Joint Life Insurance

Joint Life Cover is designed to pay out a cash lump sum to the surviving partner should either of you pass away.

It’s a Life Insurance policy for couples that provides both you and your partner with peace of mind knowing you are both financially protected should the worst happen.

- Many people with joint mortgages use it to cover the outstanding liability for both parties, such as a mortgage.

- You can opt to include Critical Illness Insurance to provide a cash lump sum should either policyholder suffer a serious illness such as cancer, heart attack or stroke.

There are many factors to consider when structuring a joint plan, including whether to choose Level or Decreasing Life Insurance and finding out if you’d benefit from writing the policy into trust.

Another important factor to consider about Joint Life Insurance is that it will only ever pay out for one death, usually the first, even though both individuals are covered by the policy.

This is usually fine if you just have a mortgage to cover, but if there are dependents who’d benefit from having both parents covered separately you can often take out two separate policies with twice the level of cover for only a little more than a single joint life insurance policy.

What Does Joint Life Insurance Cover?

Joint Life Insurance covers a two individuals under a single policy, paying out a cash lump sum should either party pass away.

You agree on the sum assured with your insurer beforehand, typically carefully aligning this with your mortgage, other liabilities or general income needs.

The payout is usually triggered on the death of the first individual (joint life, first death) but can sometimes be triggered on the death of the second partner (joint life, second death).

Most policies also include Terminal Illness Cover which pays out your benefit early if you or your partner are diagnosed with less than 12 months to live.

Do We Need Joint Life Insurance?

How would your partner and family cope financially if you were to pass away?

Could they survive without your income and keep up with all the bills and other household expenditure including, perhaps most importantly, the mortgage?

These days most households have two people earning a wage and contributing to the household finances, which means the loss of one of these incomes could prove financially disastrous.

This could especially be the case if you have a joint mortgage and the surviving partner would struggle to continue to meet the monthly mortgage repayments on their own.

Don’t underestimate the value of a stay at home parent…

Even where one half of the couple doesn’t work and instead stays home to take care of children, for instance, you would need to ask yourself how the surviving, working partner would cope with running a household and raising children as well as continuing to bring in an income.

Joint Life Insurance pays out a cash lump sum to a surviving partner so that liabilities such as a mortgage can be repaid and the family can continue to meet other vital living expenses.

Where one partner stays at home to look after children, the benefit could be used to cover childcare expenses should anything happen to them so the surviving partner can continue working.

Setting Up a Joint Life Insurance Policy

There are many different factors to consider when setting up Joint Life Insurance for couples with some of the most common detailed below.

Level or Decreasing Term Joint Life Insurance?

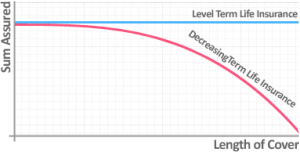

The two most common types of Term Life Insurance on the market are:

- Level Term Life Insurance

Here the benefit remains fixed over the life of the policy, with the option to link this to inflation, so your cover won’t be eroded in real terms over the length of the plan. It’s most commonly used for family protection purposes over and above the mortgage to ensure there’ll always be a fixed lump sum to help your family should the worst happen. Given it remains fixed, it can also be used to cover an interest-only mortgage. - Decreasing Term Life Insurance

Sees the benefit fall over the policy’s term. As the benefit you’ll receive goes down across the life of the policy, this is a cheaper form of Life Insurance. It’s most commonly used to cover a repayment mortgage, where the outstanding liability falls over time.

Family Income Benefit

Family Income Benefit is an alternative form of Term Life Assurance where the benefit is spread out into monthly or annual payments should a claim arise rather than providing a single lump sum.

On a regular basis for the rest of the policy term, the beneficiaries receive an amount you agreed upon with your insurer so they can keep up with their daily living expenses without your income.

The benefit is most often used to pay for bills, housing costs, groceries, school fees and any other everyday expenses your family would need to meet without you.

Joint Whole of Life Cover

Unlike Joint Term Insurance, Joint Whole of Life Cover is designed to protect individuals for their whole lives rather than just a set term, as long as you keep paying the premiums.

Given that it lasts for your entire life, it’s typically used to cover an expense that will definitely occur on your death, such as paying for a funeral or meeting an inheritance tax bill.

