Joint Mortgage Life Insurance is generally used when two people (usually but not always spouses) purchase a home together. It’s used to pay off the outstanding mortgage debt should either person die.

- A tax-free cash lump sum is paid out to the surviving partner should one half of the couple pass away. The surviving partner then uses these funds to pay off the outstanding mortgage.

- It provides you with the peace of mind that comes from knowing both you and your partner could remain in your home should the worst happen to either of you.

- The vast majority of policies include Terminal Illness Benefit, which pays out the lump sum early if you’re diagnosed as having fewer than 12 months to live.

- You can opt to include Critical Illness Insurance for further protection against serious illnesses as well as death.

There are many factors to consider with Couples Life Insurance, including whether you need Level Life Insurance or Decreasing Life Insurance and if you’d benefit from writing the policy into trust.

What Does Joint Mortgage Life Insurance Cover?

Joint Life Insurance covers the death of one of the policyholders. It’s usually on a joint life, first death basis, which means after one person has died the survivor receives a lump sum from the insurance plan. At that point, the policy ends.

In addition to covering the death of the policy holder, many policies automatically include Terminal Illness Benefit.

Rather than paying out when you pass away, Life Insurance with Terminal Illness Benefit will pay out early if you’re diagnosed with less than 12 months left to live (subject to certain conditions).

With a joint policy, both you and the other person will receive the same amount of cover, so if either of you should become terminally ill or die, the policy would pay out the agreed sum to the survivor.

Including Critical Illness Cover

While Life Insurance will pay out on death you have no protection should either person suffer a serious illness.

You can choose to add Critical Illness Insurance to your policy which will pay out a claim should either person be diagnosed with a critical illness as defined in the policy terms. The most commonly covered conditions include:

- Cancer

- Heart Attack

- Strokes

- Multiple Sclerosis

- Motor Neurone Disease

- Loss of Limbs

- Permanent Loss of Vision

When comparing Critical Illness Insurers it is important to recognise that the number of conditions covered and the definitions they use can vary considerably from one insurer to the next. We have tools in house which rank the quality of the critical illness definitions used to ensure you can make an informed decision when it comes to choosing a policy.

How Does Joint Mortgage Insurance Work?

Firstly, you should consider what you need the plan to protect to ensure you source adequate cover…

- How long do you need to be covered for?

- How much cover do you need?

- Do you want to provide any additional cover beyond the mortgage?

- Are you protecting an interest-only or repayment mortgage?

- Do you want to extend the cover to protect against serious illnesses?

Compare Joint Life Insurance Quotes

After deciding on the ins and outs of the policy, you’ll need to compare Mortgage Life Insurance quotes from across the UK market to find the best deal.

You can buy Mortgage Life Insurance without the help of a specialist but at Drewberry you get access to our 5-star independent service at no additional cost – the monthly premium will be the same as going direct.

Applying for Your Mortgage Protection

When setting up your Joint Mortgage Protection there are some essential details you and your partner will need to provide. These include:

- Occupation and employment status

- Date of birth

- Your smoking status

- Your current state of health / medical history

- Your outstanding mortgage balance and the type of mortgage you have

- The amount of cover you need

- How long you need the cover for.

Level or Decreasing Joint Mortgage Life Insurance?

One thing that you need to look out for on your Life Insurance policy is the type of cover you need. Mortgage Life Insurance is split into Level and Decreasing cover – both are very different.

Whether you need Level Term Mortgage Insurance or Decreasing Term Mortgage Insurance depends on your mortgage and your circumstances.

Level Term Life Cover

If you have an interest-only mortgage, Level Term Life Insurance may be the best policy option for you. With this type of cover, the size of your payout won’t change for the entire length of your cover.

For this reason, Level Term Mortgage Insurance tends to be the more expensive Mortgage Insurance option.

However, it’s necessary for an interest-only mortgage as the principal capital isn’t declining over time.

Sometimes, people with a repayment mortgage also opt for Level Mortgage Life Insurance to leave a sum over and above what’s left on the mortgage.

Decreasing Mortgage Life Insurance

Decreasing Term Life Insurance is generally better suited for people with a capital / principal repayment mortgage.

