How Much Does Private Health Insurance Cost?

Private Medical Insurance covers the cost of private healthcare treatment for acute health conditions. The main benefits of Health Insurance include:

- Get treated quickly when you need it most avoiding potentially lengthy NHS waiting lists

- Access new drugs and novel treatments that may not yet be available on the NHS

- Have choice of where you have treatment and the consultant you use.

- Private hospitals usually have superior facilities, e.g. private, ensuite rooms and round-the-clock visiting hours

What’s the Cost of Health Insurance?

People often want to find out how much UK Private Health Insurance costs however this is difficult to do given the level of cover varies so significantly from insurer to insurer and the cost is hugely dependant on the individual or family being covered.

To keep things simple the cost of Health Insurance is primarily determined by the level of inpatient and outpatient treatment that is covered.

- Inpatient Treatment

Any medical treatment that requires you to occupy a hospital bed overnight (day patient treatment, for less serious procedures, involves you occupying a bed just for the day). Generally, this will be some sort of surgical intervention. - Outpatient Treatment

Any medical treatment or consultation that doesn’t require a hospital bed, such as diagnostic tests/scans or physiotherapy.

Where most Private Health Insurance covers inpatient treatment in full it tends to be the level of outpatient cover that determines the overall cost and whether a policy is budget, mid-range or comprehensive.

- Budget Health Insurance

Often covers inpatient treatment only leaving all outpatient treatment to the NHS. - Mid-range Cover

Provides a level of outpatient cover up to a monetary limit anywhere between £500 and £1,500 per year - Comprehensive Medical Insurance

Without a cap outpatient treatment tends to be covered in full

The more comprehensive the policy becomes the more likely you are to claim which is reflected in the higher monthly cost of the cover.

Factors Affecting the Cost of Private Health Insurance

The best UK Private Medical Insurance offers the widest cover, but this obviously comes at an elevated cost.

For cheaper Health Insurance premiums, most policies allow you to adjust cover, potentially by reducing benefits. Alternatively, you can add options to suit your needs if your budget allows.

There are a variety of factors that will impact the cost of Private Health Insurance. The biggest six are:

- Age

The older we are, the more likely we are to need medical treatment and so the more a policy costs. - Outpatient cover

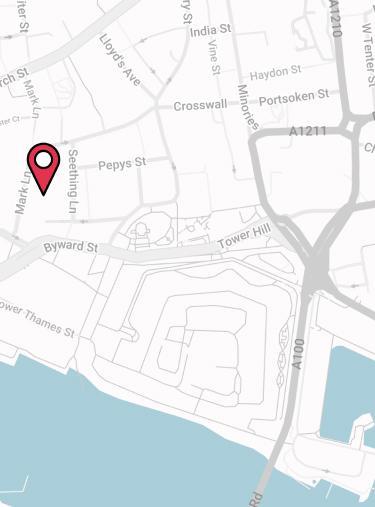

Outpatient cover involves any treatment where you don’t need a bed. You have the option for full outpatient cover, outpatient cover up to a set limit or no outpatient cover at all. - Location

Where you’re based in the UK will impact your policy; if you live near expensive hospitals, such as in Central London, you’ll pay more for your cover. - Hospital lists

The list of hospitals you’re eligible for treatment in will affect the cost of your Health Insurance, with more expensive hospitals meaning higher premiums. - Excess

How much you’re willing to pay upfront for your treatment before the insurance policy takes over, e.g. the first £100 towards your care. - Additional extras

Optional extras on your policy, such as dental and optical cover, will increase the cost of your premiums.

Inpatient-only Medical Insurance

It’s possible to drop outpatient cover entirely from your Health Insurance and buy an inpatient-only policy.

These are at the most basic end of the UK Medical Insurance market and offer the cheapest Health Insurance cover available while still paying for procedures such as surgery.

Dropping outpatient care will significantly cut the cost of your Private Health Insurance policy, but purchasing one of these plans will mean you’ll have to use the NHS for diagnostic tests, consultations etc.

Outpatient limits

Another way to reign in the cost of PMI is to put a cap on the amount of outpatient cover the insurer will pay for. Most insurers have outpatient monetary caps ranging from £500 to £1,500 per annum.

This still gives you some outpatient cover but, because the insurer won’t be liable for the full cost in the event of a particularly expensive claim, it can help reduce your premiums.

Hospital Lists and Location

All insurers will have a list of facilities that you’re eligible to receive treatment in as standard.

To keep costs down, many insurers offer additional ‘tiers’ of access to private facilities for you to choose from.

The top facilities in the country – usually those in Central London – are often kept separated from other private clinics and hospitals by this tier system because of the expense of treating patients there.

As these top hospitals are more expensive, the cost of Medical Insurance tends to be higher when you are covered for visits to these facilities.

Health Insurance Excess

Similar to a car insurance excess, whereby you agree to pay the first initial cost of repairing a damaged vehicle to keep the cost of insurance lower, Health Insurance also has an excess system.

Here, you can agree to pay an initial sum towards the cost of your treatment upfront before the Health Insurance kicks in to cover the rest.

Excesses can range from zero, meaning the insurer covers the entire cost of your treatment (making this option the most expensive) all the way up to £1,000 or more.

If affordable, you may want to look at setting a higher excess in order to keep down the monthly cost of Health Insurance premiums.

Additional Extras

Some policies will allow you to add optional extras to your insurance coverage at a cost.

Additional cover you may be able to choose from might include:

- Psychiatric cover

While the better Health Insurance policies available in the UK will offer you cover for psychiatric conditions as standard, with most insurers this is only available at additional cost. - Therapies cover

Most insurers will cover ‘therapies’ (e.g. physiotherapy and osteopathy) as standard if you have outpatient cover. However, the cheaper Medical Insurance policies may require you to add these options on as an extra, especially if you’ve opted for inpatient-only cover. - Six week NHS wait option

Some insurers offer this option that sees your private cover kick in only if the wait for the inpatient treatment you need on the NHS is more than 6 weeks, saving you money. (Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.) - Dental and optical

Most providers will cover you for emergency oral surgery (say if you accidentally knocked out a tooth) or cataract surgery; however, few will cover routine dental appointments (e.g. checkups and fillings) and optician appointments as standard. This will be an optional extra.

Average Cost of Private Health Insurance

Health Insurance costs vary so much based on your individual profile and what you need from the cover.

To work out the average cost of Health Insurance below, we’ve searched all the major players in the UK market and assumed:

- All the individuals are in good health

- They’re non-smokers

- They’re looking for a mid-range policy with a mid-range hospital list

- They’re willing to pay a £100 excess

- They’ll be underwritten on a moratorium basis

- They don’t want any additional extras on their policy

- They’re based in the same postcode as our Brighton office.

With these assumptions we have calculated pricing of a Mid-Range Health Insurance policy for different age groups as well as for individuals, couples and families. All quotes are accurate as of November 2025.

Cost of Health Insurance for Single Individuals

Cost of Private Health Insurance for Couples

Cost of Private Medical Insurance for Families

Need Specialist Advice on the Cost of Private Health Insurance?

As you can see there are a huge number of variations you can apply to your policy that will affect the cost of Health Insurance. We have a team of specialists with the know-how and tools to make sure you find the most suitable cover.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4077 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4142)