Life Insurance for Diabetics

If you’re looking for Life Insurance as a diabetic this guide should help to explain the process when trying to obtain over and provide some tips along the way.

The good news is that it is often possible to get Life Insurance with diabetes but it really does depend on a number of factors, such as:

- Whether you have Type 1 or Type 2 diabetes

- Age at diagnosis / time since diagnosis

- Your latest blood glucose readings (to see if you’re controlling the condition)

- Whether there are any ‘aggravating factors’, such as a high BMI

- If you have any other medical issues to consider, such as circulatory disease or high cholesterol

- If you’re a smoker.

What is Diabetes?

Diabetes is a disease where blood sugar levels rise out of control in someone’s body. This can cause organ damage (including kidney and heart disease), eye problems and nerve damage.

Early symptoms include tiredness, excessive thirst and losing weight without really trying.

Figures from charity Diabetes UK show that the number of people with the condition is rising. The charity states that are some 4.7 million people with diabetes in the UK as of February 2019. 90% of people have Type 2 diabetes, while 10% have Type 1.

What’s more, according to Diabetes UK, there are over 1 million people with undiagnosed Type 2 diabetes.

Different Between Type 1 and Type 2 Diabetes

Type 1 diabetes is often diagnosed in or before early adulthood. It’s also known as juvenile onset diabetes because of the early age at which it can be diagnosed.

It’s an autoimmune disease, which means your body attacks its own cells. In this case, the cells attacked are the ones in your pancreas that produce the insulin necessary to break down glucose and turn it into fuel for your muscles and cells.

This leads to no insulin production and therefore has to be treated with injected insulin. It’s not typically associated with being overweight or any other factors – in fact, it’s not yet certain what causes it.

Type 2 is often diagnosed in people aged over 30 and who are overweight. As such, it can sometimes be known as adult onset diabetes.

It occurs when the pancreas can’t produce enough insulin to keep up with diet, or where the body’s cells fail to react sufficiently to insulin.

Type 2 diabetes is usually treated with tablets to improve the way your body handles insulin or sometimes injected insulin.

Can I Get Life Insurance if I Have Diabetes?

It’s very important to note that insurers can take very different stances on diabetic Life Insurance, with some insurers declining outright and others placing a ‘loading’ or premium increase on the policy.

This loading will vary depending on the insurer and their assessment of your condition, so it pays to make sure you’ve checked the entire market to find the right deal for you.

That’s where an intermediary such as Drewberry can step in. We know the market inside out and will be able to tell you which insurers may be able to offer you cover given your condition. We’ll search the whole market on your behalf so you don’t have to.

Life Insurance can be vital if you were to die and your dependents would need financial support. The sum payable can be used to pay off a mortgage and any debts as well as towards ongoing living expenses.

For those with the condition, diabetic Life Insurance is readily available but premiums are likely to be higher than those without the condition. The cost may come down however, if you can show the condition is carefully managed.

Managed Life Insurance With Diabetes

The rapidly-rising number of people with diabetes has seen insurers reassess their Life Insurance propositions and develop policies designed with diabetics in mind. As such, there are now policies on the market that may see your premiums fall if you can show you’re managing your condition well, which might include losing weight or reducing blood glucose levels.

Robert Harvey

Head of Protection Specialist at Drewberry

What Will Insurers Need to Know?

An insurer will want to know how you control the condition, so be prepared to answer some detailed medical questions and provide evidence of specific specialist treatment you’ve had.

The insurer will also most likely want to write to your GP to check your wider medical history and your attendance at / outcomes from diabetic clinics. This might include whether you have any complications associated with diabetes, or aggravating factors such as a high BMI.

There may also be a request for blood sugar readings – the HbA1c test measures blood glucose levels. Other information required will be on weight, smoker status, alcohol units per week and any other health conditions.

Some insurers are more willing to provide life cover for diabetics and this is why it can be important to take advice. Once you have had an application declined it can be harder to obtain a policy elsewhere as you usually need to disclose whether you have been turned down in the past.

Your Drewberry adviser will be able to gather medical information specific to you and speak to the insurers anonymously on your behalf to establish which insurer is likely to offer you the most cost effective life cover.

I Had Life Insurance Before Diabetes – Is It Still Valid?

If you already had Life Insurance and were later unfortunately diagnosed with diabetes, the policy remains valid and in force.

This is because any existing policy represents a ‘snapshot’ of your health at the date of application, when you presumably didn’t have diabetes, and so covers you going forward on that basis.

What About My Workplace Death in Service Scheme?

Many people also have Life Insurance through work, which can be known as Death in Service. You should check if you have cover and if so how much cover you have.

Most Death in Service schemes cover from 1 to 4 times annul earnings, depending on the employer. While the level of cover may not be sufficient for your needs, it can nonetheless be an important cornerstone of your protection needs, especially if you’re having trouble getting insurance elsewhere with diabetes.

This is because, in most instances, the insurance provider won’t ask any medical questions of employees when taking out a Death in Service scheme. This means your diabetes won’t be relevant unless you’re one of the very few individuals (mostly company directors and other executives) who exceed the insurer’s free cover limit.

As such, if your employer offers life cover through an employee benefits scheme this may be worth considering because usually employees with serious health issues can often get cover through work even if they would have been declined for an individual policy.

Of course, the essential thing to remember is that you cannot rely on Death in Service Insurance as a permanent insurance solution. If you leave your job, retire or are made redundant your cover will cease and you may find yourself looking for cover again and back at square one.

Sam Barr-Worsfold

Independent Protection Specialist at Drewberry

Diabetic Life Insurance Advice

As you can see, there are a great many factors involved if you’re looking at getting Life Insurance with diabetes, so many that it can pay to have a specialist fighting your corner.

That’s where Drewberry would be happy to step in and help find out if it’s possible for you to get Life Insurance as a diabetic given your individual circumstances.

Speak to our advisers completely fee-free today on 02084327333. We have access to the entire UK market and can visit each and every appropriate provider so you don’t have to.

Tom Conner

Director at Drewberry

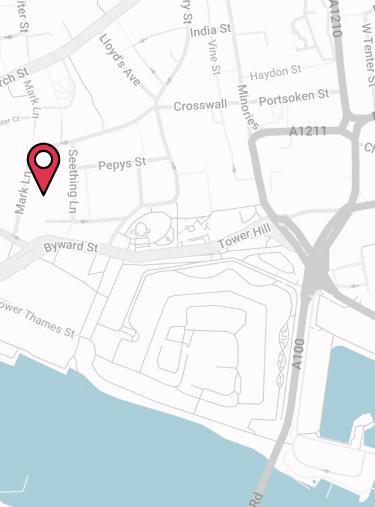

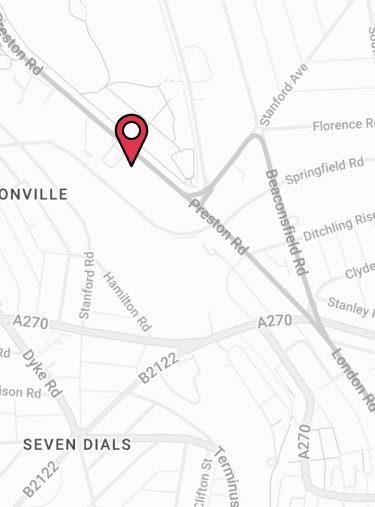

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.