This type of cover works by tapering down over time to match the declining outstanding balance of your mortgage as you continue to pay it off. Eventually, when your mortgage has been paid off in full, the cover that you are entitled to reaches zero and the policy ends.

Should I Add Joint Critical Illness Insurance?

You have the opportunity to add Critical Illness Cover to a Joint Life Insurance policy to ensure you and your partner will also receive a payout if you become critically ill.

With this type of cover, your policy would pay out a lump sum that can be used to repay your mortgage in the event of a critical illness such as a heart attack, cancer or stroke as specified in the insurer’s terms and conditions.

What Does Joint Critical Illness Insurance Cover?

The serious illnesses which are covered by the plan are outlined by your insurer in the policy wording.

Not every insurer is going to offer the same level of cover and the illness definition which results in a successful claim can vary significantly from one insurer.

Given the significant variation in the quality of cover it is so important to receive independent specialist advice to ensure you are getting the most comprehensive cover for your monthly premium.

Critical Illness policies cover an average of around 40 conditions, although some have more than 100 illnesses and conditions listed under the policy’s terms and conditions.

Important information on Less Severe Critical Illnesses…

One issue with Critical Illness Cover is that ‘less severe’ cases of illnesses (e.g. low-grade, in situ skin cancer) may not be covered in the policy.

Also, if you have any pre-existing medical conditions, your insurer may load your policy (charge a higher monthly premium) to reflect the enhanced risk you present, or exclude that condition from the Critical Illness element of the policy.

Do I Need Critical Illness Insurance and Mortgage Life Insurance?

Adding Critical Illness Insurance to your mortgage protection can be valuable and combining such cover with your Life Insurance is often cheaper than buying cover separately.

However, it does have some limitations. One of the biggest limitations is that the policy will only pay out once – on the first death or diagnosis of critical illness. After that, your policy will have played its part and will be over.

Even if one of you has a critical illness and survives, you’ll both be left without any life cover or further Critical Illness Cover.

At that point in time, reapplying for Life Insurance or Critical Illness Cover when you’re older can be a lot more expensive, especially for the person who’s suffered a critical illness where only limited cover if any may be available.

Purchasing Critical Illness Insurance independent of your Joint Mortgage Life Insurance would allow you to claim for a critical illness without losing the life insurance cover for your mortgage.

Although this may work out more expensive you do secure more cover for your money at an age when you can fix lower premiums.

Guaranteed or Reviewable Life Insurance Premiums?

There are two different types of premiums that you’ll need to consider when looking at Mortgage Life Insurance: guaranteed premiums and reviewable premiums.

Before you start looking seriously at such policies, you need to choose your premiums type.

- Guaranteed premiums

The monthly premiums are fixed in price until the end of your cover

- Reviewable premiums

The insurer is entitled to review your premiums annually and may adjust the price as they see fit, although there’s no fixed metric that will determine what this price rise might be.

Typically, reviewable premiums rise based on factors outside of your control, such as the likelihood of you making a claim, changes in tax rules, volume and value of claims the insurer has paid that year and interest rates.

The best premium option for you will depend on your situation. Guaranteed premiums may be particularly attractive if you’re young and healthy when you take out the policy. This is because you can lock in favourable premiums throughout the length of your policy.

Reviewable premiums, on the other hand, are cheaper at the start of the policy but tend to rise later on. They may match the starting price for guaranteed premiums before the end of the policy and then even rise beyond that price.

Making a Claim on Joint Life Insurance

If one of the people named on the Joint Mortgage Life Insurance policy passes away then the surviving person will need to make a claim.

They will need the original policy documents, a claim form and a death certificate to give to the insurer. As your financial adviser we offer help and support through this process to ensure the everything runs as smoothly as possible.

