Level Term Mortgage Life Insurance pays out a cash lump sum to pay off your mortgage should you pass away.

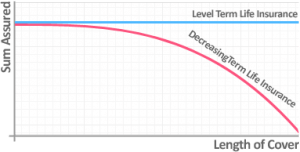

The amount insured remains fixed – or ‘level’ – over time. This means it’s particularly suited to protecting an interest-only mortgage, where the outstanding capital balance doesn’t fall over time.

Another use may be for family protection, as the sum assured doesn’t diminish with time, providing your loved ones with a consistent amount of cover over the life of the policy.

- Mortgage Life Insurance provides you with peace of mind knowing your loved ones and home will both be financially secure should the worst happen.

- Opt to include Critical Illness Cover to protect yourself against serious illnesses as well, such as cancer, heart attacks and strokes.

How Does Level Mortgage Life Insurance Work?

Level Life Insurance offers a fixed term policy that will guarantee a set lump sum that pays out if you die during that term.

![life insurance decreasing cover graph]()

For example, if you had a mortgage that lasted for 25 years, you’d take out a 25 year Mortgage Life Insurance policy to cover the mortgage balance – say £250,000 – over those 25 years.

If you died during that term, you’d receive £250,000 regardless of how many years into the policy you passed away.

Death

Level Life Insurance will pay out on the death of the insured individual.

Terminal Illness

Most policies now include Terminal Illness Cover, which allows the benefit to be paid out early if you’re diagnosed with fewer than 12 months to live.

Critical Illness

Critical Illness Insurance is an optional add-on to the policy for an additional premium. It extends the scope of the cover to include a payout for serious illnesses also – the most common claims are for:

- Cancer

- Heart Attacks

- Strokes

Where the quality of Critical Illness Cover can vary considerably from one insurer to the next it is important check the small print.

Do I Need Mortgage Life Insurance?

The first thing to note is that Mortgage Life Insurance is not compulsory. You don’t have to have it to take out the loan.

However, when looking at the risks involved with not being insured many people prefer to have suitable protection in place.

- How would your loved ones cope if you passed away during the term of the mortgage?

- Could they meet the monthly repayments?

The Risk of Passing Away…

Using Office for National Statistics mortality data, we’ve put together a Life Expectancy Calculator that can work out the risk of you passing away during the term of your mortgage.

We’ve laid out this risk for a healthy male of three different ages over the course of a 25 year mortgage, highlighting the chances of them dying before the mortgage is repaid.

How Much Does Level Mortgage Life Insurance Cost?

The price of Level Life Insurance depends on a variety of factors, including:

- Your age

- Your state of health

- Your smoker status

- How much you want to insure yourself for

- The length of the policy term.

A 50-year-old smoker with a serious health condition would therefore pay more for cover than a healthy 25-year-old non-smoker.

Adding Critical Illness Insurance to your policy will also increase premiums due to the increased likelihood of you suffering a critical illness compared to passing away.

The table below contains premiums for a healthy individual of three different ages looking for Level Life Insurance worth £250,000 over a 20 year period.

Quotes accurate as of October 2025

Compare Best UK Mortgage Life Insurance Companies

Below is an overview of some of the top Mortgage Life Insurance companies in the UK comparing some of the key details of their policy terms.

Get Specialist Mortgage Life Insurance Advice

We can help you decide on a level of cover that’s appropriate for you, advise on whether you need to write the policy into trust and the pros and cons of adding Critical Illness Insurance to the policy.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs.

- We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself.

- You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you.

- Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5.

- Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities.

- Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.