Complete Guide To Employee Benefits In The UK

Employee benefits are products and services an employer pays for on behalf of their staff. A benefits package can encompass a range of perks that reward staff for their hard work and promote their wellbeing. This includes a pension (now mandatory for many workers under auto-enrolment), as well as insurances and other wellbeing benefits.

The most common retirement and group insurance products businesses provide for their staff include:

- Group Personal Pension

- Group Life Insurance

- Business Health Insurance

- Group Income Protection / Sick Pay Insurance

- Critical Illness Cover.

These policies all protect a group of employees under a single umbrella. This lets employers insure their staff in an efficient manner that’s easy to manage.

Why Should We Offer Staff Employee Benefits?

While most benefits aren’t mandatory, there are a number of reasons you might introduce them for your staff. For instance, they’ve been shown to:

- Boost workplace morale

- Lower stress

- Reduce both presenteeism and absenteeism

- Improve productivity

- Increase the physical and mental health of the workforce

- Make it easier to attract top talent to your business

- Help retain existing staff.

Simply knowing the scheme is available if they need it is often enough to give workers a boost. Meanwhile, should they ever be in a position where they’re eligible to claim on any of these policies, having such a safety net can be a huge weight off their minds.

Which Benefits Should We Offer Our Employees?

Ultimately, this will depend on the needs of your workforce and where their priorities lie. After all, it’s no good providing benefits that staff won’t use or value.

To help in this area, consider Drewberry’s latest employee benefits survey. The top insurance benefits workers wanted their employer to offer were:

- Private Medical Insurance (31.3%)

- Life Insurance (29%)

- Income Protection Insurance (23%)

- Critical Illness Insurance (22.1%).

However, you don’t just have to offer paid-for benefits. We’ve also put together a list of low-cost or even free benefits you can offer your workers.

These include childcare vouchers, career development / training options and general help with employee wellbeing, such as assistance with healthy living, which might include regular exercise breaks or healthy snacks.

The best package will include a mixture of both types of benefits. Following our survey results we wrote another guide that you may find useful which details the 10 Best Employee Benefits People Value in 2024.

Types of Benefits for Employees

Workplace Auto-Enrolment Pension

A workplace pension with minimum employee and employer contributions is a mandatory requirement in the UK. That said many employers choose to go above and beyond their requirements to help position their staff for the best possible retirement.

There is a lot to consider if you are implementing or reviewing a group pension including:

- Level of employer contributions

- Option for salary sacrifice

- Choice of pension provider and associated charges

- Choice of investment funds

- Technology and ease of integration

- Educating staff on the value of saving for tomorrow.

There is a huge difference you can make by negotiating a pension with lower charges and better fund choice to help your employees save more for tomorrow.

To learn more you can read our guide comparing the top workplace pension providers in the UK →

Good Communication Is Vital…

As important as it is to implement a cost-effective flexible workplace pension it is vital you educate your people on the value of saving for retirement.

Educating your staff via financial wellbeing seminars or 1-2-1 sessions turns a mandatory requirement into one the most valued employee benefits you can offer.

Using our tools and expertise we do as much work communicating the benefits of the group pension for our business clients as we do the initial implementation.

Business Health Insurance

A Business Health policy will pay for your staff to have private medical care, allowing them to bypass NHS waiting lists and get treatment when they need it most.

It’s the most sought-after policy among workers and therefore very popular to introduce.

It has a range of benefits which can greatly reduce stress for employees who fall sick, such as:

- Reduced waiting times compared to the NHS, cutting time spent off work with painful health conditions, potentially on minimal sick pay

- Freedom to choose the hospital and professionals which provide your treatment

- Access to the latest procedures and medications, including some the NHS may not yet fund due to cost.

Popular Group Health Insurance Guides

- Complete UK Guide To Business Health Insurance

- How Much Does Company Health Insurance Cost?

- Business Medical Insurance Or Corporate Health Cash Plan?

