Private Health Insurance pays for the treatment of eligible medical conditions in a private hospital setting.

It offers access to the best medical treatment in some of the country’s top private facilities in exchange for a regular monthly premium.

People turn to Private Health Insurance because NHS waiting times are rising. Having cover allows you to skip queues for eligible conditions and receive treatment faster.

Health Insurance offers access to treatments such as joint replacements usually far quicker than the NHS can provide. Moreover, you’ll also have access to cutting-edge cancer care, including the latest drugs and therapies the NHS may not offer due to cost.

Do I Need It?

In the UK, we’re very fortunate in that the answer is technically no. No one needs Private Health Insurance thanks to the NHS, which provides healthcare free at the point of use.

However, following a funding squeeze, the NHS is under considerable financial pressure. This has resulted in longer waiting lists, more cancelled operations and generally greater difficulties accessing medical care.

Given retirees tend to need more healthcare more than their younger counterparts, many of our clients often prefer having some kind of provision to be seen faster privately.

Can I Get Private Health Insurance if I’m Retired?

Yes, it’s absolutely possible to get Private Health Insurance if you’re retired aged 60+.

In fact, many retirees choose Private Health Insurance specifically for their later years, recognising that things are more likely to go medically wrong as they age and wanting cover over and above what a stretched NHS can offer.

There are two maximum ages to consider when seeking Private Health Insurance: the maximum entry age and the maximum cease age.

The maximum entry age refers to how old you can be when you start a policy. Some providers, for instance, will only allow you to buy a policy if you’re under a certain age, such as 70.

The maximum cease age refers to how old you can be when the policy has to come to an end under the insurer’s terms and conditions. This is usually higher than the maximum entry age and could even run into your 90s or be unlimited.

Not every insurer will have a maximum cease age, so it’s worth comparing each provider (see the list below) to check which one is best for you.

What Does Private Medical Insurance Cover?

Firstly, the facilities at private hospitals usually include single-occupancy, ensuite rooms.

You’ll also have far more control over when and where the treatment occurs, as well as the specialist / consultant / doctor / surgeon performing that treatment.

Chronic vs Acute Conditions

Private Medical Insurance offers cover for eligible health conditions.

There are a few rules regarding what exactly is an ‘eligible’ condition, with the main one being whether a condition is chronic or acute. Health Insurance only covers acute conditions, with the NHS providing care for chronic conditions.

- Acute Condition

A condition that will pass with treatment (e.g. joint pain needing a joint replacement, gall bladder issues requiring gall bladder removal, cataracts, hernias etc.)

- Chronic Condition

A long-term condition which is persistent and cannot be cured. This includes asthma, diabetes, psoriasis etc.).

Health Insurance is designed to complement and work in tandem with the NHS rather than replacing it entirely.

For example, you’ll still use the NHS for emergency medical treatment or intensive care, which the NHS is much better placed to offer than private hospitals anyway.

Inpatient vs Outpatient Treatment

Treatment in all hospital settings is split into inpatient treatment and outpatient treatment.

Inpatient treatment requires a hospital bed, either overnight or just for the day as a day-patient. This is most commonly after surgery.

Outpatient treatment doesn’t need a hospital bed and includes diagnostic tests and scans, consultations and all other care not requiring a bed.

While every policy covers inpatient and day-patient treatment in full, not every policy covers outpatient treatment. Instead, you have to add such care onto your policy for an extra premium.

No Outpatient Cover

![Private Health Insurance No Outpatient Process]()

With Outpatient Cover

![Private Medical Insurance Outpatient Process]()

No Outpatient Cover: The Risks

You’ll usually need outpatient care of some sort (e.g. diagnostic investigations such as an x-ray or scan) before you’re admitted to hospital as an inpatient for surgery.

While you don’t have to include outpatient cover on your policy and can use the NHS for this aspect of your care to save money, this could delay your private inpatient care given current NHS waiting times.

Your Medical Underwriting

A major factor in determining what your Private Health Insurance covers will be the underwriting you select.

You have the option to choose between Full Medical Underwriting or Moratorium underwriting. Which one is right for you will depend on your circumstances and medical history.

This is complicated and is best discussed in conversation with your adviser, but roughly speaking:

- Moratorium underwriting (MORI)

The most common type of underwriting, this excludes any medical conditions you’ve suffered in the past 5 years. This is usually on a rolling moratorium basis, which means if you spend 2 years on the policy without seeking any advice, medication or treatment for a particular condition, the insurer may look to cover it once that 2 years has passed.

- Full medical underwriting (FMU)

Full medical underwriting requires you to declare your full medical history before taking out a policy. The insurer will likely exclude any condition you’ve suffered from in the past, even if it occurred more than 5 years ago. This exclusion will usually be permanent. However, it may be possible to get it lifted at a later date with medical evidence from your GP. For more minor conditions, you may be able to negotiate coverage with your insurer, particularly if that condition occurred a number of years ago.

The Cost of Private Healthcare in Retirement

You have two options for getting private healthcare in the UK: self-funding or paying for Private Health Insurance.

Many people think they would be able to afford self-funding private medical treatment. However, the reality is that we’re fairly divorced from just how much medical care costs in the UK thanks to the NHS picking up the bill.

You may therefore be surprised at just how much private treatment costs. We’ve laid out below how much private treatment would cost for some of the most common operations the NHS carries out each year.

