Moratorium or Full Medical Underwriting?

When applying for Private Health Insurance, you’ll need to choose a type of underwriting for your policy: Moratorium or Full Medical Underwriting. It’s important to get this right, as it can impact what’s actually covered in terms of possible exclusions (due to past medical advice and treatment).

Definition of Moratorium Underwriting (MORI)

This method states that any medical condition for which you have sought medical advice for in the last 5 years would be automatically excluded.

Most insurers offer a “rolling moratorium” and this usually means that if you do not need to seek medical advice for that (excluded) condition in the next 2 years then cover for that condition can be re-included in the policy.

A very small number of insurers offer what is called a “fixed moratorium” and this usually means that even if you have sought medical advice for the (excluded) condition in the 2 year period after the policy was taken out the insurer will re-include cover after the 2 years is up. Of course, the re-inclusion of any condition is subject to the insurer’s discretion.

Definition of Full Medical Underwriting (FMU)

With this method you would disclose any past medical conditions on the application and the insurer would decide if they are able to offer cover for those conditions or not (please note that different insurers may come back with different results).

If an exclusion is placed on the plan it is usually possible to have that exclusion reviewed at each policy renewal but you would need to pay for medical evidence to be provided from your doctor to support your argument that the past condition is no longer a problem.

MORI v FMU: Which is Right For You?

The type of underwriting that is best for you all comes down to the medical condition that you have suffered. With full medical underwriting any potentially serious medical conditions that you have experienced in the past (even if it was over five years ago) may be excluded. With a moratorium this would not be the case if you last had symptoms over 5 years ago.

On the flip side, with the moratorium method a medical consultation for something that may not have actually amounted to anything could potentially exclude a whole area of the body if it was within the last 5 years. Additionally, something seemingly minor like a short period of back pain 4 years ago would result in an exclusion. This is unlikely to be the case with full underwriting.

Need Help?

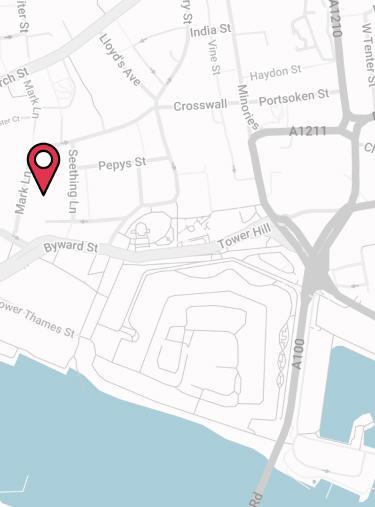

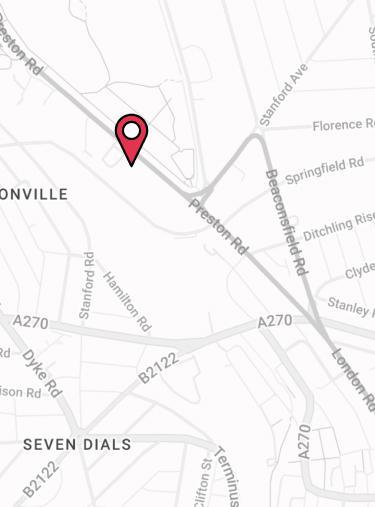

Insurance jargon can feel overwhelming – we’re here to make it simple. Call 02074425880 or email help@drewberry.co.uk to speak to one of our friendly advisers. Our advice is fee-free, and we’re able to search the entire market to find the right policy for your needs.