IMPORTANT❗️

Just so you’re aware: when we talk about Mortgage Protection Insurance here, we mean Income Protection that can help cover your mortgage payments if you can’t work. This is different from Mortgage Payment Protection Insurance (MPPI), which works in another way. If you’re unsure which type of cover you need, we’re always happy to guide you.

Your home is likely your biggest financial commitment. If you lost your income tomorrow – through illness, injury, or redundancy – could you keep up with your mortgage repayments?

Mortgage Insurance is designed to make sure you don’t lose your home if life takes an unexpected turn. It can cover monthly repayments or even pay off your entire mortgage if you pass away or are diagnosed with a critical illness.

While lenders may require you to have buildings insurance, mortgage protection insurance isn’t compulsory. It’s entirely your choice – but having it can mean the difference between keeping your home and facing repossession.

The Main Types of Mortgage Protection Cover

When it comes to protecting your mortgage, the different terms can be confusing. The most suitable product for your needs will depend on what you want to protect, and in what way. Consider whether you want to:

Mortgage Insurance to Protect Your Life

Mortgage Life Insurance pays a lump sum to clear your mortgage if you die during the policy term – protecting your family from inheriting the debt. Mortgage Life Insurance is the same product as Life Insurance, it’s a different name for the same thing.

There are two common types of Life Insurance:

- Decreasing term insurance: The payout reduces in line with your mortgage balance — ideal for a repayment mortgage

- Level term insurance: The payout stays the same throughout the term — best suited to an interest-only mortgage or when you want to leave a fixed sum.

Both can give your loved ones the security of knowing the home can be kept, even if the worst happens. Check out our review of the best Life Insurance or compare quotes if you’re confident this is what you need.

Mortgage Insurance to Protect Your Income

You have a couple of options when it comes to protecting your ability to pay the mortgage. You can opt for a short-term policy known as Mortgage Payment Protection Insurance, or a more comprehensive cover known as Income Protection.

- Mortgage Payment Protection Insurance (MPPI)

MPPI covers your monthly mortgage payments if you’re unable to work due to accident, illness, or redundancy. It’s typically a short-term policy, paying benefits for 12–24 months. These policies only cover your mortgage payments, not your overall income. If you have other large outgoings, you may still face financial pressure.

- Income Protection Insurance

If you want a more comprehensive safety net, Income Protection Insurance is usually a better option. It replaces a portion of your income until you recover or retire, allowing you to cover more than just your mortgage payments.

In this review, we’ll focus on the top providers’ Income Protection offering.

IMPORTANT❗️

We don’t offer Mortgage Payment Protection Insurance, but we do advise on Income Protection Insurance and Life Insurance. Both will protect you or your family’s ability to pay the mortgage – just in different ways.

Which Mortgage Protection Insurance Is Best In 2025?

The UK has a few major providers to choose from, each with their own unique policy types, pricing structure, and underwriting process.

There’s no one-size-fits-all when it comes to insurance. The “best” product for you won’t necessarily be the best for someone else, as it all depends on your unique situation. That’s why it’s important to compare quotes and policies from different providers. And the cheapest quote isn’t always the best.

Our list of “top” insurers has been put together by considering product offering, company size, longevity, and customer reviews.

