What’s the Best Life Insurance for Self Employed in 2021?

There is no doubt that when it comes to being self-employed there are a number of advantages. You can manage your own time, control your own finances and make decisions freely.

This is great, however being your own boss also means that you won’t get some of the key benefits that come with being employed. For example:

- Death In Service / Life Insurance

- Holiday Pay

- Sick Pay

- Health Insurance

As a result of this, it is up to you to make sure you have appropriate insurance policies in place, such as Life Insurance and Income Protection Insurance, to protect you and your loved ones.

We understand that it’s uncomfortable to think about, but if the worst were to happen how would your loved ones cope financially? Would they cope financially?

What is Life Insurance?

Life Insurance, also referred to as term life assurance or life cover, is an insurance policy you can put in place to protect your life.

Although we say protect your life, what we really mean is to protect your loved ones financially in the event of your death. Dealing with loss is hard enough without having to worry about how you will continue to pay your monthly outgoings.

With a Life Insurance policy, should the worst happen and you as the policy holder pass away, those you leave behind will receive a lump sum payment to help them cope financially.

What Can Life Insurance Cover?

The simple answer is that it’s up to you. When putting cover in place it’s important to think about what costs you currently have and whether or not your loved ones would still be able to afford these outgoings if you were no longer here.

Some common examples that people use a Life Insurance payout for include:

- Paying off a mortgage

- Replacing self-employed salary

- Funeral costs

- Family living costs

- Child care costs.

However it doesn’t have to be limited to the above. If you were employed and entitled to a Death in Service benefit, the amount of cover would be based on a multiple of your salary. What your loved ones chose to spend this on would be up to them.

Protecting Your Loved Ones With Life Insurance

We all like to think that the worst won’t happen. But the scary reality is that you are SIX times more likely to pass away before retirement age than you think.

With this in mind its worth making sure that if something was to happen, you have everything in order and know your loved ones would be taken care of financially.

Getting used to a life without you would be hard enough for them, without having to adjust the lifestyle they know and love because they simply couldn’t afford it anymore.

Why Self Employed Blogger Lynn Took Out Life Insurance…

Self-employed, Writer and Mum of three Lyn, knows all too well the importance of not just having Life Insurance but having the right level of cover in place.

What’s The Best Type Of Life Insurance For Self-Employed?

As a sole trader you can take out a personal Life Insurance policy, which means being self-employed you pay for it yourself.

Because of this it can’t be classed as a business expense, therefore it is not tax-deductible like other products which would be available to a Contractor or Company Director. However there are plenty of options to choose from.

Term Life Insurance For Self-Employed

With this particular Life Insurance you can choose the length of time you would like a policy to run for. This is known as the ‘term’ of the policy.

Should you pass away within this term your loved ones would receive a payout. For example if your term ended at age 65 but you died at 59, the policy would pay out. However if you died at age 67 no payout would be made.

There are a number of different Term Life Insurance policies that the self-employed can chose from, these include:

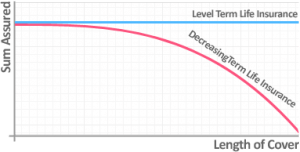

Decreasing Term Life Insurance

This particular product is designed mainly to ensure that should you pass away your loved ones could repay any outstanding mortgage.

Premiums for ‘Decreasing Term Life Insurance‘ tend to be cheaper than other types of Life Insurance. This is because the cover is aligned with your mortgage and over time, as your mortgage reduces so does the cover amount.

Level Life Insurance

Unlike with Decreasing Term Life Insurance, when you take out a Level Term Life Insurance policy, you will choose a fixed amount of cover which will not change over time.

The amount you choose to cover will be what is paid out should you die during the term of the policy. It is important to note that your premiums would also increase each year as well as your benefit amount.

Increasing Term Insurance

Over time money loses its value, £100,000 today won’t buy you the same as £100,000 in 30 or 40 years. This is because the cost of living increases each year.

With Increasing Term Life Insurance you can choose a fixed amount to cover, just like with a Level Term Policy, however the difference is that each year the amount of cover will increase inline with inflation. So the amount you choose to cover now will still have the same value in 30-40 years.

When it comes to Life Insurance having a policy is better than not having one. This is true for those that are employed and self-employed.

However it’s also really important to make sure you get the right amount of cover so that you aren’t under insured.

Samantha Haffenden-Angear

Independent Protection Specialist at Drewberry

Family Income Benefit

Rather than paying out one lump sum payment, Family Income benefit provides your loved ones with a regular, tax-free income. Just like a monthly salary, it is designed to cover every day living costs such as:

- Food

- Rent / mortgage payments

- Bills

- School fees

- Car running costs

Whole Of Life Cover

Whole Of Life Cover is exactly that. It covers someone for the whole of their life as long as they continue to pay premiums. There is no term associated with it, so no matter what age someone is when they pass away their loved ones would still receive a payout.

