Income Protection: What is Back to Day One Cover?

I am looking to take out Payment Protection Insurance or Short-Term Income Protection policy and wanted to know what ‘back to day one’ cover means? Does this still have a deferred period?

The deferred period explained

With Short-Term Income Insurance / Payment Protection Insurance it is very common to have a deferred period of 30 days. This means that the plan does not start ‘accumulating benefit’ until after 30 days of being off work.

After the 30 day excess period is up (i.e. on day 31) the plan will start accumulating benefit as if you have just started a new job where you get paid at the end of the month.

Thus, with a 30 day deferred period the first payment from the insurer would be received on day 61 (for the previous 30 days of lost earnings).

How Does Back to Day One Cover Work?

If you decide to include ‘back to day one cover’ then you still need to be off work for 30 days for the plan to become eligible for a payout but the insurer will ‘backdate’ the claim to ‘day one’, so that the benefit effectively starts accumulating from day one.

What this means is that if you select a 30 day deferment period with the back to day one option selected then the first payment will be received on day 31, rather than on day 61 without the back to day one option.

Selecting this option is very popular with individuals who would not receive any period of full sick pay from their employer (i.e. they would only receive statutory sick pay).

Please note that including this option can increase with monthly premium by as much as 10% with some insurers.

Further Information

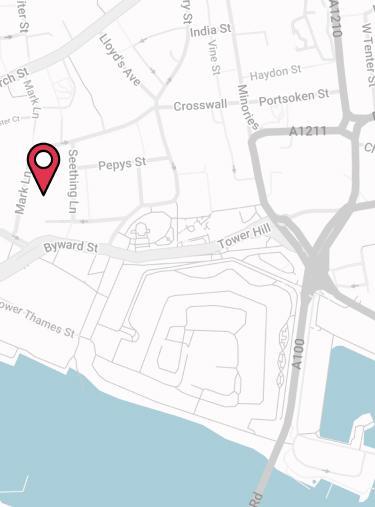

For more information please see the page: Setting the deferred period with income protection or give one of our specialist advisers a call on 02084327333 to discuss any questions you have further.

- Topics

- Income Protection

Frequently Asked Questions

What is a Split Deferred Period?

What is monthly benefit for income protection insurance?

Can Cannabis Smokers Get Income Protection Insurance?

Can I Take Out Income Protection Up to Age 70?

Difference Between Income Protection and Payment Protection?

Contact Us

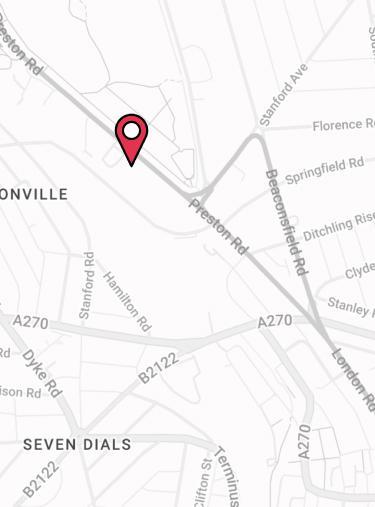

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.