How Does Decreasing Term Life Insurance Work?

What Is Decreasing Life Insurance?

Decreasing Term Life Insurance is one of the most common types of Life Insurance policy you can buy. It’s designed to pay out a tax-free cash lump sum to your loved ones should you pass away during the policy term.

Term insurance is any form of Life Insurance that lasts for a set length of time, defined at the outset of policy. Most people align the term of their Life Insurance with their mortgage to ensure cash will be available to repay the outstanding debt if they die before it’s paid off.

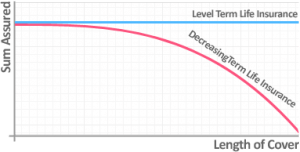

The decreasing element refers to the fact that the benefit – i.e. the amount paid out on death – falls each year until it reaches zero at the end of the policy term.

For this reason, decreasing cover is the most cost-effective form of Mortgage Life Insurance, as the benefit can be set to fall in line with the outstanding mortgage balance.

How Does Decreasing Life Assurance Decline Over Time?

Much like the capital outstanding on a mortgage, the amount of cover provided by a Decreasing Mortgage Life Assurance policy falls very slowly in the early years and declines much faster in the latter years.

By mirroring the rate at which your mortgage reduces, you’ll have enough to pay off the balance of the debt in full should you pass away.

Make sure your Decreasing Life Insurance has a maximum interest rate (high enough above your mortgage rate) so you have a buffer for fluctuations.

If your mortgage interest rate was to rise above the maximum, you could be left with a shortfall if you die during the policy’s term.

Samantha Haffenden-Angear

Independent Protection Specialist

Not all plans assume the same interest rate. Although plans with lower assumed rates come with lower premiums, they provide much less security in the event of interest rate fluctuations.

Can I Include Decreasing Critical Illness Insurance?

As with all Life Insurance policies, you can add Critical Illness Cover to Decreasing Term Life Insurance. This increases your mortgage protection as the policy will pay out not only on death, but also if you develop an insurer-specified critical illness.

Many Critical Illness Insurance policies will cover the “big three” illnesses:

- Cancer

- Heart attacks

- Strokes

In addition to the big three, most policies cover around 40 other serious illnesses. The definitions of these illnesses are really important as they can vary from one insurer to the next. We have tools in-house to compare how comprehensive these definitions are so you can make an informed decision when it comes to the most suitable policy.

When you choose Decreasing Term Mortgage Life Insurance with Critical Illness Cover, the level of Critical Illness Cover will decline over time at exactly the same rate as the Life Insurance element.

Could Income Protection Be a Better Option?

If you’re taking out a Critical Illness policy for protection against ill health, you may be better served with an Income Protection policy, which covers a wider array of conditions and can be more cost-effective. It all depends on your unique situation, which is why we recommend speaking with an independent adviser who can find the right policy for your needs. Give us a call on 02084327333 or email help@drewberry.co.uk to find out your options – fee-free.

Advantage of Decreasing Life Insurance

One of the biggest advantages of Decreasing Mortgage Term Assurance is that the policy can be aligned with your mortgage, falling as the value of your outstanding mortgage debt falls over time.

As the benefit reduces with Decreasing Term Life Insurance, the risk to the insurer falls alongside it. Given this, premiums are cheaper than Level Life Insurance, where the payout remains constant over time and the risk to the insurer remains the same across the term of the policy.

Level Life Insurance policies are most suited to repaying interest-only mortgages, where the amount of capital doesn’t fall across the term of the mortgage as you’re only repaying the interest.

Level Life Insurance vs Decreasing Life Insurance

In some cases, Level Life Term Insurance might be a better choice for you than Reducing Term Life Insurance. This depends on your needs.

If Reducing Term Life Assurance is aligned to fall alongside your mortgage, it won’t provide your loved ones with much of a lump sum in excess of the cash needed to repay the loan.

This could lead to a situation where although your beneficiaries have repaid the mortgage and own their home outright, they might not have sufficient cash to run the home, i.e. covering bills and maintenance etc.

Additionally, you may also want to some cash left over to cover funeral expenses, or to help cushion the blow from a sudden loss of income.

For this, a Level Term Life Assurance policy would be far better suited because the payout will remain fixed over time. So if you die halfway through the mortgage, the payout will be enough not only to cover the rest of your mortgage but also provide a lump sum with the remainder of the insured benefit.

We know the market like the back of our hands. We’re more than happy to help you with your enquiries and get you a policy in place – just drop us a line on 02084327333 for specialist advice.

Tom Conner

Director at Drewberry

Get Decreasing Life Insurance Quotes and Specialist Advice

With Decreasing Term Life Insurance, you’ll need to ensure that the rate of decrease doesn’t exceed your mortgage interest rate. An adviser can double check this for you.

Given that many people buy their home as a couple and have joint mortgages, it may seem logical to get a joint Reducing Life Insurance policy. However, this is also worth discussing with an adviser – in many cases two single Life Insurance policies might be better suited to your circumstances.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

- Topics

- Life Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.