Should We Use An Employee Benefits Broker?

Setting up and maintaining a competitive employee benefits package takes time and knowledge. It doesn’t matter if you’re a big corporation, a small business (SME), or a start-up – it’s a resource-heavy commitment.

That’s where an employee benefits broker comes in. These specialist consultants know the market inside out, can access policy options you wouldn’t get by going directly to a provider, and do all the heavy lifting to ensure your offering remains competitive and valuable to your team. Here’s why you should work with one.

What Is An Employee Benefits Broker?

An employee benefits broker is an industry specialist who works with you to develop, implement, and manage your company benefits package. They typically act as the middleman between a company and the employee benefits providers (think insurers and various scheme providers).

By benchmarking your rewards, a consultant can help to build and design a comprehensive employee benefits strategy, to ensure you’re providing the best perks to your staff (while adhering to your budget and business needs).

Why Should You Work With An Employee Benefits Consultancy?

Employee expectations have evolved, and simply offering a high salary is no longer sufficient to attract and retain top talent. According to our latest Workplace Satisfaction Survey, a good benefits package is the fourth most important factor when choosing a new employer, and 71% of employees would leave their current job for better pay and benefits alone.

That’s why it’s essential to curate a comprehensive and well-thought out benefits package. Which is where an employee benefits broker comes in. By working with a specialist, you can tap into their deep understanding of the benefits and their technical aspects, helping tailor your package and customise your benefits to align with your employee and company needs.

There’s a lot to gain from offering a good suite of employee benefits. You appeal to top talent and engage your current team – boosting your business reputation in the process.

Nick Nelms

Senior Consultant, Employee Benefits

What Does An Employee Benefits Consultant Do?

In short, an employee benefits consultant helps you find, implement, and regularly review your employee benefits package. They’ll work with you to better understand your business and what it needs from its benefits offering.

This is not an exhaustive list, but here are some tasks a benefits broker can do for you:

- Handle employee data

- Carry out benchmarking research

- Negotiate suitable policy terms and competitive prices

- Help with employee communications to ensure your staff are aware of and understand their benefits

- Manage benefits administration, such as applications, trusts, new joiners and leavers

- Provide claims support for insurance benefits

- Implement employee benefits technology

- Carry out annual reviews to make sure your benefits are still appropriate

- Keep you up to date with the latest legislation and ensure your benefits remain compliant.

Your consultant will also provide ongoing support if needed. Some benefits (such as Group Health Insurance and Workplace Pensions) will need to be regularly reviewed and monitored. They’ll make sure you’re still getting the best value for your money and renew policies on your behalf.

How It Works

Whether you’re setting up benefits from scratch, or reviewing existing perks, an employee benefits broker will assess your company and identify the types of benefits your staff may enjoy.

The first step is a deep dive into your company, identifying what it does and your goals for your employee benefits package. They’ll take a look at your:

- Employee demographics

- Your sector / industry

- Your budget

- Your goals.

With more insight into your company and its needs, a broker will go out to market and look for the best deals for the employee benefits you’d like to set up. They’ll gather quotes from different providers to showcase the options available.

Off the back of this, your consultant will provide you with recommendations that are backed by years of experience in the industry. Then, using the research and recommendations from the consultant, you’ll be able to make an informed decision on the benefits you want to set up, which they’ll help you implement.

When you get independent advice from a consultant, your purchases are protected by a regulatory body. But if you choose to go directly to an insurer, there’s no protection if those products turn out to be inappropriate for your business.

8 Reasons You Should Use An Employee Benefits Broker

There are a huge range of employee benefits available, some of which may be better suited to your organisation than others. As a business owner, navigating the complexities of employee benefits can be overwhelming. It can be tricky to know where to start, especially if you have little knowledge of the employee benefits in general.

This is why many employers outsource their benefits to an employee benefits consultancy (such as our Drewberry™ consultants). As specialists, they can ensure your benefits are set up correctly and follow rules and regulations.

1. They Know The Market Inside Out

Employee benefits brokers understand the complexities of setting up benefits. Part of the profession includes keeping up to date with the latest insurance products, tax rules, and technologies, so you don’t have to. From a technical standpoint, they also have the knowledge to:

- Ensure you’re meeting new employees’ contractual rights to benefits under TUPE regulations

- Help you make informed decisions on your Group Life Insurance set up; either through a master trust or a bespoke option

- Explain taxation for certain employee benefits e.g. which benefits qualify as a P11D/Benefit in Kind

- Help educate your workforce on their benefits, driving satisfaction and wellbeing through your organisation.

Not all providers offer the same benefits, so a consultant’s knowledge is essential when making a decision. There’s more to it than just cost!

