IMPORTANT❗️

Our “best” insurer lists reflect our independent analysis of product features, service quality, and value. They are intended as a guide only – the right provider for you may differ depending on your needs and circumstances.

The best Life Insurance for seniors and older adults depends on what you need a payout for. We often help people in this age bracket arrange Life Insurance to:

- Pay for a funeral

- Meet an inheritance tax bill

- Pay off small debts, such as personal loans or credit cards

- Cover inheritance tax on certain gifts they make during their life

- Cover a mortgage if they pass away before repaying it

- Protect dependent family members with a lump sum if they die.

Types of Life Insurance For Seniors

There are four main types of Life Insurance for seniors to consider. All offer peace of mind in various ways, but which one you need depends on your desired end goals.

The four types of Life Insurance are:

Which Life Insurance Type is Best For You?

Different kinds of Life Insurance do different jobs, so it’s normal to feel unsure about which one fits your situation.

We’ve broken it down by the most common needs for seniors. If it still feels confusing, don’t worry. Call us on 02084327333 and we’ll explain everything in plain English.

Covering Funeral Costs

If you want to make sure there’s money for your funeral whenever you pass away, Whole of Life Insurance is usually the best choice. A typical UK funeral now costs over £4,000, and this type of policy can help your family avoid finding that money at short notice.

Protecting Against Inheritance Tax

If your estate may face an inheritance tax bill, Whole of Life Insurance can provide a payout that helps cover it. This can stop loved ones from losing 40% of anything you leave above the tax-free threshold.

Protecting Your Family

If you still have a mortgage or anyone relying on your income, Term Life Insurance is likely the right option. It pays out if you die during a set period, i.e. before your mortgage is paid off or while your partner or children still depend on you.

You can choose Decreasing Life Insurance (cheaper, falls in line with a repayment mortgage) or Level Life Insurance (more expensive, but the payout stays the same throughout the term).

Compare Best UK Life Insurance Providers For Seniors In 2026

The UK has a few major senior Life Insurance providers to choose from, each with their own unique policy types, pricing structure, and underwriting process.

There’s no one-size-fits-all when it comes to insurance. The “best” product for you won’t necessarily be the best for someone else, as it all depends on your unique situation. That’s why it’s important to compare quotes and policies from different providers. And the cheapest quote isn’t always the best.

GOOD TO KNOW 🤓

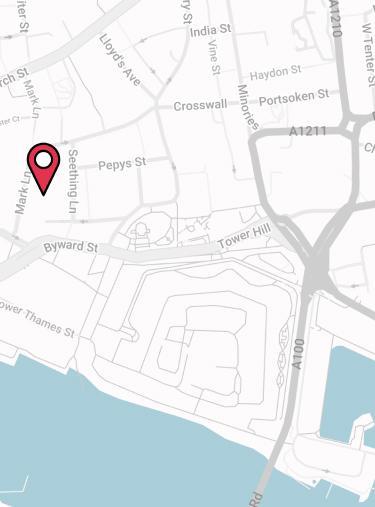

As an FCA-authorised firm, you can trust Drewberry to guide you with integrity and knowledge. You can find us on the

Financial Services Register. How We’ve Chosen Our Top Providers

As an independent insurance broker, we deal with a number of leading Life insurers every day. We’ve weighed up the key features and benefits of each provider’s offering to create this shortlist. Details we’ve compared include:

- Claims payout rates

- Defaqto rating and Trustpilot review scores

- Free policy benefits

- Optional policy add-ons.

Best Whole of Life Insurers For Seniors

While every Whole of Life Insurance provider offers Term Life Insurance, not every Term Life Insurance provider offers Whole of Life Cover.

Our list of “top” Whole of Life insurers has been put together by considering product offering, company size, longevity, and customer reviews.

Aviva

![]() Aviva is one of the UK’s largest insurers, serving more than 20 million customers across the nation. They recently acquired AIG Life UK (now Aviva Protection UK) to strengthen their personal protection offering.

Aviva is one of the UK’s largest insurers, serving more than 20 million customers across the nation. They recently acquired AIG Life UK (now Aviva Protection UK) to strengthen their personal protection offering.