Whole Of Life Insurance And Inheritance Tax

Often Whole Of Life Insurance is used to cover the cost of a funeral or more commonly now, offset the cost of an inheritance tax bill.

If you were to pass away, tax would be due on the value of your estate above a certain threshold. This means anything you want to leave behind above this threshold would be taxed by a whopping 40%.

The likelihood is that those looking to inherit your estate won’t have the cash available to pay the tax bill. As a result, they would have to either sell some of your assets or dig into their own pockets.

With Whole of life insurance this is no longer a worry as it can provide a lump sum payment which can be used to pay the tax man.

Life Insurance for Company Directors

For those that are self-employed a personal Life Insurance Policy is the only option.

However, if you are a Company Director you can choose a Relevant Life policy which can be paid for by your company. Because of this it can be classed as a business cost, therefore making it tax-deductible.

It is important to note however, that a Relevant Life policy only provides Life Insurance and additional cover such as Critical Illness and Income Protection isn’t included.

Because of this, when helping Company Directors set up Relevant Life policies, we often recommend putting Income Protection in place. This is so if you were unable to work due to illness or injury you would still receive a monthly income.

What Is The Cost Of Life Insurance For Self-Employed In 2025?

The cost of Life Insurance will depend on a number of personal and policy factors, the main ones include:

- How much you wish to cover

- Length of policy

- The type of policy you choose

- Smoker status

- Your current state of health

In the tables below we have calculated the monthly cost of Level and Decreasing Term Life Insurance for a self-employed smoker and non-smoker.

Table one provides example monthly premiums for just Life Cover and table two highlights the monthly premiums for Life and Critical Illness Insurance.

To get these monthly premiums we have assumed that the required benefit amount is £250,000, over a term of 35 years and where Critical Illness is required a benefit amount of £60,000.

Life Insurance Only | Type of Cover | 🚭 | 🚬 |

|---|---|---|

Decreasing Term | £10.90 | £20.75 |

Level Term | £12.74 | £27.17 |

Life Insurance With Critical Illness | Type of Cover | 🚭 | 🚬 |

|---|---|---|

Decreasing Term | £28.57 | £47.39 |

Level Term | £46.49 | £73.25 |

Best Providers Of Life Insurance For Self-Employed In UK 2025

There are a number of providers who offer Life Insurance, we’ve put together a list of those offering the best self-employed cover below:

Top Additional Life Insurance Benefits & Support Services

Nowadays Life Insurance is more than just a piece of paper in a draw, it can offer real tangible benefits which sit outside of its core cover.

Many insurers offer FREE additional benefits which you and your family can take advantage of. These Include things such as:

- Virtual GP

- Second medical opinion

- Discounts / rewards

- Fitness Tracking

- Counselling and support services

Is Self-Employed Life Insurance tax-deductible?

For the Self-employed Life Insurance premiums are not tax-deductible. However if you are a Company Director you could take advantage of tax-relief.

Rather than taking out a personal Life Insurance policy you could opt for Relevant Life Insurance instead.

This particular product is paid for by the company you are a Director of and as a result of this, the premiums would classed as a business cost which would be tax-deductible.

The Best Others Types of Self-Employed Insurance

Income Protection

Income Protection Insurance is a type of cover that protects your monthly income should you be unable to work due to illness or injury.

Being self-employed you won’t benefit from company sick pay so if you are unable to work, your income would stop.

By putting Income Protection in place you will ensure that should this happen you will still be able to afford your monthly outgoings and focus on getting back on your feet.

Critical Illness

When taking out Life Insurance you can also opt to add Critical Illness cover to your policy. This protects you should you fall seriously ill with certain conditions which would be outlined in your policy.

Unlike Income Protection, Critical Illness cover will pay out a lump sum payment rather than a monthly income. This could be used to help you meet certain financial obligations or to pay for modifications to your home if you have suffered from a disability.

Compare Self-Employed Life Insurance Quotes & Get Specialist Advice

Being self-employed you don’t get the safety net of company benefits, which is why its so important to make sure you have the right cover in place to protect you and your family.

As an independent Life Insurance intermediary, we are on hand to answer any questions and provide guidance to ensure you can make an informed decision when considering what cover is right for you.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

The way we work means we never charge you a fee for that advice – you effectively get all of our experience for free.

Our advisers are here to help so please do not hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.