- Setting Up International Health Insurance For Employees

- Client Story / How Drewberry Helped Thriving Engineering Firm Ytron-Quadro With Their PMI

Why Trailmix Offered Its Staff Health Cover…

London-based mobile gaming startup Trailmix introduced a small business Health Insurance scheme for its 18 workers that packs a big punch.

“Although we’re a fairly small company, this scheme has now put us on par with our competitors in the mobile gaming industry in terms of what we offer to staff,” says Lauren Alper, Trailmix’s Office Manager. “It should therefore help us attract the best talent going forward.”

Here’s why they chose Drewberry for the help and advice they needed.

Death in Service Insurance

Death in Service Cover — also known as Group Life Cover — will pay a lump sum (a multiple of an employee’s salary) to an employee’s loved ones should they pass away during their tenure at your company.

They don’t have to die while on the job. The death can occur anywhere providing they have a valid employment contract with you at the time.

As you set up a trust alongside the policy, this means the payout is free from tax for the beneficiaries.

Group Life Cover is the first policy many companies introduce because, while it’s fairly inexpensive, employees value it highly.

Useful Death in Service Guides…

- Complete UK Guide To Death In Service Insurance

- How Is A Death in Service Policy Taxed?

- What’s The Difference Between Group And Individual Life Insurance?

- Introducing Relevant Life Cover For Companies Too Small To Set-Up A Group Scheme

Why Profile Pensions Set-Up Employee Life Insurance…

“Getting Group Life Insurance in place was a bit of a no-brainer,” says Michelle Donlin, Profile Pensions’ HR and Office Manager.

“Our employees get comfort from knowing it’s there and we’re proud to provide that. We work hard to provide good benefits to our staff and show a commitment to our employees, so introducing an employee benefit was really a logical step.”

Group Income Protection

Group Income Protection — also known as Sick Pay Insurance — will pay a monthly benefit for your workers if they fall sick and can’t do their job for any medical reason. This benefit is a proportion of their monthly income before tax.

The insurer pays the benefit to you as the employer. You then distribute these funds to the employee, typically via PAYE or however else you pay your workers’ wages. As a result, employees therefore pay income tax on the benefit, just as they would on their salary.

You can set up the policy to pay out for 1, 2 or 5 years per claim (short-term cover). Alternatively, long-term cover will continue to pay a benefit until the employee reaches retirement age.

Group Income Protection has a deferred period which defines how long employees need to be out of work for before they can claim. You usually set this to align with your sick pay policy.

Getting Own Occupation Cover…

If you buy a policy with an own occupation definition of incapacity, your employees will be able to claim as long as their health problem prevents them from working in their specific role.

A different definition of incapacity may mean that an employee will not be able to claim if your provider considers them well enough to work in other roles.

More On Group Income Protection…

Group Critical Illness Cover

Group Critical Illness Cover will pay out a tax-free lump sum to an employee who becomes critically ill. This lump sum is usually set to a multiple of income, generally 1-5 times gross basic salary.

To claim, the worker must be critically ill with one of the conditions listed in the policy documents. They must also meet the definition of that condition laid out therein.

While a Group Critical Illness payout can be of great help, it covers fewer conditions than Income Protection. You may therefore find that Group Income Protection is a better fit for your workforce.

More On Group Critical Illness Cover…

Employee Assistance Programs & Additional Benefits

Employee assistance programs provide free services and additional benefits for employees. You can either arrange an employee assistance program separately or, increasingly, make use of the additional benefits that come free with your group insurance.

However, not many people are aware that these services come with their group protection. As such, they’re incredibly underused, despite the huge value such services can offer.

Some of the more popular include:

- Legal, medical and financial assistance helplines

- Counselling / cognitive behavioural therapy (CBT), either face-to-face or over the phone

- Bereavement counselling

- Access to physiotherapy

- Remote GP services.

Why Choose an Employee Assistance Program?

