Life Insurance, sometimes known as life cover or life assurance, is a policy that pays out a tax-free lump sum in the event of your death. Having such protection in place can give you peace of mind knowing that if the worst were to happen, your loved ones would be financially secure.

However when it comes to putting a policy in place it can get confusing. To ensure you get the right cover for your personal needs it’s important to compare the different providers and their policies. But how?

We know it can be a mind field which is why we’ve outlined all the key things you need to consider below.

Importance Of Comparing Life Insurance Products

When it comes to life insurance there is no such thing as an off the shelf product. What you need from a policy will be different to your friend or neighbour. This is because your needs and personal circumstances will be different to theirs.

To make sure you get a policy which aligns with your specific needs you need to compare what’s out there. Each provider will offer different policies with different features and terms.

This is why it’s so important to take the time to compare what’s available. You need to choose a provider who can offer you a policy with the best terms for you and your circumstances.

We have created a wide range of Life Insurance guides which help to answer some of the questions our clients most commonly ask.

When you are ready to compare quotes our online tool will give you pricing from all the best UK insurers including Aviva, Royal London and Vitality 🧐.

Comparing Life Insurance Policy Options

As mentioned there are a number of different variables you need to compare between policies when looking at life insurance cover. These include:

Comparing Providers

Firstly, before getting bogged down in all the policy detail, it’s important to understand that each provider is unique. They will all have different appetites to risk and their underwriting policies will vary. Because of this so will the cost of premiums, even if you opt for the same level of cover on the same terms. This is why it’s always good to shop around.

To give you an idea we’ve compared the monthly cost of a policy from two different providers using the following criteria:

- A healthy 30 year

- Non-smoker

- £150,000 worth of cover

- Decreasing term over 25 years.

Different Types Of Life Cover

Another factor to consider is that different insurers will offer different types of cover. The type you need will depend on what you are looking to protect and the needs of your family.

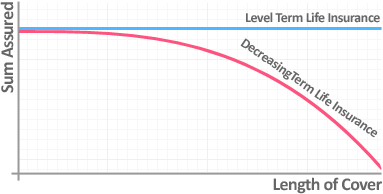

- Decreasing Life Insurance

Benefit amount covered decreases overtime. This type of cover is usually aligned with outstanding debt such as a mortgage that reduces year on year.

- Level Life Insurance

Benefit amount remains fixed over the life of a policy. This type of cover would be suitable if you have an interest only mortgage that won’t reduce over time. It is also useful if you want to provide a certain level of protection for your family.

- Family Income Benefit

Rather than providing a one off lump sum, this type of cover provides a regular monthly income. This can offer a more manageable benefit which can help your loved ones maintain their current lifestyle.

- Whole Of Life Insurance

Unlike the above options, this type of cover doesn’t have a set term. This means the policy will last until your death whereas others will at a certain age. So regardless of when you die, your loved ones will receive a cash lump sum. If you would like to cover the costs of your funeral or leave enough money to pay for an inheritance tax bill this would be a suitable option

The cost of your monthly premiums will also be affected by the type of cover you choose. For example a decreasing life insurance policy will be cheaper than a level one. This is because as mentioned above the benefit amount with decreasing cover reduces over time.

![Decreasing vs Level Life Insurance]()

When it comes to Whole of Life (WOL) insurance you can expect to pay much more compared to decreasing or level cover. This is because there is no term. Regardless of when you pass away the policy will pay out the amount you originally covered. Because of this premiums are significantly higher. To get quotes for WOL you can use our handy online tool.

Example

Using the same healthy 30 year old from above we’ve put together quotes for £150,000 worth of level, decreasing and whole of life cover using the same provider.

Joint Life Vs Single Life Insurance

Another thing to consider before taking out a life insurance policy is whether or not you need joint cover?

Joint Life Insurance means two people are covered by the same policy. It’s important to understand though that in most cases it will only pay out on the first death. This means that the surviving partner won’t be covered as the policy will have already paid out.

For this reason it might be worth considering two single life insurance policies. Or looking for a provider like Guardian who offer dual life cover which protects both partners regardless of who passes away first.

Type of Premiums

There are three different types of premiums available when it comes to life insurance. The type you choose will not only impact how much you pay now, but also in the future.

- Guaranteed

Core premiums stay the same throughout the policy. Premiums only rise if you index link your benefit so it keeps up with inflation.

- Age-Banded

Premiums are increased each year as you get older. The rate of increase can be guaranteed or reviewable.

- Reviewable

Premiums are reviewed regularly and increased depending on your situation and the insurer.

As life insurance is meant as a long term policy it’s important to understand the different options available. Not all providers will offer all three options so it is best to check when you are comparing policies.

