Freelancer Health Insurance covers the cost of medical treatment in private hospitals. With it, freelancers can avoid NHS waiting lists and receive prompt treatment when they need it the most. It’s particularly valued among our freelancing clients because, unlike employed people, they don’t usually get sick pay if they become ill or injured.

This lack of sick pay means freelancers must get back on their feet and working again as soon as possible to keep generating income.

NHS waiting lists for the treatment that may be required could be measured in weeks or months. It’s here Private Health Insurance can step in to speed up access to care.

What Does It Cover?

Most importantly, Private Medical Insurance (PMI) won’t fully replace the NHS for every healthcare need. For example, the NHS will still deal with any emergency hospital admissions and intensive care stays.

Coverage mainly depends on your chosen policy options. While it covers certain conditions and treatments as standard, your insurer may only cover others if you’ve enhanced your plan with additional options for an extra premium.

Inpatient vs Outpatient Treatment

Any medical care is broadly divided into:

- Inpatient and day-patient treatment

All treatment that requires a hospital bed, either overnight (inpatient) or only for a day (day-patient). This largely involves surgical procedures. All plans include this as standard.

- Outpatient treatment

All other medical attention not requiring a hospital bed, for example diagnostic tests and scans, consultations and certain treatments, such as physiotherapy. To access outpatient care, you must add it to your plan for an additional premium.

No Outpatient Cover

Choosing whether to add outpatient cover to your plan is one of the main decisions to make. You don’t have to — basic Medical Insurance offering only inpatient care is cheaper than a health plan with outpatient coverage.

![PMI No Outpatient Process]()

However, deciding not to add it means you’ll rely on the NHS for all outpatient appointments, tests and scans. Given current waiting lists, this could delay private inpatient care.

With Outpatient Cover

On the other hand, adding outpatient cover offers private consultations, tests and scans to diagnose you.

![PMI Outpatient Process]()

This is usually faster than the NHS can provide. If you need inpatient care, faster outpatient diagnostic procedures mean you get it sooner.

Cancer Treatment

Cancer cover is included as standard on most policies — it is one of the most valuable components of any Health Insurance plan.

This is because it can provide access to cutting-edge drugs, treatments, procedures and therapies the NHS may not be able to offer due to cost.

Private cancer care includes:

- Chemotherapy

- Radiotherapy

- Biological / hormone therapies

- Surgical removal of cancer and reconstruction surgery if necessary.

Meanwhile, although policies differ slightly in their offerings, you may also have coverage for:

- At-home chemotherapy

- Cash towards wigs and prosthetics you require as a result of cancer treatment / surgery

- Money towards scalp cooling, to reduce hair loss from chemotherapy

- Donations to a hospice should you need palliative care

- Home nursing for a set number of days, where a dedicated private nurse will come to your home to check on you during your care.

Virtual GP Appointments

As a freelancer, we know how busy you are. Moreover, we understand just how little time you can have to spare if illness strikes in the middle of a big project.

Thankfully, all Health Insurance plans now offer a digital GP service. This provides access to appointments with a UK-registered GP, typically 24 / 7.

![Video Doctors Appointment]()

Appointments are either over the phone or via video calls. You can arrange them whenever and wherever suits you, meaning you no longer have to wait for an NHS GP appointment during normal surgery opening hours.

A remote GP offers all the same services your NHS GP can. This includes offering medical advice, issuing prescriptions and making onward referrals for private health care under your plan if required.

Chronic vs Acute Conditions

It’s important to know the difference between chronic and acute conditions when considering Private Health Insurance.

Chronic conditions stick with you for life and don’t pass with time and treatment. These conditions include asthma and diabetes, which doctors can only manage rather than cure.

Acute conditions, meanwhile, respond to medical attention and pass with time. For instance, this includes cataracts requiring removal or joint pain needing joint replacement surgery.

It is important to note Private Medical Insurance only covers treatment of acute conditions. The NHS will continue to provide ongoing care and management of chronic conditions.