Our team of specialists will break down any complex jargon into simple terms, ensuring you understand everything in-depth.

2. Saves Time And Hassle

Setting up your company’s employee benefits isn’t the most straightforward task, which is why bringing in specialists can save you valuable time and effort.

We’ll do everything on your behalf. From advice and recommendations, to gathering employee data, negotiating costs and managing the admin; a consultancy is a one-stop shop for everything benefits related.

3. Get Access To Exclusive Products

As independent consultants, we have access to the UK’s leading employee benefits providers that you wouldn’t get on your own. Gathering and comparing quotes is part of our every day, meaning we can go directly to the insurers and get competitive quotes on your behalf.

When going it alone, you have to reach out to each individual provider separately. Not only is this time consuming, some providers won’t offer you quotes in the first place. Many don’t sell directly to businesses, which is where an employee benefits consultant plays an important role.

4. Negotiate Better Rates

Through the strong working relationships we’ve built with providers, we’ve got the unique advantage of bargaining power.

We can negotiate the best rates from the outset. We also know the ins and outs of the products, enabling us to find ways of reducing costs for you. So, if your budget is tight, we’ll do our best to ensure you get your money’s worth.

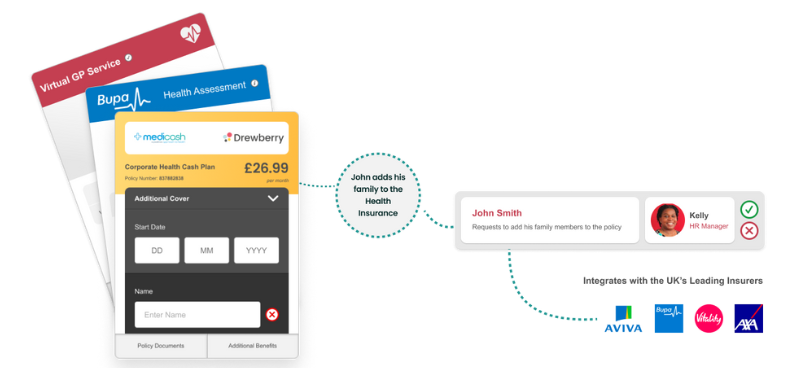

Working with an employee benefits broker ensures the administration is covered. Whether it’s through our benefits platform My.Drewberry, or our benefits admin team, you can ensure your company’s benefits package is up to date. We’ll also handle any annual renewals, for benefits such as Company Private Medical Insurance.

Nadeem Farid

Head of Health & Wellbeing Benefits

5. Get Ongoing Administrative Support

Admin comes with the territory when managing employee benefits. Whether it’s keeping track of joiners and leavers, or staying on top of benefit changes, these tasks can soon pile up. My.Drewberry gives you a full audit trail of the costs of each benefit as joiners and leavers are processed, giving you better control of your budget.

Running a business is no easy feat, which is why having a specialist consultant to handle the copious paperwork (including the compliance aspect) is worth its weight in gold.

Almost 40% of businesses are still using basic spreadsheets to manage their employee benefits admin, according to our 2024/25 Employee Benefits Benchmarking Report. That’s leaving a lot of room for error! Compared to a third who are leveraging employee benefits brokers, make sure your business isn’t left behind.

6. Support Your Communication Strategy

A key part of your employee benefits package is communicating it clearly to ensure you engage employees effectively. This needs to be carefully planned. It’s no use setting up benefits if employees don’t know they exist or how to access them.

Here’s where an employee benefits consultant can support your communications strategy. We’ll help roll out your communications once your benefits are up and running. Whether that’s sharing the need-to-knows or reminding staff to complete their various forms, we’re here to make sure your team knows what’s on offer and how all their benefits work.

7. You’re Financially Protected

If you set up your employee benefits yourself, the responsibility lies with you. Not only does this create more work for you, but you also lack financial protection.

Employee benefits consultants are generally authorised and regulated by the Financial Conduct Authority (FCA) to provide specialist financial advice. Should advice not be appropriate for your business, you’re legally protected, offering an extra layer of security and reassurance.

8. Benchmarking Keeps You Competitive

When we get to know your business, we can also take a look at what other companies in your industry are doing in terms of their employee benefits package. This information can then be used to your advantage, as we can help ensure your business is a major player among your competition.

By benchmarking your employee benefits, we’ll use industry knowledge to provide benefits your employees truly value, giving us a better idea of what your company might need to offer to remain competitive.

Support from a specialist in the employee benefits industry is often a no-brainer. Consultants come equipped with a wealth of knowledge and experience.