Joint Critical Illness Cover and Life Insurance

As with an individual policy you have the option to add Critical Illness Cover to Joint Life Insurance to protect against the risk of you suffering a critical illness such as cancer, a heart attack or a stroke.

Naturally the risk of suffering a serious illness is considerably higher than passing away. As a result, adding on Joint Critical Illness Insurance to your life plan will increase your premium.

Many couples opt to include Critical Illness Cover for peace of mind, knowing if either party were to suffer a serious illness there would be adequate funds to pay off the mortgage, make alterations within the home to accommodate the change in health or meet any other expenses associated with their illness.

When looking to protect yourself and your partner against ill health, it’s worth considering whether Critical Illness Cover is the best option.

You may want to consider an alternative, such as Income Protection, which will pay a monthly income instead of a single lump sum and is not limited to paying out based on a set list of critical conditions.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

Single or Joint Life Insurance?

The most common scenario in which individuals opt for a Joint Life Insurance policy is to cover a joint mortgage.

If there are two individuals named on the mortgage contributing to the monthly repayments it is wise to protect both parties.

Where there is only a single loan we only need the insurance to pay out on the death of one partner, as that death would trigger the objective of paying a benefit to repay the mortgage.

However, although a joint policy keeps the paperwork simple it can be more cost-effective to opt for two individual policies in certain circumstances.

Imagine a policy where a couple covers £100,000 between them for a joint mortgage.

If they were to opt for two individual policies each covering £100,000 they would have twice the cover (2 x £100,000) and the premium would typically only be a few pounds more than a joint policy.

Sam Barr-Worsfold

Independent Protection Specialist at Drewberry

Joint Life First Death or Joint Life Second Death?

As mentioned, there are two ways in which Joint Life Insurance will pay out:

- On a joint life, first death basis

- On a joint life, second death basis.

By far the most common is joint life, first death. These are used for most Joint Mortgage Life Insurance policies as the payout occurs on the death of the first partner and therefore repays the liability.

Far less common are joint life, second death policies. These are perhaps most used for joint Whole of Life Insurance policies to cover inheritance tax, for instance, where the liability will only arise on the death of the second individual. (This assumes that, on the death of the first individual, everything passes to a spouse and is therefore typically exempt from inheritance tax.)

Do I Need to Write Joint Life Insurance into Trust?

When you pass away, everything that you own is added together to form what’s known as your ‘estate’. If your estate is above a set threshold you may have to pay inheritance tax at 40% on the value of any assets above this threshold.

Life Insurance payouts are included in the valuation of your estate when you pass away, meaning that even a fairly modest Life Insurance policy could easily, when added to the rest of your assets, tip you over the inheritance tax threshold.

For this reason, people sometimes prefer to write their Life Insurance into trust, which pays out the benefit into a separate legal entity outside of your estate for inheritance tax purpose, bypassing inheritance tax on the payout.

Non-married couples…

There’s an inheritance tax exemption for transfers of assets between spouses on death, so a Joint Life Insurance policy left entirely to a spouse / civil partner won’t attract any inheritance tax in most cases.

However, if you’re not married or you both were to die at the same time, you’d need to ask yourself what would happen to the money.

If you’re not married, the money might still go to your surviving partner but there’s no protection from inheritance tax provided by marriage. Inheritance tax would therefore typically be due on the benefit.

While a policy aligned with your mortgage may well be ‘balanced out’ by the corresponding mortgage liability when your estate is added up for inheritance tax purposes, if you’re planning to leave Life Insurance over and above your mortgage you may still have an inheritance tax issue.

Ultimately, the inheritance tax position of a Joint Life Insurance policy depends on so many different factors, such as whether the couple is married, if they die at the same time, and how much the sum assured is.

How Much Does Joint Life Insurance Cost?

The cost of Joint Life Cover will normally be priced based on a variety of factors, with the biggest being how much you choose to insure.

