As of 2018 The Exeter no longer provide this policy. Instead, they have rebranded to The Exeter Health+.

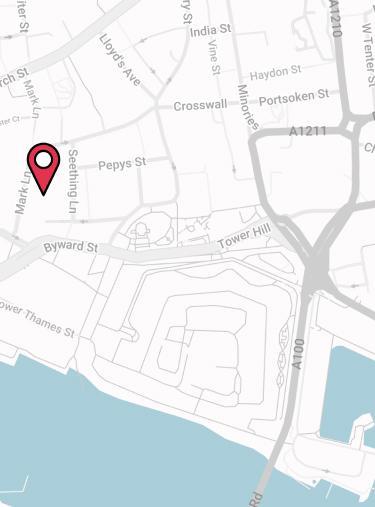

For more information or advice, feel free to get in touch with us on 02074425880.

The Exeter Overview

The Exeter’s private medical insurance, Health Choices for Me, is a modular plan with Essential Core Cover. There are a range of modules available including: cancer cover, out-patient and manipulative treatment.

In-Patient & Day-Patient Treatment

An in-patient is admitted to hospital, staying in bed overnight or longer for medical reasons. A day-patient is admitted to hospital or day patient unit because they need a period of medically supervised recovery. They do not stay in a bed overnight.

Out-patient Treatment

The Essential cover does include limited out-patient treatment. However, the Out-patient Module, Manipulative Treatment Module and Cancer Cover Module allow you to personalise the plan to suit your requirements.

A summary of all options which can either help to reduce your monthly premium or be included in the policy for an additional premium.

A summary of the ancillary benefits which are included in the policy as standard, this list also includes any benefits we have come to expect which are not included.