Who Is Vitality?

When leading South African insurer Discovery Holdings entered the UK insurance market in 2007 it did so in a joint venture with PruHealth and PruProtect, part of the Prudential Group.

In 2014, Discovery Holdings bought out Prudential and rebranded its UK operations to VitalityHealth and VitalityLife.

VitalityHealth was the first insurer to award people for healthy living. It offers a way to help policyholders take a more active role in managing their health. To do this, Vitality offers a wide range of rewards to encourage people to maintain and improve long-term health. This includes increased no claims discounts, gifts from partnership companies and other long-term rewards.

Vitality Health Insurance

Vitality Personal Healthcare is the company’s main Private Medical Insurance offering in the UK and has a 5 star Defaqto rating.

As of January 2026, Vitality has over 60,000 reviews on Trustpilot, rating it as “excellent” with 4.5 stars out of 5.

Policy Overview

Core cover from Vitality Personal Healthcare pays for inpatient care in full. It also pays for a limited amount of outpatient care, with the option to add further cover for an additional premium. Read more about the difference between inpatient and outpatient cover.

Key Benefits

- Digital GP service

Video consultations with a UK-registered GP within 48 hours via the Vitality GP app. Appointments are available from anywhere in the UK 9am-7pm Monday to Friday and 9am-1pm on Saturdays. There’s also a 24 / 7 GP advice line, which you can use while abroad.

- Face-to-face private GP service

You can choose to see a private GP face-to-face for an upfront payment of £20 if you’ve selected London Care as your hospital list.

- Breakthrough cancer drugs and therapies

Access to cutting-edge cancer drugs and treatments, even when they’re not approved for NHS use due to cost. This includes no limits on biological, hormone and bisphosphonate therapies.

- Vitality Care

For complex ongoing claims, such as for cancer or mental health conditions, a team of clinically-trained doctors and nurses will assist with your treatment and provide ongoing support.

- Mental health support

Vitality’s core cover includes mental health support as standard. This includes up to eight talking therapy sessions (e.g. counselling and cognitive behavioural therapy).

- Vitality points for fitness tracking

Vitality offers discounts on a range of wearable tech to track your fitness and activity. You turn activities into points to spend on various rewards. This includes discounts and freebies from coffee shops, spas and hotels, weight loss groups and more.

Get 1 Month Free Cover 🥳

By reaching this page you are eligible for 1 month FREE cover when you arrange a new Health Insurance policy.

Simply fill in the form below to apply your 1 month free discount or call us on 02084327333 stating the code VC2MF.

What Does Vitality Personal Healthcare Cover?

Inpatient and Day Patient Treatment

Inpatient and day-patient treatment involves all medical care requiring a hospital bed. This might be overnight (inpatient) or just for the day (day-patient). This most commonly, but not exclusively, involves surgical procedures.

Outpatient Treatment

All medical care not requiring a hospital bed. Vitality does not include most outpatient care as standard — it’s an optional extra you add to the policy for an additional premium.

Outpatient Limits

You can either opt to have Vitality pay for eligible outpatient care in full or limit it to a fixed monetary amount per policy year.

However, even where you choose an outpatient limit, Vitality will still pay in full for MRI, CT and PET scans as well as physiotherapy when arranged through its Priority Physiotherapy Network.

The outpatient limits you can choose are:

- £500

- £750

- £1,000

- £1,250

- £1,500.

Should you opt to limit your outpatient cover, you can choose the Full Cover Diagnostics option. This means Vitality will still pay in full for any outpatient diagnostic tests / scans etc. you require, regardless of your outpatient limit. Only specialist consultations will come out of your outpatient limit with this option.

Cancer Care

Cancer cover is one of the most valuable elements of any Private Medical Insurance policy. It pays for diagnosis and treatment of cancer, including offering access to drugs, treatments, therapies and procedures the NHS may not yet offer due to their cost.

End of Life Care

Where your cancer isn’t curable, Vitality will pay £75 for each night spent in a hospice receiving end of life care. It will continue to pay in full for treatment required to relieve pain and other symptoms, even after a terminal diagnosis.

