Life Insurance pays out on death, securing your loved ones a benefit to see them through such difficult times.

Use a policy to protect an outstanding mortgage, leave a cash lump sum or replace your income – whichever would be best for your family.

Include Critical Illness Cover to protect against the risks of illnesses such as heart attack, cancer and stroke.

What Does Family Life Insurance Cover?

- Death

Should you pass away during the life of your policy, it will pay out a tax-free cash lump sum (or an income, depending on the type of insurance) to your beneficiaries.

- Terminal Illness

The vast majority of Life Insurance policies will pay out early if you’re diagnosed as terminally ill (usually defined as having fewer than 12 months to live).

- Critical Illness

If you add Critical Illness Cover and Life Insurance together, you get a policy that will pay out not just on death but also if you’re ever diagnosed as critically ill.

There are a number of different policies you can use to provide your family with security after your death.

Family Income Benefit

Although Family Income Benefit is one of the lesser-known Life Insurance products, it’s nonetheless a powerful planning tool to ensure your family can maintain fiscal stability long after your death.

While other Life Insurance products pay out a lump sum, Family Income Benefit will pay out a regular income for a set period.

Mortgage Insurance

Mortgage Life Insurance is a form of Term Life Insurance that covers you for the outstanding mortgage debt for the set term of the loan.

If you die during the policy’s term, the insurance pays out so your loved ones don’t have to worry about how they’ll afford to stay in the family home.

Whole of Life Insurance

Whole of Life Insurance is designed to cover you until your death, whenever that may be. It’s therefore designed to insure your family for obligations that won’t be cleared over time, such as funeral expenses or inheritance tax bills.

Do I Need Family Life Insurance?

It’s not something that anyone wants to think about, but while the risk of death is fortunately relatively low for a healthy person in the UK today, it’s still a factor you need to consider when looking to protect your family.

The point of most Life Insurance policies is to protect you for the long run, say over the length of an entire mortgage.

When you examine the likelihood of you passing away over a much longer period, the risk rises.

Given the relatively inexpensive cost of life insurance versus the cost of leaving your family unprotected, it is often a no brainer to have suitable cover in place to provide a financial lifeline should the worst happen.

Youth is no protection…

Younger people might feel that they have no need for Life Insurance and in the short-term this may be true.

The risk of death for a healthy, 30-year-old man over the next 10 years is 1 in 85. However, when you extend this period to 25 years, which is around the typical length for a mortgage, the risk rises to 1 in 18.

What is Family Income Benefit?

The Life Insurance most people are familiar with pays out a tax-free cash lump sum on the death of the policyholder.

However, there’s another type of Life Insurance for families that may be more useful – Family Income Benefit.

Family Income Benefit pays out an annual income to your loved ones for the remainder of the policy term should you die.

It is designed to provide a continuation of the policyholder’s income into the household, potentially protecting your family’s financial future for years or decades.

You can also include Critical Illness Cover on the policy, so the insurance will kick in if you’re diagnosed with a serious illness such as heart attack, cancer or stroke.

Adding Critical Illness Insurance to Family Income Benefit may not always be the best option to protect your income. Income Protection tends to be far better suited for this purpose as it covers you if you’re off work for any medical reason.

Of course there may be instances where adding Critical Illness Cover to FIB makes sense, but it’s a complicated area. Talking it through with a specialist such as one of the team at Drewberry can help.

Why Family Income Benefit?

Receiving a one off lump sum to manage ongoing financial commitments can be quite a daunting task.

If costs spiral it could feasibly be eaten up quickly leaving your loved ones with financial worries and a shortfall to make up, everything the life insurance was supposed to prevent.

Providing income continuity…

Family Income Benefit will provide a continuation of income rather than a lump sum.

The end date usually aligns with the age your youngest child can reasonably be expected to be financially independent.

Family income insurance is commonly used where you have a more precise idea of your family’s financial outlay going forward, such as where you need to cover school fees.

It’s also popular if you have older children as beneficiaries, who may use any financial freedom they have to spend a lump sum unwisely.