Opting For Indexation

Indexation may sound complicated but actually it’s quite simple. It refers to cover which is linked with inflation and the cost of living.

If you buy a level term policy with a benefit amount of £100,000 today, that £100,000 won’t have the same value in 20-30 years. However if you index-link your cover the benefit amount will increase in line with inflation overtime. This means your benefit won’t lose any purchasing power.

SPECIALIST TIP 🤓

In most cases you can’t add indexation once you’ve taken a policy out so it’s important to decide if this is something you want or can afford before taking out cover.

Including Critical Illness Cover

When comparing life insurance policies it’s also important to look at whether or not you need critical illness cover. With this optional extra you can add an additional benefit amount which would pay out if you suffered from a critical illness such as a heart attack, cancer or stroke.

Many providers will allow you to add this type of protection onto your life insurance policy for an extra premium. Below we have compared the monthly cost for a level life insurance policy with and without critical illness cover. The quotes are both from Scottish Widows and based on:

- a healthy, non-smoking 30 year old

- 25 year term

- £150,000 life cover

- £150,000 critical illness cover.

It’s always best before choosing a policy to compare quotes. We have a handy life insurance quote tool that will give you pricing from all the best UK insurers within seconds 🧐.

Writing A Policy Into Trust

Writing your life insurance policy into trust simply means that the payment is kept separate to the rest of your estate.

Why is this a good thing? It typically means that your beneficiaries will receive payment much faster. Not only this the payment will avoid inheritance tax. If you’d like more control over what happens to your benefit it is definitely an option worth considering.

When it comes to adding your policy into trust you want to make sure you choose a provider that has an easy process. When comparing look out for those that offer online trust services rather than those who still use a paper based process.

Policy Exclusions

It’s really important to check the exclusions providers place on a policy. What one provider might cover, another might not.

This is based on their appetite for risk. For example some will place exclusions on certain occupations which are deemed risker. Or on certain lifestyle and health issues. We go into these in more detail below.

Personal Factors To Consider When Comparing Life Insurance

It’s not just policy factors you need to consider when comparing life insurance, you also need to look at certain personal factors. Certain parts of your lifestyle may lead insurers to asses you as a higher risk in terms of death.

Different providers will view certain personal factors differently though. For example some will exclude certain medical conditions from cover whereas others won’t. And some will take a different stance on hazardous sports and dangerous travel.

For this reason it’s important to look at these factors when comparing insurers as the cover and cost will vary across the market.

Smoker Status

There are some insurers who take a neutral stance on smoking, however the majority will charge you a higher premium if you smoke. This is due to the increased health risks that comes from consuming nicotine.

If you’re a smoker it’s worth comparing different insurers to see what their individual stance is. It’s also important to remember that if you give up smoking after 12 months of being nicotine free you will be classed as a non-smoker.

To give you an idea of the difference in cost, we’ve provided an example below of premiums for a non-smoker vs a smoker with the same provider. This is based on:

- Healthy 30 year old

- £150,000 cover

- Decreasing cover

- 25 year term.

It might come as a surprise but it’s not just smoking cigarettes that will increase your premium. Any consumption of nicotine will see your premiums increase with most providers. This includes the use of patches and vape’s.

Medical History

Your medical history is one of the key factors providers look at when considering you for a life policy. This is because it can have a direct impact on your life expectancy. Your immediate families medical history will also be taken into account.

As morbid as it sounds, certain conditions will increase the risk of insurers having to pay out on a policy. So if you suffer, or your family has a history of conditions such as heart disease or diabetes, an insurer will class you as higher risk. This will have an impact on:

- The exclusions put on your policy

- The level of cover you can get

- How much your premiums will cost.

Your Occupation

Your occupation may also affect your policy. What one insurer deems as a higher risk job another might not. As a result of this the premiums you pay with one provider may be much higher than with another.

This is because generally insurers who class a job as high risk will apply a loading fee rather than exclude it from cover. This could be a percentage of 25% upwards or a per mill loading. An example of per mill loading could be £1 upwards per £1,000 of cover which could end up being extremely expensive.

Examples of high risk jobs can include:

- Diver

- Oil Rig Worker

- Armed Forces

- Emergency Services

- Scaffolder

- Construction Worker

- Pilot

You’d be surprised with some occupations which get classed as higher risk so its always worth checking different insurers risk ratings when it comes to jobs. You could end up paying more with one insurer than another.

Hazardous Hobbies

It’s not just medical history that could result in you being deemed as high risk. If you like to take part in hazardous hobbies such as rock climbing or hang gliding you could also be put in this category.

