Do Businesses Have To Offer A Death In Service Benefit?

Quite simply, no. You don’t have to set up Death In Service Insurance for your employees. It’s entirely down to you as the employer, as it’s not a mandatory benefit in the UK.

That said, there are many good reasons why you should consider setting it up. Here are some of those benefits:

Helps Support Recruitment And Retention

As a new small business, the Employee Benefits [https://www.drewberryinsurance.co.uk/employee-benefits] you choose to set up can do wonders for helping you to attract the very best talent. They can also help ensure your staff stay long term.

In our 2025 Employee Benefits Survey, we discovered that:

- 1 in 4 employees want their employer to provide Group Life Insurance

- However, only 13% of employees say they currently have a Death in Service benefits

- 90% of employees are stressed, with money worries topping the list. Having a Death in Service benefit in place can reduce such worries by reassuring workers their loved ones will be able to cope financially should the worst happen.

It’s An Affordable Benefit

Cost is often a barrier for companies wanting to provide valuable employee benefits. The good news is that Death in Service is actually one of the most affordable benefits you can offer. It also comes with great tax relief for you and your staff.

As an employer, you aren’t required to pay corporation tax on the premiums you pay on behalf of workers. HMRC views it as a business expense, meaning the company corporation tax bill will be reduced. And for your employees, Death in Service isn’t a taxable P11D / Benefit in Kind.

What’s more, if the policy is set up under a trust, the payout isn’t liable for Inheritance Tax. The Death in Service benefit the employee’s loved ones then receive is usually a tax-free lump sum.

No Medical Underwriting Necessary

With personal Life Insurance, the insurer will ask about the member’s health history. This is to determine the cost of the policy and exclude any pre-existing conditions.

But with Group Life Assurance, staff don’t need to provide any medical information. This enables all of your employees – regardless of their health status – to get cover.

It also removes the financial barrier associated with buying a Life Insurance policy. Even more so if an employee has a medical history that would have increased the costs if they bought a personal plan.

Insurers underwrite the vast majority of staff on a group basis, so it’s easier for them to secure cover.

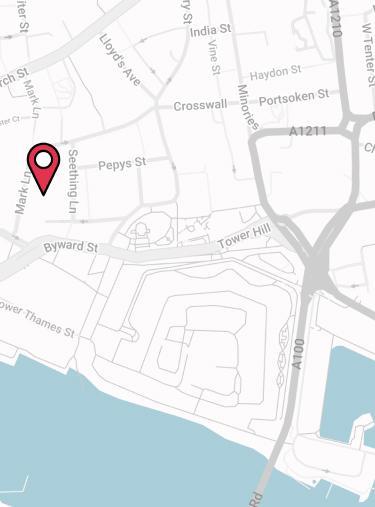

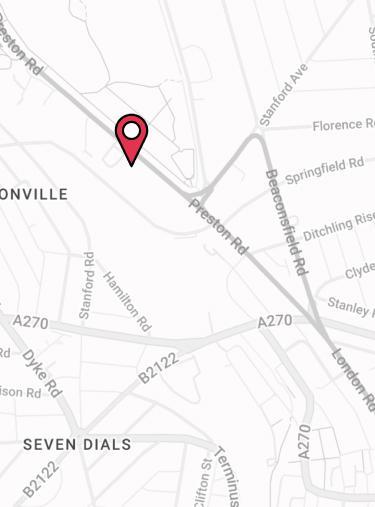

Get Fee-Free Specialist Advice

For specialist advice on your small business employee benefits, please don’t hesitate to get in touch. Call 02074425880 or email help@drewberry.co.uk.

Our advisers can do the heavy lifting for you. They can make sure the policy is set up correctly and meets the needs of your business.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4090 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.