Mortgage Life Insurance

When asking yourself if you need Mortgage Insurance, consider one question: Would your family be able to stay in their home if you died before repaying the loan?

These days, most mortgages are joint and rely on two incomes. How would your family cope if they suddenly lost one of those incomes, especially if it was the main income?

If you’re concerned that your loved ones may have to sell up and move out in the event of your death and want to insure the family home by covering the mortgage, Mortgage Life Insurance may be the option for you.

How Does Mortgage Life Insurance Work?

Mortgage Insurance is a type of Term Life Insurance, which is split into:

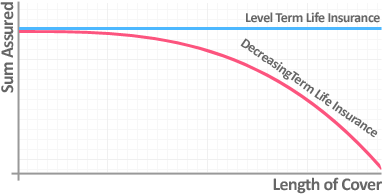

- Decreasing Term Insurance

- Level Term Insurance

What is Decreasing Life Cover?

Decreasing cover can run alongside a mortgage. The term is set for the same length of time as the mortgage and the amount you’re covered for falls over this period alongside your outstanding loan, reaching zero by the end of the policy.

What is Level Cover?

Level Mortgage Life Insurance is also set for a specific term, although unlike decreasing cover the benefit remains the same throughout this period.

![difference between level life insurance and decreasing life insurance]()

It’s therefore particularly well-suited to interest-only mortgages, where the outstanding amount you owe remains fixed over time.

Others use Level Life Insurance to provide a fixed lump sum above the amount owed to the mortgage lender, leaving extra money to their family to cover costs such as bills or funeral expenses.

Comparing the two, as the amount you’re covered for falls over time with decreasing cover, it will often be cheaper than level cover.

What is Whole of Life Insurance?

Many people have heard of Whole of Life Insurance without even realising it. Over-50s Life Insurance is a specific form of Whole of Life Cover.

In insurance terms, a Whole of Life policy does exactly what it sounds like it will do – cover you for your whole life, right up until your death.

All you need to do is continue paying the monthly premiums until you pass away.

This is compared to Term Insurance, which only covers you for a set period of time and then ends, perhaps long enough to cover a mortgage debt or another outstanding loan.

Whole of Life Insurance is sometimes referred to as Whole of Life Assurance because it protects against an event that’s assured to happen, i.e. your eventual death, rather than an event that may happen during the policy’s term.

Given that you definitely secure a payout from Whole of Life Cover providing you keep paying the premiums, it’s often used to cover items you know will be need such as for inheritance tax purposes or funeral expenses.

Over 50s Life Cover for Funerals

Whole of Life Cover is often used to cover funeral expenses. Given this, a funeral can be our last major expense, one we want to protect our families from having to pay out of their own pockets or having deducted from their inheritance.

Whole of Life Insurance and Inheritance Tax

You can also use Whole of Life Insurance to spare your family from the entire inheritance tax bill on your estate.

To save your family from going through the hassle and expense of covering the bill out of their own pocket or taking out an executors loan to pay the bill to release the estate, a Whole of Life Insurance policy written into trust can be used to cover an entire inheritance tax bill.

How Much Does Family Life Insurance Cost?

How much your family life cover will cost depends largely on a couple of key factors: the length of time and the amount you’re looking to insure yourself for as a benefit.

Other factors that affect the cost of Life Insurance include:

- Your age

The older you are at the start of the policy, and when you want the policy to end, the higher the risk you represent and therefore the higher the cost of cover

- Your state of health

Your health currently has a big impact on the cost of Family Life Insurance, particularly if you’re suffering from serious medical conditions such as diabetes or have a high BMI

- Your medical history

While less serious medical issues you’ve suffered in the past have little bearing on the cost of Life Insurance, more serious illnesses in the past, such as cancer, will increase the cost of cover

- Your smoking status

You can get Life Insurance for smokers, but the premiums will be higher due to the increased risk of death you present to the insurer.