As you can see, some of the procedures you may need as you get older, such as joint replacements, are among the priciest treatments.

Cancer treatment, meanwhile, especially if you are eligible for new drugs not yet approved by the NHS due to cost, can easily run into tens of thousands of pounds or more once you consider surgery, radio / chemotherapy, tests, scans and aftercare.

Few people could afford such an out of pocket expense, especially in retirement when they no longer have an income from work. It’s here Private Health Insurance can step in.

How Much Does UK Health Insurance Cost for the Over-60s?

Overall, the cost of Health Insurance for retirees is calculated depending on your circumstances and a variety of other factors, including your:

- Age

The older we are, the more likely we are to need medical treatment and so the higher the cost of cover

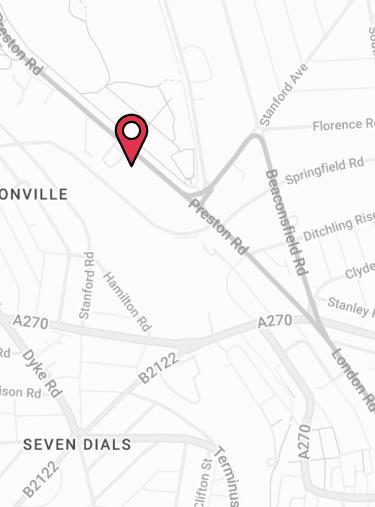

- Location

Living in areas with more expensive hospitals increases your premiums

- Claims history

If you have made a claim on Health Insurance in the past, you may face higher premiums

- Smoker status

The negative health effects of smoking mean insurers charge smokers higher rates.

The premiums in the table below are for people who are:

- Healthy non-smoking individuals

- Retired

- Living in the same postcode as our Brighton-based financial advisers

- Going to be underwritten on a moratorium basis

- Wanting full outpatient cover

- Willing to pay a £500 excess towards the cost of their treatment per year.

Cutting the Cost of Premiums

The price of Health Insurance naturally rises as we age and become more prone to illnesses and injuries that could lead us to claim.

However, there are things you can do as an individual to reduce the cost of Health Insurance and secure yourself cheaper Private Medical Insurance premiums. This can be particularly beneficial if you’re of retirement age.

Below we’ve listed a selection of options you may wish to consider to bring down the cost of your premiums.

6 Week NHS Wait

The 6 week NHS wait means that you’ll receive inpatient treatment on the NHS unless the NHS waiting list for that treatment exceeds 6 weeks.

Despite growing NHS waiting lists, many treatment are still available within this 6 week window, meaning you’ll likely receive NHS care within this time period.

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

No Claims Discount

Linked to the 6 week NHS wait is a no claims discount. While you’ll still likely see an age-related increase in premiums each year, this can be reduced significantly if you’ve held the policy for several years and not had to claim on it.

Even if you become ill but you receive treatment on the NHS in the 6 weeks, you won’t be classed as having made a claim on your Health Insurance.

Level of Outpatient Cover

As mentioned, hospital care is split into inpatient and outpatient treatment.

Outpatient treatment is an optional extra you can add to your policy at additional cost.

To save money, you can opt not to have any outpatient care on your policy, meaning the NHS would carry out all diagnostic tests and scans etc.

Alternatively, you could opt for a mid-range policy. Here, the insurer places an annual cap on the amount of outpatient cover you can receive, typically at £1,000 per annum.

Higher Excess

You have a choice of excesses when it comes to Private Health Insurance, ranging from £0 all the way up to £5,000 depending on the insurer.

Your excess means that you have to pay that amount upfront towards your private medical care before the insurance kicks in and picks up the bill for the rest.

Just as with car insurance, the higher your excess, the lower your premiums.

An excess is usually paid once per policy year, so if you have multiple claims in one policy year you’ll only need to pay the excess once. However, there are some insurers which charge the excess per claim, so you need to be sure you understand how your excess will work.

Hospital Access

One option that can save money is to choose your hospital list wisely.

You have the option to choose hospitals that may include private wards of NHS hospitals all the way up to the best Central London hospitals that charge the highest sums for their procedures due to their prestige, location and top-notch facilities.

If you limit your hospital list to a lower ‘tier’ of facilities you can cut the cost of your Health Insurance.

Compare UK Health Insurance Providers

The biggest way to save money on the cost of Health Insurance premiums for retirees is to ensure you compare the market when taking out the policy.

Using an independent financial adviser such as Drewberry — we have access to every single UK Health Insurance company, including some that may offer preferential pricing for clients who access cover through an adviser — can save you cash.

Review the Market Annually

Health Insurance is an annually-reviewable policy, which means that at the end of each policy year you can conduct a market review to see if you can get a better price.

While this is not typically an option for those who’ve made a ‘major’ claim on Health Insurance — typically including cardiac, cancer and mental health claims — it may be an option for you, especially if you have built up a no claims discount.

Compare Best 5 UK Health Insurance Providers

The UK has five major health insurers:

The market also has a handful of smaller companies. At Drewberry, we compare Health Insurance quotes from every single UK insurer so you know you’re getting the best deal.

Need Help? Get Specialist Advice…

If it’s all getting a bit confusing and you’d just like some advice, why not give us a call?

We’re available on 02074425880 and can help with a range of questions and queries before helping you arrange Health Insurance.

Why Speak to Us…

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health. Below are just a few reasons why it makes sense to talk to us.