Why Have My Health Insurance Premiums Increased?

Why Private Medical Insurance Premiums Increase

You may find that your Private Health Insurance premiums increase at renewal. This could be down to a number of factors, but usually the main reason – and the one that will cause the biggest jump in premiums – is if you’ve made a claim.

However, even people who haven’t made a claim can find the cost of Private Medical Insurance (PMI) going up compared to last year, possibly due to:

- Rising risk of expensive conditions

Cancer Research UK reports half of people born post-1960 will get cancer – among the most expensive conditions to treat – during their lifetime - Insurance Premium Tax (IPT) hikes

Despite extensive industry lobbying, the government has continued to increase IPT - Improved medical treatment

New drugs, operations and techniques are introduced all the time, but this comes at an increased cost - Access to cutting-edge healthcare

Often Private Medical Insurance will offer access to new and expensive treatments, particularly cancer drugs and therapies, that the NHS deems too expensive - Ageing population

While it’s good news that we’re living longer than ever before, this is leading to a number of acute conditions of the type Medical Insurance is designed to fix, such as worn out joints requiring replacement - General inflation

This pushes up the cost of everything from the electricity to light the operating theatre to the meals you may be served as an inpatient.

What Can I Do If My Health Insurance Premiums Have Gone Up?

One of the biggest weapons at your disposal if your health insurance premiums have increased on renewal is actually one of your easiest options.

In fact, you’ll barely have to lift a finger. We have built a quote engine which compares the best UK health insurance policies so you can see how competitive your existing policy is compared to the rest of the market.

Speak to Our Health Insurance Specialists for a Full Market Review

We provide a fee free Health Insurance advice service, our specialists will research the whole market and compare the UK’s major providers to see if they can find you a better deal.

All we’ll need from you to help is:

- Details about your policy

- Your current state of health

- Any claims history on your existing policy

- Minor personal details already held by your current insurer, such as age, address, gender etc.

Providing your premium rise isn’t due to a recent claim, especially a ‘major’ claim (e.g. cancer, heart or psychiatric), we may be able to find you comparable, cheaper cover elsewhere.

How Can I Get Cheaper Health Insurance?

If you’re not happy with your Private Medical Insurance renewal quote, there are ways to lower the cost of premiums without switching insurer if you don’t want to move.

Health Insurance has a wide range of variables that can be adjusted to suit your needs and circumstances, but also to reduce price if necessary.

What’s Covered by the Best Health Insurance?

The best Private Health Insurance will provide a wide range of coverage, including:

- Both inpatient and outpatient cover

- Access to all the best hospitals in the UK, no matter where they are or what they charge

- Full ‘therapies’ cover (e.g. physiotherapy, osteopathy)

- Low or no excess (so the insurer picks up the vast majority of the bill).

Obviously in an ideal world you’d have the best Health Insurance with all the bells and whistles. However, sometimes due to budget this is simply not possible. Fortunately, Health Insurance is flexible and there’s plenty you can do to adjust your cover and reduce premiums.

How to Reduce the Cost of Private Health Insurance

One of the biggest things to check is that you’re actively using – or even need – every element of the cover on your policy.

That’s why it’s important to review your Medical Insurance to make sure you aren’t paying for cover you may never use or simply don’t need.

For instance, sometimes people forget that they have travel insurance through a packaged bank account – would you need worldwide travel cover with your PMI as well?

Extra optical or dental cover might be a nice to have, but you could check to see if you were entitled to free or subsidised NHS dental treatment and eye tests.

Other tips to reduce your PMI premiums…

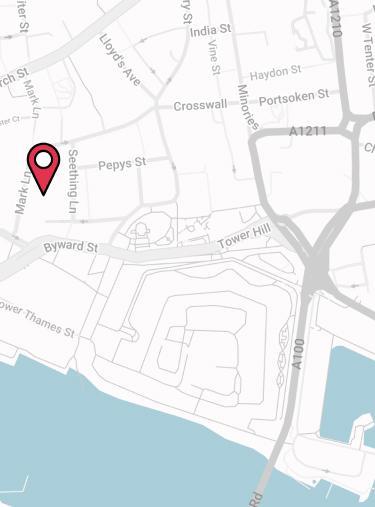

- Restrict your hospital access

The most expensive hospitals in the country (usually those in central London) are on insurers’ ‘top tier’ of hospitals. Opting to restrict your access to a lower tier of (still private) hospitals rather than having access to these top ones can cut the price of cover. - 6 week NHS wait option

Some insurers offer an option where the policy will only pay for inpatient treatment if the waiting list on the NHS in your area is over 6 weeks. Note that this only applies to inpatient care; if you’ve added outpatient treatment to your policy, this will still be taken care of privately as soon as possible. (Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.) - Increase your excess

Just as with car insurance, a low excess will increase the cost of cover as it increases the proportion of the bill the insurer will have to pick up. - Cap/remove outpatient cover

Outpatient cover is any healthcare that doesn’t require an overnight stay in a hospital bed, such as blood tests and x-rays. It’s possible to cap outpatient cover or remove it entirely, leaving cover just for operations and other treatment requiring an overnight hospital stay. - Remove ‘extras’

The best PMI will cover more than a mid-range or basic plan, so you may want to consider trading down if you have a plan with a high level of coverage with lots of additional extras, such as optical and dental cover. - Strip back certain cover (provider dependent

Some policies will offer reduced cover for a lower price in certain areas, e.g. in cancer cover where the insurer will only pay out if the treatment you need isn’t covered by the NHS.

Get Specialist Advice Reviewing Your Health Insurance

We help people everyday who have seen their Private Medical Insurance increase at renewal. Whether it be switching providers or simply tweaking your existing plan we have team of specialists on hand to help.

Why speak to us?

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated specialist from start to finish

You will speak to a named specialist with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 4074 and growing independent client reviews rating us at 4.92 / 5. - Benefit from the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

We are here to offer impartial and, most importantly, fee-free Health Insurance advice.

If you want to talk through your options to make sure you are looking at the most suitable cover then don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4129)