Key Facts

- Maximum entry age: 85

- Claims payout rate: 98.8% in 2024

- Standout features: Optional waiver of premium, Aviva DigiCare+ for health support.

Why It’s Good for Seniors

- Guarantees payout for funeral or estate planning

- Predictable premiums and flexibility for life changes

- Can increase cover without medical underwriting if IHT rules change.

Enquire about an Aviva Whole of Life policy.

Royal London

![royal london]() Royal London is the UK’s largest mutual life, pensions, and investment company, owned by its members rather than shareholders. With over 2.3 million members, it’s known for its customer-first approach – scoring highly on review sites.

Royal London is the UK’s largest mutual life, pensions, and investment company, owned by its members rather than shareholders. With over 2.3 million members, it’s known for its customer-first approach – scoring highly on review sites.

Key Facts

- Maximum entry age: 88

- Claims payout rate: 99.9% in 2024

- Standout features: Helping Hand wellbeing service, guaranteed insurability for certain life events without new medical evidence.

Why It’s Good for Seniors

- High flexibility for estate planning and legacy

- Strong customer ratings and Defaqto 5-star rating

- Excellent claims record for Whole of Life product.

Enquire about a Royal London Whole of Life policy.

Scottish Widows

![]() Part of the Lloyds Banking Group, Scottish Widows is one of the UK’s oldest financial institutions, founded in 1815. With over 200 years of experience, they have built a strong reputation for stability and customer care, offering a wide range of protection, pension, and investment products.

Part of the Lloyds Banking Group, Scottish Widows is one of the UK’s oldest financial institutions, founded in 1815. With over 200 years of experience, they have built a strong reputation for stability and customer care, offering a wide range of protection, pension, and investment products.

Key Facts

- Maximum entry age: 79

- Claims payout rate: 99% in 2024

- Standout features: Access to Scottish Widows Protect: a range of practical and emotional support services at no extra cost.

Why It’s Good for Seniors

- Excellent claims record

- Cover lasts to age 90

- Terminal illness cover included.

Enquire about a Scottish Widows Whole of Life policy.

Vitality

![Vitality]() Vitality is a leading insurance and investment company, offering a range of Life and Health Insurance products. Its core purpose is to make people healthier and help them to protect their lives, offering perks and incentives for policyholders who practice healthy habits.

Vitality is a leading insurance and investment company, offering a range of Life and Health Insurance products. Its core purpose is to make people healthier and help them to protect their lives, offering perks and incentives for policyholders who practice healthy habits.

Key Facts

- Maximum entry age: 84

- Claims payout rate: 99.7% in 2024

- Standout features: Unique rewards and discounts for adopting a healthy lifestyle.

Why It’s Good for Seniors

- Discounts and rewards for healthy living (up to 40% off premiums)

- Optional extras for later life care and illnesses such as dementia

- Strong claims payout record.

Enquire about a Vitality Whole of Life policy.

Zurich

![]() Zurich Insurance Group is a global insurer with over 150 years of experience, serving customers in more than 200 countries.

Zurich Insurance Group is a global insurer with over 150 years of experience, serving customers in more than 200 countries.

Key Facts

- Maximum entry age: 83 (for single life cover)

- Claims payout rate: 99.8% in 2024

- Standout features: Increase cover without medical underwriting.

Why It’s Good for Seniors

- Ability to adjust cover without medical checks

- No upper age limit at claim

- Strong financial stability and high claims payout rates.

Enquire about a Zurich Whole of Life policy.

Best Term Life Insurers For Seniors

There are more Term Life Insurance providers than Whole of Life Insurance providers, so you’ll have a few more to choose from if you go for this option.

Our list of “top” Term Life insurers has been put together by considering product offering, company size, longevity, and customer reviews.

Aviva

![]() Alongside their Whole of Life offering, Aviva also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Aviva also offers a Term Life Insurance product which can be suitable for seniors.

Key Facts

- Maximum entry age: 77

- Claims payout rate: 98.8% in 2024

- Standout features: Terminal illness cover, Aviva DigiCare+ for health support.

Enquire about an Aviva Term Life policy.

