A bit morbid we know, but this tool works out the risk of you passing away based on ONS Life Expectancy Data

Mortgage Life Insurance is designed to pay off your outstanding mortgage debt should you pass away.

When the policyholder dies, a lump sum will be paid out to the family which can be used to pay off the remainder of the mortgage.

If the primary earner of a household passes away, those they leave behind may find it difficult to cover their core expenses including monthly mortgage payments, utility bills and everyday living costs.

Mortgage Insurance can provide the financial support to allow your loved ones to stay in their home without the worry about making mortgage repayments should the worst happen and you pass away.

Mortgage Life Insurance first and foremost covers the death of the policyholder by paying out a cash lump sum to clear the mortgage debt should they pass away.

Insurers usually include Terminal Illness Cover in policies, which provides you with a payout if you’re diagnosed with less than a year to live. This benefit is subject to certain terms and different insurers may have different definitions of a terminal illness.

Most types of Life Insurance will typically cover almost any cause of death; however, there are a few common exclusions that you will find on many if not most Life Insurance policies. The most common exclusion is death by suicide within the first 12 months of the policy.

Other exclusions include if the death was in pursuit of a criminal activity or as a result of drug or alcohol misuse.

Most Life Insurance policies provide an option to include Critical Illness Insurance (not to be confused with Terminal Illness Cover) to protect you and your mortgage against the risk of serious illnesses such as:

Given the chance of suffering a serious illness is far higher than the risk of passing away, including an element of critical illness cover will increase the overall cost of your policy.

Often mortgage brokers and lenders will say it’s a requirement for you to have Life Insurance to cover your mortgage, but in reality there’s no law that says it’s necessary.

Mortgage Life Insurance may not be required if:

Yet while there are certain situations in which Mortgage Life Insurance may not be required, the reality is that most of us want to leave the property to someone else, have dependents living in the home or don’t have anyone else who could take on the entire mortgage debt themselves.

In such situations, we’d typically recommend a Life Insurance policy which at least covers the outstanding mortgage debt.

It provides the peace of mind and security that comes from knowing your family and your home are covered should the worst happen.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

We’ve used our Life Expectancy Calculator – which is based on Office for National Statistics mortality data – to work out the risk of a healthy male of three different ages passing away during the life of a 25 year mortgage.

The results are laid out in the table below.

Age 25 | Age 35 | Age 45 |

|---|---|---|

1 in 33 | 1 in 15 | 1 in 6 |

For many people, the risk of passing away during the life of a mortgage is higher than they might have thought.

The first thing to consider is how much cover you need. Typically, you’d align this with the outstanding mortgage debt you hold.

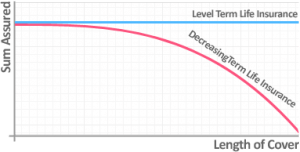

The type of mortgage you have will also impact the type of Mortgage Insurance you will need: either a Decreasing or Level Life Insurance policy.

With Level Mortgage Life Insurance your insurance benefit will stay the same throughout the term of your policy and won’t change.

This type of Mortgage Insurance is designed to cover an interest-only mortgage. This is because the outstanding capital with these types of mortgages doesn’t decline over time.

Level Term Insurance provides exactly the same amount of cover at the end of your policy as you had at the beginning.

Decreasing Term Mortgage Life Insurance will see your cover reduce the longer you have it, eventually reaching a benefit of zero when the end of the policy’s term is reached.

This type of Life Insurance is best suited to cover a repayment mortgage loan. This is because the cover of the insurance policy decreases to match the fall in your mortgage debt.

This saves mortgage owners from having to pay for cover that they don’t need as premiums for decreasing insurance policies tend to be cheaper than they are for Level Term Mortgage Insurance.

However, these policies are set up to decline over your mortgage term and reach zero by the end, so there’ll be no cover once your mortgage is repaid.

If you take out Decreasing Life Insurance, ask your adviser for help ensuring the rate at which your level of cover decreases doesn’t exceed the rate at which your mortgage is decreasing, or you may face a shortfall.

If you share a mortgage with your partner, you might consider a Joint Mortgage Life Insurance policy.

This type of insurance works very much in the same way as Mortgage Life Insurance, except that the policy will be based on two people and will pay out to the surviving partner if one partner dies.

