April UK Health Insurance [Review]

As of July 2018, April UK no longer provide Health Insurance in the UK.

Who Were April UK?

April was an award-winning provider of Health Insurance. The insurer’s main policy was known as April Regional Plus. It came with three different ‘levels’ of cover: inpatient-only, inpatient and limited outpatient, and full inpatient and outpatient cover.

The company also offered inSpire Health Insurance in partnership with Spire Healthcare, offering access to UK-wide Spire Hospital facilities.

In July 2018, April announced it was pulling out of the UK Health Insurance market. While it still offers international cover, it is no longer providing any UK health cover.

What Does the April Health Insurance Market Withdrawal Mean?

April UK Health Insurance policyholders have three options available to them now the company is no longer offering Medical Insurance in the UK:

- Let the policy end and take out a new policy with a new provider

- Take out a policy with a new provider and make the switch before your renewal date

- Let the policy lapse and not take out new cover.

Your policy won’t renew at the end of the current policy year. This means that if you do want to continue with Health Insurance, it’s better to act sooner rather than later.

Once your April UK coverage lapses, it may be difficult to switch you to a new insurer on similar terms. This is because you usually need existing coverage to port to a new insurer.

Compare Health Insurance quotes using the form below. This looks at every major UK insurer to find you the best deal.

How Do I Switch Health Insurance?

Before making a move to switch Private Health Insurance providers, you’ll have to do some research. This is to ensure that you get similar coverage to your old policy under your new plan.

It’s also vital that you switch your Health Insurance on a continued personal medical exclusions (CPME) basis. This ensures ongoing coverage for any conditions you’ve suffered while on your April UK policy.

Providing none of your conditions are excluded as standard by your new insurer, you should get the same level of cover as your old policy. Your new insurer will also copy across any exclusions you have on the old April UK policy.

Compare Health Insurance Quotes & Get Specialist Health Insurance Advice

With April no longer offering cover, acting quickly to get Health Insurance quotes from a new provider is essential. However, switching insurers can be tricky if you do it by yourself.

Fortunately, the team at Drewberry is here to help. We have access to every single major UK insurer, meaning we’ll do our best to find you the best cover at the right price.

Switching insurers is best left to a specialist.

It’s not an area you want to gamble with by going it alone, especially when something as important as your health coverage is at stake.

Joseph Toft

Health & Wellbeing Specialist at Drewberry

Why Speak to Us…

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are independent and work with all the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- We are very proud of the 4100 and growing independent client reviews rating us at 4.92 / 5

- Benefit from the protection of regulated advice

- Claims support when you need it most.

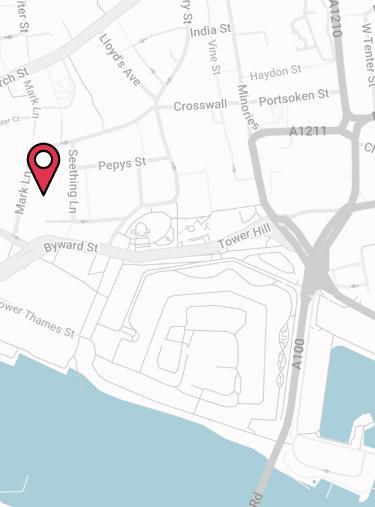

Pop us a call on 02074425880 or email help@drewberry.co.uk.

Contact Us

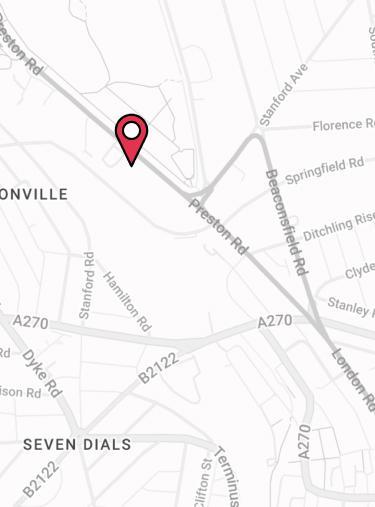

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=2093)