When considering a policy it’s important to check different providers. You will need to understand how they view certain activities as this will impact the cover you get and the price you pay. It is likely that you will have to pay an increased premium for your cover.

Example Hazardous Hobbies…

- Freestyle Rock Climbing

- Scuba Diving

- Skydiving

- Private Plane Flying

- Bungee Jumping

- Motorsports

- Parachuting.

SPECIALIST TIP 🤓

If you par-take in any extreme hobbies it is best to discuss your options with an adviser. Most online quote tools won’t consider the additional risk, therefore the quotes you receive may not be accurate.

Is Overseas Travel Included?

If you find yourself travelling abroad a lot it’s always worth checking whether or not a policy covers you for overseas travel. The last thing you want is for the worst to happen whilst you’re away and your policy not cover you because you were out of the country.

In most cases insurers will cover you for short business trips or holiday plans to the EU, North America or Asia. However if you travel to a country considered extremely dangerous insurers may not cover you. It’s always best to check when comparing policies what providers terms are when it comes to overseas travel.

What Information Will An Insurer Request During Application?

Once you’ve compared quotes and picked an insurer to buy life insurance from, they will request certain information from you. This can include the following:

- Annual income

- Mortgage loans

- Health history including any past serious illnesses / conditions

- Weight and height

- Doctor’s name and address

- Any existing policy details.

What Is A Life Insurance Quotation?

When comparing different insurance providers, you’ll fill out a quote form and get a list of quotes back. These are an estimation of how much you might expect to pay for your monthly premium.

What Is The Best Type Of Life Insurance?

What’s best for you will be different to what’s best for anyone else. The type of life insurance you pick will suit your needs and provide the appropriate level of cover. To find the best life insurance for you though, research is key, as well as understanding the terminology used in the policies.

Once you know what you need from your policy, you can compare life cover quotes to help you find the most suitable coverage.

We have written a complete guide to the best life insurance providers in the UK 2026 which should help you gauge the most important factors when setting up your own cover.

Compare Top 10 UK Life Insurance Providers 2026

There are a range of providers offering life insurance products. It’s important to compare each as they will all offer different types of policies and terms.

To help you get started we’ve provided a list of some of the top UK life insurance providers below. We’ve also compared the additional benefits each offer with their policies.

For a comprehensive review of each of the leading providers we have put together a complete guide to the best life insurance providers in the uk 2026 →.

If you need any help please do not hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Comparing Providers Claims Rates

Another factor to compare when looking to put life insurance in place is provider claims rates. Claims rates are the percentage of claims a provider receives that are successfully paid out.

It important to look at the claims rates in conjunction with their terms and policy features. It’s no good if they have a high claims rate but don’t cover you for everything you need.

We’ve put the latest claims stats for the leading UK life insurance providers below.

IMPORTANT NOTICE 🧐

You shouldn’t use payout statistics alone to decide which insurer offers the best life insurance. Instead, use them as a rough guide to compare successful claims across the industry as a whole.

Going Direct Vs Speaking With An Adviser

From everything we’ve covered above, we hope to have highlighted just how many things there are to consider when taking out life insurance.

It’s not as simple as just getting a quick online quote and putting a policy in place. You need to ensure the cover you opt for is tailored specifically to you, your health and lifestyle.

Going Direct To An Insurer

No one wants to have to make a claim on their life insurance policy. However if the worst should happen and your loved ones need to, you want to ensure that the policy pays out.

By going direct your policy would be classed as what is known as a non-advised sale. This means you wouldn’t be entitled to any financial protection should the policy not be fit for purpose. If you have over looked terms or not disclosed certain medical information the claim would simply be rejected.

To avoid this, you need to make sure you fully understand the terms of the different providers. You will need to review and compare all the different documentation so you can decide which policy offers the best level of cover.

Speaking With An Independent Adviser

By working with an adviser, not only are you getting specialist advice but you will also be financially protected. This is because a policy bought through an adviser is classed as an ‘advised sale’ and protected through the Financial Conduct Authority.

Specialist advisers such as the team here at Drewberry, live and breath this type of protection. This means they can do all the heavy lifting for you.

By understanding your needs they can identify the most suitable providers for you. This can save you hours of trying to make head nor tail of different policy terms and conditions.

Need Advice Comparing Life Insurance?

Being life insurance brokers we can talk you through your options to ensure you buy life insurance you need. Our team can guide you through the process and answer any questions about your life cover options.

If you have a pre-existing medical condition, we can speak to the underwriters to help you get the most favourable terms available in the market.

Reach out to us today to speak to a financial advisor. You can call us on 02084327333 or email help@drewberry.co.uk.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.