The cost of Critical Illness Insurance is something that our recent survey found most people tend to overestimate, particularly since the pandemic, with 74% of people thinking the cost has increased as a result of it.

In reality this just isn’t the case and a policy doesn’t have to cost the earth. Yes, there will be certain personal and policy factors which will affect the amount you pay, however some of these can be managed and as a result can help you to keep the cost down.

In this guide we will walk through the various options available, how they work and the most cost effective way of setting up your cover.

What Is Critical Illness Cover?

Critical Illness Insurance pays out a tax-free cash lump sum if you were to be diagnosed with certain serious illnesses, the most common life-threatening illnesses which tend to be covered include:

- Cancer

- Heart Attack

- Stroke.

The number of illnesses which are covered can vary considerably. Some policies only cover these 3 core illnesses where others can cover over 100 illnesses which can include:

- Multiple Sclerosis

- Permanent loss of vision / hearing

- Loss of limbs

- Motor Neurone Disease

- Organ failure / transplant.

Each insurer has their own illness definition for a claim to be successful, for more information on what exactly qualifies for a claim you can read more here.

How Much Cover Do You Need?

To figure out how much Critical Illness Insurance you need you’ll firstly need to decide what the payout would need to cover. The more you need to cover the more expensive your monthly premiums will be.

A Critical Illness policy is designed to provide you with financial stability at a time when you may not be able to work.

The money it pays out can be used to help you keep up with payments such as rent, mortgage and monthly bills or even help towards making lifestyle alterations needed to help you cope with your illness.

Some of the most common expenses our clients use their benefit for include:

- Outstanding mortgage balance

- Other loan repayments

- Everyday expenses such as bills, the weekly shop council tax etc.

- Medical treatment

- Carers or domestic helpers

- Therapy and rehabilitation treatments

- Modifications to your home to accommodate a disability

- Medical / mobility equipment.

If you know the level of cover you require you can use our critical illness cost calculator to compare premiums from the top UK insurers including Aviva, Vitality and Royal London 😊.

How Much Does Critical Illness Cover Cost?

Just like with other types of cover such as, Life Insurance, Private Medical Insurance or Income Protection, there will be a number of personal and policy factors that will affect the cost of your policy.

To give you an idea of how much you could expect to pay for different types of Critical Illness Insurance, we’ve calculated the monthly premiums for a 30 year old who:

- has no pre-existing conditions

- is a non-smoker

- is in a low risk office based job

We have compared Critical Illness insurance quotes from all the top UK insurers and used the cheapest option for each example.

Level or Decreasing Cover?

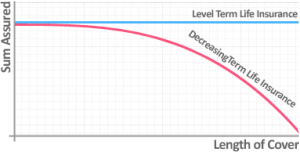

One of the first decisions you will need to make is the type of critical illness cover you need. The cover can either remain fixed or decline over time and there is a significant difference in cost depending on which one you need.

![Critical Illness Insurance Graph]()

Typically decreasing cover is used to cover the outstanding balance of a repayment mortgage where a level term policy could be used for a fixed debt or lifestyle planning.

- Level Term Cover

The benefit stays fixed over time, so the policy will pay out the same tax free cash lump at anytime during the policy term should a claim be made.

- Decreasing Term Cover

The benefit falls over time, reaching zero by the end of the policy. Should a claim need to be made at the beginning of the policy the payout would be significantly higher than a claim at the end of the policy term.

Average Cost Of Critical Illness Insurance In 2025

Where the financial risk to the insurer falls over time with decreasing cover the premiums are significantly cheaper than a comparable level term policy.

Where a level term plan has a fixed payout amount that remains the same over time you can expect to pay around 70% more for your policy.

Policy Factors Affecting The Cost Of Critical Illness Insurance

When deciding on the most appropriate cover there are a number of policy factors which will affect the monthly cost.

If you have a set budget these are factors which can be adjusted to make sure your policy remains affordable.

The More Cover You Need The Higher Your Premiums

The more you want to cover the more expensive your premiums will be. How much you need to cover will depend on your own personal circumstances.

Below are some examples of how the cost of cover increases in a linear fashion the higher the benefit you need.

The Longer You Need Cover The More It Will Cost

When deciding on the length of cover many clients look to align their policy with the end of their mortgage, retirement or other key lifestyle event.

The longer you require cover the higher the chance of suffering a serious illness and so the more expensive the policy will cost.

The Number Of Illnesses Covered

The number of serious illnesses covered under the policy can have a significant impact on the cost.

Generally the more illnesses that are covered the higher the premiums will be as there is more risk to the insurer of the policy paying out.

Some policies limit cover to the big 3 critical illnesses in cancer, heart attack and stroke where others can cover over 100 serious illnesses.

We have specialist tools to help distinguish between all the leading UK policies and the illnesses they cover to make sure you are getting the most comprehensive critical illness insurance for your budget.

