What is Medical Underwriting for Health Insurance?

Underwriting is the process used by insurers to decide on the level of cover you will get from your policy.

Private Health Insurance underwriting focuses mainly on your policy’s exclusions, which are the conditions that your Medical Insurance provider will not cover you for.

There are different types of Medical Underwriting that you may be able to choose from which will affect how your insurer makes these decisions.

What are the Different Types of Underwriting?

There are three main types of medical underwriting that you’ll come across in Health Insurance terms if you’re buying a policy personally:

- Full Medical Underwriting

- Moratorium Underwriting

- Continuing Personal Medical Exclusions.

If you’re buying PMI for a large group of employees, there’s a fourth definition you may wish to know about: Medical History Disregarded.

Each of these different underwriting types determines:

- If your insurer requires your medical history

- At what point will they review your medical history

- How they decide which conditions to exclude

- How long they decide to exclude them for.

What is Full Medical Underwriting?

Full Medical Underwriting means that your insurer will ask for your medical history during the application process.

They will then automatically exclude any serious past and present pre-existing medical conditions that you have experienced.

These exclusions will be permanent once you have agreed to your policy and will last until your cover ends.

If you have a history of poor health, you may find a considerable number of exclusions added to your Health Insurance policy with Full Medical Underwriting.

It is up to your insurer to decide which of your past conditions they will and won’t cover.

While underwriters can sometimes be lenient and allow you to negotiate cover for minor conditions, it goes without saying that most providers will exclude any serious medical conditions.

Moratorium Underwriting Definition

Moratorium Underwriting means that your insurer will automatically exclude any medical conditions that you have suffered from in the 5 years prior to taking out your policy.

However, excluded conditions can be covered by your policy again later on. One benefit of Moratorium underwriting is that your exclusions may not be permanent.

Rolling Moratorium Underwriting

If you serve 2 years on your Health Insurance policy without getting any advice, medication or treatment for an excluded condition, then the condition may be added back onto your cover at your insurer’s discretion.

Continuing Personal Medical Exclusions

Continuing Personal Medical Exclusions (CPME) is the type of underwriting that you would choose if you are switching providers.

It allows you to keep the same exclusions as your old policy when you take out a new one without the need to answer any more medical questions when you apply.

Any conditions you suffered while on your old policy won’t be excluded on your new one.

Medical History Disregarded

Medical History Disregarded is a type of underwriting that involves an underwriter disregarding your medical history completely.

This means that aside from your provider’s standard exclusions, none of your previous or current medical conditions will be excluded from your health insurance policy.

This type of medical underwriting is the most expensive out of all of them and is only available when purchasing Group Health Insurance policies above a certain size.

Which is the Best Underwriting for Health Insurance?

The best medical underwriting for one person may be different from another depending on your circumstances and your budget.

If you are purchasing an Individual Health Insurance policy, then it is very unlikely that Medical History Disregarded underwriting would be an available option.

This is because Medical History Disregarded underwriting is designed specifically for Group Health Insurance policies.

Meanwhile, Continuing Personal Medical Exclusions is designed specifically for people with an existing PMI policy that would like to switch providers, so if you’re taking out a brand new policy this will not be the underwriting option for you.

That leaves Full Medical Underwriting and Moratorium Underwriting as your options. Which is right for you will depend on your medical history and circumstances.

To find out which underwriting you should choose for your Health Insurance, you can read our full guide ‘Full Medical Underwriting vs Moratorium Underwriting‘.

Need Specialist Medical Insurance Advice

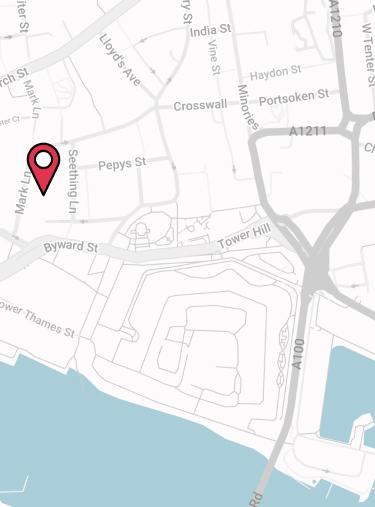

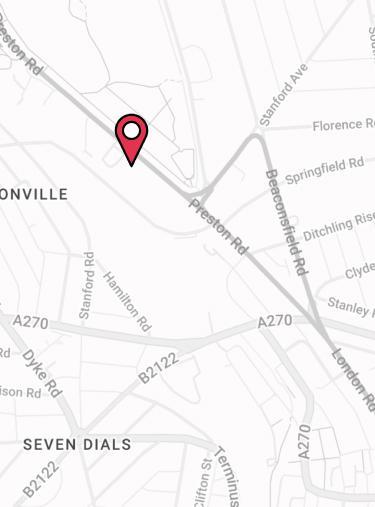

We have a team of specialist advisers who are on hand to help you with your queries and ensure you obtain the most appropriate health insurance for your needs.

Why Speak to Us?

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health. Below are just a few reasons why it makes sense to talk to us.

If you need help getting the best medical insurance, give us a call on 02074425880 or email help@drewberry.co.uk.