Why AdWorks Took Out Keyman Insurance

This year, Adworks celebrated its 20th anniversary. The business was founded by Alex Knox – a veteran of Ayrshire’s local newspapers – to provide advertising design and purchasing services to businesses across Scotland and beyond.

The company began life as the Advertising Business Consultancy (ABC-Ayr). By 1999 Daniel Knox, son of the founder and today’s MD, had joined the business and within two years of this, the growing consultancy had won full agency recognition (allowing it to charge commission on the adverts it creates and places).

By 2002, it had become a limited company and with little competition in Ayrshire the company, now known as Advertisingworks Scotland, grew quickly acquiring major local clients such as South Ayrshire Council and, along the way, changing its name once more, this time to Adworks.

Sue Heathcote, Adworks’ Company Secretary, has been with the company since day one. Like several of her colleagues, Sue’s background was in the local newspaper sector and, since joining Adworks, she’s never thought of leaving.

“Many of us worked closely with Alex back in our newspaper days,” explains Sue, “so we’re a very close-knit team. We’ve enjoyed a fair deal of success providing bespoke digital and print design services to our clients so the emphasis isn’t really on growth anymore.

“For us,” she says, “it’s all about doing the best job for each of our clients – whatever their needs – and building on business relationships that often go back a decade or more.”

Protecting Adworks with Key Person Cover

“Although everyone at Adworks is important,” says Sue, “we realised some time ago that if we were to lose Daniel’s leadership and business acumen the company could face real hardship.

“We previously had a 5-year term key person contract in place for this reason, but when the policy came close to expiring we contacted our previous broker and were told that our adviser had since retired. We explained our position and waited to hear back from them but they never contacted us and the policy lapsed.

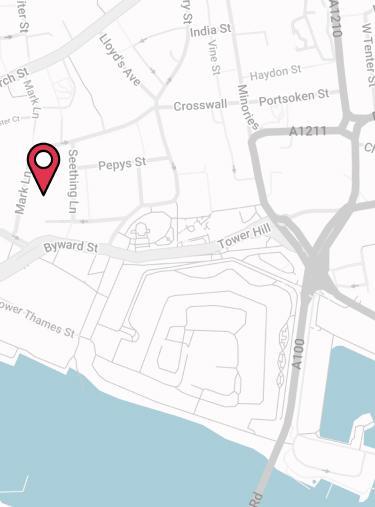

“We came across Drewberry when we were researching a new key person policy for Daniel. They stood out thanks to the excellent client reviews on their site. When we started talking to our Drewberry adviser we found that he had a number of useful ideas. He was also able to look across the whole of the market to find the best combination of premiums and cover for our needs.”

“We now have a long-term policy in place that will protect our happy little company and our client relationships should anything happen to Daniel,” says Sue.

Longer-Term Keyman Insurance Proved a Better Solution…

Adworks’ Drewberry adviser saw they were interested in renewing their cover, but that no one had clearly explained the options open to them.

We suggested Keyman Life and Critical Illness Cover for the company’s MD so that the business could continue in the event of serious ill health as well as Daniel’s early demise.

We also looked at how to avoid the problem of having to renew cover every 5 years. The company’s previous policy had just lapsed, and while taking out another 5-year term contract would keep the premiums lower it was clear that the company needed longer-term protection.

In the end, it made sense to take a 15-year policy term as this would save them money in the long term and spare them the ordeal of new underwriting every five years.

We recommended a policy from Vitality, thanks to the company’s proportionate benefit approach to claims which means that, unlike most policies currently available, it’s not an ‘all or nothing’ proposition.

It’s possible to get a proportion of the cover paid out for a lot of illnesses that aren’t quite as severe but which could still mean that time needs to be taken off work.

Contact Us

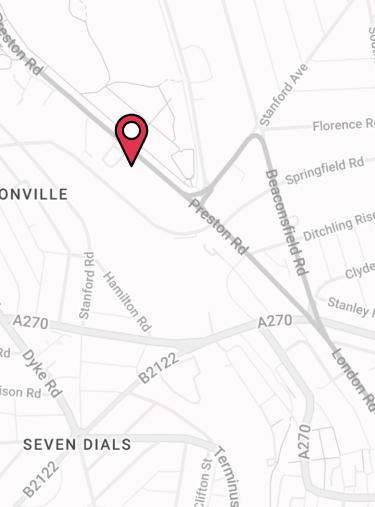

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.