These can provide comfort and support for employees and their families, which can have a range of benefits.

When Aviva performed a study on the effects of its Employee Assistance Program, it found that 75% of employees that the program supported returned to work within 6 months if they were absent due to illness or injury.

Employees with access to these programs can use the services at any time, even if they are not currently making a claim.

This means workers can use these services not only for assistance in difficult situations, but also to help them avoid issues in the first place.

I recently used Smart Health’s remote GP service myself due to a health issue I hoped would go away but only got worse.

It worked fantastically — the appointment was thorough, easy to arrange, didn’t feel rushed and was just what I needed to provide reassurance without having to take time out of the office to wait in my local GP surgery.

Andrew Jenkinson

Director at Drewberry

AIG’s new Smart Health service offers the opportunity to book a GP appointment and speak to a doctor through their smartphone. It’s offered as part of AIG’s Death in Service package, which we have for all our staff.

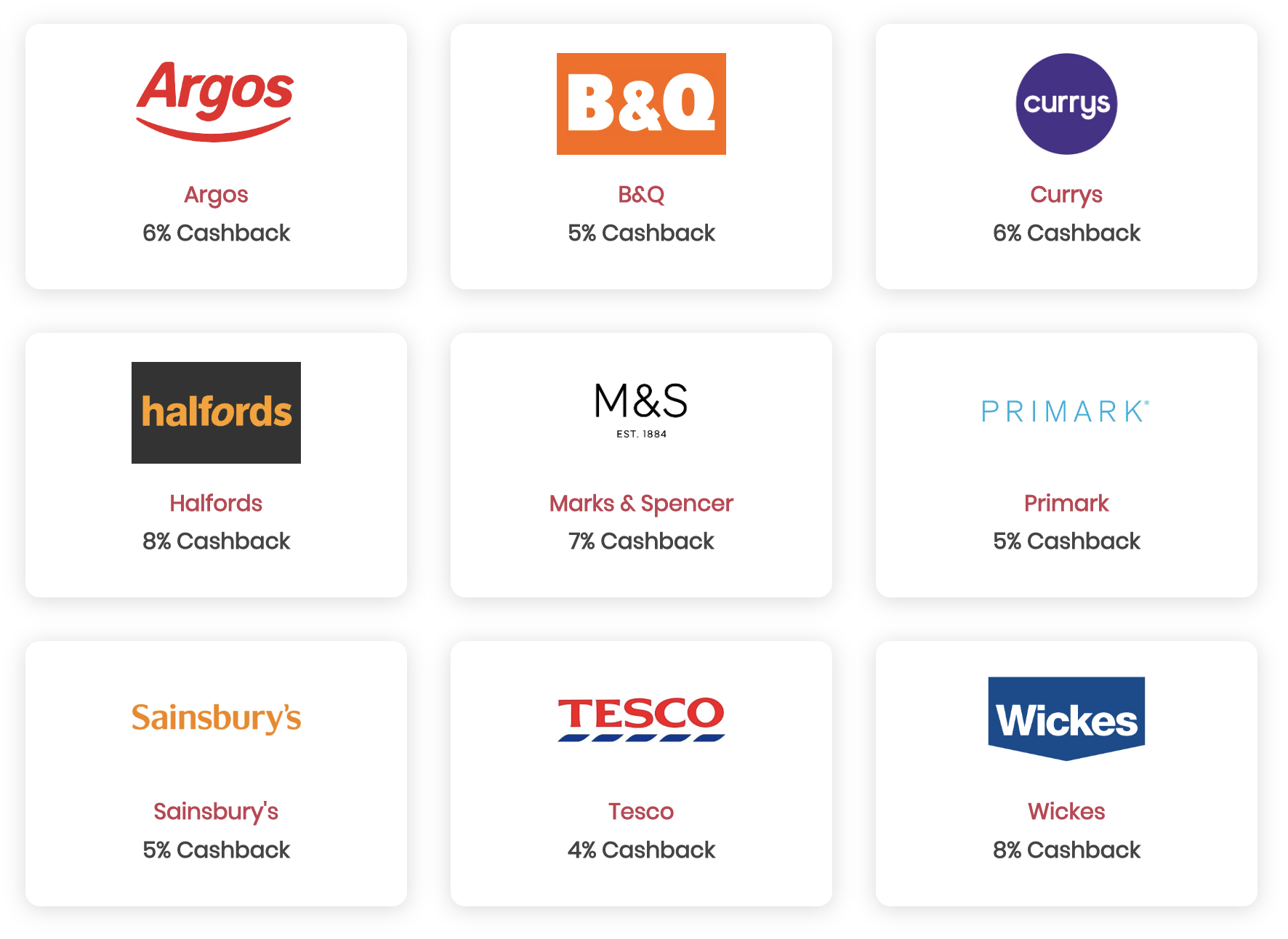

Help Your Staff Save With An Employee Discount Scheme

Finding ways to help staff with the cost of living crisis has prompted many employers to look at ways they can help their staff save on their monthly expenses.

In addition to offering a Corporate Cash Plan to save money on medical costs or paying Pension contributions via salary sacrifice many firms are implementing an employee discount scheme to help with the everyday costs.

Help your employees save thousands for year

An employee discount platform can cost as little as £1 – £2 per employee per month but can provide staff with everyday discounts that can help them save hundreds of pounds per month.

Our employee discount offering provides sizeable discounts on groceries, clothing, travel, technology, eating out and more.

For further information on implementing a discount scheme for your staff please do not hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

Who Are The Best Employee Benefits Providers In The UK?

Below are some of the top Employee Benefits providers. There are four main providers in the Group Health Insurance market, while the Group Risk market (comprising Group Income Protection, Group Life Insurance and Group Critical Illness Cover) has six major insurers.

