Key Person Insurance (also known as Keyman Insurance) is an insurance policy that protects your business by paying a cash lump sum if a key employee dies.

The company can use the cash lump sum benefit however you see fit to get through the loss of that key individual. It might, for example:

- Use it as a buffer against loss of profits

- Pay for recruitment / training to replace the key employee

- Repay outstanding loans

- Make up for the loss of important personal / business contacts

- Help reduce loss of confidence from suppliers and customers

- Ease difficulties in raising finance for new developments

- Wind down the company in an orderly fashion.

You can cover anyone who’s key to the success of the business, for example the owner(s) / founder(s), an essential salesperson or any other worker you simply couldn’t do without.

Cycling insurance tech startup Bikmo needed Keyman Insurance to cover founder David George and Chief Technology Officer Jorge Ives. Read their story.

Covering Serious Illnesses Increases The Cost

You can choose to add Critical Illness Insurance to your policy. This pays out if a key person leaves the company due to a critical illness (for instance cancer, heart attack or stroke) as well as if they die.

Adding Critical Illness Cover increases the cost of Keyman Insurance. However, this is just because you’re more likely to get a critical illness than you are to die during the policy term. Higher premiums simply reflect the bigger risk to the insurer.

Given the risk of serious illness / injury, many of our Keyman Insurance clients extend their plan with Critical Illness Cover.

How Much Does Keyman Insurance Cost In 2025?

Insurers calculate the cost of Keyman Insurance based on both personal factors relating to the individual(s) insured as well as policy factors, such as the amount of cover you need.

Personal Factors

Age

The older you are, the higher the cost of Keyperson Insurance premiums. This is because you’re more likely to claim as you age.

Smoker Status

Smokers pay more than non-smokers for most insurance cover as they tend to die earlier than non-smokers. Moreover, they’re more likely to become seriously ill compared to non-smokers, further bumping up the price of Keyman Insurance.

General State of Health

Insurers consider your health and pre-existing conditions when pricing Keyman Insurance. You might therefore pay higher premiums for the Life Insurance part of a policy if you have high blood pressure, for example.

With Critical Illness Cover, if you’ve suffered a condition such as cancer, the insurer might place an exclusion on paying out for that type of cancer if it comes back rather than upping premiums.

Hazardous Hobbies / Activities

Keyman Insurance costs more for those who regularly do hazardous activities due to the heightened risk of death / injury associated with them.

Such risky hobbies generally include skydiving, outdoor rock climbing, motocross, deep sea diving / caving / wreck exploration etc.

Policy Factors

As for policy factors, the biggest influence on the cost of Key Person Insurance is first and foremost the size of your benefit. The more cover you need, the higher your premiums.

Other important policy factors that impact the price of cover include:

Policy Length

The longer you think a key person will be key to the business and therefore need cover, the higher your premiums.

This is because the policy will cover the key individual to an older age, meaning there’s therefore a bigger chance of death / critical illness during the policy term.

Adding Critical Illness Insurance

Adding Critical Illness Cover increases the cost of premiums considerably. However, it means the company gets a payout if a key person develops one of several relatively common illnesses (e.g. cancer, heart attacks and strokes), as well as if they die.

Critical illnesses are considerably more likely than death. For example, half of everyone in the UK born after 1960 will get cancer at some point in their life according to Cancer Research UK. Meanwhile, the British Heart Foundation reveals someone is admitted to hospital with a stroke in the UK every 5 minutes.

Average Monthly Keyman Insurance Premiums

Given insurers look at so many factors when calculating the cost of Keyman Insurance, it’s not always east to pin down what your premiums will be.

However, the table below offers a rough guideline using premiums from our instant online quote engine. To get these figures, we’ve made various assumptions about each key person. For example, we’ve assumed they’re:

- A healthy non-smoker

- A company director with office-based duties

- Seeking £150,000 of Life Insurance or £150,000 of combined Life Insurance and Critical Illness Cover

- Wanting level cover that won’t reduce in value over the policy term

- Looking for protection over the next 10 years.

How Much Key Person Insurance Do You Need?

This is a tricky question. After all, no two companies and no two key people are the same.

How exactly do you value a key person’s contribution to your company? This can be especially difficult if you’re a young company that’s growing fast.

For many businesses, it may be hard to put a monetary value on a key person’s role until you’re suddenly facing life without them.

When considering the level of cover, you should consider any additional costs you may incur as a result of the loss:

- A multiple of salary (to cover the training and salary for a replacement key individual)

- Recruitment costs to replace the key person

- Loan repayments.

In addition to tangible costs, we suggest covering a multiple of the gross or net profit a key person generates for the company, using a different multiple if the business is growing or breaking even.

We help companies with this all the time, so we’re well-placed to provider regulated advice. See how we helped e-procurement firm Applegate set up their key person cover here.

Compare Keyman Insurance Quotes and Get Specialist Advice

The cost of Keyman Insurance depends so much on each key person’s circumstances. As a result, how much it costs can vary considerably even between two key people in the same company. With so many different factors to consider, it’s important to get them right.

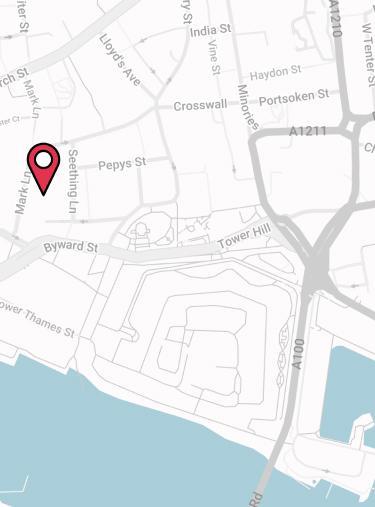

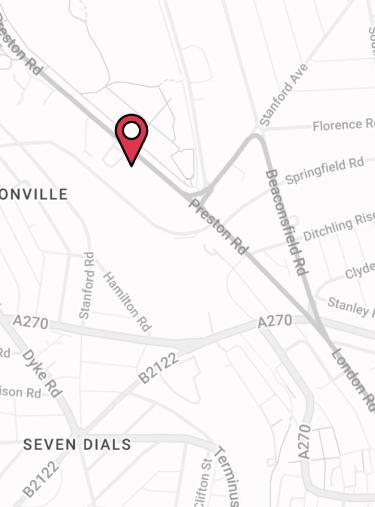

Our team of specialist business protection advisers can help you work out how much insurance you need, and compare quotes and policies from all the top UK insurers to get you the right deal. Call 02084327333 or email help@drewberry.co.uk to talk through your options.

Why Speak to Us?

You give so much to your business. That’s why you deserve first class service when it comes protecting it. Here’s why you should talk to us:

- No fee for our service

- Award-winning 🏆 independent insurance advisers, working with leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.