Other factors that will influence the cost of Joint Life Insurance for couples include:

- How long you want to insure yourself for

The older you are when the policy ends, the higher the risk of you claiming and so the higher the price - The age of the oldest person to be insured

With Joint Life Cover, risk is priced based on the oldest individual to be covered - The type of cover you choose

Whole of Life Insurance, with a guaranteed payout, is typically far more expensive than a Term Insurance policy with a limited payment window - Optional additions

Adding Critical Illness Cover to your policy, for instance, will significantly increase the cost of your cover, albeit while expanding the breadth of coverage - Your smoker status

Smoking shortens life expectancy, so smokers are charged more for Life Insurance to compensate for the increased risk that they’ll make a claim - Your medical history

Pre-existing or current health conditions may have an impact on the cost of your cover, with the potential for your policy to be ‘rated’ or ‘loaded’ depending on the condition and the insurer.

Below is a table detailing the cost of Life Insurance for couples of the same age. We’ve put together the cost of a joint policy and the cost of two individual policies so you can compare couples Life Insurance based on this.

For the purposes of this illustration, which was carried out in October 2025, we’ve assumed:

- Both halves of the couple are of the same age

- They’re looking for a £300,000 decreasing policy across 25 years

- They’re non-smokers

- There is no untoward medical history to speak of

- They don’t want any Critical Illness Cover.

Age | One Joint Policy | Two Single Policies | Price Difference |

|---|---|---|---|

25 | £9.09 | £11.96 | +31.5% |

35 | £15.96 | £19.42 | +21.6% |

45 | £37.97 | £41.08 | +8.9% |

As you can see, for the price of a few extra pounds each month you could potentially secure two single policies covering £600,000 that would pay out on each individual’s death rather than paying out £300,000 once as would be the case with a joint policy.

Best UK Joint Life Insurance Providers

Some of the top UK Life Insurance companies on the market today include:

- Aegon

- AIG

- Aviva

- Guardian

- Legal & General

- Liverpool Victoria

- Royal London

- Scottish Widows

- Vitality

- Zurich.

Of course, there a number of factors you should look at when comparing Life Insurance companies to find out which one is the best for you.

Most life insurers, like all insurers, publish their policy documents on their website, so you can see the level of cover you might be getting if you chose them.

We’ve provided a brief summary of the cover offered by the UK’s leading Life Insurance companies in the table below (for term assurance, the most commonly-purchased type of Life Insurance), but for more detail it always pays to check the policy wording carefully.

AegonAegon’s Scotland-based UK operations are wholly owned and operated by Dutch insurer Aegon N.V.

| |

AIGUS insurance giant American International Group, Inc. (AIG) was first founded in 1919 and since then has grown to operate on a global scale. It provides a range of protection products for both individuals and businesses.

| |

| AvivaAviva was founded in 1797, but the Aviva brand as it is today was formed in 2000 by the merger of Norwich Union and CGU PLC.

|

GuardianGuardian is a relaunched protection brand with a number of unique features to its policies.

| |

Legal & GeneralL&G was formed as an insurance company for lawyers, by lawyers in 1836. It has since grown to become one of the country’s best-known financial services companies

| |

Liverpool VictoriaLV is the UK’s largest friendly society, with more than 5.8 million customers, 1.1 million of whom are members.

| |

Royal LondonRoyal London previously operated Scottish Provident and Bright Grey as separated brands providing Critical Illness Insurance under the Royal London umbrella. From 2016, both were merged into the main Royal London brand.

| |

Scottish WidowsFounded in 1812, Scottish Widows is today part of Lloyds Banking Group.

| |

VitalityVitality entered the UK market in 2007 with a joint venture with PruHealth and PruProtect, part of the Prudential Group. It has since bought out Prudential and is now branded solely as Vitality.

| |

ZurichZurich is a Swiss-based global insurance giant, operating in more than 170 countries. It employs around 55,000 employees worldwide, including 4,500 in the UK.

|

Get Specialist Joint Life Insurance Advice

As you can see, there are a number of decisions that need to be made when you’re taking out a Joint Life Insurance policy – including whether you may even be better served with two single policies.

To discuss this with a specialist adviser or to talk through any other points, don’t hesitate to pop us a call.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

At Drewberry we help with couples’ Life Insurance needs all the time so are well-placed to help you and your partner with your requirements.

We’ve got specialists on hand ready to help so please do not hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

- Topics

- Life Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.