Best Workplace Pension Providers

- Aegon

- Aviva

- Nest

- Now: Pensions

- Royal London

- The People’s Pension

Best Private Medical Insurance Providers

- Aviva

- Axa

- Bupa

- Vitality.

Best Group Risk Providers

- AIG

- Aviva

- Canada Life

- Legal & General

- MetLife

- Unum.

Each provider has different limits, different multiples of remuneration, different deferred periods and a variety of other factors which vary between providers. There will also be a marked difference in the additional benefits free with each insurer.

Which provider to choose will therefore be different for every company, even among businesses of similar sizes in similar industries.

How Do I Get Quotes?

While you can get quotes for personal policies online, it’s more difficult for group benefits. This is because there are so many details that factor into the cost of a policy.

For instance, in order to get accurate pricing for your workers, you’ll need to provide:

- Group size

- Employees’ dates of birth

- Employees’ genders

- Geographic location

- Industry and occupation

- Salary details

- Desired policy options.

You’ll then have to take these details to every provider on the market one by one to compare premiums and ensure you’re getting the most competitive quotes.

To make the process easier, our expert employee benefits consultants do all of this heavy lifting on your behalf.

Compare Employee Benefit Insurance Quotes & Get Expert Advice

Putting together the right employee benefits package can be a difficult task, as is finding the right balance between cost and coverage.

At Drewberry, our dedicated experts collect and compare quotes for you from across the entire UK market. Once that’s done, we provide a recommendation report detailing the best solution for your circumstances.

Why Speak to Us?

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- We are award winning 🏆 independent insurance advisers who work with all the leading UK insurers

- You’ll speak to a dedicated expert from start to finish

- We are very proud of the 3765 and growing independent client reviews rating us at 4.92 / 5

- We are authorised and regulated by the Financial Conduct Authority. You can find us on the financial services register here 🧐

- Claims support when you need it most.

If you need help setting up or reviewing your employee benefits give us a call on 02074425880 or email help@drewberry.co.uk.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.