How Much of Your Income Can Be Covered?

Most Income Protection policy providers will allow you to cover up to 70% of your gross (pre-tax) income. Also called the “sum assured”, the higher this payout percentage, the higher your premiums.

Do You Need the Maximum Level of Cover?

It’s natural to want to go for the biggest amount of cover available, but it’s advisable to really think about how much cover you actually need.

For example, if your expenses are £1,500 per month do you really need to pay the extra premium for £2,000 worth of cover? In most cases, it’s best to align your sum assured with your core monthly outgoings.

What About Business Income Protection?

If you work through your own limited company you may be able to take out Executive Income Protection which will allow you to cover up to 80% of your income.

These director plans are owned and paid for by your business. Should you need to claim, the payments would be made to the business who would then need to distribute the funds to the individual as income (which would be taxed accordingly).

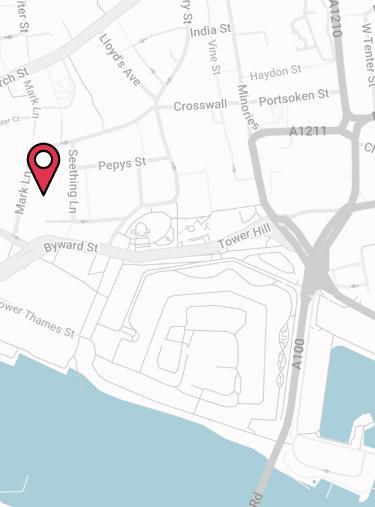

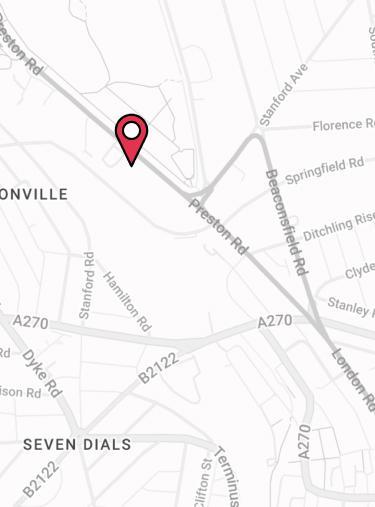

Finding the right Income Protection cover can be confusing, which is why it’s best to speak to an independent adviser before buying a policy. Our advice is fee-free, and we’re able to search the entire market to find the right policy for your needs. Call 02084327333 or email help@drewberry.co.uk to find out your options.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4100 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.