Calculate the Cost of Family Life Insurance and Compare Quotes

You could go to each insurer individually and get Life Insurance quotes from all of them to find the best cover for you, but this would take a lot of time.

Why not get a Life Insurance quote engine to compare the UK’s leading providers for you instead and save you all the legwork?

Drewberry has access to the entire UK market. While this means we can help you find the best price for Family Life Insurance, it will likely mean you’ll see a lot of options come up when you use our online Life Insurance comparison tool.

Single or Joint Family Life Insurance?

Spouses and civil partners, or those who have combined interests, often look to Joint Life Insurance to protect themselves and their families.

While Joint Life Insurance is typically cheaper than two single policies, there’s a good reason for this. It’s because the policy will only pay out once, usually on the death of the first partner. This is known as joint life first death insurance.

Most Joint Life Insurance is written on a first death basis, which can mean it’s always not particularly suitable for providing comprehensive family protection.

This is because it leaves the surviving partner without Life Insurance on the death of the first partner, meaning nothing can be passed down to children if the first payment is used to cover a mortgage.

The surviving partner may find getting re-insured at a later date far more expensive due to their older age and any health conditions they’ve suffered since taking out the first policy.

Should I Add Critical Illness Cover?

A major consideration when it comes to Life Insurance is whether or not you should include Critical Illness Cover, which will enhance your insurance so it pays out if you develop a critical illness.

If you do add this cover, the critical illness must be one of the ones specified by the insurer and of a specific severity.

The most common claims on such policies are for cancer, heart attacks and strokes.

If you do unfortunately become critically ill, the policy pays out the same lump sum as if you’d passed away.

Having additional protection that will cover your mortgage, for instance, if you develop a serious illness or disability and can no longer provide for your family is attractive to many people.

After all, for many people a critical illness could deal the same financial blow to the family as death, especially if the ill person is never able to work again.

When Income Protection Could Be More Suitable…

If you’re worried about an illness or injury stopping you working and paying the mortgage on the family home or meeting other bills and expenses it may make more sense to opt for Income Protection alongside Life Insurance.

This covers you for any illness or injury which stops you from working and will pay out a regular income for as long as you need it, rather than just one lump sum.

Income Protection is often seen as more comprehensive than Critical Illness Cover because it will pay out for anything that prevents you from working, regardless of severity.

Should I Opt for Indexation?

Another option you have is whether or not you want to index-link your Life Insurance so that your payout won’t be eroded by the effects of inflation.

Life Insurance is a long-term product, so it’s inevitable that inflation will take a bite out of your benefit over time.

This is less of a concern with Decreasing Term Insurance, because it is used to protect a known debt such as a repayment mortgage with the benefit designed to fall over time.

However, if you are trying to protect your family’s standard of living until they are of an age where they are self sufficient, inflation could do a lot of damage to the real purchasing power of the benefit over time.

In such cases opting to index your benefit amount means your family would have the same purchasing power whether a claim is made today or 20 years down the road.

Reviewable or Guaranteed Premiums

With Life Insurance you can choose to either guarantee your premiums so that they stay fixed (unless you’ve indexed them, in which case there’ll be an inflationary increase).

The alternative is reviewable premiums, where the insurer can adjust your premiums each year.

The issue with this is that you never know how much your Family Life Insurance will cost year-on-year, and your premiums could rise significantly over the course of your policy.

Will My Medical History Impact My Life Insurance Application?

When you apply for your Life Insurance you’ll be medically underwritten, which entails you being asked a series of medical questions to assess your current state of health and therefore the level of risk you present to the insurer.

Although this is sufficient for insurers to price cover for the vast majority of applicants, in some instances further medical evidence may be required because of:

- Your age

- The size of the benefit you’re requesting

- Medical conditions/your state of health

- Your BMI

- Smoker status

- Family history of hereditary illnesses

- Any combination of the above.

GP Reports, Nurse Screenings and Medicals…

The medical evidence an insurer might ask for could vary, from a simple GP report about your medical history all the way to a full blown medical.

