Being self-employed comes with its benefits, but it can also be quite daunting. The buck stops with you, so if you’re unable to work due to ill health, your income can be significantly impacted. This is why many individuals working for themselves opt for Self-Employed Health Insurance.

But what exactly is it? How much does it cost? And do you really need it? Our complete guide to Self-Employed Health Insurance, covers everything you need to know.

What Is Self-Employed Health Insurance?

Firstly, this type of cover works in the same way as personal Private Medical Insurance (PMI), except it’s designed with self-employed people in mind.

Health Insurance for the self-employed offers access to private medical care for people who work for themselves. It provides quick treatment for acute conditions and ensures you get back on your feet. You’ll be able to:

- Skip long NHS waiting lists

- Pick where you get treatment and who by

- Receive private care when you need it most

- Get access to drugs and procedures which aren’t on the NHS.

Why Is It Important?

The very nature of self-employment puts you at risk if you fall ill or suffer an accident which stops you from working. Being your own boss means you don’t get the same benefits as an employee working for a company.

You’re not entitled to any sick pay as a self-employed person, so if you get sick and are unable to work, it’s highly likely your finances will struggle. Taking time off when you work for yourself means if you’re not working, you’re not generating an income.

This is what makes Self-Employed Health Insurance so essential. While it doesn’t cover loss of income (you’ll need Self-Employed Income Protection for that), it can help ensure you get the treatment and medication you need quickly.

With a Self-Employed Health Insurance policy tucked under your belt, you’ll have peace of mind that you can recover as quickly as possible and avoid taking too much time off work.

Many policies also come with free additional benefits, such as virtual GP services and mental health support. These can help to limit absences, if not prevent them from happening in the first place.

Nick Nelms

Senior Consultant, Employee Benefits

How Does Health Insurance For The Self-Employed Work?

As we explained above, your Self-Employed Health Insurance works in the same way as a standard PMI policy.

You’ll pay for premiums, either monthly or annually, through your own personal bank account. When your policy is live, you’ll be entitled to make a claim if you need treatment, provided it’s covered by your health plan.

You can pay for premiums via your limited company. But doing so changes the tax regulations. We’ll explain how you can pay for premiums through your company later.

Does It Replace The NHS?

No. When you buy a Self-Employed Health Insurance policy, you aren’t forgetting the NHS altogether. Instead, it’s designed to supplement the NHS. No matter whether you have insurance, you’ll always need the NHS for certain health issues, such as accidents and emergencies.

But how often you need to rely on the NHS will depend on the level of cover you have on your policy. You’ll still visit your GP, but the process of receiving treatment will depend on your policy.

Using Private Healthcare Alongside The NHS

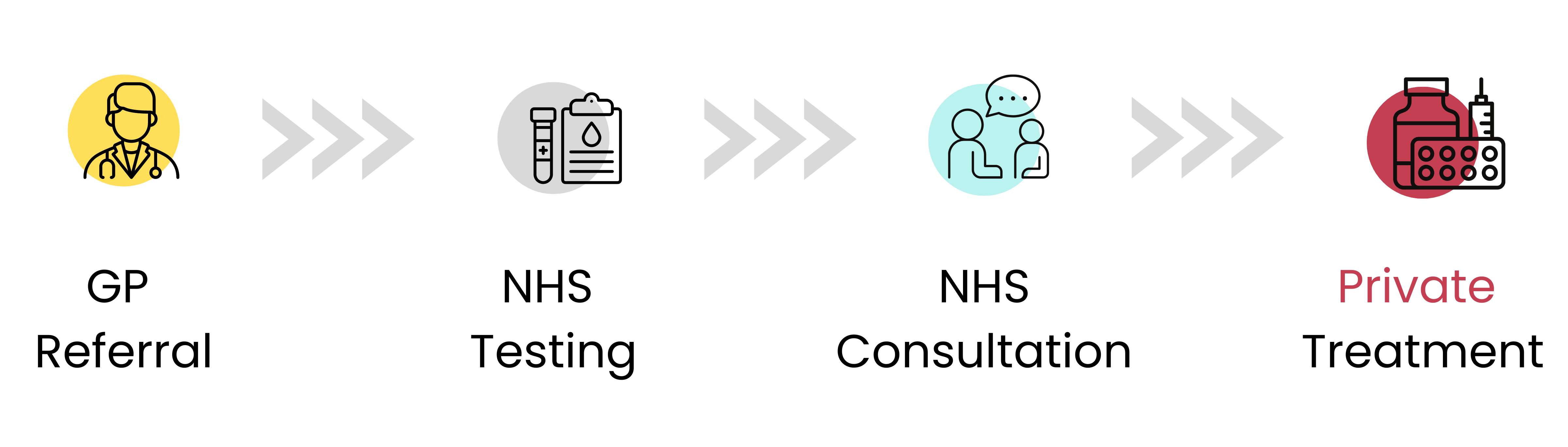

Basic Health Insurance policies don’t cover outpatient care, so your GP will refer to the NHS for all tests, consultations and diagnostics. After this, you’ll be referred to a private facility for care. The following infographic breaks down the process.