Are There Any Standard Exclusions?

Yes, Health Insurance policies come with some exclusions. Given plans are designed to supplement the NHS rather than replace it, the NHS still takes charge of some of your care.

Typical exclusions include:

- Routine pregnancy / childbirth (you may be covered for complications)

- Chronic conditions

- Cosmetic surgery

- Emergency medicine

- Intensive care

- Kidney dialysis

- Screening and preventative treatment (e.g. mammograms).

Do I Need It?

The NHS is fantastic. It does an incredible job and is quite rightly a much-loved national institution. However, external factors are acting on it to put it under unprecedented strain.

The past decade has seen a budget squeeze, for example, all at a time where demand for healthcare is rising. This has seen waiting times grow.

At the end of July 2020, there were 4.05 million people on NHS waiting lists in England. More than half such patients — 2.15 million people — had been awaiting treatment for more than 18 weeks. 83,203 had been waiting more than a year.

How Much Does Freelancer Health Insurance Cost?

The cost of premiums depend on you as an individual as well as the options and level of cover you choose. Personal factors influencing your monthly premium include your:

- Age

- Smoker status

- Current health and medical history

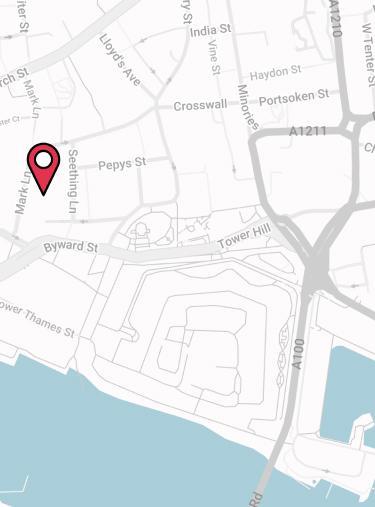

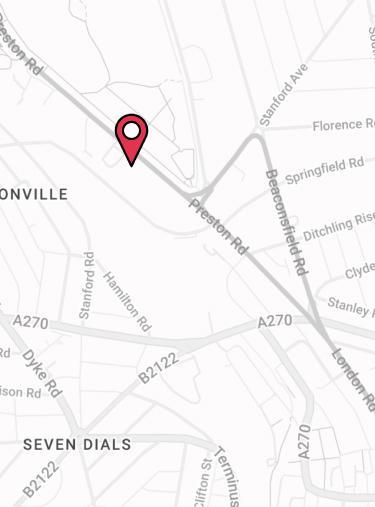

- Location.

Example Premiums

The table below contains premiums reflecting the cost of Health Insurance for freelancers. To calculate the cost we’ve researched and obtained quotes from all leading providers, assuming the freelancer in question is:

- In good health

- A non-smoker

- Looking for a comprehensive policy with full outpatient cover

- Willing to pay a £250 excess

- Going to be underwritten on a moratorium basis

- Not looking for any additional extras on their plan

- Based in the same postcode as our Brighton office.

Top Ways To Reduce The Cost

Health Insurance is modular, so your coverage (and therefore premiums) depends largely on the policy options you choose. As such, there are plenty of options available to cut the cost of premiums.

Raise Your Excess

With Private Medical Insurance, an excess is how much you’re willing to pay towards your care. Your insurer pays the rest of the bill above your excess, which means the higher your excess the lower your premiums.

Adding or increasing your excess is perhaps the best way to reduce premiums without impacting how comprehensive your policy is.

Policy excesses start at £100. However, excesses of up to £5,000 are available with some providers for certain treatments.

IMPORTANT NOTICE 🧐

While a higher excess means lower premiums, you should always ensure your excess is affordable for you if you ever need to claim.

Adjust Your Level of Outpatient Cover

As mentioned, outpatient care is an optional extra and can make up a significant proportion of the overall cost.

