When it comes to supporting your employees, Group Life Insurance offers exceptional value at a surprisingly low cost. Providing peace of mind for your team and their families, it’s one of the most affordable ways to show you care, while also enhancing your company’s benefits package.

In this guide, we’ll break down what drives the cost of Group Life Insurance, provide examples of typical premiums, and share tips on getting the best value for your business. If you’re balancing budgets with offering meaningful support to employees, Group Life Insurance could be the perfect solution.

What Is Group Life Insurance?

Group Life Insurance is an insurance policy that your business takes out to protect your team. It pays a tax free lump sum to your employees’ loved ones if they pass away while employed with you.

Also known as Death in Service, it’s a highly valued employee benefit – over a third of our latest survey respondents receive it, and a fifth want Group Life Cover added to their company benefits package.

Why Is Company Life Insurance For Employees Important?

For employees, it offers peace of mind that their family is protected. For employers, it’s a cost-effective benefit that enhances wellbeing, attracts talent, and demonstrates care. With tax-efficient premiums and straightforward setup, Group Life Insurance is a valuable addition to any benefits package.

What Affects The Cost Of A Group Life Insurance Policy?

When speaking to businesses about Employee Life Insurance, there are two big questions that always get asked:

- How much Life Insurance should we provide our employees?

- How much will it cost per employee?

The answers to these questions will all depend on the unique needs of your business, and there’s a number of different factors that can affect the outcome of your Group Life policy.

Biggest Cost Factors Of Group Life Cover

The cost of Group Life Insurance depends on various personal factors about your staff, as well as some factors specific to the insurance product that you buy. These include:

Employee Salaries / Level Of Cover

Insurers pay a multiple of the employee’s salary if they pass away – usually around 2x or 4x times their yearly pre-tax earnings. The higher your average employee salary – coupled with a higher payout – will increase the cost of your Group Life cover.

Policy Cease Age

A “policy cease age” is the age an employee will be when the policy stops covering them. Most employers choose a cease age of 65 or the State Pension Age, but you can set it as high as 75. The higher the cease age, the bigger the cost. This is because there’s more risk to the insurer as employees age.

Your Industry / Job Titles

Some industries and jobs (such as manual work or working at heights), are riskier than others. If you’re in a riskier industry and have a high number of employees doing higher-risk activities each working day, you’ll likely pay more for your employees’ Life Insurance.

Employee Ages

The older your workforce, the more your Group Life policy will cost. This is because the chance of making a claim gets higher as we get older. If you have a fairly young workforce, you’ll usually benefit from lower premiums.

Group Size

While large workforces will cost more to insure, insurers usually offer a discount if you insure a greater number of employees.

Place of Work

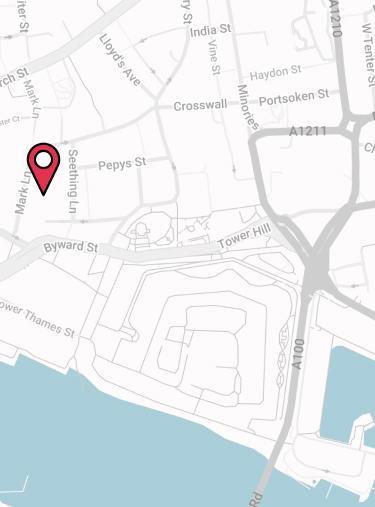

Location matters to insurers because life expectancy differs across the UK, so expect to see your premiums increase if you have employees based in areas with lower life expectancies.

Type Of Underwriting

Medical underwriting is a technical term for the way health and medical information is used when assessing an insurance policy. There are different types of underwriting for Group Life Insurance, and all will affect the cost in different ways:

- Moratorium Underwriting

This cost-effective option skips detailed health questionnaires, making it quicker to set up. However, it excludes pre-existing conditions from the last five years unless the employee remains symptom-free for two continuous years, which can help keep premiums lower.

- Full Medical Underwriting

Requires a detailed medical history from the employee at the start of the application process, providing clear coverage details and potential exclusions, offering certainty and sometimes lower costs than Moratorium Underwriting.

- Continuing Personal Medical Exclusions

Allows businesses to switch insurers while maintaining the same underwriting terms, avoiding the hassle of starting from scratch and ensuring previously covered conditions remain covered, though new exclusions may apply if eligibility criteria are not met.

- Medical History Disregarded

Ignores employees’ medical history, covering all pre-existing and new conditions, and is typically available for Group Health Insurance with at least 15 employees, though it comes with a significantly higher premium.

Average Cost Of Group Life Insurance Policies 2025

To give you an idea of the average Group Life Insurance cost, we’ve pulled together some example premiums per employee for companies of different size and industry. We’ve also toggled with different policy cease ages to demonstrate the cost factors within your control (quotes accurate as of November 2025).

How To Get Personalised Death In Service Quotes for Your Business

The above table gives you a rough idea of Group Life Insurance cost, but insurance is a bespoke product, and you’ll need to speak to a specialist to find out the real numbers for your business.

The Death In Service cost to employer could therefore be very different, even compared to a similarly-sized company in a similar sector. For example, if you have an older workforce or offer your staff particularly good salaries, your costs might be higher.

Ultimately, the best way to get Group Life Insurance quotes tailored to your company is to speak to an independent specialist. That’s where we come in. We have a team of regulated advisers who are on hand to provide specialist advice to help get you the best deal on your Employee Life Insurance.

How Is Group Life Insurance Taxed?

The tax position of Group Life Insurance actually makes it one of the most tax-efficient ways to offer Life Insurance.

In most cases, HMRC considers Group Life premiums as a business expense and therefore eligible for corporation tax relief.

When you set up the policy, you also arrange a trust with it. You either create a purpose-built trust just for your company or use the insurer’s more generic master trust. Read more about these two options.

Either way, the trust receives the payout from the insurer if an employee dies. The trust then pays the money out directly to the people or the charity the employee wanted to give the funds to.

This means the money doesn’t become part of the employee’s estate, so there’s no inheritance tax on the payout.

Is Group Life Insurance A P11D / Benefit In Kind?

No, Group Life Insurance isn’t a P11D / benefit in kind.

P11D benefits are those which employees must pay additional tax on if their workplace provides them. However, this isn’t the case for Group Life Insurance so there’s no need for employees to worry about it.

Are Premiums Discounted If Paid Annually?

Yes, some Group Life providers offer a discount if you can pay your entire year’s premiums in one go.

However, this isn’t the case for all insurers. Depending on the number of employees you have / the benefit you want to offer, it could end up being a large upfront expenditure. It’s best to chat with your adviser about whether it makes sense for your business.

Compare Group Life Insurance Quotes And Get Specialist Advice

Now you know: the best way to get tailored Group Life Insurance quotes is to speak to an adviser like our Drewberry specialists.

Setting up and maintaining your perks requires a decent bit of admin, so it quickly becomes time consuming. We do the heavy lifting for you, giving you more time to focus on what matters.

We live and breathe employee benefits, doing this day in-day out for businesses just like yours. Looking at the big picture, we get to know your unique workforce and benchmark your offering against competitors.

Best of all? We have access to the most competitive rates on the market for Group Life Insurance. So give us a call on 02084327333 or email help@drewberry.co.uk to get started.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4077 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.