Legal & General

![]() Legal & General is one of the UK’s biggest Life Insurance providers, with a long track record in protection.

Legal & General is one of the UK’s biggest Life Insurance providers, with a long track record in protection.

Key Facts

- Maximum entry age: 77 (level/increasing), 74 (decreasing)

- Claims payout rate: 97% in 2024

- Standout features: Waiver of premium, wellbeing support services, and a £10,000 funeral pledge.

Enquire about a Legal & General Term Life policy.

Liverpool Victoria (LV=)

![]() LV= is a well-established UK mutual insurer (Liverpool Victoria), focused on protection, savings, and general insurance.

LV= is a well-established UK mutual insurer (Liverpool Victoria), focused on protection, savings, and general insurance.

Key Facts

- Maximum entry age: 84 (level/decreasing), 79 (inflation-linked)

- Claims payout rate: 97% in 2024

- Standout features: Terminal illness cover included, free access to LV= Doctor Services and legal advice line.

Enquire about an LV= Term Life policy.

Royal London

![]() Alongside their Whole of Life offering, Royal London also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Royal London also offers a Term Life Insurance product which can be suitable for seniors.

Key Facts

- Maximum entry age: 87 (if going through an adviser)

- Claims payout rate: 93.8% of Term Life Insurance claims in 2024

- Standout features: Helping Hand wellbeing services, including 24/7 GP access, nurse support for recovery and bereavement, and physical and mental wellbeing support.

Enquire about a Royal London Term Life policy.

Scottish Widows

![]() Alongside their Whole of Life offering, Scottish Widows also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Scottish Widows also offers a Term Life Insurance product which can be suitable for seniors.

Key Facts

- Maximum entry age: 79

- Claims payout rate: 99.1% in 2024

- Standout features: Access to Scottish Widows Protect support services, including 24/7 remote GP access and a dedicated nurse team.

Enquire about a Scottish Widows Term Life policy.

Vitality

![Vitality]() Alongside their Whole of Life offering, Vitality also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Vitality also offers a Term Life Insurance product which can be suitable for seniors.

Key Facts

- Maximum entry age: 74

- Claims payout rate: 98.9% in 2024

- Standout features: Unique rewards and discounts for adopting a healthy lifestyle.

Enquire about a Vitality Term Life policy.

Zurich

![zurich]() Alongside their Whole of Life offering, Zurich also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Zurich also offers a Term Life Insurance product which can be suitable for seniors.

Key Facts

- Maximum entry age: 83

- Claims payout rate: 99.8% in 2024

- Standout features: Waiver of premium included, Free Life cover during underwriting for up to £2 million.

Enquire about a Zurich Term Life policy.

IMPORTANT❗️

We have taken care to ensure that the above information is accurate. However, the market changes frequently, and we cannot guarantee 100% accuracy. The best way to get the most up-to-date information is to speak to our advisers. Call 02084327333 to find the best provider for your needs.

How Much Does Life Insurance for Seniors and Retirees Cost?

How much your Life Insurance will cost depends on a number of factors. However, Term Life Insurance is far cheaper than Whole of Life Insurance. That’s because Whole of Life Insurance guarantees a payout whenever you die, whereas Term Life Insurance as it only lasts for a set term.

For this reason, we find people generally cover much smaller amounts with Whole of Life Insurance (for example a few thousand pounds for funeral costs) than with Term Insurance.

Cost of Whole of Life Cover for the Over 50s

The cost of Whole of Life Insurance depends on various personal and policy factors. For example, to price your monthly premium, insurers look at your:

- Required level of cover

- Age

- State of health

- Smoker status.

To come up with the below premiums, we’ve had to make a number of assumptions about the individual involved. For instance, we’ve assumed they are:

- Healthy

- Seeking £50,000 worth of cover

- Retired.

These Whole of Life Insurance premiums are the cheapest available for someone who meets the above criteria.

Generate quotes in 60 seconds to compare Whole of Life Insurance prices tailored to you.

Cost of Term Life Insurance for the Over 50s

The cost of Term Life Insurance depends on various personal and policy factors such as:

- Total chosen benefit

- Length of cover

- Policy type (e.g. level or decreasing)

- Age

- Health / pre-existing medical conditions

- Smoker status.

