Does Critical Illness Insurance Cover Accidents?

I’ve got Critical Illness Cover and was wondering if this includes any accidents that I might have in the future?

What Does Critical Illness Insurance Cover?

Critical Illness Insurance covers around 40 different conditions, although there are policies which cover more than 100 conditions and those which cover less than 10, so it pays to check your policy carefully.

These conditions are determined by the insurer so they do vary depending on the provider and you would have to check the documentation to see exactly what they cover.

Critical Illness Insurance can cover a medical condition resulting from an accident. Conditions such as total blindness, deafness, coma, traumatic head injury and third degree burns are usually covered and could result from an accident.

However, the insurance does not cover less severe medical conditions that could result from an accident, such as broken arms or legs.

Another Option Might Be Income Protection…

Income Protection Insurance pays out if you are unable to work as a result of an accident. The payout is a monthly tax-free benefit which is paid until you are well enough to return to work or until the end of the policy life (which ever is soonest).

The policy can be set up as a long-term plan which could potentially pay out until retirement age if you had a severe accident and were unable to work again.

Frequently Asked Questions

Should I take out income protection insurance?

Can I Cover Dividends With Income Protection Insurance?

Can I Get Short-Term Disability Insurance?

What's the Difference Between Health Insurance and Income Protection?

What Is Employment and Support Allowance (ESA)?

Contact Us

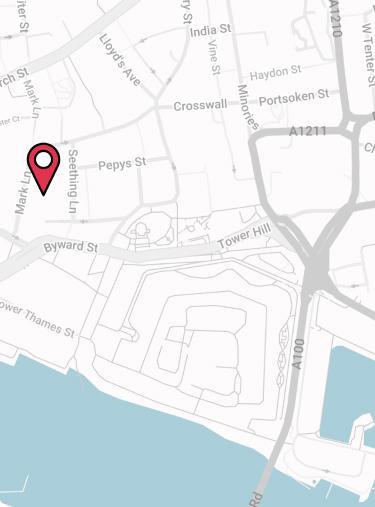

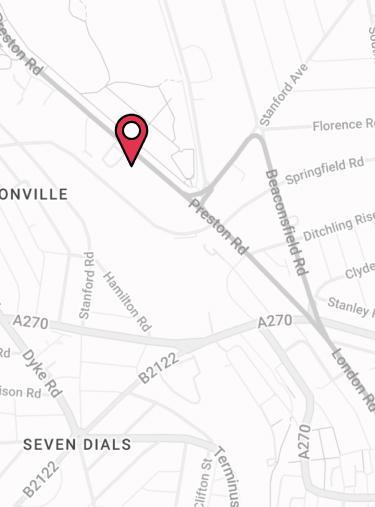

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.