Complete Guide To Employee Benefits In The UK 2026

Your employee benefits are a powerful tool to create a workplace where employees feel genuinely valued, supported, and motivated to excel. When implemented correctly, the right benefits package fuels loyalty, drives productivity, and sets your business up for sustained success.

Surprising, then, that only 12% of employees say they’re truly happy with their current rewards, and more than a third would leave their current job for a better benefits package. And considering that almost half of say a good benefits package is the most important factor when choosing an employer, it’s vital to ensure you have a well-rounded and comprehensive employee benefits package if you want to keep hold of your team – and attract the best talent.

What Are Employee Benefits?

Employee benefits are products and services an employer provides on behalf of their staff. These are perks that are typically outside of an employee’s salary and aim to provide extra value to them. There are benefits you can pay for and some which are low cost or even free.

A benefits package can encompass a variety of perks that reward staff for their hard work and support their wellbeing. This includes mandatory employee benefits, such as a workplace pension scheme and holiday allowance, as well as other discretionary benefits, such as insurance policies and wellbeing services.

In the UK, employee benefits are tailored to fit the needs of you and your employees. Some of the most common types of benefits provided include:

- Group Life Insurance (also called Death In Service)

- Business Health Insurance

- Corporate Health Cash Plans

- Group Income Protection

- Critical Illness Cover

- Salary Sacrifice Schemes

- Workplace Pension Schemes

- Employee discount Schemes

- Dental Insurance.

Beyond these common benefits, there’s a wide range of other options to choose from. For example, flexible working, learning and development opportunities, and duvet days. The list goes on! You can tailor what you offer based on your business objectives and the needs of your staff.

Why Offer Staff Employee Benefits?

Many businesses go beyond mandatory benefits, offering additional options that provide even greater value. Introducing a diverse range of meaningful benefits is a strategic move with numerous advantages, including:

- Boost workplace morale

- Lower stress

- Improve employee engagement

- Reduce presenteeism and absenteeism

- Improve workplace productivity

- Support your employee’s health and wellbeing

- Make it easier to attract top talent to your business

- Help retain talent.

Surprisingly, only 12% of employees are truly happy with the benefits their employer offers. This gap in satisfaction can significantly diminish the positive outcomes that benefits are meant to deliver.

Which Benefits Should You Offer?

There’s no right or wrong answer to this. The benefits you decide to offer your staff are dependent on your workforce, employee needs, and budget. When creating a benefits package, it’s important to tailor it to your staff. What do your employees want? What would they get the most value from?

It’s no use providing benefits your staff won’t use or value!

Employers can use benchmarking to their advantage here to see where they stand among their competitors. By benchmarking your employee benefits to others in your industry, you can fill in any gaps in your benefits package and try to better leverage yourself as a top employee.

What Do Employees Want?

To give you an idea, we asked nearly 1,000 UK employees in our 2025 Employee Benefits Survey about their benefits. And these benefits were most in demand:

- Flexible working hours (42%)

- Reduced working week (i.e. 4-day week) (39%)

- Enhanced pension contributions (37%)

- Remote / hybrid working (36%)

- Company Health Insurance (32%)

These are a mix of company-paid for benefits and free perks to implement. The best employee benefits package includes a mix of all these benefits. For more insight, we’ve written a guide to the top benefits employees truly value in 2024.

With a clear understanding of what benefits can do for your workforce, here’s a thorough rundown of the different employee benefits available.

Types Of Employee Benefits

As we have mentioned, some benefits are mandatory in the UK and as an employer you have to provide them. These include:

- Workplace Pension

- Annual leave / paid time off

- Parental leave (maternity and paternity)

- Statutory Sick Pay.

However, beyond these mandatory benefits, there’s a wealth of additional options employers can offer to enhance their overall package. By tailoring your benefits to meet the diverse needs of your workforce, you can create a more attractive and supportive environment for your team.

Below, we explore the key types of employee benefits available to UK employers.

Workplace Auto-Enrolment Pension With Enhanced Contributions

A Workplace Pension with minimum employee and employer contributions is one of the mandatory benefits you must provide. That said, many employers choose to go above and beyond their requirements to help position their staff for the best possible retirement.