In the table below, we’ve put together some quotes for both Level and Decreasing Term Life Insurance for seniors aged 50+. To do this, we’ve made a number of assumptions about each individual:

- Healthy

- Retired

- Seeking £100,000 worth of cover either on a level or decreasing basis until their 75th birthday.

The premiums in the table represent the cheapest Life Insurance quotes available for someone with the above characteristics.

Generate quotes in 60 seconds to compare Term Life Insurance prices tailored to you.

What’s the difference between Whole of Life Insurance and Term Life Insurance?

Whole of Life Insurance does exactly what it says on the tin. It covers you for your whole life, paying out on your death, whenever that is (providing you keep paying premiums).

The payout is guaranteed as the event is assured to happen. For this reason, insurers sometimes call it Whole of Life Assurance or Permanent Life Insurance.

Term Life Insurance covers you for a set term and then ends. If you pass away during the policy term, you receive a payout.

Premiums are much higher with Whole of Life Insurance because the insurer guarantees a pay out on your eventual death. Clients therefore typically use it for smaller benefits.

Term Life Insurance, on the other hand, has an end date. After this, the cover stops and the insurer doesn’t pay out. This end date means lower premiums.

Do Seniors Need a Medical for Life Insurance?

This depends on the type of cover you need and the size of the benefit you require.

For Over 50s Life Insurance, most insurers guarantee acceptance if you’re under a certain age. They won’t ask any questions about your medical history, except perhaps your smoker status.

However, all other Life Insurance for seniors needs some form of health assessment. This could be as simple as a list of medical questions.

For older adults, those applying for higher benefits or with medical conditions, the insurer might ask your GP for access to your medical records.

They may even want a full medical assessment by a nurse or doctor depending on your circumstances.

What's the maximum age I can take out Life Insurance?

This depends on the insurer. Many Life Insurance providers have a minimum term requirement, which means they won’t offer coverage for a period shorter than that minimum. While insurers each have a maximum entry age, the minimum term applies.

It’s best to speak to an adviser to find an insurer that meets your requirements. Call 02084327333 or compare quotes online to find out your options.

How can I bring down the cost of Senior Life Insurance?

Life Insurance has fewer adjustable policy options than other protection plans. This makes it harder to reduce the overall monthly premium with seniors Life Insurance.

However, if premiums seem too expensive, you could use following options to cut the cost:

- Quit smoking

If you go nicotine-free (including substitutes such as vaping / nicotine replacements) for 12 months, you can apply for lower premiums

- Reduce your benefit

Carefully calculate your benefit. For example, if the plan is for a funeral and cremation is acceptable for you and your loved ones, it’s usually cheaper than a burial. Or if it’s for an inheritance tax bill, there may be inheritance tax planning opportunities to lower the bill while you’re still alive

- Reduce the term

For term insurance, consider how long you’ll realistically need cover. The longer a policy lasts, the more it costs. Will you need a payout after your mortgage ends? Is cover to the maximum age essential or just nice to have? If so, you could reduce the term to cut premiums.

How will HMRC tax the payout?

When you pass away, the value of all your assets forms your estate. If your estate exceeds your nil-rate band threshold, HMRC charges inheritance tax at 40% on everything above the nil-rate band.

For inheritance tax, assets include payouts from Life Insurance. The size of your estate could therefore be boosted significantly by Life Insurance, resulting in a higher inheritance tax bill.

For most people, this is the exact opposite of what they want. Why pay premiums for a benefit only for HMRC to take a chunk before your family gets it?

However, if you’re planning to use Life Insurance to cover your inheritance tax bill it would be even worse, having exactly the opposite effect you intended.

That’s one of the many reasons it might make sense to write Life Insurance into trust so it’s separate from your estate when you pass away.

The insurer pays the benefit to the trust first before the trustees pass it to your beneficiaries. As the payout never falls into your estate, you avoid inheritance tax on it.

What about specific over-50s Life Insurance policies?

Over 50s Life Insurance is a specific type of Whole of Life Insurance.