If your cancer cannot be cured, Vitality will also pay for a qualified nurse to provide at-home nursing care, up to a maximum of £1,000, for no more than 14 days.

Lifestyle Surgery

Recognising that obesity is a serious health condition that can lead to a range of other serious conditions such as diabetes and heart disease, Vitality pays for gastric banding or gastric bypass where clinically necessary and subject to its eligibility criteria.

To help combat the emotional distress caused to young people by conditions such as port-wine stain birth marks or prominent ears, Vitality also pays for surgery / treatment to correct these.

In all instances you or the insured dependent must have held the policy for at least 12 months and you’ll need to pay 25% of the cost of treatment upfront.

- Weight loss surgery

Pays for weight loss surgery to fit a gastric band, gastric sleeve or undertake a gastric bypass if you have a BMI or over 40 or a BMI of over 35 with co-morbid conditions such as type 2 diabetes, sleep apnea or high blood pressure.

- Port-wine stain birthmark correction

Pays for up to ten sessions of laser treatment for a child the policy covers who is under five to correct a port-wine stain birthmark on the face.

- Correction of prominent ears in children

Pays for ear reshaping surgery (pinnaplasty) to correct prominent (bat) ears in a child aged between 5 and 14.

- Breast reduction / male breast tissue removal

Pays for a female breast reduction or removal of excessive male breast tissue (gynaecomastia) for a covered individual aged under 21 with a BMI of under 27.

Additional Benefits

You get the following additional benefits free with Vitality Health Insurance:

- Private ambulance

Pays for transportation in a private ambulance should you require it.

- Home nursing

A nurse will visit your home where medically advised following eligible inpatient or day-patient treatment.

- Mental health support

Vitality offers up to eight talking therapies (e.g. counselling or cognitive behavioural therapy) as standard. You also get access to Big White Wall, an award-winning mental health service, for 24 / 7 support, and can spend reward points on mindfulness services such as a discount on the smartphone app Headspace.

- Parent accommodation

If a child your policy covers aged under 14 is having eligible private inpatient treatment under your Health Insurance, Vitality pays for accommodation for you to stay close by.

- Baby bonus

A cash benefit of £100 on the birth of a new child or the adoption of a child aged under 18.

- NHS cash benefit

If you choose to have inpatient or day-patient treatment on the NHS that you would have been eligible to have under your Health Insurance, Vitality pays £250 per night for inpatient stays up to £2,000 per year and £125 for day-patient treatment up to £500 per year.

- Oral surgery

Pays for surgical removal of impacted teeth, removal of jawbone cysts and reduction in facial and reducing mandibular fractures after an accident.

- Rehabilitation

Offers up to 21 days of rehabilitation treatment following a stroke or serious brain injury after a period of eligible inpatient treatment providing it is within 2 months of initial diagnosis.

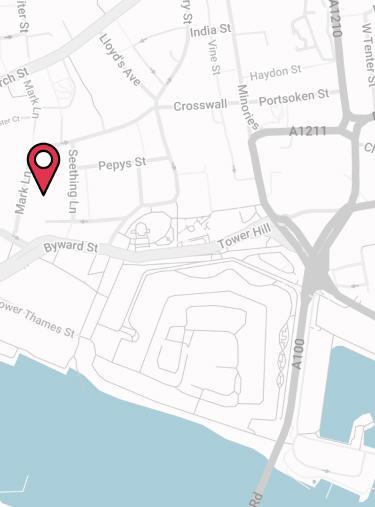

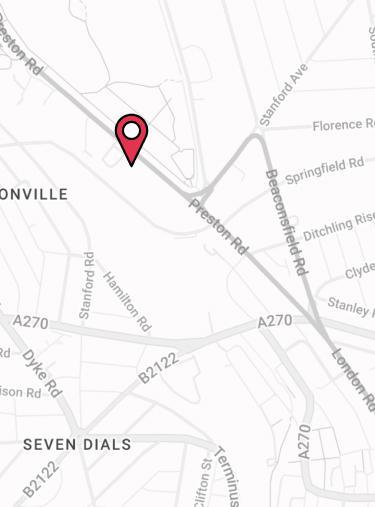

Hospital List

Your hospital list impacts which facilities you get private healthcare in and also how much your premiums will be. Some hospitals are more expensive than others, so opting for access to a wider array of private facilities increases premiums.