GOOD TO KNOW 🤓

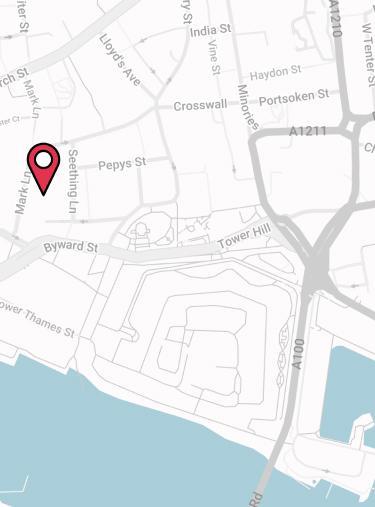

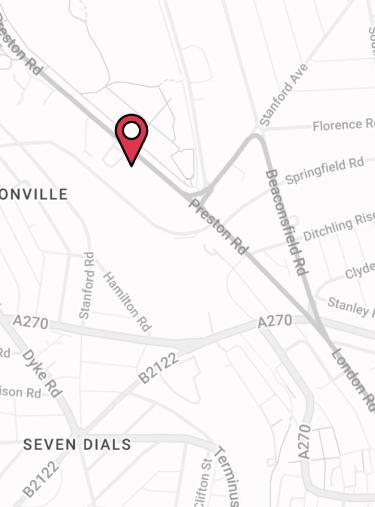

As an FCA-authorised firm, you can trust Drewberry to guide you with integrity and knowledge. You can find us on the Financial Services Register.

How We’ve Chosen Our Top Providers

As an independent insurance broker, we deal with a number of leading insurers every day. We’ve weighed up the key features and benefits of each provider’s offering to create this shortlist of best Mortgage Protection Insurance companies. Details we’ve compared include:

- Claims payout rates

- Defaqto rating and Trustpilot review scores

- Relevant products

- Free policy benefits

- Optional policy add-ons.

Aviva

![Aviva Health Insurance Provider Logo]()

Aviva is one of the UK’s largest insurers, serving more than 20 million customers across the nation. They recently acquired AIG Life UK (now Aviva Protection UK) to strengthen their personal protection offering.

- Relevant products: Income Protection, Life Insurance, Critical Illness Cover

- Defaqto rating: 5⭐

- Claims payout rate: 97.1% of claims paid in 2024

- Additional benefits: Aviva DigiCare+: Annual health checks, Bupa 24/7 helpline, mental health support, personal nutritionists, bereavement and legal support.

Pros And Cons Of Aviva Income Protection

What Aviva Customers Say

As of November 2025, Aviva has Aviva currently has over 52,000 reviews on Trustpilot (73% of them giving 5⭐), giving them an average “Excellent” score of 4.3/5 stars. Note that this is for the company as a whole, rather than just the protection division.

Read our specialist review of Aviva Income Protection, or get a quote online in 60 seconds.

British Friendly

![]()

Founded in 1902 to provide sickness benefits for commercial travellers, British Friendly is a UK mutual society (friendly society) – meaning it doesn’t have shareholders and operates for the benefit of its members.

- Relevant products: Income Protection

- Defaqto rating: 5⭐

- Claims payout rate: 86% of claims paid in 2024

- Additional benefits: Mutual Benefits: Additional financial support in life-changing events, unlimited digital GP Consultations, physiotherapy sessions, mental health support, second medical opinion, discounted annual health check.

Pros And Cons Of British Friendly Income Protection

What British Friendly Customers Say

As member-focused provider, British Friendly is a good option for those in manual or higher-risk occupations who are looking to protect their ability to pay the mortgage. As of October 2025, British Friendly has almost 300 reviews on Trustpilot (70% of them giving 5⭐), giving them an average “Average” score of 3.4/5 stars.

Read our specialist review of British Friendly Income Protection, or get a quote online in 60 seconds.

Cirencester Friendly

![]()

Cirencester Friendly is a UK mutual society specialising in Income Protection Insurance for employed and self‑employed individuals. Their main products include “My Earnings Protected” and “Income Assured Enhanced”, designed to help you replace part of your earnings if you’re unable to work due to illness or injury.

- Relevant products: Income Protection

- Defaqto rating: 5⭐

- Claims payout rate: 95.8% of claims paid in 2024

- Additional benefits: Member Benefits: 24/7 virtual GP, children’s Critical Illness support, personal nurse helpline, financial support from the 125 Foundation, perks and discounts from popular brands.

Pros And Cons Of Cirencester Friendly Income Protection

What Cirencester Friendly Customers Say

Cirencester Friendly doesn’t currently have a Trustpilot review page, making it hard for potential policyholders to find genuine insights. However, they’ve won multiple awards in 2025, including Best Financial Protection Provider at the What Mortgage Awards, and Best Protection Service at the Moneyfacts Awards.

