Do I Need Life Insurance?

Why Life Insurance?

It’s safe to say that there’s no single answer to the question of whether you need Life Insurance as it will depend on individual circumstances.

However, if you’re single, have no dependants, no liabilities and no concern about what happens to your estate after your death, then you don’t generally need Life Insurance as it has few benefits when you’re alive.

While some policies come with features such as terminal illness cover – which could help you financially if you’re diagnosed with a terminal condition – other insurance products such as Income Protection and Critical Illness Cover would be more suitable for such circumstances.

This is because neither Income Protection nor Critical Illness Cover requires the condition to be terminal to make a successful claim.

Life Insurance for Your Loved Ones

Yet while Life Insurance isn’t typically suited to those without dependents, liabilities or any concern about their estate, this isn’t the case for many of us.

Most of us have families, mortgages and want our estates to benefit our loved ones should we pass away. That’s where Life Insurance can step in to provide invaluable financial support should the worst happen.

Ask yourself whether your loved ones would need a payout if you were to die. Could they survive without your income, including keeping up with mortgage repayments and generally sustaining their lifestyle?

Unfortunately, you can’t rely on the government to take care of your family after your death.

State benefits are typically much lower than you’d probably expect, so Life Insurance becomes an essential part of planning to ensure your family will be financially secure after you’re gone.

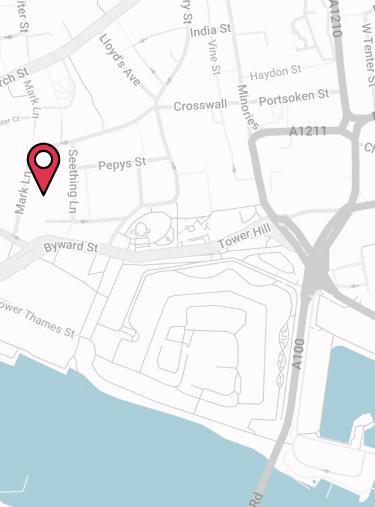

Mike Barrow

Independent Protection Specialist at Drewberry

According to 2017 research conducted by Drewberry, 2 in every 5 households have no more than £1,000 in cash savings to see them through should they fall on hard times, such as after the death of a breadwinner.

With state benefits being lower than many expect, and families having little in the way of a cushion to fall back on should the worst happen, this makes Life Insurance seem particularly important.

Even if you’re part of a working couple remember the extra pressure that would be placed on a surviving partner’s income after a death could see finances being significantly strained.

Chances of Needing to Make a Life Insurance Claim

It’s not something anyone likes to think about, but the Life Insurance industry was founded on the calculations made from life tables, which show the probability of a person of a particular age dying before their next birthday.

As those shopping for life insurance will have already reached adulthood, one of the simplest ways of calculating your risk of death is to use our Life Expectancy Calculator, which is powered by ONS data.

This tool was used in February 2019 to calculate the likelihood of death by the age of 60 of three distinct age groups:

- 30-year-old: male (one in 12 chance of death by age 60) / female (one in 18 chance)

- 40-year-old: male (one in 13 chance of death by age 60) / female (one in 20 chance)

- 50-year-old: male (one in 19 chance of death by age 60) / female (one in 28 chance)

Liverpool Victoria Life Insurance Claims Data

In 2017…

Male Claimants

- 63 was the average age for a male life insurance claim

- 52 for a male critical illness claim

Female Claimants

- 63 was the average age for a female life insurance claim

- 47 for a female critical illness claim

Other Statistics

- The youngest life cover claimant was 24 years old

- The average person had had their policy for just 9 years upon sadly passing away and leaving their family needing to claim.

Will Life Insurance Pay Out After I Die?

Reassuringly for something as important as Life Insurance, the vast majority of claims are successful. This is despite there being the perception among some that the industry doesn’t pay out, or tries to ‘wriggle out’ of paying up.

According to the Association of British Insurers (ABI), in 2017 98% of term insurance claims were successful, as were 99.99% of whole of life claims.

For the small proportion of claims that weren’t paid, the ABI cites that this was largely due to clients not disclosing important information when taking out the policy, or claiming for a condition that is not covered by the policy.

To avoid this outcome, be sure to be upfront and honest with your insurance company / financial adviser. This includes mentioning any pre-existing conditions you have that may impact the policy.

Such conditions must be declared to an insurer during the application process and, based on your medical history, the insurer may do one of three things:

- Offer the policy on its standard terms

- Place an exclusion on the policy relating to the pre-existing condition

- Cover the pre-existing condition but charge a higher premium to reflect the increased risk.

How Much Life Insurance Do I Need?

Again, how much Life Insurance you would need is something that depends entirely on your circumstances.

The amount of cover you need will typically have to be aligned with your needs, such as your outstanding mortgage balance, your family’s financial needs after your death or an inheritance tax liability.

When considering how much you’d need, it’s worth thinking about any employee benefits you might have. For instance, many employers these days provide Life Insurance in the form of a Death in Service scheme, which pays out a multiple of your salary should you pass away while in employment with that organisation.

This may go some way to meeting your Life Insurance needs, so you could actually need less cover than you think, which will in turn reduce premiums.

However, with employee benefits, it’s essential to realise that such protection is tied to your employment, meaning that if you leave or lose the job, you’ll also lose the protection.

While it should then be possible to take out your own cover, remember that you become more of an insurance risk as you get older. This means that the longer you leave it before taking out Life Insurance, the higher the premiums are likely to be.

According to the ABI, in 2017 the average payout on a term life policy was £78,323 and on a whole of life policy it was £4,511. Of course, many people need more than this to cover all their financial commitments, so if this seems too low for your needs don’t worry. It’s absolutely possible to obtain more cover.

When working out how much life cover you may need it’s important to consider if your partner would be able to repay any personal loans, the mortgage and still be able to cover all other household expenditure.

It usually makes sense to ensure you at least have enough cover to repay any debts outstanding and then consider additional protection to cover household expenditure for a period.

A lot of couples make the mistake of only covering their mortgage amount, but if you have a very young child then it’s often unrealistic to expect a single parent to go back to work right after the death of a partner, so extra cover should be considered to alleviate that pressure for a number of years

Get Specialist Life Insurance Advice

If you’re still unsure about whether you need Life Insurance, why not speak to a specialist adviser?

At Drewberry there’s absolutely no fee for talking to an adviser and making use of their knowledge to ensure you get the right Life Insurance in place for your needs, so why not pop us a call today?

You can speak to us by calling 02084327333, or – to save your phone bill – by arranging a call back with one of our financial advisers.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4074 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

- Topics

- Life Insurance

Contact Us

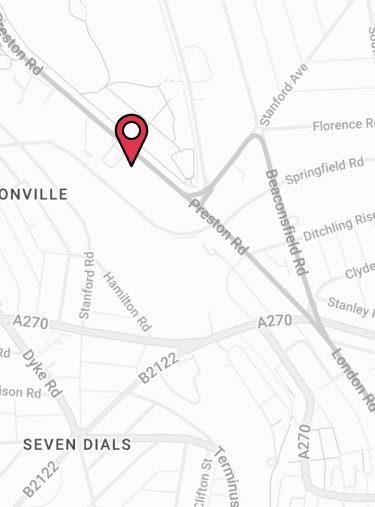

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.