It’s slightly different in that many insurers offer guaranteed cover for anyone under a minimum age, regardless of your medical history, without needing a medical.

As insurers don’t ask about your health, they can’t use it to assess the risk and calculate your potential life expectancy.

The maximum benefit available is usually therefore much lower, and premiums usually higher in terms of the payout you get for your money, than cover which looks at your medical history.

Is Over 50s Life Insurance the best option for me?

This depends on your circumstances.

For example, if you’re in your early 50s, a non-smoker and healthy, you may be better off with a policy that looks at your medical history.

That’s because you’ll likely find you can get a higher benefit at a lower cost than with most Over-50s Life Insurance plans.

However, if you’re older, a smoker and / or in poor health, the lack of medical questions could work in your favour. Cover with an insurer that asks health questions will likely be more expensive for you than an Over-50s policy.

Insurers which assess your health also tend to offer higher maximum benefits as they can better price risk. For example, the maximum benefit on Over-50s Life Insurance is typically just £25,000.

If you need a higher benefit than this, then Over-50s Life Insurance is unlikely to work for you.

Do Over-50s Life Cover policies have qualification periods?

Most policies have a qualification period: insurers also call it a moratorium or waiting period.

It’s a length of time at the start of the policy where it won’t pay out if you die. This might be 12 or 24 months.

Some insurers waive this if you die in an accident (for example a car crash) during this period rather than of natural causes. However, others won’t pay out for any death at all during this period.

If this happens, your loved ones typically get a refund of the premiums you’ve paid up until that point, but certainly not the full benefit you were expecting.

These qualifications period are not required on traditional life insurance policies where your cover is medically underwritten. As soon as your policy is live you are covered on a traditional plan.

Compare Senior Life Insurance Quotes and Get Specialist Advice

There’s a lot to think about when buying Life Insurance for retirees or older adults.

For example, not many people are lucky enough to make it to 50+ without some form of health condition. Older adults therefore tend to need more help navigating the market to find the best Life Insurance given their health.

Seniors also need to think about inheritance tax planning and funeral costs, making it harder to figure out how much cover you need, the type of policy that’s best, and how to structure it.

With so much to consider, and so much information to sift through, we’re here to help. We live and breathe insurance, and are ready to chat about what’s best for you.

We’ve helped thousands of people to protect their loved ones. Call 02084327333, email help@drewberry.co.uk, or compare quotes to get started.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Part of the Lloyds Banking Group, Scottish Widows is one of the UK’s oldest financial institutions, founded in 1815. With over 200 years of experience, they have built a strong reputation for stability and customer care, offering a wide range of protection, pension, and investment products.

Part of the Lloyds Banking Group, Scottish Widows is one of the UK’s oldest financial institutions, founded in 1815. With over 200 years of experience, they have built a strong reputation for stability and customer care, offering a wide range of protection, pension, and investment products. Vitality is a leading insurance and investment company, offering a range of Life and Health Insurance products. Its core purpose is to make people healthier and help them to protect their lives, offering perks and incentives for policyholders who practice healthy habits.

Vitality is a leading insurance and investment company, offering a range of Life and Health Insurance products. Its core purpose is to make people healthier and help them to protect their lives, offering perks and incentives for policyholders who practice healthy habits. Zurich Insurance Group is a global insurer with over 150 years of experience, serving customers in more than 200 countries.

Zurich Insurance Group is a global insurer with over 150 years of experience, serving customers in more than 200 countries. Legal & General is one of the UK’s biggest Life Insurance providers, with a long track record in protection.

Legal & General is one of the UK’s biggest Life Insurance providers, with a long track record in protection. LV= is a well-established UK mutual insurer (Liverpool Victoria), focused on protection, savings, and general insurance.

LV= is a well-established UK mutual insurer (Liverpool Victoria), focused on protection, savings, and general insurance. Alongside their Whole of Life offering, Royal London also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Royal London also offers a Term Life Insurance product which can be suitable for seniors. Alongside their Whole of Life offering, Zurich also offers a Term Life Insurance product which can be suitable for seniors.

Alongside their Whole of Life offering, Zurich also offers a Term Life Insurance product which can be suitable for seniors.