Read our specialist review of Cirencester Friendly Income Protection, or get a quote online in 60 seconds.

The Exeter

![]()

The Exeter is a specialist UK mutual insurer, focusing on Health, Life, and Income Protection products designed to support working professionals and the self-employed. As a member-owned organisation, The Exeter reinvests profits into improving cover options and customer service rather than paying dividends to shareholders.

- Relevant products: Income Protection, Life Insurance

- Defaqto rating: 5⭐

- Claims payout rate: 93% of claims paid in 2024

- Additional benefits: HealthWise: Digital GP, second medical opinion, mental health support, nutrition and lifestyle advice, physiotherapy, annual health MOT.

Pros And Cons Of The Exeter Income Protection

What The Exeter Customers Say

As of October 2025, The Exeter currently has over 1,000 reviews on Trustpilot (72% of them giving 5⭐), giving them an average “Great” score of 3.9/5 stars.

Read our specialist review of The Exeter Income Protection, or get a quote online in 60 seconds.

Holloway Friendly

![]()

Holloway Friendly is a mutual society focused on income protection (sickness cover) rather than being a broad financial-services conglomerate. Its roots stretch back to the 19th century, and it claims credit for pioneering income protection in 1875. Their offering centres on “My Sick Pay” policies (plus variations like “Classic Plus”) that allow members to insure a portion of their income if illness or injury prevents them working.

- Relevant products: Income Protection

- Defaqto rating: 5⭐

- Claims payout rate: 88.3% of claims paid in 2024

- Additional benefits: Heath Hero: 24/7 Virtual GP, advice and counselling service.

Pros and Cons of Holloway Friendly Income Protection

What Holloway Friendly Customers Say

As of October 2025, Holloway Friendly has just over 150 reviews on Trustpilot (78% of them giving 5⭐), giving them an average “Great” score of 3.9/5 stars.

Read our specialist review of Holloway Friendly Income Protection, or get a quote online in 60 seconds.

Legal & General

![]()

Legal & General is a large and well-established insurer in the UK market, serving over 10 million customers across the country. Their Income Protection Benefit product lets customers insure a portion of their gross pay if they can’t work because of sickness or injury.

- Relevant products: Income Protection, Life Insurance, Critical Illness Cover

- Defaqto rating: 5⭐

- Claims payout rate: 84% of claims paid in 2024

- Additional benefits: RedArc: Health and wellbeing assistance from registered nurses, available to policyholders as well as partners and children.

Pros and Cons of Legal & General Income Protection

What Legal & General Customers Say

As of October 2025, Legal & General has over 26,000 reviews on Trustpilot (57% of them giving 5⭐), giving them an average “Great” score of 4.2/5 stars. Note that this is for the company as a whole, rather than just the protection division.

Read our specialist review of Legal & General Income Protection, or get a quote online in 60 seconds.

LV=

![]()

Liverpool Victoria (LV=) is a large provider of individual Income Protection and financial services in the UK. Founded in 1843, LV started out as “The Liverpool Independent Legal Victoria Burial Society” and sold Life Insurance at the cost of a penny per month. Now with over 180 years of experience, it offers a range of protection products and has acquired over 1.28 million customers.

- Relevant products: Income Protection, Life Insurance, Critical Illness Cover

- Defaqto rating: 5⭐

- Claims payout rate: 90% of claims paid in 2024

- Additional benefits: LV= Doctor Services: Virtual GP consultations, prescriptions, second opinion services, remote physiotherapy, remote psychological services, and discounted health MOTs.

Pros and Cons of LV= Income Protection

What LV=’s Customers Say

As of October 2025, Legal & General has over 81,000 reviews on Trustpilot (80% of them giving 5⭐), giving them an average “Excellent” score of 4.5 stars. Note that this is for the company as a whole, rather than just the protection division.

Read our specialist review of LV= Income Protection, or get a quote online in 60 seconds.