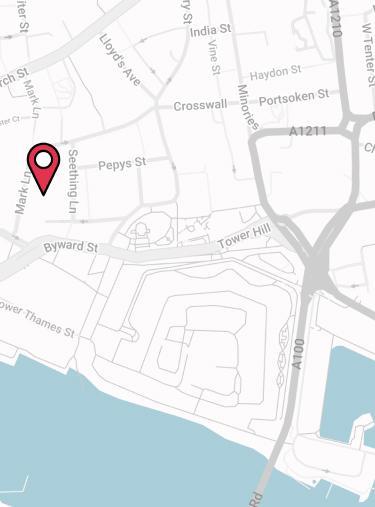

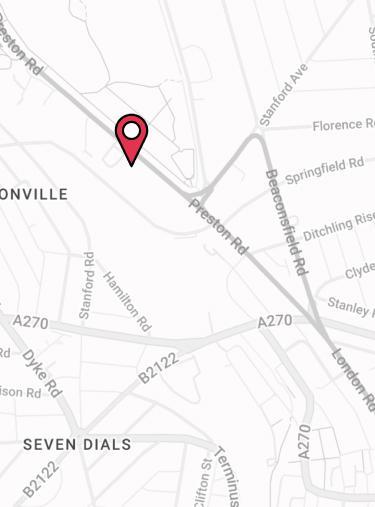

The insurer is entitled to ask for an original death certificate. Death certificates can be obtained from various places, depending on if the person’s death is in:

Receiving the Life Insurance Payout and Repaying the Mortgage

The insurer will most likely pay a claim within a maximum of a few weeks of receiving all the relevant documentation. So long as adequate cover was put in place when the plan was set up the amount that the insurer will pay out should at least align with the outstanding mortgage debt.

If the policy was written in trust, the insurer would pay it directly to the trust where it would then be distributed to the beneficiary. Regardless of the circumstances the benefit would not be affected by inheritance tax.

If your Joint Life Insurance policy was not written in trust, the payout will form part of the deceased’s estate. When this happens, the estate’s executors will be in charge of delivering it to the intended people.

This is a legal process known as probate and can take up to 6 months to complete. If the person did not have a will, this can take even longer.

If the partner on your policy is your spouse, then the insurance payout will reach them without being affected by tax.

Should We Write Our Joint Mortgage Life Insurance in Trust?

Given that most policies are set up for two spouses and there’s no inheritance tax to pay on transfers between spouses, inheritance tax tends to be less of an issue for Joint Mortgage Life Insurance.

Problems may arise if the couple isn’t married, as there’s no protection on transfers between unmarried couples on death.

Joint Mortgage Life Insurance Trusts for Tenants in Common

Furthermore, while the outstanding mortgage debt is usually deducted from the estate when calculating its size for IHT, this may not be the case if you own your home as tenants in common.

As opposed to joint tenants, where you both effectively own the entire house, tenants in common allows you to own a set percentage of the home each.

If you own your home as tenants in common (say 50/50) with a joint mortgage and have Joint Mortgage Life Insurance, HMRC may only consider 50% of the debt belonging to the deceased.

That would mean the whole debt couldn’t be deducted from the value of the deceased’s estate, which would include a Life Insurance policy large enough to cover 100% of the mortgage.

Single or Joint Mortgage Life Insurance?

If you’re a couple who own a home together, you have the option of purchasing two single policies instead of Joint Mortgage Life Insurance.

Both options have pros and cons that make them better suited to certain people’s circumstances. Joint Life Insurance policies may work out cheaper at the start and might be easier to manage (in that there’s one policy rather than two).

However, two single Life Insurance policies may be more flexible and offer increased level of cover for both people.

Single vs Joint Mortgage Life Insurance

Joint Life First Death Insurance policies will only ever pay out once, but if you only need the payout to cover the mortgage and don’t require additional Life Insurance, then there’s less need to buy two policies.

On the other hand, if you’re a young family with children who you would like to ensure are financially secure should something happen, two Single Mortgage Life Insurance policies may be better.

This will ensure that your mortgage is paid for in case of the first death and allow the second parent to leave some money behind for dependants in the event of their death.

This is particularly important if you both should tragically die at the same time – with a joint policy, you’d only get one payout even in this example.

To find out whether you would benefit more from a joint or two single policies feel free to ask our insurance advisers today. It is often the case that two single policies may only cost 15-20%% more in premium but will provide you with twice the level of cover.