Most Joint Life Insurance policies work on a ‘joint life, first death‘ basis, which means they will end after it has paid out for the death of the first partner.

If you would need a second payout after the first partner’s death, perhaps to provide financial stability for children even after the mortgage is paid off, then you may need to consider taking out two single policies instead of one joint policy.

This will ensure that any dependants or beneficiaries will receive payouts upon the death of both partners. The first would clear the mortgage, while the second could be used to maintain a standard of living.

By adding Critical Illness Insurance to your insurance policy, you will be able to claim if you’re diagnosed with a serious illness such as cancer, heart attack or a stroke as per the terms of your policy.

Some insurers can cover as many as 100 different medical conditions with this type of cover, although the average policy covers around 40. This said, there are policies that cover less than 10 critical illnesses, so it pays to read your policy’s terms and conditions carefully.

While it may seem like a good idea to add Critical Illness Insurance and secure a payout in the event of illness as well as death, it may not be the best approach for everyone.

One of the most notable issues with combined Life Insurance and Critical Illness Cover is that the policy will only pay out once for either critical illness or death. If you need to claim for a critical illness that pays out 100% of the benefit, you will be left without Life Cover.

If your only purpose for taking out the insurance policy is to pay off your mortgage, then it won’t be a problem that this kind of policy pays out once. However, if you’ll need Life Insurance after receiving a critical illness payout this could be problematic.

Another potential issue with Critical Illness Cover is that it will only cover you for critical illnesses as listed in the policy terms. Less serious illnesses won’t be covered, even if they stop you working – this might include a bad back, for instance.

Income Protection is another form of sickness insurance that you can buy separately from Life Insurance.

While you can’t package it together with Life Insurance as you can Critical Illness Cover, it’s nonetheless a valuable benefit to consider.

Income Protection is designed to pay out for anything that medically prevents you from doing your job – the illness / injury doesn’t have to be critical as defined by the insurer’s terms.

It also pays out what some people may find a more manageable monthly income (a percentage of your pre-tax earnings) as opposed to the lump sum offered by Critical Illness Insurance.

When speaking to clients we often end up talking about Life Insurance and separate Income Protection rather than adding on Critical Illness Cover.

It can be more cost-effective and may offer a greater level of protection to ensure mortgage repayments can be met each month.

Victoria Slade

Independent Protection Specialist at Drewberry

There are two types of premiums to choose from when you take out a policy:

For example, with reviewable premiums, if your insurer doesn’t have a particularly successful investment year, they might increase your premiums. You might not know what you’ll pay from one year to the next.

For this reason we generally recommend you take out a policy with guaranteed premiums. While this may be more expensive at first, you’ll at least know what you’ll be paying month-on-month and year-on-year.

If the policyholder passes away, is diagnosed with a terminal illness, or is diagnosed with a critical illness (if you added critical illness cover to your policy), you can claim.

To do this, you will need a claim form from the insurer, as well as the original documents for your policy and a death certificate if you’re claiming for a death.

Obtaining a death certificate can be done by contacting either the General Register Office (England and Wales), the National Records of Scotland (Scotland), or NIDirect (Northern Ireland).

If you’re claiming for a critical or terminal illness, you’ll be asked to provide medical evidence of your diagnosis.

When you take out your insurance policy with us, we can support and help you through the process of claiming at such a difficult time.

Our financial advisers can ensure everything runs smoothly and that you have all of the right documentation prepared to make a claim.

Robert Harvey

Head of Protection Advice at Drewberry

Providing the insurer receives all of the relevant documentation and the claim is accepted (the top insurers by claims paid had a successful claims rate of over 97% in 2017), you’ll most likely receive your benefit in a few weeks.

If you did not write your policy in trust, the payout will form part of the deceased person’s estate and it will be the responsibility of the estate’s executor to deliver the policy’s payout to the necessary persons.

You’ll likely have to wait for probate, which could take time; writing your policy into trust means this process is bypassed as the cash is paid directly to the trust on your death.

With the payout from your insurance policy, your loved ones will be able to pay off the rest of their mortgage debt all at once. That way they can stay in their home without having to worry that they might fall behind on mortgage payments without your help

There are a range of factors that will influence the cost of a Mortgage Life Insurance policy. The cost of a policy will be different for different people and while we do have control over some cost factors, there are others that we cannot control:

In the below table, we’ve laid out the monthly cost of Life Insurance for a smoker and non-smoker of various ages.