We’ve set up benefits for all types and sizes of businesses, so it’s second nature to us. We’ll also ensure your team gets access to their benefits at the most competitive rates for your budget.

Danielle Bines

Employee Benefits Consultant

Corporate Client Stories

What Employee Benefits Can A Consultant Set Up?

An employee benefits consultant can help you to set up all types of benefits. Whether it’s your Workplace Pension scheme, or core benefits such as Group Life Insurance, our years of experience means we can guide you through all the benefits available and find the right fit for your business.

Beyond the mandatory employee benefits you have a legal obligation to offer, benefits you can set up through a consultant include:

Insurance Benefits

Your company insurance policies, also referred to as Group Risk policies, are the big ticket items that act as a real draw for top talent.

- Group Life Insurance

Also known as “Death In Service”, Group Life Insurance pays a lump sum to an employee’s family or loved ones should they pass away during their employment with you. - Group Income Protection

Designed to complement your sick pay policy, Group Income Protection replaces a portion of your employee’s monthly income should they become unable to work due to illness or injury. - Group Private Medical Insurance

The third most-wanted benefit (according to our latest Employee Benefits Survey), Business Health Insurance pays for employees to access private healthcare, often leading to faster treatment and recovery times compared to NHS services. - Group Critical Illness Insurance

Designed with recovery and rehabilitation in mind, Group Critical Illness Cover pays a cash lump sum to an employee if they’re diagnosed with a serious condition such as cancer, heart attack, or stroke. - Corporate Health Cash Plans

Corporate Health Cash Plans allow employees to claim back costs of routine healthcare, such as dental, optical, and physiotherapy care. See how Drewberry’s very own Senior Content Writer, Colette, made the most of her cash plan—demonstrating just how valuable this benefit can be for employees.

These core insurance products were in employees’ top seven most-wanted benefits, according to our latest Employee Benefits Survey.

Workplace Pensions

As a mandatory benefit, there’s a great deal of compliance around setting up your Company Workplace Pension. Your employee benefits broker can find the best scheme for your needs, along with implementation and ongoing management and compliance.

Salary Exchange Pensions

Alongside a regular Workplace Pension, you can also run a Salary Exchange Workplace Pension scheme, which takes employee contributions from their pre-tax salary. This is a cost-effective way to increase employee pension pots or increase their take home pay.

It’s something staff want to know more about too, with 47% of employees keen to learn more about the potential tax savings that Salary Exchange offers. As an employer, you can also benefit by reducing National Insurance costs.

60% of employees told us they’d take larger employer pension contributions over other benefits. Are you missing a simple trick to engage your team? A consultancy can talk through your options, and ensure your benefits budget is being spent in the right place.

Salary Exchange Schemes

Salary Exchange Schemes (or Salary Sacrifice benefits) lets employees swap part of their gross salary for valuable benefits like pension contributions, a new bike, or an electric car. This reduces National Insurance contributions for both you and your team in some cases. It’s a cost-effective way to enhance your benefits package while boosting employee engagement and motivation.

- Cycle To Work Scheme

Cycle To Work is an affordable way for employees to get a brand new bicycle, while cutting your employers’ National Insurance bill. Employees can save up to 42% off a new bicycle and cycling equipment. Your business fronts the purchase cost, and employees pay you back over six or 12 months via salary exchange. - Electric Car Schemes

Electric Car Schemes offer an affordable way for employees to transition to clean, green transport. Employees can lease (and purchase if they wish) a brand new electric car through salary exchange. Employees agree to swap part of their gross salary to pay for the lease, meaning you both save on National Insurance contributions. - Holiday Trading

Also known as Holiday Purchase, Holiday Buy/Sell or Holiday Buyback Schemes, Holiday Trading schemes allow employees to buy extra days of annual leave, or sell unwanted holiday back to your business. - Techscheme

Techscheme is a great way for employees to get a new piece of tech or homeware, allowing them to purchase items from across the entire Currys and IKEA catalogues and spread the cost over 12 months. Your business fronts the purchase, and employees pay you back via salary exchange. Because of the reduction in gross pay, both you and your employees save on your National Insurance contributions.

Read more about cutting your NI bill with Salary Exchange.

Other Benefits A Broker Can Help With

Alongside the mandatory benefits and the core insurance policies, a benefits consultant can also set up a number of holistic benefits for your business.

- Employee Discount Platforms

An Employee Discount Platform offers savings, coupons and cashback on a number of everyday purchases - Season Ticket Loans

A Season Ticket Loan is an interest-free loan which helps cover the costs of commuting.

Alongside setting up employee benefits, a consultant may provide ongoing review services as part of their package. So you’ll get support every step of the way.