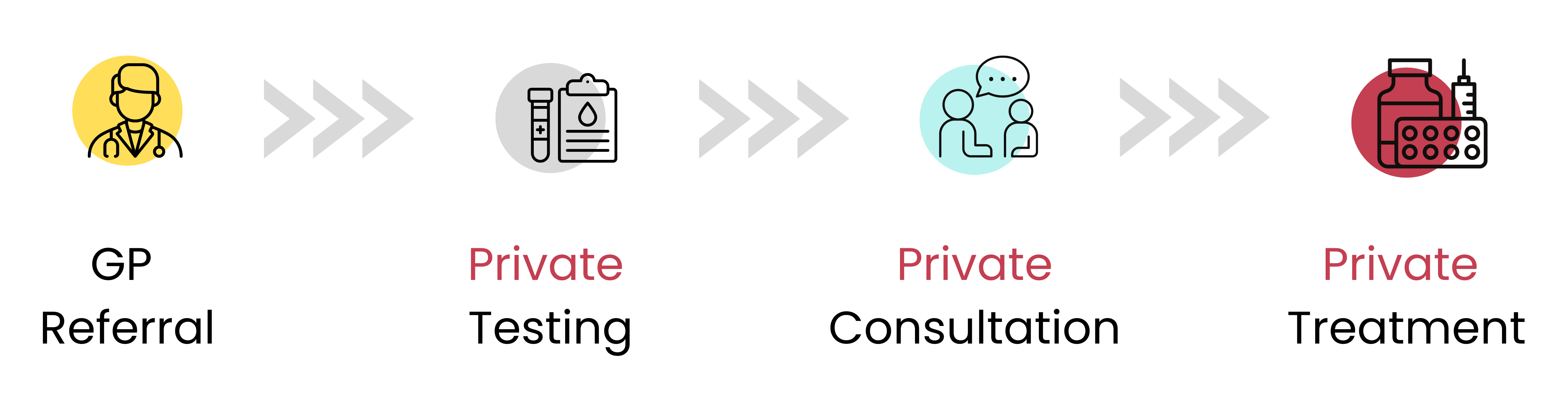

If you opt for a more comprehensive Private Health Insurance, outpatient cover is usually included. In this case, rather than your GP referring you to the NHS for diagnostics, they’ll refer you straight to a private facility for care. The route illustrated below is typically quicker than the NHS due to shorter waiting lists.

SPECIALIST TIP 🤓

The good thing with Self-Employed Health Insurance, although you will still need to be referred by your GP, in most cases you can do this via the remote GP services.

Chronic Vs Acute Conditions

There are two types of health conditions you could develop during your lifetime. These are:

- Chronic conditions

These are conditions which Drs can manage but not cure. They are essentially things that will be with you for life. For example, asthma or diabetes - Acute conditions

Unlike chronic conditions, acute conditions can be cured over time. These include things such as joint pain requiring a joint replacement or cataracts.

It’s important to understand that Self-Employed Health Insurance will only cover acute conditions. Any chronic conditions, will be treated and managed via the NHS.

This is why we say the private health insurance works alongside the NHS rather than replaces it.

Health Insurance Client Stories

What Does Self-Employed Health Insurance Cover?

So, you know exactly how Health Insurance works as a self-employed person, but what does it cover?

Well, as we’ve said, it covers acute conditions only, but to what extent depends on your policy options. All health policies cover certain conditions and treatments as standard. For others, you’ll have to pay more if you’d like to add on extra cover.

Level Of Cover

How much coverage you get on your health policy is dependent on your decisions when setting up your policy.

Regardless of whether you receive private or NHS healthcare, all of your medical treatment is split into two categories. Inpatient or Outpatient:

- Inpatient / Day-Patient Care

All private health insurers in the UK cover inpatient and day-patient care as standard. This is any treatment which requires a hospital bed, either overnight (inpatient) or for the day (day-patient). This includes surgeries - Outpatient Care

Outpatient is the opposite. This is treatment you have without needing a hospital bed. Diagnostic tests and scans, as well as physiotherapy, for example, are normally carried out as an outpatient procedure.

