9 Reasons To Get Employee Benefits Advice

Whether you are a start-up, small business or established company there comes a point where you need to implement an employee benefits package.

You either have the option of doing it yourself or getting employee benefits advice from a broker / consultancy who specialises in this area.

We may be a little biased but we know the resources / knowledge needed to set up and maintain a competitive employee benefits package. With us providing independent advice and there being no fee for our service there is little reason to deal with this headache yourself.

SPECIALIST TIP 🤓

When you seek independent advice you are protected via a regulated body if the advice isn’t appropriate for your business. If you choose to do it yourself and go direct to an insurer, you are on your own if things go wrong.

What Employee Benefits Are Available?

Some of the most common employee benefits you may consider include:

- Death in Service Insurance

- Group Income Protection

- Group Critical Illness Cover

- Business Health Insurance

- A workplace pension

However, employee benefits can be anything from flexi-time to a cycle to work scheme. With such a wide variety to offer your workers, it can be hard to know where to start.

Supporting Small Businesses

Many smaller businesses simply don’t have the resources to take this on in-house. Undertaking all the product research, legislative requirements and staying on top of any changes is a significant undertaking if you are doing all this for one small group of employees.

In addition to the set up you will want to review policies on a regular basis to ensure your premiums remain competitive. We see far too many firms paying over the odds for their cover purely because they have not been proactive in reviewing it on a regular basis.

9 Reasons Employee Benefits Advice Makes Sense…

As we’ve said, arranging employee benefits for your workforce — which could be hundreds or even thousands of people — isn’t straightforward.

The complexity and the time it takes to get everything in place drives many of our clients to seek us out for specialist employee benefits advice.

1. We Have Access To The Whole Market

You get access to the entire UK market when you choose an independent adviser, such as ourselves, to supply employee benefits advice.

Ultimately, getting quotes from across the market usually means saving money. That’s why we search every single UK provider to make sure you get the best employee benefits at the best possible price.

We work closely with all the leading UK insurers and given the number of clients we look after we are often able to negotiate better rates than if you were to speak directly with the provider yourself 😎.

2. We Take The Legwork Out Of Arranging Benefits

All that searching around for quotes from every single provider is hard work.

That’s especially true if you don’t know all the industry terminology when comparing options. You’ll firstly have to learn all of this before you can do a proper comparison.

Furthermore, getting employee benefits quotes isn’t as simple as it is with individual policies. There are no instant online calculators for employee benefits because the cost depends so much on your company, industry and workforce.

It’s almost impossible for providers to offer quotes without speaking to you and receiving employee data. Without an employee benefits adviser, you have to go to every company individually with your employee data to get a good range of quotes.

Our relationships with every provider let us get your quote request to the top of their to-do list.

It also means you don’t have to lift a finger, leaving you free to concentrate on what you’re best at — delivering your own proposition — while we do our thing.

Nadeem Farid

Head of Employee Benefits at Drewberry

3. Negotiating You Better Rates

Again, our relationships with providers helps our clients. As an independent intermediary who places hundreds of companies a year with employee benefits providers, we have bargaining power on our side.

We know exactly who to speak to at every employee benefits company to get you the best deal possible. We can also access rates you may not be able to if you go it alone.

4. You Have An Specialist In Your Corner

As employee benefits advisers, some of the most common questions we’re asked include:

- How will Group Income Protection work with my company’s sick pay policy or state benefits?

- Is it fine to use the insurer’s master trust with Group Life Insurance rather than your own bespoke option?

- What are my obligations for offering benefits to new employees brought on board under TUPE regulations?

Employee benefits are our bread and butter. We answer questions just like these for your clients day in, day out. We therefore usually have the answers for you — and if not, we know specialists who can lend a hand.

Part of our role is to stay on top of any legislative changes and requirements an employer may have with their employee benefits so we know our clients schemes are always all above board.

Our knowledge means we know each provider inside out. We know which will offer favourable terms for a company of your size and which have the best additional benefits.

We also use every tip and trick of the trade to cut the cost of benefits without compromising on coverage.

Nick Nelms

Senior Consultant, Employee Benefits

5. Regular Reviews Are Covered

Over time, things change. This is especially true in business, where your company could undergo a period of growth, taking on more employees and becoming more profitable.

If that’s the case, what worked for you and your employees when you first arranged your benefits will likely change as well.

Moreover, especially with insurance such as Business Health Insurance, which renews annually, you might be able to get a better deal elsewhere at each renewal.

That’s why conducting regular reviews of your benefits is so important. You want them to change and grow with your company while also ensuring you continue getting the best value for money.

Employee benefits advice from Drewberry is anything but a ‘one and done’ service. We’re here not just to arrange your package but throughout its life, undertaking regular reviews to make sure you still have the best option.

You can also come back to us to make any changes you want, whether that’s expanding coverage or anything else you want us to look into.

6. Employee Benefits Advice Offers Ongoing Support

Administering an employee benefits package means keeping on top of joiners and leavers. Keeping up to date with who’s on the scheme is crucial not just so new joiners can benefit but also for the price of your package.

If you’re a company which is growing rapidly and seeing many new hires, the administration of your benefits package could become time consuming.

Our Group Admin team helps you take care of these little details so you don’t feel like you’re getting bogged down.

7. Help With Employee Communication

Once you’ve got employee benefits in place, the next job is spreading the word. You want your employees to know about, understand and use the new package so you can reap the rewards of offering benefits such as improved workplace morale.

However, in a large organisation, this can be tricky. It may also be difficult to encourage employees to engage with aspects of a particular benefit, such as returning nomination of beneficiary forms for Group Life Insurance.

Drewberry offers help and advice on an employee communications strategy so both the company and your staff can make the most of the benefits from day one.

We can even produce a bespoke employee benefits page for your company, laying out the benefits in one place for all your workers to see.

8. You Are Protected

When you choose the DIY route to arrange employee benefits, there’s no protection if things go wrong. If you don’t take advice, the responsibility is on your shoulders.

On the other hand, employee benefits advice from a regulated intermediary such as Drewberry offers financial protection. As we offer advice on your benefits package, it’s therefore our responsibility to ensure it’s right for you and your workers.

9. There Is No Fee For Our Employee Benefits Advice

Lastly, we don’t charge for our employee benefits advice. We do all of the above on a totally fee-free basis.

It won’t cost you a penny more to take out cover through us than it would to search every single provider yourself. It might even be cheaper as we have more bargaining power than you do as an individual entity.

With that in mind, what’s to lose by giving us a call?

Get Specialist Employee Benefits Advice…

We understand the importance of employee benefits, both for employers and their workers. That’s why we offer fee-free employee benefits advice to any company looking to introduce or improve a benefits package.

We advise on all areas of employee benefits, so why not get in touch? Feel free to pop us a call on 02074425880. Alternatively, drop us an email at help@drewberry.co.uk.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4067 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

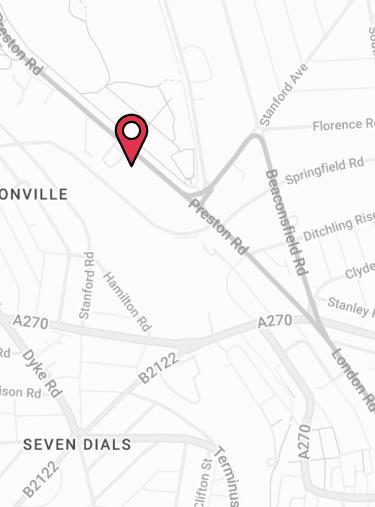

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.