How Insurers View Pre-Existing Medical Conditions

Taking out Income Protection can get complicated if you have existing health conditions.

When you apply for cover, the insurer will ask you to declare any medical conditions you have suffered in the last 5 years. Any information you provide will be reviewed and you can expect one of three outcomes:

- The condition is covered on standard terms

- The condition is covered for an additional premium

- The condition is excluded

The more serious the existing health condition the more likely that it will be excluded from your policy.

Those looking for Income Protection Insurance with pre-existing medical conditions may find significant variation among insurers on how the condition is underwritten and what terms are offered.

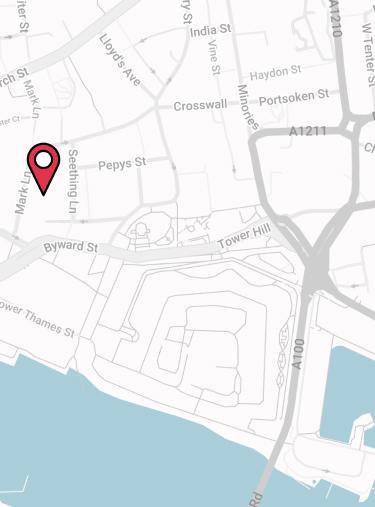

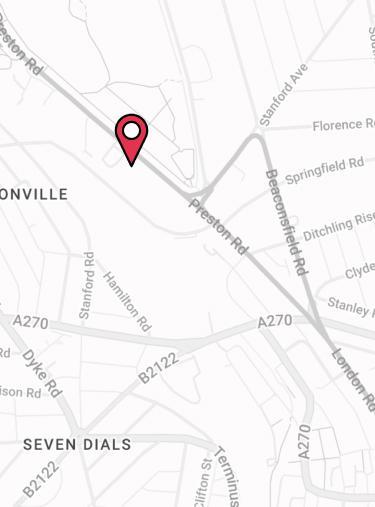

We have direct access to the underwriters at all the top UK insurers which means we are able to talk to them about your specific situation and negotiate the best possible terms. If you need some help please do not hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

The Older The Medical Issue, The Better Your Chances of Being Covered

If the medical issue was over 5 years ago, you stand a good chance of being covered for a future claim, especially if the medical issue was relatively mild in nature, i.e. you broke a bone in your foot a couple of years ago but you recovered from that with no lasting complications, then they wouldn’t typically exclude your foot for a future claim.

Try Providers Who Offer a Review System

Some insurers offer a review system, where they will look to consider removing an exclusion in a given time, say in 1 or 2 years, if the issue does not re-occur. The best option for you is to speak to us and we can glean a strong indication from the insurers for you before you apply.

What Happens If You’re Currently Awaiting Test Results?

If you’re currently awaiting tests for a medical issue, then the insurers will postpone offering cover until the result of those tests and any follow-up are concluded.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.