What’s The Difference Between Inpatient And Outpatient Treatment On My Health Insurance?

Regardless of whether you use the NHS or go private under a Health Insurance policy, all medical treatment is broadly split into inpatient and outpatient care.

What is Inpatient Treatment?

Inpatient treatment involves all medical care requiring you to stay in a hospital bed overnight. This is most often after major surgery.

For minor surgical procedures, the hospital might admit you as a day-patient. This means you need a hospital bed but are discharged the same day of the procedure without spending the night in that bed.

For inpatient care, the costs involved include:

- Catering, the hospital room itself and related amenities (‘hotel costs’)

- Initial blood tests and other checks to ensure you’re fit and well for the procedure

- Fees for the medical and hospital staff (for example surgeons, anaesthetists, nurses, porters)

- Fees for the medical care itself (for example the operation, drugs required during the procedure etc.).

When it comes to Private Health Insurance, all policies cover inpatient treatment for eligible conditions as standard. A basic, low-cost Health Insurance policy covers inpatient treatment only. You can add outpatient cover to make your plan more comprehensive.

What is Outpatient Treatment?

Outpatient treatment involves all medical attention that doesn’t need a hospital bed. This includes:

- Diagnostic tests and scans (for example x-rays, MRIs, CT scans, blood tests etc.)

- Consultations

- Treatment such as physiotherapy.

Outpatient care involving tests and scans usually diagnoses conditions needing further treatment. This might be either more outpatient care, such as physiotherapy, or surgery (inpatient treatment).

As mentioned, outpatient cover isn’t included automatically on Health Insurance policies. It’s an optional extra you choose to add for an additional premium.

Do I Need Outpatient Cover On Private Health Insurance?

If you don’t add outpatient cover to your Medical Insurance, your premiums will be cheaper. You’ll still have cover for inpatient treatment, such as surgeries.

However, it means you’ll need to wait for the NHS for diagnostic tests and scans. It’s only after the NHS has diagnosed you that you’ll be able to access private inpatient treatment. With outpatient cover, on the other hand, you’re both diagnosed and treated privately, speeding up your care.

Essentially, having no outpatient cover could delay private inpatient treatment.

Limited Outpatient Cover

To strike a balance between affordability with no outpatient cover at all and comprehensive coverage, there is a middle ground. You could opt for a mid-range Health Insurance plan.

Rather than paying for all outpatient treatment in full, as comprehensive Health Insurance does, a mid-range policy permits outpatient claims up to a set limit per policy year. This limit is typically £1,000 but it varies between providers. It offers you some outpatient cover while helping to keep premiums in check.

Other Ways to Reduce Health Insurance Premiums

You also have three other main options to consider to get cheaper Health Insurance that won’t impact your level of outpatient cover. These are:

Adjusting Your Excess

A Health Insurance excess is the amount you agree to pay upfront towards your treatment before the policy kicks in. The higher your excess, the lower your premiums, but be careful to ensure your excess is affordable should you need to claim.

Excesses start at £100 and go all the way up to £5,000 depending on your insurer and the treatment you require.

Limiting Your Hospital List

Most providers have “tiers” of hospitals you can access with the policy. These range from private wings of NHS hospitals all the way up to world-leading Central London facilities. Limiting the hospitals you’re eligible to be treated in to cheaper facilities can reduce the cost of cover.

Choosing the 6 Week NHS Wait

Under this option, before authorising private inpatient care, your insurer firstly examines the NHS waiting list for the treatment you need in your local area. If the waiting list for that treatment is less than 6 weeks, you have your care under the NHS.

However, if the wait is more than 6 weeks or the NHS doesn’t offer the procedure you need, the insurer pays for you to have it privately.

This only applies to inpatient care. If you’ve added outpatient cover to your policy, this will continue privately as normal regardless.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4074 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

We are here to offer impartial and, most importantly, fee-free Health Insurance advice.

If you want to make sure you’re looking at the most suitable cover, call us on 02074425880 or email help@drewberry.co.uk to talk through your options.

Contact Us

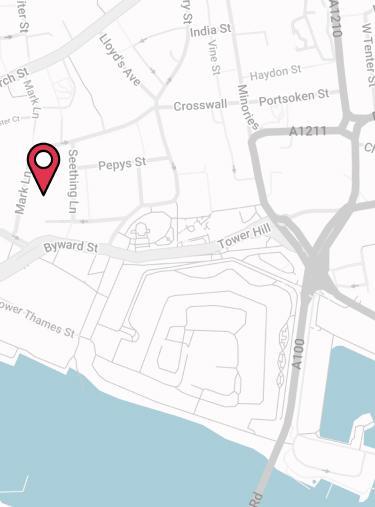

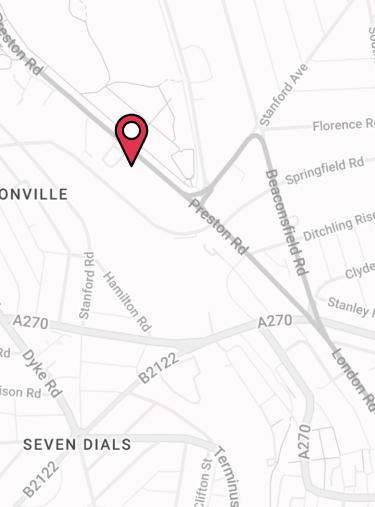

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4135)