and job satisfaction, with more than a third of workers citing it as a key priority for an employer. Employees increasingly expect employers to invest in their skills and progression, and it makes sense from a business perspective.

Training and development options might include:

- Access to e-learning platforms

- Time to attend courses or conferences

- Cross-departmental training

- Mentoring and coaching.

Employees that are upskilled add more value to your business. In fact, a study by SurveyMonkey found that 59% of employees say training improves their overall job performance.

Key Considerations

- Are there equal opportunities for development across all roles and levels?

- Do you have an per-employee allowance to manage costs transparently?

- Be sure to link learning goals with business objectives.

Healthy Living Benefits

Encouraging physical and mental wellbeing is a high-impact, low-cost strategy for any organisation. Options include:

- Discounted or subsidised gym memberships

- Healthy office snacks and hydration stations

- Cycle-to-Work schemes (which can also save money on your business’s NI contributions)

- Team wellness challenges or walking meetings.

Key Considerations

- Choose benefits your people will genuinely use, are they gym-lovers or outdoor walkers?

- Offer options that suit different fitness levels and lifestyles – inclusivity should be a core driver

- Consistency: Encourage small, ongoing habits rather than one-off events.

Investing in health pays back through fewer absences, higher energy, and stronger morale.

Money-Saving Benefits Employees Love

In a time when household budgets are being squeezed, financial wellbeing is fast becoming one of the most important dimensions of employee benefits.

For employers, offering perks that help staff make their pay go further is an effective, low-cost way to show empathy, boost morale, and build loyalty – especially when large pay rises aren’t possible.

Below are some of the most popular and impactful money-saving employee benefits in the UK – and how to implement them effectively.

Employee Discount Schemes

Employee discount platforms give staff access to savings across everyday purchases – from groceries and fuel to tech, fashion, and travel. These schemes are easy to roll out and can save employees hundreds of pounds per year, often at minimal cost to the employer.

Examples of discounts

- Supermarkets and high-street retailers

- Cinema tickets, days out, and holidays

- Mobile phones, broadband, and tech products

- Fitness and wellness subscriptions.

80% of employees say financial stress affects their focus at work. A discount scheme is a simple way to help.

Key Considerations

- Some schemes charge per-user fees, while others can be integrated free via your insurer or reward provider

- Promote discounts regularly, via newsletters, onboarding, or payslips — to maintain engagement

- Partner with a trusted provider such as My.Drewberry, which offers a wide range of discounts and an intuitive online portal

- Track uptake to understand ROI and which discounts staff use most.

Salary Exchange Schemes

Salary Exchange schemes (also known as Salary Sacrifice) allow employees to buy bigger-ticket products or services from their gross salary before tax and National Insurance, meaning real savings.

The Techscheme, for example, enables staff to purchase laptops, phones, or furnishings from the IKEA and Currys retailers through deductions, saving on National Insurance while spreading payments interest-free.

For many of these schemes, your business also benefits as a result through savings on National Insurance contributions. This is because you’ll only pay NI on the employees’ reduced salary.

Popular Salary Sacrifice schemes include:

- Cycle-to-Work schemes

- Electric Vehicle leasing

- Techscheme

- Salary Exchange Workplace Pensions (52% of employees said they want to learn more about this contribution method).

Each provides a tangible financial perk while supporting wellbeing or sustainability.

Key Considerations

- Who’s eligible? A Salary Exchange agreement can’t push an employee’s salary below national minimum wage

- Work closely with your payroll team and scheme provider to ensure deductions run smoothly

- Communicate the tax advantages clearly to employees so they understand the real savings.

Bringing It All Together with Total Reward

So, you’ve set up the best employee benefits for your company. How can you let your employees know what’s on offer? Your Total Reward Statement shows employees the full value of their employment: salary, pensions, insurance, and perks combined. It helps staff see the bigger picture and value what you offer.

Think of it like this: if only 12% of employees say they’re truly satisfied with their current benefits, how much of that could be down to poor communication? Only 11% say they receive regular communication about their rewards.

By creating a total reward statement which encompasses all the benefits you provide, you can highlight to staff the great bundle of benefits and rewards you offer. When employees understand and appreciate their benefits, they’re less likely to move for a marginal pay rise elsewhere.

When teams understand and value their benefits, they’re more likely to show higher levels of engagement.

This can lead to a happier and more productive workforce, who are less likely to be tempted away for a small increase in salary elsewhere.