Using A Broker To Optimise Your Benefits

Optimising your employee benefits is about more than simply offering a standard package—it’s about tailoring your benefits to meet employee needs while ensuring cost-efficiency for your business. By reviewing and fine-tuning your existing benefits, a broker can help you maximise value, improve employee satisfaction, and uncover opportunities to enhance your offering.

Benchmark Your Benefits

In today’s competitive job market, offering benefits that resonate with your employees is crucial for retaining and attracting top talent. Comparing your employee benefits package against your competitors ensures you’re offering a package that not only meets but exceeds employee expectations, giving your business a valuable edge.

This is where benchmarking comes into play. It helps to identify if the benefits you’re offering are competitive in your industry and meeting the needs of your employees. It isn’t a quick task though, and you might not have the time and resources to do it. This is where the team at Drewberry can help.

71% of employees told us they’d change jobs for better pay and benefits, and 51% are ready to go within the next 12 months. Benchmarking ensures your package remains competitive enough to secure your top talent.

Nadeem Farid

Head of Health & Wellbeing Benefits

Highlight Key Person Dependancy

An employee benefits brokerage can highlight any key dependencies your business has and use that data to introduce benefits, such as Key Person Insurance. This is an insurance policy that helps ensure a business stays afloat in the event a key person is unable to work.

Review Existing Benefits & Rates

An employee benefits consultant can tweak your current benefits to ensure they run effectively. For example, if you have Group Health Insurance, our employee benefit consultants have the ability to negotiate free cover limits, so you can offer a good level of cover to all your employees regardless of their health.

Introduce You To Employee Benefits Technology

Many employee benefit consultants offer technology to employers to support the management and setup of your company benefits. Our very own employee benefits platform, My.Drewberry is an all-in-one platform helping to streamline benefits administration and automate some of those pesky admin tasks.

It’s platforms like this that improve the visibility of your company employee benefits, giving your staff a holistic view of their perks.

How To Choose The Right Employee Benefits Consultancy

Every business has different requirements for their employee benefits. So, it’s important to work with an employee benefits consultancy who will provide the right level of support and guidance. Below are the important questions to ask yourself when looking for a broker.

What Do You Really Want From A Broker?

What do you want from a broker service? Having an idea of this can help you get the most out of the relationship.

For example, perhaps you’re a small business wanting to set up benefits for your employees but don’t know where to start. Or which benefits are best for a small budget. Whereas a bigger, more established business may be seeking help to review their existing employee benefits package.

By knowing what it is you need from a consultant, you can narrow down the search and find the right employee benefits consultant for you.

Do They Have Experience In Your Industry?

An employee benefits broker is likely to have worked with many types of businesses. But some may have more experience in a specific industry than another.

It’s worth keeping this in mind when enquiring about the consultancy’s services.

- Have they set up employee benefits for a company similar to yours?

- Do they understand the needs of your sector in terms of employee benefits?

- Do they have experience implementing a full suite of employee benefits?

Is Your Data Safe With Them?

Data analysis often informs consultants about your business needs. It also identifies where your company employee benefits stand alongside your competitors.

Do they conduct an audit of your employee benefits and benchmark your company against those in your industry? They can then identify what employee benefits you should consider for your team and highlight any gaps in the package.

We’re ISO 27001 certified at Drewberry, which is the gold standard for information security. When you work with us, your data is always protected.

What Do Their Customers Say About Them?

Have a look for any reviews the broker/consultancy has. These can be a helpful indicator of what to expect and whether they’re the right broker for you.

You can also ask other business owners you have connections with. They might be able to provide a recommendation.

Our Drewberry reviews speak for themselves. We’re approaching almost 4,000 reviews on Reviews.io, with happy clients giving us an average of 4.9 out of 5.

How Do They Charge?

Brokers charge for their services in several ways, including:

- Through commission

- Consultancy fees

- Billable hours.

How you pay for their services will depend on what level of support you require. As part of the process of finding the right broker, you first need to ensure your company budget has room for a broker. And if so, in what capacity? These questions will help you make a decision during your enquiries with brokers.

Enhance Your Benefits with a Trusted UK Employee Benefits Broker

It doesn’t matter where you’re at with your benefits package, an employee benefits consultant can always step in to provide extra support. They can help you design a benefits package that supports employee wellbeing and enhances workplace culture. So, whether you’re a new business looking to set up benefits for your team, or you want to review and improve your existing package, a consultant can do it all.

We offer regulated advice on all employee benefits, so we can help to find the right ones for your company and set those up. We can save you time on admin and ensure your benefits are set up for success. Call us on 02074425880 or email help@drewberry.co.uk to get the ball rolling.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4074 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.