The Two Types of Mortgage Insurance…

There are two types of Joint Mortgage Insurance which although both protect you from defaulting on your repayments cover very different risks:

- Joint Mortgage Payment Protection Insurance (MPPI)

MPPI will pay out a monthly income for up to 12 months should you or your partner suffer an accident, sickness or unemployment which stops you from earning an income.

- Joint Mortgage Life Insurance

Life Insurance will pay out a tax-free cash lump sum on death to clear the outstanding mortgage balance should either you or your partner die during the term of the mortgage.

What Does Mortgage Protection Insurance Cover?

Combining the two types of Mortgage Insurance provides protection which can offer you the peace of mind that comes from knowing your mortgage debt will not be a concern should something happen to you or your partner.

Accident & Sickness Cover

You and your partner will be covered against the risk of having to take time off work due to illness or injury, thus ensuring you can keep up with your monthly repayments.

Redundancy Insurance

The vast majority of Joint MPPI plans also have the option to cover yourself against the risk of forced redundancy, so should either of you lose your job through no fault of your own the policy would pay out to cover the mortgage repayment while you are out of work.

Death, Critical Illness & Terminal Illness

Joint Life Insurance will cover the full outstanding balance of your mortgage if you or your partner are diagnosed with a terminal illness or pass away.

You can add Critical Illness Cover that will pay out in the same way should you suffer a serious illness such as things like cancer, heart attack and strokes. The list is pre-defined by the insurer and can cover anywhere from 10 to over 100 critical conditions.

Do I Need Joint Mortgage Insurance?

Whether or not you need Mortgage Protection Insurance is going to depend on what it is that you are looking to protect with your policy and what resources are available for you if you or your partner one day face misfortune.

- Do you have enough savings to keep up with the mortgage if you were out of work for a period due to an accident or sickness?

- Would your household struggle without the income of one partner?

- What would happen to your mortgage if one of you were to pass away?

If you’re not sure about any of these questions, you may want to consider Mortgage Protection Cover.

The considerable cost of a mortgage is the main reason why so many couples take out a joint mortgage and agree to pay a proportion of the monthly repayments each.

However, sharing responsibility for a mortgage can add to the risk of being unable to meet payments, particular if both partners make significant contributions towards the monthly loan repayments.

Joint Mortgage Payment Protection Insurance

Joint Mortgage Payment Protection Insurance (MPPI) can cover short-term illness, injury or unemployment.

What Does it Cover?

This type of policy will pay out a monthly benefit to cover the monthly mortgage payments. The maximum amount that you can cover is the full loan payment plus up to an additional 25% that can be put towards associated home costs, such as council tax and utility bills.

In some cases, however, it is possible to cover only the incapacitated partner’s contribution if you would prefer to save money on your policy.

For example, if both partners have equal income then it can be structured so that the insurance policy would pay out 50% of the loan amount each month if a claim needs to be made, which would make the monthly premiums cheaper.

How Long Can I Claim?

Joint Mortgage Payment Protection policies are designed to provide only short term protection for your mortgage payments. The maximum length of time a claim will pay out is either 12 months or 24 months, whichever you choose at the start of the plan. However, this period will only commence after your policy’s Deferred / Excess Period, which is usually set at a minimum of 30 days.

During this time, you will also be subject to assessments to assess your incapacity. Your insurer will use a predetermined definition of incapacity to decide whether or not your health problem is severe enough to prevent you from working.

Joint Mortgage Unemployment Insurance

If you choose to add Unemployment Cover to your policy, it’s important that you research carefully when you are and are not entitled to your benefits. Unemployment Cover can only be claimed under specific circumstances, in general when you have lost your job through no fault of your own.

Typically, instances of unemployment that are not covered by Joint Mortgage PPI include:

- You are self-employed or working part-time;

- You were voluntarily made unemployed or have taken a career break (other than to care for a sick dependent);

- You were aware of and given warning that you may be made redundant when you took out your policy;

- You were made unemployed as a result of misconduct, dishonesty or fraud;

- Your redundancy came about as the result of industrial action.

It is also important that you are aware that having an MPPI policy may prevent you from receiving certain government benefits if you are in need of an alternative source of income.

Joint Mortgage Payment Protection vs Income Protection

While Joint Mortgage Payment Protection protects your monthly mortgage payments, the amount that you get from your monthly payouts can’t cover much else. This means that you will have to find another way to meet your other essential expenses.

If this is something you worry about, Income Protection Insurance is often seen as a more comprehensive alternative to Mortgage Payment Protection.

While you can’t get joint Income Protection for couples – each person would need to have an individual policy – it’s possible to cover more than just your mortgage, including other daily living expenses.

You can typically cover up to 65% of your gross individual pre-incapacity income rather than just covering mortgage repayments, which makes it a favourable option for many people.

Joint Mortgage Life Insurance

Joint Mortgage Life Insurance will pay out a lump sum if either of the policyholders dies or is diagnosed with a terminal illness with less than 12 months to live.

Policyholders are able to set the level of cover they want from their policy, which is usually set at the full amount of the remaining mortgage. This will be used to pay off the mortgage in full and reduce potential financial stress for the surviving partner.

Level or Decreasing Cover?