Joe Toft

Senior Consultant, Employee Benefits

What the Best Global Employers Offer (and Affordable Alternatives)

Even small businesses can adopt big-company thinking when it comes to rewards. Here’s how leading employers do it – and how you can follow their lead affordably.

| Global Firm | Signature Benefit | SME Alternative |

|---|---|---|

| Dropbox | Unlimited paid holiday | Enhanced leave or birthday off |

| British Red Cross | 4-day week at full salary | Condensed hours or flexi-time |

| Free meals, food and drink | Free snacks or drinks | |

| Salesforce | On-site fitness classes | Discounted gym membership |

| Etsy | 26-weeks paid parental leave (all genders) | Enhanced parental leave |

| Money.co.uk | Star Wars themed cinema room | Discounted cinema tickets |

The key isn’t copying big firms, but finding scalable ways to support your employees. Try benchmarking your benefits to find out what your team really values, and see how you compare against competitors.

How to Choose the Right Mix of Employee Benefits for Your Business

No two workforces are the same, so benefits packages shouldn’t be either. The “best” employee benefits for one organisation might not make sense for another. The secret lies in building a package that’s relevant to your people, sustainable for your business, and clearly communicated.

Here’s how to design the right blend of benefits for your business.

Survey Your Staff

Before investing in new perks, take the time to ask your employees what they truly value. The best insights often come directly from the people you’re trying to support.

How to gather feedback:

- Run a short, anonymous survey using tools like Microsoft/Google Forms, SurveyMonkey, or your HRIS

- Ask open questions about which benefits staff currently value and what they’d most like added

- Check out what employees really want in our nationwide survey.

If you already have benefits in place, measure awareness as well as satisfaction. Sometimes the issue isn’t the benefit itself, but poor communication about what’s available.

Benchmark Against Industry Standards

Your benefits shouldn’t exist in a vacuum. To remain competitive, it’s worth knowing what’s typical within your sector – and where you can stand out. You can do this by benchmarking.

How to benchmark:

- Review competitor careers pages and job listings for advertised perks

- Talk to similar businesses in your space when networking or attending events

- Work with a benefits consultant (like us!) to understand current norms.

Benchmarking ensures your package supports recruitment and retention, helping you attract talent without overextending your budget.

Balance Your Budget

Not every benefit requires deep pockets. The most successful employers blend low-cost, high-impact perks (such as flexible working or retail discounts) with core long-term protections like enhanced Workplace Pensions and group insurance.

Budgeting tips:

- Prioritise benefits that deliver business impact — such as reduced absenteeism or lower staff turnover

- Consider cost-neutral initiatives such as Salary Exchange to extend value without heavy expenditure

- Work with a specialist consultant who can design the ideally-costed benefits package for your business.

Compare Employee Benefits and Get Specialist Advice

Setting up and maintaining a competitive employee benefits package requires a decent bit of admin, so it quickly becomes time consuming. We do the heavy lifting for businesses of all sizes in the UK, so you can focus on delivering your own proposition.

If you need help setting up group insurance, Salary Exchange schemes, or benchmarking your offering, give us a call on 02074425880 or email help@drewberry.co.uk.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

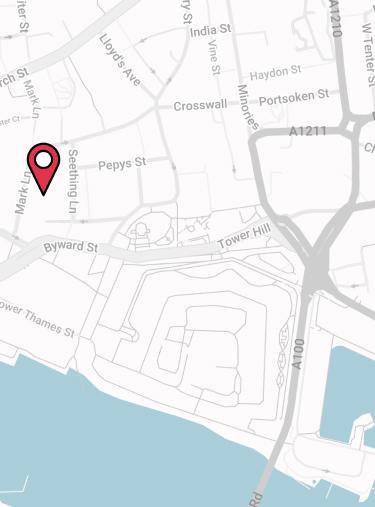

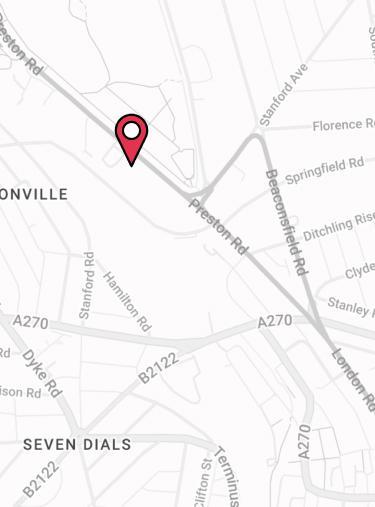

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.