Comprehensive Health Insurance pays for all eligible inpatient and outpatient care in full. However, it’s the most expensive option.

To cut premiums without compromising as much on your level of cover, you could choose a mid-range plan. Here, the insurer caps the amount of outpatient care it pays for per policy year, often at £1,000.

This offers cheaper premiums than a comprehensive plan but with some level of outpatient cover should you need it.

Opt for the 6 Week NHS Wait

This option means that, before authorising private inpatient treatment, your insurer first checks the NHS waiting list for that treatment in your local area. If that procedure is available on the NHS in less than 6 weeks, then you have it under the NHS.

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Limiting Your Hospital List

You’ll likely have a choice of multiple ‘tiers’ of private facilities to choose from.

The cheapest option usually provides treatment in private wings of NHS hospitals. Meanwhile, at the other end of the scale, you have a comprehensive list. This offers care in the best private hospitals in the UK, including those in Central London.

Choosing a limited hospital list reduces premiums.

Can Freelancers Pay for Health Insurance Through Their Limited Company?

Ultimately this depends on your set up as a freelancer. If you’re self-employed without a limited company structure employing you, then the answer is no, you can’t buy Health Insurance through your business.

However, if you’re freelancing via your own limited company, you can use your business to pay for your Private Health Insurance.

Depending on your circumstances, your limited company paying for Health Insurance may offer tax relief that’s unavailable when you pay for a plan personally. This generally makes it cheaper to pay premiums this way over paying out of your own pocket.

IMPORTANT NOTICE 🧐

Speak to your accountant before setting up your cover to make sure you’re aware of the tax implications of running your policy through your business.

How Is It Taxed By HMRC?

If you pay for your Health Insurance through your company, the business can offset premiums against corporation tax.

However, there are other tax implications for both you and the business.

HMRC considers Health Insurance a P11D benefit in kind when a limited company buys Private Medical Insurance for its staff. As an individual, you’ll therefore have to pay extra tax on the value of the benefit you receive.

Meanwhile, the business must pay Employer’s National Insurance contributions on premiums.

Should you choose to pay for cover personally, on the other hand, there are no such tax issues. This is because you’re paying for an individual plan from income HMRC has already deducted tax from so there’s no additional taxation to consider.

Who Are The Top UK Private Medical Insurance Providers?

There are five major UK Health Insurance providers in the market each with their own unique proposition:

In addition to these major insurers, there are a handful of smaller, specialist providers that may prove the best fit for your needs.

It is very important to research the whole market and get quotes from all the leading UK insurers. Pricing can vary considerably depending on your circumstances and cover requirements.

We compare Health Insurance quotes from across the entire market so you know you’re getting the best deal. If you need help give us a call on 02074425880 or email help@drewberry.co.uk.

Regularly Reviewing Your Policy

Each year, your Freelancer Health Insurance will renew. Your insurer will write to you outlining the premiums you’ll pay for the coming 12 months.

Sometimes, premiums creep up over time. For this reason, it’s important you ask your adviser to undertake regular market reviews.

For our clients we review the market annually comparing Health Insurance quotes from every insurer to see if you can get cheaper cover elsewhere.

If you can reduce the cost of premiums by switching insurers, your adviser will handle this for you. It’s essential to do this with care, using continued personal medical exclusions (CPME) underwriting if you have medical conditions to consider.

CPME underwriting ensures you get vital continuity of cover when porting providers and your new insurer won’t add any exclusions that weren’t on your previous plan.

Compare Freelancer Medical Insurance Quotes & Get Specialist Advice

If you’re looking for Health Insurance as a freelancer, there’s plenty to consider.

Whether it’s finding the best insurer, discussing the level of cover or tax position we are here to make sure you obtain the most appropriate cover.

Why Speak to Us…

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health. Below are just a few reasons why it makes sense to talk to us.

If you need help setting up private medical insurance or reviewing an existing policy give us a call on 02074425880 or email help@drewberry.co.uk.