Does Smoking Increase Health Insurance Premiums?

I smoke about 10 cigarettes per day and I know sometimes this can increase insurance premiums – is this the case with Medical Insurance? I am reducing the number of cigarettes I smoke and aim to be a non-smoker in the next 3-6 months, when would I be considered a non-smoker in insurance terms?

As you are well aware with many insurance products, particularly the protection products such as Life Insurance and Income Protection, being a smoker results in higher premiums due to the higher risk.

Will smoking make a different to my premium?

Generally, yes. Most insurers will ask if you’re a smoker and increase premiums accordingly, although this may not be the case for all insurers.

Incentives for being healthy

One insurer may provide more preferable rates for a younger individual who smokes while another may be more competitive for a fit and active individual moving towards retirement.

As with any protection product a smoker is often defined as an individual who has used tobacco products in the past 12 months. Thus to be considered a non-smoker you usually have to have been smoke-free for 12 consecutive months.

Frequently Asked Questions

What's the Difference Between Health Insurance and Medical Insurance?

Is Normal Pregnancy Covered by Private Health Insurance?

Will My Health Insurance Premiums Rise Over Time?

Will My Health Insurance Cover Coronavirus?

What Does Moratorium Underwriting Mean on My Health Insurance?

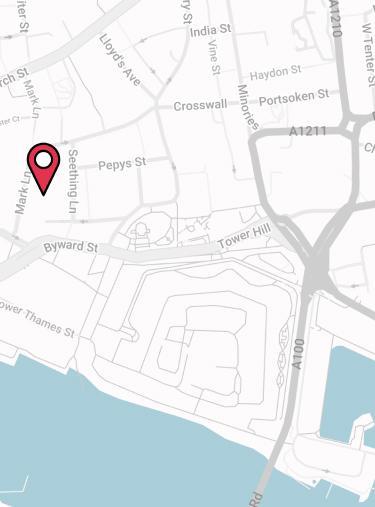

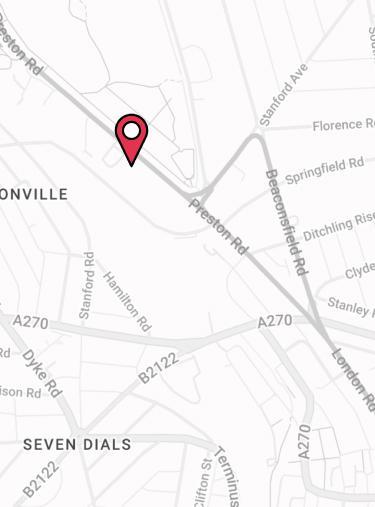

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.