SPECIALIST TIP 🤓

Not having outpatient cover can cause delays in diagnosis as you would be reliant on the NHS. Because of this we always recommend adding at least some cover. It will increase premiums but it is worth it.

As a self-employed person, your Health Insurance plan will cover:

- Extensive cancer care and treatment (we’ll go into this a little more later)

- Diagnostic testing, such as CT / MRI scans and blood tests

- Private hospital access and nursing care

- Surgery as inpatient or day-patient.

Depending on the level of cover you’d like, you may also get:

- Outpatient medical treatment

- Mental health support

- Complementary therapies

- Physiotherapy.

Cancer Care

One of the most valuable aspects of any private health policy is the Cancer Care provided. You can access drugs, treatments and therapies which aren’t on the NHS due to cost. This may include new experimental medicine.

You’ll find that all major UK health insurers now offer some level of cancer cover as standard. This generally includes:

- Chemotherapy & radiotherapy

- Biological therapies

- Cancer surgery / reconstruction

- Cash towards prosthetics / wigs you need as a result of cancer treatment.

As well as the above, you may also be able to add extra cover such as Dental and Optical Care to your policy as an optional add-on.

What Doesn’t Health Insurance For The Self-Employed Cover?

Like all insurance policies, there are certain things which are excluded from your policy. It doesn’t matter if you work for yourself or not, these are excluded:

- Pre-existing medical conditions

- Emergency care

- Issues related to alcohol / substance abuse

- Pregnancy / fertility treatment

- Cosmetic treatment which isn’t medically necessary

- HIV / AIDS

- Kidney dialysis

- Self-inflicted injuries, such as those sustained through dangerous sports / hobbies.

Do I Need Self-Employed Private Medical Insurance?

It’s not a legal requirement to have Health Insurance if you are self-employed. However, it is something that you should strongly consider.

When you’re self-employed, you’re your own boss, which makes it costly to take time off if you get ill or become injured. Waiting for treatment on the NHS could take weeks, even months, so if unable to work your income could take a massive hit.

Protecting your health can ensure that you get any treatment you need quickly and at a time you need it most.

The Statistics…

At the end of January 2023, 7.2 million patients were on NHS waiting lists in England. Approximately 3 million of which have been waiting more than 18 weeks for treatment. This is something to factor into your decision to buy Self-Employed Health Insurance.

What’s more, the shocking reality is that the NHS hasn’t met its 18 week treatment target since 2016. Many people, just like you, are waiting longer than 4 months or more for the treatment they need.

If an illness or injury stopped you from working, how would you manage if you had to wait at least 18 weeks for care?

This is where Self-Employed Private Health Insurance takes centre stage. You’ll be able to get the care you need faster. And you’ll be back to work before you know it.

You should consider Private Medical Insurance if you:

- Want fast access to private healthcare services

- Prefer flexibility over where and how you receive treatment

- Want peace of mind that you can get the care you need as quickly as possible

- Want to skip long NHS waiting lists

- Can afford monthly Health Insurance premiums.

We are lucky to have the NHS, however it is under increasing pressure. Having Self-Employed Health Insurance in place, not only helps to relive some of this, but also ensures you get the treatment you need quickly.

If you’re still unsure whether Health Insurance is for you, let’s have a chat. Don’t hesitate to get in touch on 02074425880 or via email at help@drewberry.co.uk.

Matthew Brown

Employee Benefits Consultant

How Much Does Self-Employed Health Insurance Cost?

The cost of your Private Health Insurance depends on several factors. Some of which are within your control, however others, such as age, aren’t.

To give you a better idea of how these factors can impact the cost of a policy, here are some example quotes.

Factor 1: The Provider

When comparing UK health insurers, you’ll notice that every provider charges different premiums. This is because each one has its own appetite for risk and offers different services and benefits.

To highlight how costs can vary from provider to provider, we have provided an example below. This is based on:

- A 35-year-old self-employed individual

- Comprehensive cover

- £250 excess

- Non-smoker.

Different Providers | |

|---|---|

|

|

£71.22 a month | £87.78 a month |

Factor 2: The Level Of Outpatient Cover

You can expect to pay extra if you choose to add outpatient cover to your health policy. The cost of which depends on how much outpatient cover you have.

A mid-range policy might give you up to £1,000 of outpatient cover. While a comprehensive plan would provide full cover.

Using the same factors from above, we’ve pulled quotes using our calculator so you can see how different levels of outpatient cover impact cost.