Royal London

![royal london]()

Royal London is the UK’s largest mutual life, pensions, and investment company, owned by its members rather than shareholders. With over 2.3 million members, it’s known for its customer-first approach – scoring highly on review sites.

- Relevant products: Income Protection, Life Insurance, Critical Illness Cover

- Defaqto rating: 5⭐

- Claims payout rate: 86.8% of claims paid in 2024

- Additional benefits: Helping Hand: Mental wellbeing services, 24/7 virtual GP, virtual physiotherapy, second medical opinion, bereavement support.

Pros and Cons of Royal London Income Protection

What Royal London’s Customers Say

As of October 2025, Royal London has over 4,400 reviews on Trustpilot (77% of them giving 5⭐), giving them an average “Excellent” score of 4.6 stars – the highest on this list. Note that this is for the company as a whole, rather than just the protection division.

Read our specialist review of Royal London Income Protection, or get a quote online in 60 seconds.

Vitality

![Vitality]()

Vitality is a leading insurance and investment company, offering a range of Life and Health Insurance products. Its core purpose is to make people healthier and help them to protect their lives, offering perks and incentives for policyholders who practice healthy habits. They offer “Mortgage protection insurance” which is the same as Term Life Insurance. For this review, we’ve summarised their Income Protection offering.

- Relevant products: Income Protection, Life Insurance

- Defaqto rating: 5⭐

- Claims payout rate: 91.9% of all protection claims paid in 2024

- Additional benefits: Vitality Optimiser: Save up to 40% on premiums by adopting a healthy lifestyle, and earn rewards and discounts from top brands through the Vitality Programme.

Pros and Cons of Vitality Income Protection

What Vitality’s Customers Say

As of October 2025, Royal London has over 58,000 reviews on Trustpilot (71% of them giving 5⭐), giving them an average “Excellent” score of 4.4 stars.

Read our specialist review of Vitality Income Protection, or get a quote online in 60 seconds.

IMPORTANT❗️

We have taken care to ensure that information in this review is accurate. However, the market changes frequently, and we do not guarantee 100% accuracy and accept no liability for any losses.

How to Choose the Best Mortgage Protection Policy

Finding the “best” Mortgage Protection Insurance will depend on your unique needs. Here are some aspects to consider.

Step 1: Think About Your Personal Circumstances

Your best policy depends on factors like:

- Whether you’re employed, self-employed, or a contractor

- The type of mortgage you have (repayment or interest-only)

- Your family situation – do others rely on your income?

- Your existing cover, such as Income Protection or Life Insurance through your employer.

If you already have certain benefits, you might not need to double up on cover – but gaps are common, especially for the self-employed.

Step 2: Compare the Key Features

When comparing policies, look closely at:

- Deferred period options: Would you need your payout to kick in straight away? Or do you have sick pay and savings that could stretch for a little longer? Both will impact your premiums in different ways

- Maximum payout term: Do you want to be covered up until retirement age? Or do you just want a safety net in place for a couple of years?

- Exclusions: Your medical history, lifestyle and other factors will determine the best insurer for your needs.

It’s crucial to understand what’s not covered before you buy, which is why we always recommend speaking to an independent adviser before taking out Mortgage Protection Insurance. It’s free to get our advice, and we’ll search the market to find you the most suitable policy for your needs. Call 02084327333 to chat through your options.

Step 3: Understand the Cost

The price of Mortgage Protection depends on your age, health, job, mortgage size, and policy type.

Premiums vary a lot between providers, so always get multiple quotes and make sure you’re comparing like-for-like. Check out our guide to the cost of Income Protection.

Get Mortgage Insurance Quotes and Specialist Advice

Buying a house is a huge milestone, and making a commitment to a mortgage can be daunting prospect. With such a large liability attached to your name, it’s important to make sure you’re suitably protected.

Our specialists live and breathe the protection market, and have helped thousands of people to protect their most important asset – themselves. We’re here to make what can be a stressful time go as smoothly as possible, so call 02084327333, email help@drewberry.co.uk, or compare quotes to get started.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.