Mortgage Life Insurance with Critical Illness Cover

Mortgage Life Insurance pays out a cash lump sum to pay off your mortgage should you pass away.

Opting to include Critical Illness Insurance will cover your outstanding mortgage should you suffer a serious illness. The most commonly covered conditions include.

- Cancer

- Heart Attacks

- Strokes

Although insurance to cover your mortgage isn’t compulsory, having it in place can provide you with the peace of mind that comes with knowing that your home and loved ones will be financially secure should the worst happen.

- 1 in 4 Brits still have at least £100,000 left to pay on their mortgage if they were to pass away tomorrow according to our survey. How would your family cope with this debt?

What Does Mortgage Life & Critical Illness Cover?

Opting to include Critical Illness Cover extends your Life Insurance policy as you will be covered if you suffer a serious illness. Given the risk of suffering a critical illness is far higher than passing away the monthly premiums reflect the additional risk you are looking to cover.

Death

Should you die within the term of the policy, Mortgage Life Insurance pays out a lump sum that can be used repay the mortgage loan.

Terminal Illness

Most Life Assurance policies will also pay out early if you are diagnosed with less than 12 months to live by a medical practitioner.

Critical Illness Insurance

You have the option with most Mortgage Life Insurance to add Critical Illness Insurance to your policy. The plan will then pay out if you were to suffer any one of the serious illnesses as defined in the policy wording. Some policies will also offer partial payouts if you suffer a less serious form of a condition listed on the policy.

The quality of Critical Illness Insurance can vary considerably from one insurer to the next. Some policies cover fewer than 10 conditions while others cover 100 conditions so it is important to read the small print.

Do I Need Life and Critical Illness Cover for My Mortgage?

As mentioned, it’s not compulsory to insure your mortgage with either Life or Critical Illness Cover.

However, many people do so because they want to be safe in the knowledge that, should the worst happen, they will be protected (along with their family and their home).

What Does Critical Illness Insurance Cover?

Critical Illness policies typically cover around 40 different critical illnesses, which are disclosed by your insurer in your policy.

However, some insurers will cover 120+ conditions and others will cover less than 10, so it’s essential you read the terms and conditions carefully.

We have tools in-house to compare the quality of the illness definitions used by the insurers so you are able to make an informed decision when it comes to choosing the most suitable policy.

In addition to cancer, heart attacks and strokes being covered you can expect the below conditions to be covered on most policies.

- Multiple sclerosis

- Parkinson’s

- Blindness

- Deafness

- Traumatic brain injury

Some insurers also have a list of ‘additional critical illnesses’ for an additional premium that entitle you to a partial payout rather than your full sum assured. This may include early stage / less invasive cancers, for example.

Things to Consider Before Buying Mortgage Critical Illness Cover

If you are looking to purchase Mortgage Life Cover with Critical Illness Insurance, then it is important that you know that your policy will only pay out once on the first event – for either a critical illness or for your death.

Because your Life Insurance policy is tied together with your mortgage, your policy only needs to pay out once for you to completely pay off your mortgage.

This means that if you you claim for a critical illness that entitles you to 100% of the benefit, your family will not be able to claim if you died which can be a problem if you have no other type of Life Insurance.

One aspect of Critical Illness Insurance that can also be a problem is that the ‘critical illnesses’ covered by your policy are defined by your insurer. This is where this type of insurance cover can sometimes fall short.

There are certain types of illnesses that, while no means critical, could stop you from working and paying your mortgage.

Critical Illness vs Income Protection

For these reasons and a few others, some people may benefit more from Income Protection than they would from adding Critical Illness Insurance to their policy.

Income Protection is designed to pay out if anything medically renders you unable to do your job, rather than the illness having to be ‘critical’ as defined by your insurer.

Critical Illness Insurance vs Income Protection | Critical Illness Cover | Income Protection |

|---|---|

Covers specific conditions | Covers any conditions that prevent you from working |

Pays out a lump sum | Pays out monthly benefits to substitute income |

Ends after you have claimed | You can make as many claims as you need until your policy’s cease age |

Rather than adding Critical Illness Cover to your Mortgage Life Insurance, it may be beneficial to take out a separate Income Protection policy.

While Critical Illness Insurance is beneficial for covering severe medical conditions, Income Protection can protect you against the many other illnesses and injuries that may not be life-threatening, but will prevent you from earning.

Setting Up Mortgage Life and Critical Illness

There are a number of policy factors you will need to consider when setting up your mortgage insurance which will impact on the cover provided and the overall cost of the policy.

Level or Decreasing Cover?

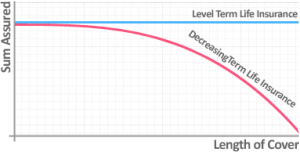

There are different types of Mortgage Life Insurance that are designed to protect different types of mortgages.

- Level Term Mortgage Life Insurance policies will offer the same Life Insurance benefit throughout the entirety of your policy’s term. This type of policy is designed to match an interest only mortgage.

- Decreasing Term Mortgage Life Insurance policies, on the other hand, will decrease in cover over time. A decreasing policy is designed to cover capital repayment mortgages and, at the end of your policy’s term, your Life Insurance benefit will reach zero and your policy will end.