Level Of Outpatient Cover | Type Of Policy | Outpatient Cover | Cost |

|---|---|---|

Basic | £0 | £39.79 a month |

Mid-Range | £1,500 | £54.26 a month |

Comprehensive | Full Cover | £71.22 a month |

Factor 3: The Excess Amount

An excess is how much you’re willing to pay upfront for care before your Health Insurance kicks in. The higher your excess, the lower your premiums. You’ll pay this excess per claim or per policy year. It’s essential you check which one applies.

Excesses start at £0 and go all the way up to £5,000. Aviva offers one of the highest excesses on the market, at £5,000. While Bupa’s highest is just £500.

To give you an example of how this can affect premiums, we’ve got some examples for you. This is based on the same 35-year-old from above.

Level Of Excess | Excess Amount | Monthly Premium |

|---|---|

£250 | £71.22 |

£500 | £62.94 |

£1,000 | £54.66 |

Factor 4: The Policyholder’s Age

Now let’s look at how age can affect your premiums. As we get older, we become more susceptible to becoming ill or suffering an injury. To compensate for the higher risk, insurers will increase the cost of your Self-Employed Private Health Insurance.

Using the same example from above, we provided some costs based on comprehensive cover for different ages.

35 Year Old | 45 Year Old | 55 Year Old |

|---|---|---|

£71.22 a month | £95.89 a month | £132.89 a month |

Factor 5: Smoking Status

Another significant factor in the price of your Self-Employed Health Insurance is your smoker status. Some insurers will charge you more for your cover if you smoke. This is due to the increased health risks associated with the habit.

We’ve provided an example below from AXA to show you the difference between smokers and non-smokers. This is based on a 35-year-old self-employed worker, wanting comprehensive cover and a £250 excess.

Smoker Vs Non-Smoker | |

|---|---|

🚬 | 🚭 |

£75.69 | £71.22 |

Factor 6: Treatment Facilities

A policy doesn’t entitle you to receive treatment in all private facilities. When you buy a policy, you’ll pick what’s called a hospital network. This will determine which private hospitals you can visit.

Policies have several ‘tiers’ of private facilities. The best private hospitals in the country, such as those based in Central London, are the priciest to receive medical care in.

The more comprehensive your network and the pricier the facilities, the more you’ll pay for cover. So if you’re not too fussed about receiving care in a high-profile facility, you can limit your hospital list and reduce the cost of your premiums. These are often limited to local private facilities and private wings of NHS hospitals.

Factor 7: Policyholder’s Location

Insurers take your location into consideration when providing you with health cover. If you live somewhere with some of the top private hospitals, such as Central London, premiums will be higher.

SPECIALIST TIP 🤓

There are some insurers, such as Freedom, that don’t base premiums on location. Providers like this could be more suitable if you live in London, unlike others, as they won’t rate premiums on your postcode.

6 Week Wait Option

If you want to bring the cost of your monthly payments down, another option is something called the 6 week NHS wait. Opting for this means your policy only pays out if the NHS waiting list for the inpatient treatment you need is more than 6 weeks. Or if the NHS doesn’t provide the procedure you require.

Otherwise, you have the treatment on the NHS. This only applies to inpatient treatment. Outpatient care is unaffected as this is an optional add-on to your policy. You’ll always receive care privately with this add-on.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Can I cover my partner and dependents?

This will depend on the health insurer you take cover out with. Some providers will charge you for adding your first child to the plan, but add any extra children on for free.

If adding your family to your policy is something you have in mind, we recommend speaking to a specialist adviser. Our team can help you find the right policy for your needs and provide recommendations.

Does Self-Employed Health Insurance cover sick days?

No. Private Health Insurance isn’t designed to cover any income loss. Your Self-Employed Health Insurance policy covers the costs of private medical care. There are other products, such as Self-Employed Income Protection Insurance, which can pay out if you’re unable to work due to accident, illness or injury.

Is private medical care better than the NHS?

Private treatment isn’t necessarily better than the NHS. The services work in tandem to provide comprehensive health treatment. In fact, many medical professionals work in both private facilities and NHS hospitals.

Your health policy provides private medical care when you need it most. It allows you to skip those long NHS waiting lists and get the private medical treatment you need faster. You can also pick more convenient times and places for medical attention.

That said, the NHS will always be needed. We’ve listed some of the potential exclusions on Self-Employed Private Health Insurance policies. Chronic conditions, pregnancy, and emergency treatment will always require the NHS.

Can I Pay For Self-Employed Health Insurance Via My Limited Company?