Our 2025 Workplace Pension Survey revealed just how much employees value their retirement benefits. With 58% of staff preferring higher pension contributions and fewer other benefits, it’s important to keep this in mind when developing your pension scheme. Meeting the demands of your staff can help you to keep your top talent.

84% of employees also told us that it’s important for an employer to provide a good pension when looking for new roles. So, your pension scheme is also a benefit that can help to attract from a more diverse talent pool.

There is a lot to consider if you’re implementing or reviewing a Workplace Pension scheme, including:

- Level of employer contributions

- Option for salary sacrifice

- Choice of pension provider and associated charges

- Choice of investment funds

- Technology and ease of integration

- Educating staff on the value of saving for tomorrow.

There is a huge difference you can make by negotiating a pension scheme with lower charges and better fund choice to help your employees save more now for the future.

Read our guide comparing the top Workplace Pension Providers in the UK for more information.

Communicating Your Pension Scheme

Effective communication is the cornerstone of a strong workplace pension. Providing a pension is just the start – it’s equally important to empower your employees with the knowledge they need to save confidently for retirement.

Our 2025 Workplace Pension survey revealed that over 57% of employees don’t know how much they need to save for retirement.

By providing effective pensions education, you can turn statutory benefits into perks your employees truly value. We help our clients to better communicate their group pension, as well as the initial implementation and management of a scheme.

Business Health Insurance

Business Health Insurance provides your staff access to medical treatment at private UK facilities. They can bypass long NHS waiting lists and get the care they need sooner rather than later. Considering over 2.87 million patients were waiting longer than 18 weeks for treatment as of May 2025, this employee benefit helps to fast track their care.

It’s one of the most sought-after employee benefits. With more than a third wanting their employer to offer Private Health Insurance, it’s a popular benefit to implement.

If an employee is unwell, health coverage is beneficial, as it enables staff to:

- Access medical treatment quickly, skipping those NHS waiting lists

- Receive treatment in private facilities

- Flexibility over when they receive treatment and by which healthcare professional

- Potentially get access to the latest procedures and medicines that aren’t funded by the NHS

- Remain fit and healthy enough to work.

Why Trailmix Offered Its Staff Health Cover

London-based mobile gaming startup Trailmix introduced a small business Health Insurance scheme for its 18 workers that packs a big punch.

“Although we’re a fairly small company, this scheme has now put us on par with our competitors in the mobile gaming industry in terms of what we offer to staff,” says Lauren Alper, Trailmix’s Office Manager. “It should therefore help us attract the best talent going forward.”

Here’s why they chose Drewberry™ for the help and advice they needed.

Popular Group Health Insurance Guides

Death In Service Insurance

Death in Service Insurance – also known as Group Life Insurance – pays out a tax-free amount (a multiple of an employee’s salary) to an employee’s loved ones should they pass away while working for your company.

This is normally one of the first employee benefits a company implements for its employees. It’s an affordable benefit for employers to set up and employees value it highly. As Death In Service cover is set up via a trust, this makes the payout tax free for the employee’s family.

It provides peace of mind to staff that if they die, their nominated beneficiaries are financially secure. Your employees can even make use of the policy themselves, as most insurers offer a range of additional flexible benefits for staff to help support their health and wellbeing.

Why Profile Pensions Set-Up Employee Life Insurance

“Getting Group Life Insurance in place was a bit of a no-brainer,” says Michelle Donlin, Profile Pensions’ HR and Office Manager.

“Our employees get comfort from knowing it’s there and we’re proud to provide that. We work hard to provide good benefits to our staff and show a commitment to our employees, so introducing an employee benefit was really a logical step.”

Read Profile Pensions’ story here

Useful Death In Service Resources

Group Income Protection

Group Income Protection – also known as Sick Pay Insurance – pays a monthly benefit to an employee if they become sick or suffer an injury and need time off work. The payment they receive is a proportion of their monthly income before tax.

This is a valuable policy to offer to your team, as it helps them financially should they ever need time off for any medical reason. You can set up Group Income Protection to pay out for 1, 2, or 5 years per claim (short-term Income Protection), or choose long-term cover that supports employees until their expected retirement age.

In the event of a successful claim, the insurer pays the benefit to you, the employer. It’s then your responsibility to distribute the sum to the employee (typically through PAYE). They then pay Income Tax on the sum received, just like they do their salary.