Vitality has three tiers of hospital lists:

- Local

- Countrywide

- London Care.

Note that to access private face-to-face GP appointments, you’ll need to choose the most expensive London Care option.

Read Vitality’s hospital list in full here.

Medical Underwriting Options

When you apply for Health Insurance as an individual, you choose how you want your insurer to underwrite you.

Vitality has two medical underwriting options:

- Full medical underwriting

You disclose your medical history when you take out the policy

- Moratorium underwriting

Vitality won’t ask for any medical details until you submit a claim.

These are two very different options which can impact the way your insurer decides on exclusions for any pre-existing conditions you may have. The best underwriting for you depends on your circumstances. Read more about the difference between full medical underwriting and moratorium underwriting.

You can also switch to Vitality Personal Healthcare from another provider on continued underwriting terms on a continued personal medical exclusions basis.

IMPORTANT❗️

We have taken care to ensure that information in this review is accurate. However, the market changes frequently, and we do not guarantee 100% accuracy. For the most up-to-date provider information, call 02074425880 or email

help@drewberry.co.uk to talk to one of our specialist consultants.

How Does Vitality Health Insurance Compare?

Choosing a Health Insurance company is a big decision. That’s why it’s a good idea to weigh up the unique aspects of each provider to ensure it’s a good fit.

No Claims Discount

Unlike other insurers, Vitality does not offer a standard tiered no claims discount system. However, you can collect Vitality reward points for participating in healthy activities, from health screenings to exercising. These build up to form your Vitality status: bronze, silver, gold and platinum.

Depending on your Vitality status at the end of the policy year, combined with whether or not you’ve made claims and how much these claims were for, you could receive a discount on premiums accordingly the following year.

Vitality Points and Rewards

Vitality offers discounts on fitness trackers, such as Fitbits and smart watches. You then use these to track your fitness and exercise levels, thereby earning Vitality points. These points can combine to provide rewards, such as high street discounts.

They also add up to your Vitality status, which can impact your premium the following policy year.

Lifestyle Surgery

Vitality is one of the few insurers that offers surgery such as breast reduction and weight loss procedures. While it is subject to the insured paying 25% of the cost upfront and meeting strict eligibility criteria, it’s an option that few other insurers in the market offer.

Vitality Care

You get access to a team of trained medical professionals and case managers if you’re diagnosed with a serious, complex condition, such as cancer or a psychiatric illness.

These professionals can guide your treatment and answer any questions you may have relating to it. They can also arrange for you to have treatment at home, such as chemotherapy, where clinically appropriate.

Limited Talking Therapies Access as Standard

Vitality offers access to talking therapies (e.g. counselling and cognitive behavioural therapy) as standard with core cover. You’re entitled to up to eight sessions per year of such treatment. Few other insurers offer this benefit as standard – usually it’s an optional add-on for an additional premium.

How Much Does Vitality Health Insurance Cost?

To give you an idea of how much you can expect to pay for a Vitality Health Insurance policy, we’ve provided example premiums based on varying ages, for basic and comprehensive cover below.

To get these quotes we have assumed that the individual looking for cover:

- Is in a low risk office based role

- Wants an excess of £100

- Is a non-smoker

Get Vitality Health Insurance Quotes and Specialist Advice

As you can see when it comes to putting Health Insurance in place there are lots of points to consider. With so many factors and a lot of different terminology at play, it can be tricky to know exactly what you need.

If you’re unsure its always best to speak with a specialist such as one of the team here at Drewberry. They can talk you through all your options and make sure you get the most suitable protection for your circumstances.

On the other hand you can compare the top UK providers in seconds using our Health Insurance quote tool.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4102 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=2103)