It’s important to note that if you choose Decreasing Mortgage Life Insurance, your Critical Illness benefit will decrease as well.

If you want your Critical Illness Cover to stay the same while your Mortgage Life cover decreases, you will likely need to buy a separate Critical Illness Insurance policy.

Guaranteed or Reviewable Premiums?

There are two different premium types that you will need to choose from when you take out your policy:

- Guaranteed Premiums

Guaranteed premiums stay the same throughout the length of the policy. - Reviewable Premiums

Reviewable premiums can be reviewed by the insurer on a regular basis, perhaps as often as yearly, and potentially adjusted upwards in certain circumstances. This means the cost of your cover could rise over time.

Cease Age

The ‘cease age’ is the age at which your Mortgage Life Insurance policy will end.

As a Mortgage Life Insurance policy exists to pay off a specific loan, it makes sense to arrange for the insurance policy to end at the same time as the loan.

The younger you set your policy’s cease age the less expensive it will be because of the lower risk of death during the term of the policy, but you don’t usually want to set the cease age to younger than the age at which your mortgage will be repaid.

Family Income Benefit

Family Income Benefit will split your Life Insurance payout into smaller benefits which will be given to your family on a regular basis rather than receiving the entire benefit in a lump sum.

This can be used to cover not just monthly mortgage repayments but also other expenses on top of the mortgage, from bills and groceries to school fees.

It’s useful where the family left behind would need to replicate the income of the breadwinner rather than receive a lump sum.

Joint Mortgage Critical Illness Insurance

If you have a joint mortgage with your partner, you might consider taking out a Joint Mortgage Life Insurance policy with Critical Illness Cover.

A joint policy will pay out if either person passes away or is diagnosed with a critical illness.

However, despite two people being covered, most policies work on a ‘joint life, first death’ basis. This means that the policy will only ever pay out once.

After the first person is diagnosed with a critical illness or dies, the policy will end leaving the surviving partner without any life or critical illness cover.

If your joint policy was bought for the sole purpose of paying off your mortgage, then it shouldn’t be an issue that it only pays out once because it will pay off the mortgage in full.

However, it will leave the surviving partner without any cover after the first death.

How Much Does Mortgage Life and Critical Illness Cover Cost?

The price of a Mortgage Life Insurance policy with Critical Illness Cover will depend on a range of factors.

Typically, the cost of a Mortgage Life Insurance policy will depend predominately on the amount of cover that you want. However, when you factor in the added cost of Critical Illness cover, pricing can become a bit more complicated.

Overall, the most important factors that will influence the cost of your policy are as follows:

- The desired level and length of cover

- Your chosen policy options

- Your age

- Your smoker status

- Your pre-existing medical history.

Cost of Mortgage Life Insurance

In the table below, we’ve laid out some sample Life Insurance and Life and Critical Illness Insurance quotes for a healthy, non-smoking office worker of three different ages.

They’re looking for £250,000 of decreasing cover over 25 years to cover a straightforward repayment mortgage. Premiums were collected on March 14th 2019 and represent the cheapest quotes from across the UK market.

Age | Life Only | Life & Critical Illness Cover |

|---|---|---|

30 years old | £6.23 per month | £35.45 per month |

40 years old | £11.26 per month | £71.86 per month |

50 years old | £23.84 per month | £135.93 per month |

Best Mortgage Life and Critical Illness Cover Providers

When comparing providers of Critical Illness Cover, remember to compare not only the number of conditions but the types and definitions of those conditions.

AegonAegon’s Scotland-based UK operations are wholly owned and operated by Dutch insurer Aegon N.V.

| |

AvivaAviva was founded in 1797, but the Aviva brand as it is today was formed in 2000 by the merger of Norwich Union and CGU PLC.

| |

GuardianGuardian is a relaunched protection brand with a number of unique features to its policies.

| |

Legal & General

| |

Liverpool VictoriaLV has more than 5.8 million customers, 1.1 million of whom are members.

| |

Royal LondonRoyal London previously operated Scottish Provident and Bright Grey as separated brands providing Critical Illness Insurance under the Royal London umbrella. From 2016, both have been merged into the main Royal London brand.

| |

Scottish WidowsFounded in 1812, Scottish Widows is today part of Lloyds Banking Group.

| |

VitalityVitality entered the UK market in 2007 with a joint venture with PruHealth and PruProtect, part of the Prudential Group. It has since bought out Prudential and is now branded solely as Vitality. Vitality looks at ‘serious illnesses’ rather than critical illnesses, expanding its scope of coverage significantly.

| |

ZurichZurich is a Swiss-based global insurance giant, operating in more than 170 countries. It employs around 55,000 employees worldwide, including 4,500 in the UK.

|

Get Specialist Mortgage Insurance Advice

When it comes to something as important as protecting your mortgage, you want to make sure you get it right. That’s where having the help of a specialist can be invaluable.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 2098 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you need some help then please don’t hesitate to get in touch.

Pop us a call on 02084327333 or email help@drewberry.co.uk

Tom Conner

Director at Drewberry

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.