Own Occupation Cover

By setting up the group policy with the “own occupation” definition of incapacity, employees can claim for a health problem if it prevents them from carrying out the duties of their specific job role.

It’s important to opt for this type of cover, as it’s the easiest definition to claim on. Other definitions make it harder to make a successful claim, as they may be deemed well enough to work in another role.

More On Group Income Protection

Group Critical Illness Cover

Group Critical Illness Cover pays out a tax-free lump sum to an employee if they’re diagnosed with a critical illness listed on the policy. They must meet the definition of the condition as detailed in the policy documents to make a successful claim.

The lump sum is set to a multiple of income, generally 1-5 times gross basic salary.

Group Critical Illness can be valuable to employees, providing great financial help. However, it does cover fewer conditions than Group Income Protection. As a result, you may find the latter to be a better employee benefit for your workforce.

More On Group Critical Illness Cover

Corporate Health Cash Plans

A Corporate Health Cash Plan is another type of health-related employee benefit. It differs from Group Health cover in that it helps staff to cover the costs of everyday healthcare, such as routine dental checkups and optician appointments.

For some companies, Private Health Insurance can be a little on the expensive side. A Health Cash Plan is an affordable alternative that still helps with employee wellbeing. It enables staff to get monetary support for things like physiotherapy, therapies, and dental and optical care. See how Drewberry employee Colette sorted her eye health with ease thanks to her Cash Plan.

The dentistry aspect is the most used element of cash plans. Since dentistry isn’t available on the NHS for free, health cash plans offer financial assistance, covering part of the cost of treatment. So, instead of ignoring any dental niggles, they can get the treatment they need.

Employee Assistance Programmes and Additional Benefits

Employee Assistance Programmes (EAP) provide free services and additional benefits to your employees. You can arrange an EAP on its own or make use of the wellness programs that come free with your group insurance policies. Group Health Insurance often comes with an EAP attached.

Many employers are unaware of the extra perks offered alongside their core protection, meaning such benefits go unused.

Make sure you sing and dance about the additional benefits available to your staff. These may include:

- Legal, medical and financial assistance helplines

- Counselling / cognitive behavioural therapy (CBT), either face-to-face or over the phone

- Mental health support

- Bereavement counselling

- Access to physiotherapy

- Remote GP services.

Why Offer An Employee Assistance Programme?

EAPs can provide comfort and support to employees and their families, helping them to improve their health and wellbeing and get the support they need.

Your staff can use the services of an EAP at any time; they don’t need to be making a claim to utilise the services. This is hugely beneficial, as it not only provides support in difficult times, but can help them to prevent issues from occurring in the first place.

One very important aspect of an EAP is the virtual GP services. These allow your employees to book a GP appointment at a convenient time for them. Appointments can be carried out over telephone or video call, meaning your staff don’t have to worry about having to attend their doctor’s surgery.

A report by HCML found that despite 79% of employers providing an EAP, only 27% of staff know it exists. Considering how an EAP can help staff, it’s important to communicate the benefits. Even more so if the perk is provided for free alongside a group policy.

I recently used Smart Health’s remote GP service myself due to a health issue I hoped would go away but only got worse.

It worked fantastically. The appointment was thorough, easy to arrange, didn’t feel rushed and was just what I needed to provide reassurance without having to take time out of the office to wait in my local GP surgery.

Andrew Jenkinson

Director at Drewberry

Salary Sacrifice Benefits

Salary sacrifice schemes are a tax-efficient way to offer benefits to your team. These work by an employee sacrificing a part of their salary each month for valuable benefits (see which ones below).

As an employer, salary sacrifice means you save on National Insurance Contributions at the same time as potentially boosting employee engagement and motivation.

Offering these schemes can set you apart from your competitors, giving them access to purchases your employees might not have been able to afford otherwise.

There are many salary sacrifice benefits to choose from that it can be hard to pinpoint the right ones for your people, but the big ones are:

- Cycle To Work: Great for an active workforce, spreading the cost of a new bicycle and equipment

- Techscheme: Staff can get their hands on big purchases from IKEA and Curry’s

- Holiday Trading: Employees can buy extra days of annual leave by swapping their salary

- Electric Vehicles: An affordable way to fund the purchase of an electric car

- Enhanced Pensions: Savings made on National Insurance can build employees’ pension pots, and even boost take home pay.