If you’re self-employed and working through your own limited company set up, how premiums are paid can be a little different. Provided you’re the director or a contractor of the company, your business can pay for the Health Insurance.

To qualify, there needs to be some form of business entity to own and pay for the policy. When your Health Insurance premiums are run through your limited company, instead of your personal bank account, HMRC views it as an allowable business expense. This is only if you operate via a limited company as opposed to a sole-trader basis.

With a personal policy, you would pay for your premiums out of your net pay. This means you pay tax and NI before paying them.

Paying through your company means you can write the premiums off against your corporation tax and pay less.

Is It A P11D Benefit?

If you pay for your policy via your limited company, it’s considered a P11D Benefit. You’ll pay Class 1A employer National Insurance on the premiums as a result.

If you don’t operate via a limited company, you won’t be eligible. You’ll pay for your Health Insurance plan from your personal bank account as a sole trader.

Health Insurance Product Reviews

Compare Top 5 UK Self-Employed Private Medical Insurance Companies

The UK Health Insurance market has much to offer. The five major providers listed below all cater to self-employed people.

There are also smaller providers who are particularly competitive for sole traders looking for cover.

Additional Benefits

Many providers often offer free additional benefits on top of their core cover. When comparing, it’s important to look at what these are, as they can add real value to your policy. Some of the most common additions you can expect to see include:

- Remote GP services

- Health checks

- Physiotherapy

- Stress & mental health support

- Second medical opinions

- Rewards & discounts.

Common Private Health Insurance Questions

Which medical underwriting is best for Self-Employed Health Insurance?

When buying your Self-Employed Health Insurance, the insurer will underwrite you on either a Moratorium or Full Medical Basis. Which one is best depends on your medical history—not just on the conditions you’ve had, but also how severe those conditions were.

Moratorium Underwriting (MORI)

Moratorium is the most common form of underwriting. Your insurer will assess your medical history and exclude any health condition for which you’ve had advice, medication or treatment for in the previous 5 years.

Most providers underwrite under a 2-year rolling basis. Here they might reconsider cover for a previous condition as long as you haven’t sought any treatment or advice for it in those 2 years.

Full Medical Underwriting (FMU)

Full Medical Underwriting means you’ll fill in a form declaring any pre-existing conditions when you apply for cover. Your insurer will then go on to exclude these conditions.

Although you’ll know what you’re covered for from the start, there’s often very little wiggle room to remove exclusions.

It does, however, provide a faster payout as you don’t need to provide medical proof, unlike Moratorium Underwriting. Your insurer already knows your health history.

Should I review my Health Insurance every year?

Private Health Insurance is like Car Insurance, it renews on an annual basis. Each year, your insurer will write to you about your premiums for the following year.

You may find your premiums rise due to medical inflation. The cost of your health cover must reflect the increasing costs of the latest, cutting-edge medical advances, drugs and treatments.

It’s always recommended to review your policy to ensure you’re getting the best deal for your money.

If you’re unhappy with the costs and want to check you’re still receiving the most competitive terms and price, one of our specialist advisers will be happy to help. We’ll compare the whole market on your behalf, like we did when you first applied.

If we find another insurer is offering lower premiums, we’ll be able to assist in switching providers. Our team will help make sure you get the right underwriting terms and continue receiving the same level of cover. This is referred to as a Continued Personal Medical Exclusions (CPME) basis.

What other types of insurance should the self-employed have?

Due to the difference between contracted employment and self-employment, there are other policies you may want to consider if you’re your own boss. These can help fill any protection gaps you have as someone who is self-employed.

Self-employed people rarely get sick pay. If you couldn’t do your job for any length of time and had no money coming in, how would you cope financially? For this reason, many of our self-employed clients buy Self-Employed Income Protection. It pays out an income if you can’t work for any medical reason. While Long-Term Income Protection will pay out right up until retirement if necessary.

If you’re set up via a limited company, you can also opt for Relevant Life Insurance, which is tax-efficient life cover paid for by your business.

Get Specialist Advice On Your Self-Employed Health Insurance

Self-Employed Health Insurance policies are complex to compare due to the variety of policy options available. The best Private Health Insurance for you will depend on many of the factors we’ve mentioned already, such as age and location. This is why if you’re self-employed, it’s worth speaking to a specialist who knows the insurers and policies inside and out.

At Drewberry, we have years of experience helping clients with their Health Insurance, ensuring they get the best cover for the best price. We can compare the UK market for you and answer any questions you may have.

For specialist advice and further information, please don’t hesitate to get in touch with us. You can call us on 02074425880 or email help@drewberry.co.uk.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=2113)