The Main Reasons for Critical Illness Insurance Claims

The “big three” medical conditions, namely stroke, heart attack and cancer, make up the vast majority of critical illness insurance (CIC) claims every year. CIC insurance also will cover different conditions such as Multiple Sclerosis, children’s issues and stroke, which are fast approaching the “big three” claim numbers.

These three additional conditions are becoming more and more prevalent in the UK today.

Combining life insurance with critical illness cover will end up being cheaper in the long run because of lower monthly premiums than obtaining them individually. Also, income protection insurance is a viable option primarily due to the fact that IP will cover many of the conditions that CIC will not.

Critical Illness Insurance claims are predominantly dominated by the “big three;” namely stroke, heart attack and cancer. There are also many other conditions that can be covered under CIC, such as children’s coverage, multiple sclerosis and Parkinson’s disease. Trends are indicating that children’s issues and multiple sclerosis are fast approaching the “big three” claim numbers in the UK.

The “Big Three”

Cancer is still the main consideration when people take out CIC policies. In fact, cancer is the number one fear for the British public over terrorism, heart attack and Alzheimer’s. In 2008, there were 156,723 British citizens who died from cancer and 297,991 Britain’s’ were diagnosed with cancer in 2007.

Further, out of the 200 types of cancer, 4 of them (lung, prostate, colorectal and breast) account for over 54% of new cancer cases. Also, it is estimated that 1 in 3 people will develop some sort of cancer within their lifetimes.

Stroke accounts for around 9% of deaths every year in the UK, representing approximately 53,000 people and it is the primary cause of premature mortality, which total about 9,500 Britain’s under age 75 per year.

Heart disease is the biggest killer in the UK, with 193,000 deaths reported in 2007, or 34% of all deaths in the UK. Also, there are approximately 3.4 million adults who report that they have, or have had, a heart attack and/or angina.

The Additional “Big Three”

Children’s issues, Multiple Sclerosis and diabetes are all fast approaching the “big three” in terms of the numbers of claims filed every year.

Children’s coverage claims have become so prevalent that these claims have moved out of the “other” category to being the 5th largest claim cause, only 1% behind Multiple Sclerosis and strokes. Claims concerning children have rose from 2% in 2006 to 5% in 2011.

It has been suggested that the increase could be due to the fact that more people are becoming aware that children are covered in their policies. A vast majority of insurers cover children’s issues as a free extra in policies with payouts usually being the lesser of £10,000 to £25,000, depending on the insurer, or 50% of the sum assured.

Multiple Sclerosis has the closest claim numbers to the “big three,” so close in fact that Royal London Group indicates that MS should be included, making it the “big four.” Around 100,000 people have MS in the UK, according to the MS Society. It has become the most common progressive neurological disorder in young adults.

Insurance Coverage

Along with critical illness insurance, a viable alternative is income protection insurance (IP). This is because IP will pay out for practically any medical condition that CIC won’t cover, which forces a person to be off work. Either way, CIC coverage is important since more and more serious life-threatening diseases are becoming prevalent.

Usually, combining a life insurance policy with critical illness insurance is the cheapest way to take out this coverage because of the combined monthly premiums are far lower than two separate plans.

- Topics

- Life Insurance

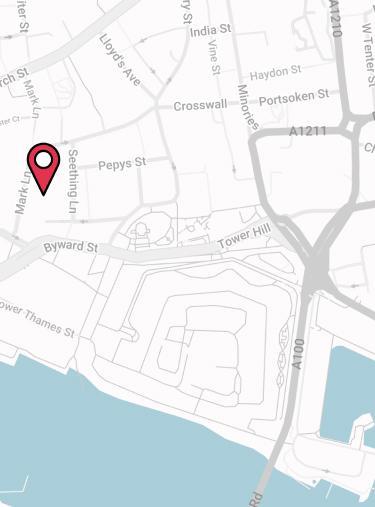

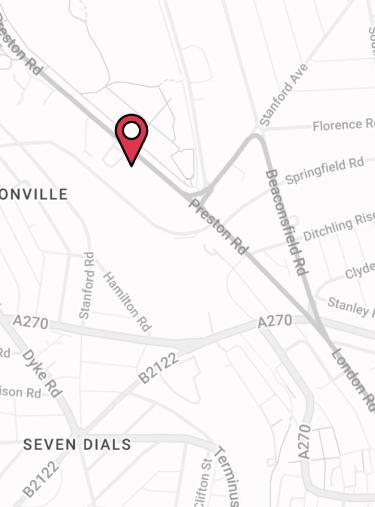

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.