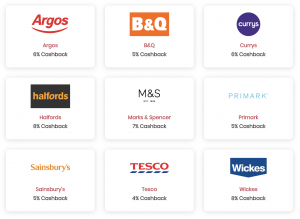

Employee Discounts Schemes

An affordable and useful benefit to offer is an employee discounts scheme. In a time where the cost of living is high and people are trying to make their income stretch further, a discount scheme offers a great range of savings. Employees can use the scheme to save some cash on their everyday purchases.

From grocery shops and household energy suppliers to homeware, holidays and fashion, staff can save hundreds of pounds a year.

The best part? An Employee Discount Platform can cost as little as £1-£2 per employee per month.

Discounts With My.Drewberry 🤩

Our very own Employee Benefits platform, My.Drewberry, has a discount scheme incorporated into it. Staff can access a range of discounts, including digital vouchers, cheaper cinema tickets, and cashback. You can get an idea of some of the retailers included within a discount scheme below.

For further information on implementing a discount scheme for your staff, pop us a call on 02074425880 or email help@drewberry.co.uk.

Employee Benefits For Small Business UK

Got a small business? There are still loads of employee benefits smaller businesses can implement that won’t exceed your budget. This is often a worry for small business employers, but you can offer some great benefits that cost very little (or even nothing!).

No matter the size of your business, you have to provide a suitable workplace pension scheme – it’s the law.

Corporate Health Cash Plans are more affordable for small businesses, compared to a Group Health Policy. So, this is something to consider. All the benefits we’ve already mentioned can be tailored to suit a budget.

There are plenty of free perks you can offer, though, including:

- Flexible working options

- Rewards and recognition for hard work

- The option to buy or sell holiday

- Free day off for birthdays

- Additional paid leave

- Bonus mental health days / wellness days

- A number of days allocated for volunteering.

And don’t forget the extra benefits and services that tend to come with your core employee benefits. For example, if you set up group health benefits, your employees may get access to an Employee Assistance Programme (which includes mental health benefits) or remote GP services for free.

Who Are The Best Employee Benefits Providers In The UK?

There are many employee benefits providers in the UK, each offering different benefits and perks. Each provider has different limits, multiples of remuneration, deferred periods and a variety of other factors that vary between providers. There will also be a marked difference in the free additional benefits each insurer offers.

What provider to choose for your employee benefits is dependent on your company, its needs, and your budget. Even the industry matters. A provider may suit your company more than a competitor in your sector, for example. The good news is that employee benefits can be tailored to suit the needs of your business and employees, and there are ways to reduce costs. Give us a call on 02074425880 or email help@drewberry.co.uk to speak to one of our friendly advisers – they know the market inside out, and can find the right fit for your organisation.

How Do I Get Quotes?

While it’s fairly easy to get quotes online for personal policies, it’s slightly more difficult for group benefits. This is because there are so many factors influencing the cost of a policy. And again, every business is unique, so this needs to be considered when gathering quotes for your company benefits.

To get accurate pricing for your employee, you’ll need to provide:

- How many employees you have

- Employees’ dates of birth

- Employees’ genders

- Geographic location

- Industry and occupation

- Salary details

- Desired policy options.

You’ll then have to take these details to every provider on the market one by one to compare premiums and ensure you’re getting the most competitive quotes.

To make the process easier, our specialist employee benefits consultants do all of this heavy lifting on your behalf. All you need to do is get in touch with us and we’ll get the ball rolling.

IMPORTANT NOTICE❗

It’s a different process for group pensions. Employers would need to sign up to our Drewberry services before we go to market and find you the right pension solution for your business.

Compare UK Employee Benefit Quotes and Get Specialist Advice

Putting together the right employee benefits programme for your staff can be a difficult task, as is finding the right balance between cost and coverage.

At Drewberry, our dedicated specialists gather and compare quotes for you from the whole UK market. Once that’s done, we provide a recommendation report detailing the best employee benefits for your circumstances. As specialists, we have exclusive access to all the insurers on the UK market, meaning we’re in a great position to negotiate and get the best deal for the right price.

We can then help you to set up your benefits and manage them through our platform, My.Drewberry. Get in touch with our team by calling 02074425880 or email help@drewberry.co.uk for more information.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.