If you need help making sure you have the most suitable cover at the cheapest premium please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk

Choosing Reviewable Or Guaranteed Premiums

When setting up your Critical Illness policy you will need to choose between reviewable and guaranteed premiums.

There can be a significant difference in cost between these two options over the life of the policy.

- Guaranteed Premiums

Initially they tend to be more expensive compared to reviewable premiums but they remain fixed throughout the life of the policy.

- Reviewable Premiums

These tend to start off cheaper, however the total cost is usually higher over the life of the policy as the insurer has the right to increase the monthly premium they charge for providing cover.

Personal Factors Affecting The Cost Of Critical Illness Insurance

In addition to the policy factors you have control over there are number of personal factors that will also affect the cost of your Critical Illness Insurance.

Some are more obvious than others and some you can control whereas others you can’t. We’ve outlined these below.

It Is More Expensive The Older You Are

Sadly yes, your age will affect how much you pay for Critical Illness. This is because with every year you get older, there is a higher risk of becoming seriously ill. Due to this higher risk insurers will charge older people more than those that are younger.

Based on this, the cost of covering a £200,000 for our 30 year old goes from £29.56 a month to £64.82 for a 40 year old wanting the same cover.

Your Health Can Affect How Much You Pay For Critical Illness

When you take out a Critical Illness policy, insurers will look at your medical history to determine what cover they can offer, if any, and at what cost.

If you do have a known pre-existing medical condition which is life-limiting or that affects your health, providers will tend to:

- Provide cover but with increased premiums

- Exclude the condition you suffer from but offer discounted premiums

- Cover you without any exclusions and no premium loading.

Not all providers will class pre-existing health conditions in the same way, which is why it’s best to speak with a specialist such as one of the team here at Drewberry.

We can review the whole market to ensure you get cover tailored to your particular circumstances and the best bit is we offer a fee free service.

Just pop us a call on 02084327333 or email help@drewberry.co.uk.

Smokers Pay A Hefty Premium

Whether you smoke cigarettes, use vapes or are trying to give up and using patches, you can expect to pay more for your Critical Illness.

This is because the majority of insurers class anyone who has consumed nicotine in any form in the last 12 months, as a smoker due to the health risks associated with it.

Will Quitting Nicotine Reduce Premiums?

If you give up smoking and can prove to an insurer you haven’t consumed any nicotine within the last 12 months, your smoker status can be changed to ‘non-smoker’ and as a result your premiums will reduce.

Hazardous Hobbies Come At A Cost

Do you enjoy off-piste skiing or exploring the worlds oceans with a bit of deep sea diving? If you do you could find yourself paying more for your Critical Illness policy than someone who takes part in less extreme hobbies.

Why? By taking part in such hazardous activities insurers are likely to class you as being higher risk than someone who doesn’t and charge you an additional premium.

- Big wave surfing

- Off-piste skiing

- BASE jumping

- Kiteboarding

- Free climbing

- Scuba diving

- Hand gliding

Each provider will have a different take on how they view hazardous sports, because of this it’s always a good idea to speak with a specialist such as one of the team at Drewberry.

Don’t hesitate to get in touch if you do have any questions just pop us a call on 02084327333 or email help@drewberry.co.uk.

Does Critical Illness Insurance Include Any Free Additional Benefits?

When considering the cost of Critical Illness premiums it’s important to look at what other benefits are included as these could add real value to your policy.

For example some of the most popular free additional benefits include:

- 24/7 Video GP Service

- Online Prescription Service

- Nurse Staffed Medical Advice Helpline

- High Street and Fitness Discounts

You may even be able to make unexpected savings by taking advantage of your plan’s discount scheme allowing you to offset some of the cost of your cover.

Who Are The Top UK Critical Illness Insurance Companies In 2025?

When it comes to Critical Illness Insurance there are a range of providers and policies to choose from which of course will bring varying costs.

However rather than focus on getting the cheapest deal, it’s important to look for cover that gives you and your family the best protection and that meets your particular circumstances.

For a comprehensive review of the best Critical Illness Insurance you can read our specialist guide comparing all the top UK insurers.

Where some insurers are more competitive with higher risk occupations or covering certain medical conditions we compare all the leading insurers when finding you the most cost-effective cover for your needs.

This will usually include considering:

It’s Important To Do Your Research…

Our whole of market access and experience offering advice means we can match you with the most cost-effective critical illness insurance for your needs.

It is important to do your research and obtain quotes from all of the leading UK providers as premiums can vary considerably based on your age and your current circumstances.

To compare the top UK providers in seconds use our handy Critical Illness Insurance quote tool →

Compare Critical Illness Quotes & Get Specialist Advice

When protecting something as important as your income and family it’s essential to understand what you’re buying in terms of Critical Illness Insurance. Making a mistake could have expensive consequences.

Our team are on hand to help you make an informed decision when setting up the most suitable cover for your specific circumstances.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

For help and fee-free advice, don’t hesitate to give us a call on 02084327333 or email help@drewberry.co.uk.