They’re all looking to insure themselves for £250,000 of Decreasing Life Insurance to cover a repayment mortgage over 25 years and have no untoward medical history that would impact premiums.

The quotes shown represent the best Life Insurance quotes from across the entire UK market, as of October 2025.

|

Age |

🚭

|

🚬

|

|---|---|---|

| Age 30 |

£6.23 |

£9.84 |

| Age 40 |

£11.26 |

£19.17 |

| Age 50 |

£23.84 |

£54.08 |

No, you don’t need to have Life Insurance to repay your mortgage if you were to pass away. You can get a mortgage loan without it.

However, you should think carefully about what might happen were you to die during the life of the loan. Do you have a partner or children who you might want to stay in the house if you were no longer around?

If so, could your partner afford to keep up with the mortgage repayments themselves? If not, Mortgage Life Insurance, which will step in to pay off the outstanding mortgage balance were you to die before repaying the loan, may be a good consideration.

Mortgage Life Insurance is aligned with your mortgage in that it will cover the outstanding mortgage balance for the term of the mortgage. Once the mortgage term has ended and you’ve repaid the loan and own your home outright, the policy simply ceases.

You may still need Life Insurance for family protection after you’ve repaid the mortgage, however; for this, you might want to consider a separate Life Insurance policy to run for a longer term than the mortgage (perhaps until your children are financially independent, for example).

The main difference between Mortgage Life Insurance and Life Insurance is that Mortgage Life Insurance is tied to your mortgage loan. It will run for as long as the mortgage does and the payout will align with the outstanding mortgage balance.

Mortgage Life Insurance may be a good option to consider if you have a mortgage, you want to leave your home to beneficiaries if you were to pass away, and your beneficiaries would struggle to afford the mortgage on their own.

Life Insurance that’s not tied to your mortgage, however, may be more useful for family protection purposes, such as ensuring your loved ones can maintain their standard of living were you to die, that any school / university fees are covered and that your family is generally financially secure.

Yes, your Mortgage Life Insurance policy will pay off your mortgage loan if you pass away. This will leave your house owned outright and allow your beneficiaries, perhaps a partner and children, to continue living in the property without having to worry about monthly mortgage repayments.

AegonAegon’s Scotland-based UK operations are wholly owned and operated by Dutch insurer Aegon N.V.

|

AIGUS insurance giant American International Group, Inc. (AIG) was first founded in 1919 and since then has grown to operate on a global scale. It provides a range of protection products for both individuals and businesses.

|

AvivaAviva was founded in 1797, but the Aviva brand as it is today was formed in 2000 by the merger of Norwich Union and CGU PLC.

|

GuardianGuardian is a relaunched protection brand with a number of unique features to its policies.

|

Legal & GeneralL&G was formed as an insurance company for lawyers, by lawyers in 1836. It has since grown to become one of the country’s best-known financial services companies

|

Liverpool VictoriaLV is the UK’s largest friendly society, with more than 5.8 million customers, 1.1 million of whom are members.

|

Royal LondonRoyal London previously operated Scottish Provident and Bright Grey as separated brands providing Critical Illness Insurance under the Royal London umbrella. From 2016, both were merged into the main Royal London brand.

|

Scottish WidowsFounded in 1812, Scottish Widows is today part of Lloyds Banking Group.

|

VitalityVitality entered the UK market in 2007 with a joint venture with PruHealth and PruProtect, part of the Prudential Group. It has since bought out Prudential and is now branded solely as Vitality.

|

ZurichZurich is a Swiss-based global insurance giant, operating in more than 170 countries. It employs around 55,000 employees worldwide, including 4,500 in the UK.

|

Getting Life Insurance to protect a mortgage can be valuable if you have a family and a home that you are still paying off.

With this protection in place, you will be able to ensure that your loved ones can comfortably stay in their home should the worst happen and you pass away before clearing the mortgage debt.

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

We will help you find and compare quotes and, should the time come where you need to claim, we’ll also help you get all of the necessary documentation in order.

If you need some help please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.