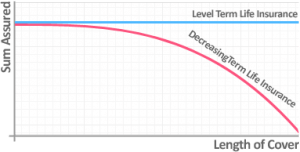

Different types of Mortgage Life Cover are designed to match different types of mortgages. When you set-up your policy, you will initially need to decide whether you want Level or Decreasing Term Mortgage Life Insurance.

![life insurance decreasing cover graph]()

If you have Level Term cover, it means that the amount that you and your partner are insured for will not change while you have your policy. This type of cover is designed to protect an interest-only mortgage where the outstanding balance doesn’t fall over time.

On the other hand, if you have a capital / principal repayment mortgage, the more appropriate choice would likely be Decreasing Term cover. This type of policy will decrease in value the longer you have it, matching the decreasing amount that you have left to pay on your mortgage.

By matching the term of your policy to the estimated time that you expect to have paid off your mortgage, you can expect your Decreasing Life cover to reach zero at the same time as your mortgage debt.

Including Critical Illness Cover

To cover the risk of serious illness or injury preventing you from meeting your mortgage payments Critical Illness Cover can be added to a Joint Mortgage Life policy.

Mortgage Life Insurance with Critical Illness will pay out a lump sum if one of the policyholders suffers a critical illness specified in the policy as well as if they pass away.

You typically set the amount of Critical Illness Insurance to cover the full amount of your mortgage and, if you’re diagnosed with a critical illness of the specified severity listed in the policy terms, you’ll receive the full payout to clear your mortgage.

The big three claims on Critical Illness policies are for:

- Cancer

- Heart attacks

- Strokes

Policies can cover anywhere from 10 to 100 conditions but most cover around 40 critical illnesses so it pays to read the terms and conditions carefully.

One important detail about Joint Mortgage Life policies that many people don’t realise is that although two people are covered by the policy, it will only pay out once. With a standard policy, the lump sum would be paid out upon the death of the first partner.

If you are purchasing Joint Mortgage Protection Insurance for the sole purpose of protecting your mortgage, then this detail will not have much of an impact on you. You only need the policy to pay out once to clear the mortgage.

If, on the other hand, you had hoped to leave something behind for your loved ones that will cover more than just the mortgage then you may want to consider alternative options including opting for two individual policies instead of joint cover.

How Much Does Joint Mortgage Protection Cost?

Given that Mortgage Payment Protection and Mortgage Life Insurance are designed to do two very different things, the cost of them is very different.

Cost of Mortgage Life Insurance

To come up with the cost of joint Mortgagee Life Insurance, we’ve assumed the following about the couple:

- They are both healthy.

- They’re both non-smokers

- They both have low risk office based occupations

- They’re looking for £250,000 worth of Decreasing Life Insurance over 25 years.

Cost of Mortgage Payment Protection

Where MPPI has to be taken out individually the pricing below is per person. For the purpose of our calculations we’ve assumed:

- The individual is healthy

- They’re a non-smoker

- They’re an office worker

- They want a 4 week deferral period

- They’re looking for £1,000 a month of cover to protect their mortgage.

Do I need Mortgage Insurance to get a mortgage?

No, Mortgage Insurance isn’t compulsory to get a mortgage. It’s not a legal requirement, so it’s possible to get mortgage without it.

However, you need to think carefully about whether you’ll need protection if you were unable to work, you were made redundant or you pass away. Without any protection, you or your loved ones could potentially lose your home if the worst were to happen.

What happens to Life Insurance when the mortgage is paid?

Mortgage Life Insurance is designed to run alongside your mortgage for the length of the loan, always being there to repay the outstanding balance should you pass away during the life of the policy / your mortgage.

As the Life Insurance lasts for the same term as the mortgage, once the mortgage is over the Life Insurance also ends. If you want a policy to last longer than the mortgage, perhaps for some family protection until your children are financially independent, you’d likely need a separate policy such as Level Life Insurance or Family Income Benefit.

Is joint Mortgage Protection Insurance worth it?

This depends on your point of view and your circumstances.

Mortgage Life Insurance might be worth it if you want to ensure your partner and / or children could stay in the property if you were to pass away and you are worried your beneficiaries wouldn’t be able to keep up with your mortgage repayments without you.

If, however, you’re single and don’t have any beneficiaries, and are happy with the property being sold to repay the mortgage on your death, it may not be necessary.

Mortgage Payment Protection Insurance might be worth it if you’re concerned what would happen with your mortgage repayments if you became too ill to work or were made unemployed. If you’re covered elsewhere, such as with an Income Protection policy, you may not need additional cover.

If you’re not sure whether or not Mortgage Protection Insurance would benefit you, you can always ask one of the specialists at Drewberry for help.

Is Mortgage Protection Insurance the same as PPI?

Mortgage Payment Protection Insurance is a form of Payment Protection Insurance (PPI) that is tied to a loan secured on a property rather than being used to cover unsecured debts such as credit cards or bank loans.

With Mortgage Payment Protection, the policy typically pays out to you and you use the funds to maintain the monthly mortgage repayments. With PPI, the payments are typically paid straight to the lender.

Get Joint Mortgage Insurance Quotes & Specialist Advice

Your mortgage is likely to be the largest debt you will ever have. It makes sense to ensure you have adequate mortgage protection in place should the worst happen or should you be too ill or injured to meet your mortgage repayments.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs.

- We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself.

- You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you.

- Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5.

- Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities.

- Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.