Drewberry’s Online Relevant Life Insurance Quote Engine for UK Small Businesses

Drewberry has constructed the UK’s first online comparison engine for Relevant Life Insurance available to consumers, paving the way for far greater takeup of this highly tax-efficient life cover.

Get Tax-Efficient Life Insurance with Relevant Life Cover…

It’s all about recognising the opportunity…

Only a small percentage of UK small business owners are currently aware of the opportunities presented by what’s known as ‘relevant life insurance’. Relevant Life Cover is highly tax-efficient, providing a way for owners of UK businesses too small to qualify for group life underwriting terms and secure valuable life insurance cover for themselves and their chosen employees.

There are currently well over five million UK businesses employing less than nine people. Such companies account for around a third of total employment in the UK. However, only a fraction are currently making use of Relevant Life Insurance cover even though it can reduce Life Insurance premiums by 30-50% effectively (post-tax).

Tom Conner

Director at Drewberry

What is Relevant Life Insurance?

Relevant life insurance differs from individual life cover in that the premiums are paid by your company, which retains ownership of the policy. If the individual covered then dies during the policy’s term, the proceeds are paid into a Relevant Life trust. The Life Insurance payout is tax-free to beneficiaries when distributed via such a trust.

“In the meantime,” Tom continues “the various tax and national insurance savings can reduce the premiums by 30% or more while the company can write off the cost of the premiums as a business expense.

“This makes it a very efficient way for companies that are too small to qualify for group life insurance terms to extend a highly valued company benefit to their employees.”

It’s also a means the two million or so owners of small business with more than one employee can effectively secure hugely discounted life cover for themselves for so long as they continue to work for the company they own. Check out a fully-worked example of the potential tax savings with Relevant Life Insurance here →

Our Online Quote Engine Calculates Tax Savings from Relevant Life Insurance

Despite its appeal, only a tiny minority of small business owners have so far taken advantage of Relevant Life Cover. This is partly down to the hours they tend to put in and partly due to the fact that too few of their accountants or business advisers – if they even have them – have made them aware of the opportunity.

Samantha Haffenden-Angear

Business Protection Specialist at Drewberry

That’s why Drewberry built the UK’s first online comparison engine for Relevant Life Cover. We hope to bring down many of the barriers that have so far prevented business owners from engaging with the topic.

Like all our online tools and calculators, it’s free to use and will provide full details of premiums for the best Life Insurance for small business owners. It also allows for any number of possible variations – because we recognise that no two businesses and small business owners are the same.

Spreading the Word: Tax-Efficient Life Insurance

Our main hope is that accountants and business advisers encourage their small business clients to make use of this easy to use tool as a first step to improving their life insurance coverage and that of their key employees. With potential savings of up to 50% available on Life Insurance for company directors, it’s at least worth getting a quote.

Contact Us

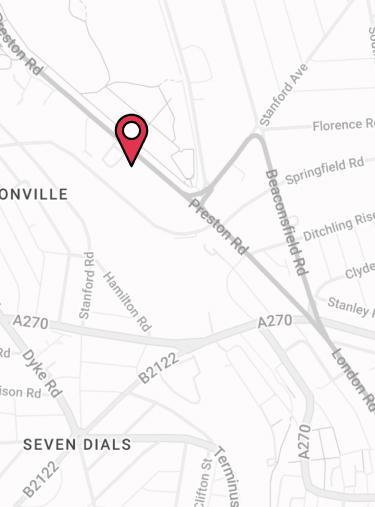

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.