These medical screenings are entirely paid for by the insurer and are usually held in private clinics across the country – wherever is the most convenient for you.

A step between requesting GP reports and an entire medical is a basic nurse’s screening. This involves a qualified nurse coming to your home or place of business and taking simple measurements such as height, weight and blood pressure.

Life Insurance with Pre-Existing Conditions

If you have a pre-existing condition which, in the insurer’s eyes, may increase the chance of you claiming on the policy the insurer will do one of two things:

- Decline to offer cover

- Offer cover but with a ‘loading’ on the baseline premium.

The thresholds for requiring medical evidence and applying loading vary. That’s why it’s worth getting advice from the specialists at Drewberry as we’re best-placed to know which insurers offer the best terms for pre-existing conditions.

Can I Get Life Insurance Without a Medical?

Yes, you can get Life Insurance with no medical screening. Over-50s Life Insurance which is a specific Whole of Life Insurance plan rarely requires a medical and is usually advertised as ‘guaranteed acceptance’.

This is because providers understand the 100% likelihood of a claim providing the insured keeps paying the premiums, and so the cost of Whole of Life Insurance is priced accordingly.

For other types of cover, it’s perfectly possible that you’ll need no medical checks for Life Insurance other than the questions initially asked on the application.

This will be the case if you don’t trigger any of the insurer’s requirements for further medical evidence such as applying for a high benefit, a poor medical history, high BMI or a combination of these or any other conditions that prompt the need for a medical.

Do I Need to Write My Life Insurance Into Trust?

If you’ve gone to all the trouble of protecting your loved ones with Family Life Insurance, the last thing you want to think about is them being faced with a big Inheritance Tax bill after you’re gone.

If you’ve gone to all the trouble of carefully calculating how much your loved ones will need then you don’t want anything to take cash out of your family’s hands.

However, this may well happen if you haven’t taken steps to mitigate the inheritance tax on Life Insurance payouts that becomes due if your benefit is paid into your estate.

While Life Insurance is free from income tax, if you pass away and the Life Insurance policy pays out to your estate it may be subject to inheritance tax at 40%.

This bill must usually be paid before your family even gets access to your estate, which could cause significant financial hardship. Many people don’t realise this and could be in for a bit of a shock to receive such a big bill form HMRC at a difficult time.

Beware Inheritance Tax on Family Income Benefit!

While Family Income Benefit will be paid free from income tax, it will be treated as one lump sum for inheritance tax purposes.

So even a relatively modest FIB benefit of £18,000 a year over 20 years would gross up to a £360,000 benefit overall – well in excess of the single person’s IHT nil-rate band threshold of £325,000.

Your family may therefore have to find cash upfront to pay an inheritance tax bill on an income they may not receive until decades have passed.

Inheritance Tax for Unmarried Couple with Life Insurance

If you’re not married then the inheritance tax implications on any wealth you leave behind, including Life Insurance payouts, are even greater.

While married couples can leave Life Insurance to each other usually IHT-free, there’s no such protection for cohabiting couples – you need to be married.

With a rise in the number of families made up of unmarried couples named in each other’s Life Insurance, it’s rapidly becoming the case that the spousal exemption is available to fewer and fewer people.

Avoid Inheritance Tax by Writing Life Insurance into Trust

The way to ensure your Life Insurance is not paid into your estate and therefore removing the risk of it adding to any IHT liability you can opt to write your Life Insurance into trust.

Then because the money is never paid to your estate it’s all free from inheritance tax when the trust distributes it to the beneficiaries.

If you put your Life Insurance in trust, you may be able to avoid inheritance tax and stop your benefit being eaten up by the taxman.

Get Specialist Advice on Life Insurance for Your Family

Drewberry’s team of specialist advisers arrange cover to protect clients’ families every day, so we’ve got a wealth of Life Insurance tips and tricks to pass on to make sure you get the best deal.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs.

- We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself.

- You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you.

- Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4100 and growing independent client reviews rating us at 4.92 / 5.

- Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities.

- Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.